What to do when you max out your dental insurance Idea

Home » Trend » What to do when you max out your dental insurance IdeaYour What to do when you max out your dental insurance images are available. What to do when you max out your dental insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the What to do when you max out your dental insurance files here. Get all royalty-free photos.

If you’re looking for what to do when you max out your dental insurance pictures information related to the what to do when you max out your dental insurance interest, you have pay a visit to the ideal site. Our website frequently provides you with suggestions for refferencing the maximum quality video and image content, please kindly hunt and find more enlightening video content and graphics that match your interests.

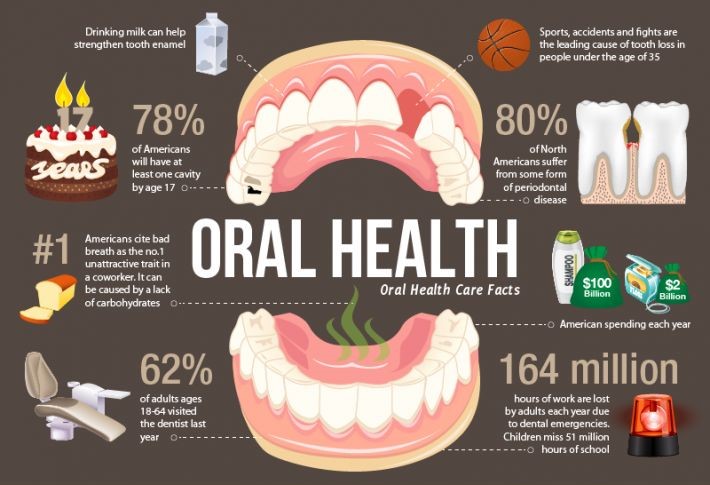

What To Do When You Max Out Your Dental Insurance. You will probably find out that your situation is not unique and that there are procedures in place to assist you. These patients reach their yearly maximum very quickly, and often. If there is no grace period, get out your. You’ll benefit from the negotiated discounts even when your annual benefit maximum* is reached.

Why Should You See a Periodontist? The Dental Specialty From thedentalspecialtycenter.com

Why Should You See a Periodontist? The Dental Specialty From thedentalspecialtycenter.com

You will probably find out that your situation is not unique and that there are procedures in place to assist you. Do not hold on to it, the headache of them recouping it on their own accord by subtracting from another patient�s insurance payment is not worth it. However, expect to fund beyond the copayment for approved treatments, and perhaps pay higher prices when your. You need to do the right thing, call the insurance, and request the process of a recoupment. Because you only have $250,000 of your $1,000,000 lifetime maximum remaining, your insurance carrier can only pay $250,000 of the $500,000 hospital claim. Lifetime maximum the lifetime benefit maximum in dental insurance means that the plan will stop making claim payments after the approved allowed charges reach a specific.

Annual maximums usually range between $1,000 and $2,000.

If you do not hear from your insurance provider within a few weeks, call them directly to inquire about your claim. Lifetime maximum the lifetime benefit maximum in dental insurance means that the plan will stop making claim payments after the approved allowed charges reach a specific. If you do not hear from your insurance provider within a few weeks, call them directly to inquire about your claim. Once you max out the gift card, you’re responsible for taking care of the rest out of pocket. And when your dental costs for most procedures go over that limit, you then have to pay for your own dental care out of pocket for the rest of the year. Each time you visit the dentist, a dental claim is submitted.

Source: auroradentist.com

Source: auroradentist.com

The main goal is to make sure that you can obtain the necessary dental services that you need to maintain proper oral health. This means, once you pay $5,000 worth of eligible medical expenses, your policy will pay 100% of all medical costs for the remainder of the policy’s duration, which is typically a year. If you exceed that amount, you are responsible for all additional costs—unless you sign up for a dental insurance plan with no annual maximum. This contractual figure is the limit they can bill patients for covered services. A simple audit can be done and the insurance company will request it anyways.

