What to do with lump sum life insurance payout Idea

Home » Trending » What to do with lump sum life insurance payout IdeaYour What to do with lump sum life insurance payout images are ready. What to do with lump sum life insurance payout are a topic that is being searched for and liked by netizens now. You can Download the What to do with lump sum life insurance payout files here. Find and Download all free images.

If you’re searching for what to do with lump sum life insurance payout images information connected with to the what to do with lump sum life insurance payout topic, you have visit the right blog. Our site always provides you with hints for refferencing the maximum quality video and image content, please kindly hunt and find more informative video articles and graphics that fit your interests.

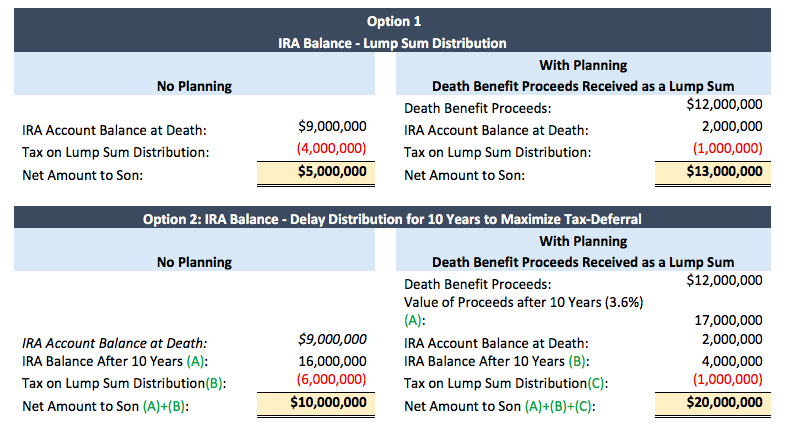

What To Do With Lump Sum Life Insurance Payout. We will make a payment directly to the legal owner of the policy, unless that person is deceased, in which case it will be paid to their personal representative, usually the executor of their will. In nebraska, you could be required to pay as much as 18%! If there’s anything left over after you’ve covered those costs, you can invest the death benefit and save for retirement. The payout from an annuity can be managed by someone else who decides how it gets invested, but all of this responsibility falls on you with a lump sum payment.

What To Do With Lump Sum Life Insurance Payout Death From foxysletters.blogspot.com

What To Do With Lump Sum Life Insurance Payout Death From foxysletters.blogspot.com

The lump sum payment of the life insurance benefit saves your family the financial burden after death and will ensure that they are taken care of. Generally, it is not counted as taxable income (only in rare cases would. Depending on how you got your lump sum and where you live, you could owe taxes on it. As the name suggests, a lump sum payout allows the life insurance beneficiary to receive the entire death benefit at once. Find a trusted financial advisor. Traditional term insurance plans are believed to be the simplest and cheapest form of life insurance.

Find a trusted financial advisor.

For instance, as of february 2021, six states impose an inheritance tax. Furthermore, some insurers pay the dependent the full sum assured as a lump sum payment plus a monthly payment for the next few years. Depending on how you got your lump sum and where you live, you could owe taxes on it. You can run your term life quote with lump sum payout to view rates and plans. For instance, as of february 2021, six states impose an inheritance tax. If there’s more than one, each beneficiary has to submit their own claim.

Source: elalmadeunlobo.blogspot.com

Source: elalmadeunlobo.blogspot.com

As the name suggests, a lump sum payout allows the life insurance beneficiary to receive the entire death benefit at once. The payout from an annuity can be managed by someone else who decides how it gets invested, but all of this responsibility falls on you with a lump sum payment. As the name suggests, a lump sum payout allows the life insurance beneficiary to receive the entire death benefit at once. Any claim will be paid as a lump sum in pound sterling to a uk bank account. “if you have received a life insurance payout, this is one time where it may make sense to let the cash just sit in your account,” says r.j.

Source: elalmadeunlobo.blogspot.com

Source: elalmadeunlobo.blogspot.com

Traditional term insurance plans are believed to be the simplest and cheapest form of life insurance. Traditional term insurance plans are believed to be the simplest and cheapest form of life insurance. “if you have received a life insurance payout, this is one time where it may make sense to let the cash just sit in your account,” says r.j. It is important to remember to submit all accurate information when filling out your policy, to ensure that the process is quick and that your family will able to receive the benefits within the time frame that is needed. Again, there is absolutely no cost to you for our services.

Source: foxysletters.blogspot.com

Source: foxysletters.blogspot.com

A lump sum life insurance death benefit is a one time payment to the policy’s beneficiaries. If there’s more than one, each beneficiary has to submit their own claim. The life insurance payout will be sent to the beneficiary listed on the policy. Usually, to file that claim, they will. After the death of a loved one, this money can provide critical financial security.

Source: foxysletters.blogspot.com

Source: foxysletters.blogspot.com

A lump sum life insurance death benefit is a one time payment to the policy’s beneficiaries. Like most options, there are pros and cons to consider: Who we pay out to: Traditional term insurance plans are believed to be the simplest and cheapest form of life insurance. Usually, to file that claim, they will.

Source: sproutt.com

Source: sproutt.com

Who we pay out to: When the policy is purchased, the owner decides how much insurance coverage they want to buy. Any claim will be paid as a lump sum in pound sterling to a uk bank account. Usually, to file that claim, they will. Again, there is absolutely no cost to you for our services.

Source: smartzonefinance.com

Source: smartzonefinance.com

It is important to remember to submit all accurate information when filling out your policy, to ensure that the process is quick and that your family will able to receive the benefits within the time frame that is needed. Consult with a tax professional if you need to do so. You can run your term life quote with lump sum payout to view rates and plans. “if you have received a life insurance payout, this is one time where it may make sense to let the cash just sit in your account,” says r.j. If there’s more than one, each beneficiary has to submit their own claim.