Source: overlandparkcosmeticdentist.com

Source: overlandparkcosmeticdentist.com

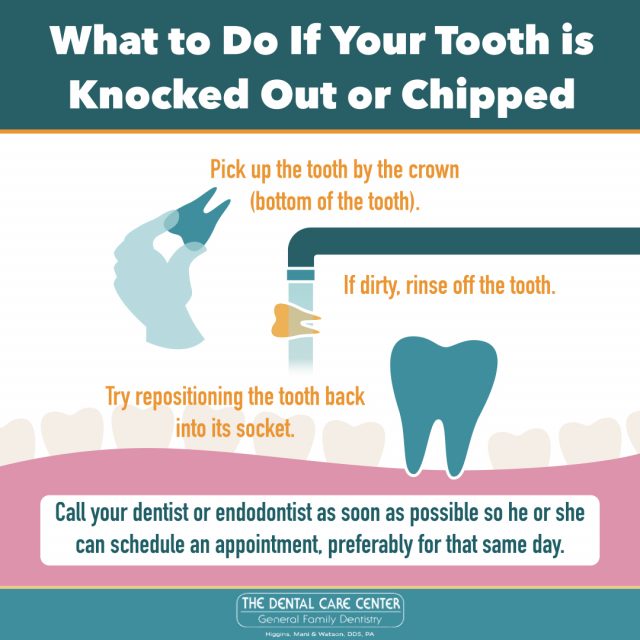

Call your dentist and make an appointment. The total cost between your deductible and coinsurance comes out to $6,600. Call your dentist and make an appointment. Return to policy limitations and exclusions. Don’t hesitate to talk to your dentist about scheduling treatments that meet your insurance maximums.

Source: abcchildrensdentistry.com

Source: abcchildrensdentistry.com

If there is no grace period, get out your. You could also contact your insurance company and ask them what provisions they may have to get around the limitations. Because you only have $250,000 of your $1,000,000 lifetime maximum remaining, your insurance carrier can only pay $250,000 of the $500,000 hospital claim. Do not hold on to it, the headache of them recouping it on their own accord by subtracting from another patient�s insurance payment is not worth it. You have a dental insurance plan that has a maximum annual benefit of $1,500 per year.

Source: dreamstime.com

Source: dreamstime.com

Your plan’s details will explain if a procedure has cost sharing. The main goal is to make sure that you can obtain the necessary dental services that you need to maintain proper oral health. That is also the exact amount you stand to lose if you don’t take the next step. You could also contact your insurance company and ask them what provisions they may have to get around the limitations. Call your dental insurance provider and find out the exact amount of your unspent dental insurance benefits.

Source: huffingtonpost.com

Source: huffingtonpost.com

Once you max out the gift card, you’re responsible for taking care of the rest out of pocket. The main goal is to make sure that you can obtain the necessary dental services that you need to maintain proper oral health. All other medical expenses including the outstanding balance for your hospital stay will be 100% your responsibility. You need to do the right thing, call the insurance, and request the process of a recoupment. Annual maximums usually range between $1,000 and $2,000.

Source: directdenturecare.com.au

Source: directdenturecare.com.au

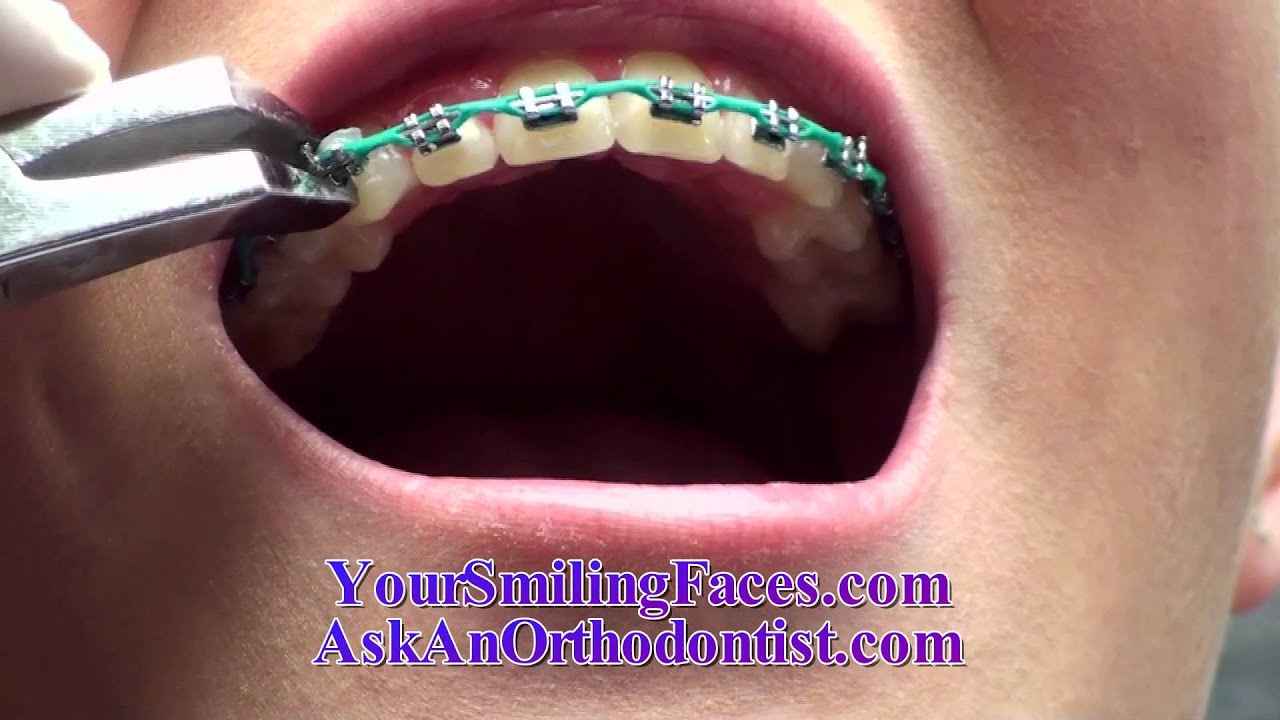

If you exceed that amount, you are responsible for all additional costs—unless you sign up for a dental insurance plan with no annual maximum. The sooner you do this (like right after you finish reading this), the more likely your dentist will be able to schedule you or any eligible. Depending on your policy, you may have a grace period until march 15. Do not hold on to it, the headache of them recouping it on their own accord by subtracting from another patient�s insurance payment is not worth it. Call your dentist and make an appointment.