Source: fcimagine-beliebers.blogspot.com

Source: fcimagine-beliebers.blogspot.com

When the policy is purchased, the owner decides how much insurance coverage they want to buy. The payout from an annuity can be managed by someone else who decides how it gets invested, but all of this responsibility falls on you with a lump sum payment. An annuity pays you a steady income for life, while a lump sum payment is just one large cash amount that�s paid to the policyholder at once. “if you have received a life insurance payout, this is one time where it may make sense to let the cash just sit in your account,” says r.j. You can run your term life quote with lump sum payout to view rates and plans.

Source: takemycounsel.com

Source: takemycounsel.com

As the name suggests, a lump sum payout allows the life insurance beneficiary to receive the entire death benefit at once. Then, the insurance company will pay each person or organization the amount the policyholder left them. If there’s anything left over after you’ve covered those costs, you can invest the death benefit and save for retirement. Who we pay out to: Consult with a tax professional if you need to do so.

Source: foxysletters.blogspot.com

Source: foxysletters.blogspot.com

The payout from an annuity can be managed by someone else who decides how it gets invested, but all of this responsibility falls on you with a lump sum payment. Generally, it is not counted as taxable income (only in rare cases would. Traditional term insurance plans are believed to be the simplest and cheapest form of life insurance. Any claim will be paid as a lump sum in pound sterling to a uk bank account. Weiss, a cfp® professional and founder of the personal.

Source: rootfin.com

Source: rootfin.com

Depending on how you got your lump sum and where you live, you could owe taxes on it. As the name suggests, a lump sum payout allows the life insurance beneficiary to receive the entire death benefit at once. Traditional term insurance plans are believed to be the simplest and cheapest form of life insurance. When the policy is purchased, the owner decides how much insurance coverage they want to buy. Under these plans, the policyholder pays a yearly premium for a fixed time.

Source: foxysletters.blogspot.com

Source: foxysletters.blogspot.com

A lump sum life insurance death benefit is a one time payment to the policy’s beneficiaries. Weiss, a cfp® professional and founder of the personal. Beneficiaries on life insurance policies have to file a claim to collect the death benefit. Like most options, there are pros and cons to consider: Life insurance death benefits are typically large, anywhere from $500,000 to upward of $1 million.

Source: foxysletters.blogspot.com

Source: foxysletters.blogspot.com

Find a trusted financial advisor. Under these plans, the policyholder pays a yearly premium for a fixed time period, mostly 20 to 30 years, against a total sum assured. Generally, it is not counted as taxable income (only in rare cases would. Then, the insurance company will pay each person or organization the amount the policyholder left them. As the name suggests, a lump sum payout allows the life insurance beneficiary to receive the entire death benefit at once.

Source: revisi.net

Source: revisi.net

Any claim will be paid as a lump sum in pound sterling to a uk bank account. Life insurance death benefits are typically large, anywhere from $500,000 to upward of $1 million. The life insurance payout will be sent to the beneficiary listed on the policy. Find a trusted financial advisor. “if you have received a life insurance payout, this is one time where it may make sense to let the cash just sit in your account,” says r.j.

Source: youtube.com

Source: youtube.com

“if you have received a life insurance payout, this is one time where it may make sense to let the cash just sit in your account,” says r.j. Then, the insurance company will pay each person or organization the amount the policyholder left them. Traditional term insurance plans are believed to be the simplest and cheapest form of life insurance. The lump sum with fixed monthly income payout option allows a policyholder�s dependent to receive 50 to 60% of the whole value assured as a lump sum and the rest as monthly instalments. We can help walk through some strategies for life insurance including lump sum payouts based on your situations.

Source: havenlife.com

Source: havenlife.com

Depending on how you got your lump sum and where you live, you could owe taxes on it. Depending on how you got your lump sum and where you live, you could owe taxes on it. Any claim will be paid as a lump sum in pound sterling to a uk bank account. “if you have received a life insurance payout, this is one time where it may make sense to let the cash just sit in your account,” says r.j. “if you have received a life insurance payout, this is one time where it may make sense to let the cash just sit in your account,” says r.j.

Source: elalmadeunlobo.blogspot.com

Consult with a tax professional if you need to do so. Life insurance death benefits are typically large, anywhere from $500,000 to upward of $1 million. A lump sum life insurance death benefit is a one time payment to the policy’s beneficiaries. Furthermore, some insurers pay the dependent the full sum assured as a lump sum payment plus a monthly payment for the next few years. Beneficiaries on life insurance policies have to file a claim to collect the death benefit.

Source: elalmadeunlobo.blogspot.com

Source: elalmadeunlobo.blogspot.com

As the name suggests, a lump sum payout allows the life insurance beneficiary to receive the entire death benefit at once. A lump sum life insurance death benefit is a one time payment to the policy’s beneficiaries. We will make a payment directly to the legal owner of the policy, unless that person is deceased, in which case it will be paid to their personal representative, usually the executor of their will. If there’s more than one, each beneficiary has to submit their own claim. Who we pay out to:

Source: revisi.net

The lump sum payment of the life insurance benefit saves your family the financial burden after death and will ensure that they are taken care of. If there’s anything left over after you’ve covered those costs, you can invest the death benefit and save for retirement. Under these plans, the policyholder pays a yearly premium for a fixed time. Consult with a tax professional if you need to do so. Then, the insurance company will pay each person or organization the amount the policyholder left them.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what to do with lump sum life insurance payout by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information