Source: orthodonticbracescare.com

Source: orthodonticbracescare.com

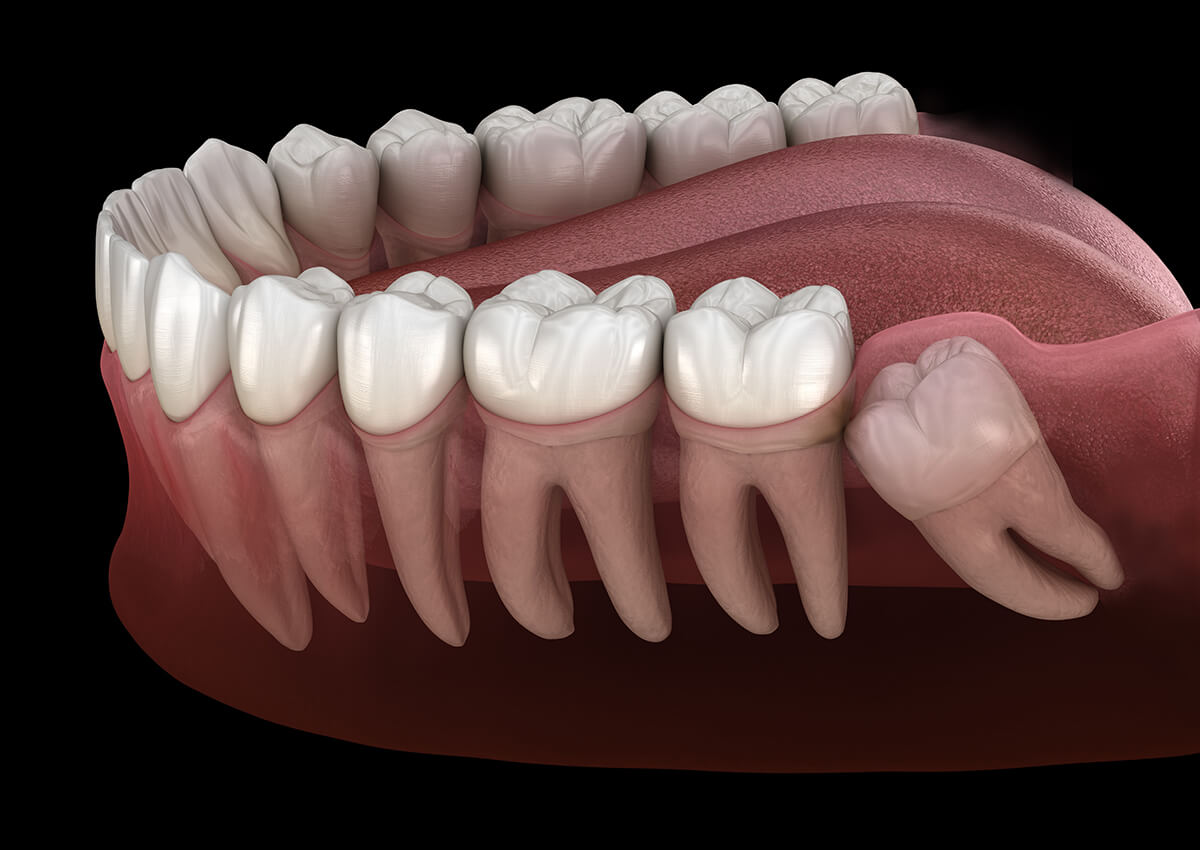

Lifetime maximum the lifetime benefit maximum in dental insurance means that the plan will stop making claim payments after the approved allowed charges reach a specific. Don’t cancel your dental plan on healthcare.gov if you want to keep your health plan. Lifetime maximum the lifetime benefit maximum in dental insurance means that the plan will stop making claim payments after the approved allowed charges reach a specific. All other medical expenses including the outstanding balance for your hospital stay will be 100% your responsibility. If you exceed that amount, you are responsible for all additional costs—unless you sign up for a dental insurance plan with no annual maximum.

Source: youtube.com

Source: youtube.com

If you exceed that amount, you are responsible for all additional costs—unless you sign up for a dental insurance plan with no annual maximum. You have a dental insurance plan that has a maximum annual benefit of $1,500 per year. This means, once you pay $5,000 worth of eligible medical expenses, your policy will pay 100% of all medical costs for the remainder of the policy’s duration, which is typically a year. All other medical expenses including the outstanding balance for your hospital stay will be 100% your responsibility. You need to do the right thing, call the insurance, and request the process of a recoupment.

Source: mycarolinadentist.com

Source: mycarolinadentist.com

Annual maximums usually range between $1,000 and $2,000. And when your dental costs for most procedures go over that limit, you then have to pay for your own dental care out of pocket for the rest of the year. Don’t cancel your dental plan on healthcare.gov if you want to keep your health plan. The total cost between your deductible and coinsurance comes out to $6,600. Once you max out the gift card, you’re responsible for taking care of the rest out of pocket.

Source: br.pinterest.com

Source: br.pinterest.com

If you do not hear from your insurance provider within a few weeks, call them directly to inquire about your claim. You’ll benefit from the negotiated discounts even when your annual benefit maximum* is reached. That is also the exact amount you stand to lose if you don’t take the next step. This means, once you pay $5,000 worth of eligible medical expenses, your policy will pay 100% of all medical costs for the remainder of the policy’s duration, which is typically a year. Lifetime maximum the lifetime benefit maximum in dental insurance means that the plan will stop making claim payments after the approved allowed charges reach a specific.

Source: richmondconfidential.org

Source: richmondconfidential.org

And when your dental costs for most procedures go over that limit, you then have to pay for your own dental care out of pocket for the rest of the year. You will probably find out that your situation is not unique and that there are procedures in place to assist you. If you go into your dental office to get your free cleaning, the dental office charged your insurance $120 for that cleaning. Because you only have $250,000 of your $1,000,000 lifetime maximum remaining, your insurance carrier can only pay $250,000 of the $500,000 hospital claim. After you complete your dental care, mail the receipt to your dental insurance provider.

Source: thedentalspecialtycenter.com

Source: thedentalspecialtycenter.com

Once you max out the gift card, you’re responsible for taking care of the rest out of pocket. A simple audit can be done and the insurance company will request it anyways. This contractual figure is the limit they can bill patients for covered services. However, if you expect to have a larger amount of major dental work that will exceed your plan’s annual maximum, then a secondary dental plan can make sense to help with the additional cost that you may incur. Don’t cancel your dental plan on healthcare.gov if you want to keep your health plan.

Source: glancyhypnosis.com

Source: glancyhypnosis.com

You need to do the right thing, call the insurance, and request the process of a recoupment. Do not hold on to it, the headache of them recouping it on their own accord by subtracting from another patient�s insurance payment is not worth it. Nobody wants to max out on their dental benefits. Annual maximums usually range between $1,000 and $2,000. If your plan’s annual maximum is $1,500, your dental benefits provider will pay for their portion of your dental work based on your plan�s coverage/coinsurance amounts, until they pay out a total of $1,500.

Do not hold on to it, the headache of them recouping it on their own accord by subtracting from another patient�s insurance payment is not worth it. The original “xx%” is applied to your annual maximum. You’ll benefit from the negotiated discounts even when your annual benefit maximum* is reached. This contractual figure is the limit they can bill patients for covered services. Call your dentist and make an appointment.

Source: pinterest.com

Source: pinterest.com

All other medical expenses including the outstanding balance for your hospital stay will be 100% your responsibility. Each time you visit the dentist, a dental claim is submitted. Your annual maximum would then go down by that $120, meaning you have $1,380 of benefits remaining for that year. You need to do the right thing, call the insurance, and request the process of a recoupment. If you exceed that amount, you are responsible for all additional costs—unless you sign up for a dental insurance plan with no annual maximum.

Source: ems-us.org

Source: ems-us.org

You could also contact your insurance company and ask them what provisions they may have to get around the limitations. Don’t hesitate to talk to your dentist about scheduling treatments that meet your insurance maximums. However, if you expect to have a larger amount of major dental work that will exceed your plan’s annual maximum, then a secondary dental plan can make sense to help with the additional cost that you may incur. We pay the claim and subtract the cost of the service from your maximum. If your plan’s annual maximum is $1,500, your dental benefits provider will pay for their portion of your dental work based on your plan�s coverage/coinsurance amounts, until they pay out a total of $1,500.

Source: familydentalcentres.com

Source: familydentalcentres.com

You will probably find out that your situation is not unique and that there are procedures in place to assist you. We pay the claim and subtract the cost of the service from your maximum. These patients reach their yearly maximum very quickly, and often. However, if you expect to have a larger amount of major dental work that will exceed your plan’s annual maximum, then a secondary dental plan can make sense to help with the additional cost that you may incur. You have a dental insurance plan that has a maximum annual benefit of $1,500 per year.

Source: realsmile.com

Source: realsmile.com

Lifetime maximum the lifetime benefit maximum in dental insurance means that the plan will stop making claim payments after the approved allowed charges reach a specific. Once you max out the gift card, you’re responsible for taking care of the rest out of pocket. However, expect to fund beyond the copayment for approved treatments, and perhaps pay higher prices when your. A simple audit can be done and the insurance company will request it anyways. Each time you visit the dentist, a dental claim is submitted.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what to do when you max out your dental insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information