What to look for in a disability insurance policy information

Home » Trending » What to look for in a disability insurance policy informationYour What to look for in a disability insurance policy images are available in this site. What to look for in a disability insurance policy are a topic that is being searched for and liked by netizens today. You can Get the What to look for in a disability insurance policy files here. Find and Download all royalty-free images.

If you’re searching for what to look for in a disability insurance policy images information connected with to the what to look for in a disability insurance policy keyword, you have come to the right blog. Our site frequently gives you suggestions for downloading the maximum quality video and picture content, please kindly hunt and find more enlightening video content and graphics that match your interests.

What To Look For In A Disability Insurance Policy. Unquestionably, disability insurance is more complicated than other forms of insurance. Residual benefits will help you to make up the rest of your income, making these benefits extremely important. Shopping for disability insurance—any insurance policy for that matter—can be a confusing and frustrating experience. Disability insurance is also known as disability income, income protection insurance, or di.

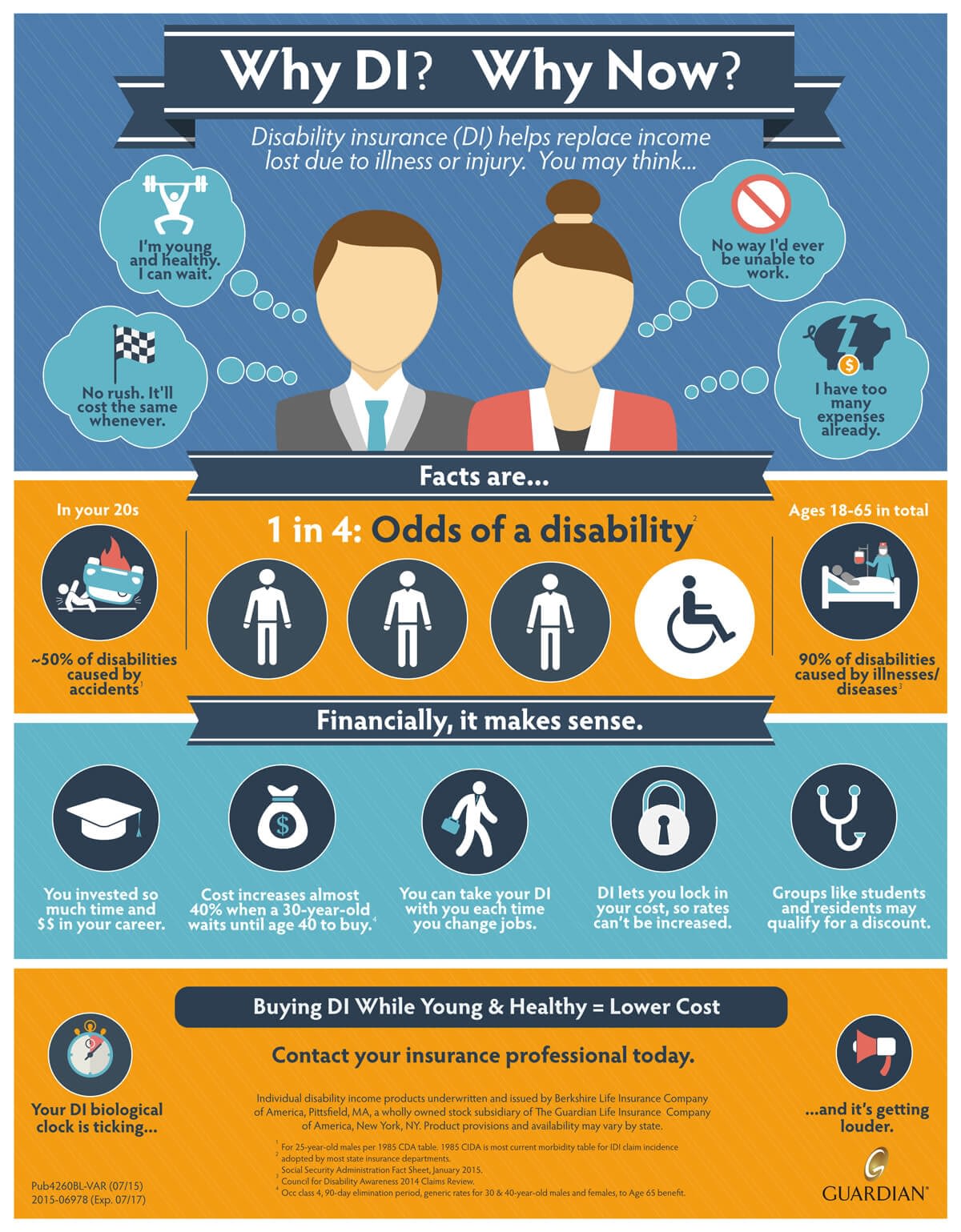

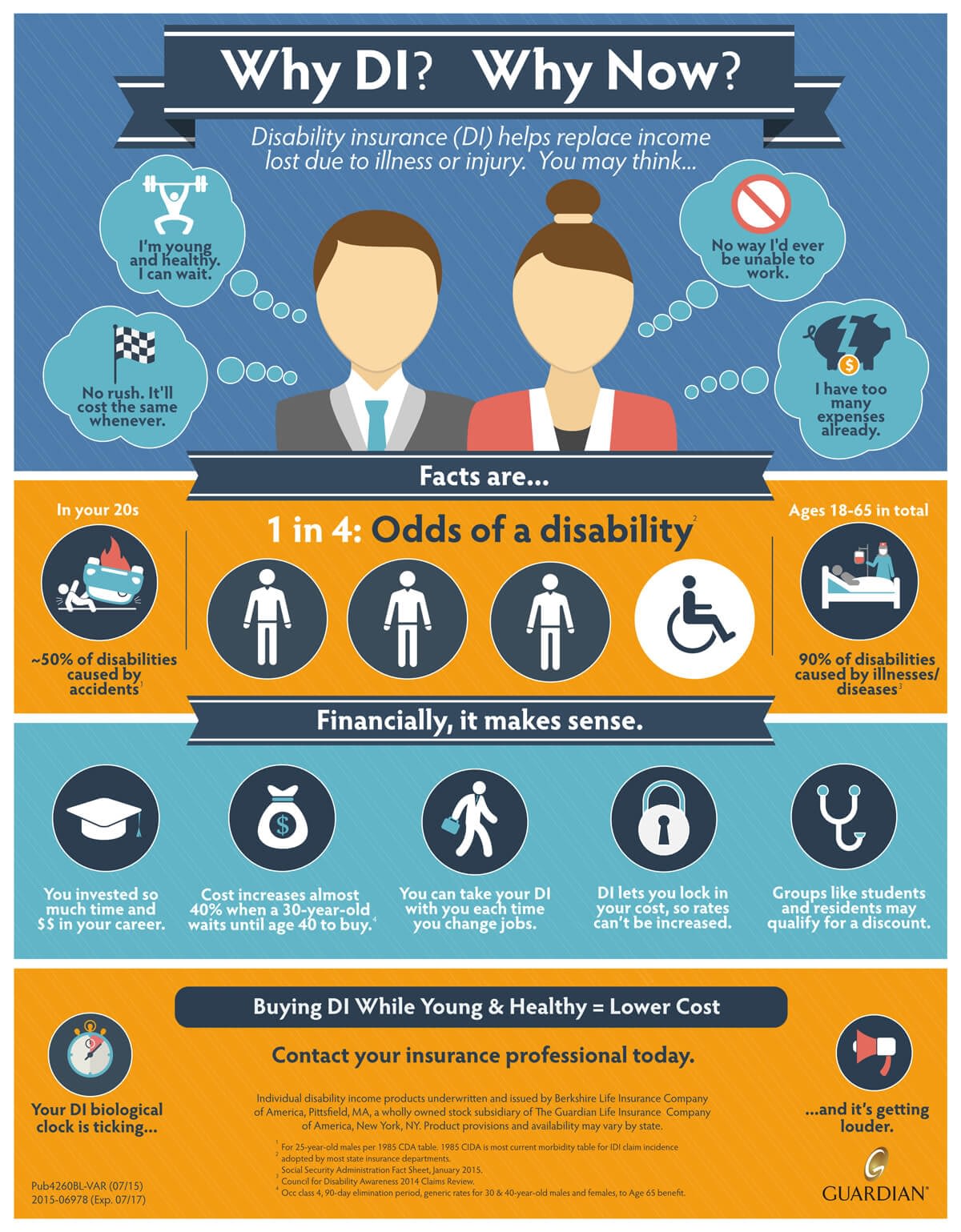

Why Disability Insurance? Legacy Insurance Agency From legacyinsuranceagency.com

Why Disability Insurance? Legacy Insurance Agency From legacyinsuranceagency.com

There are a lot of moving parts to understand in order to create the right kind of coverage, which may be one reason why many people are reluctant to look into it. Disability insurance is a protection policy against income loss resulting from an illness, injury, or other disabling condition that prohibits you from working. A single policy may limit you to a $15,000 monthly benefit, even if you currently earn $35,000 a month in income. There are so many types and features out there that not understanding them all can mean getting a policy that does not have what you need. Shopping for disability insurance—any insurance policy for that matter—can be a confusing and frustrating experience. Disability insurers have maximum benefit amounts they will issue to physicians, regardless of what you earn.

Shopping for disability insurance—any insurance policy for that matter—can be a confusing and frustrating experience.

Disability insurance is a protection policy against income loss resulting from an illness, injury, or other disabling condition that prohibits you from working. You might also look for an inflation rider with your policy. Disability insurance is also known as disability income, income protection insurance, or di. Unquestionably, disability insurance is more complicated than other forms of insurance. There are a lot of moving parts to understand in order to create the right kind of coverage, which may be one reason why many people are reluctant to look into it. Residual benefits will help you make up your income if you can only work partly.

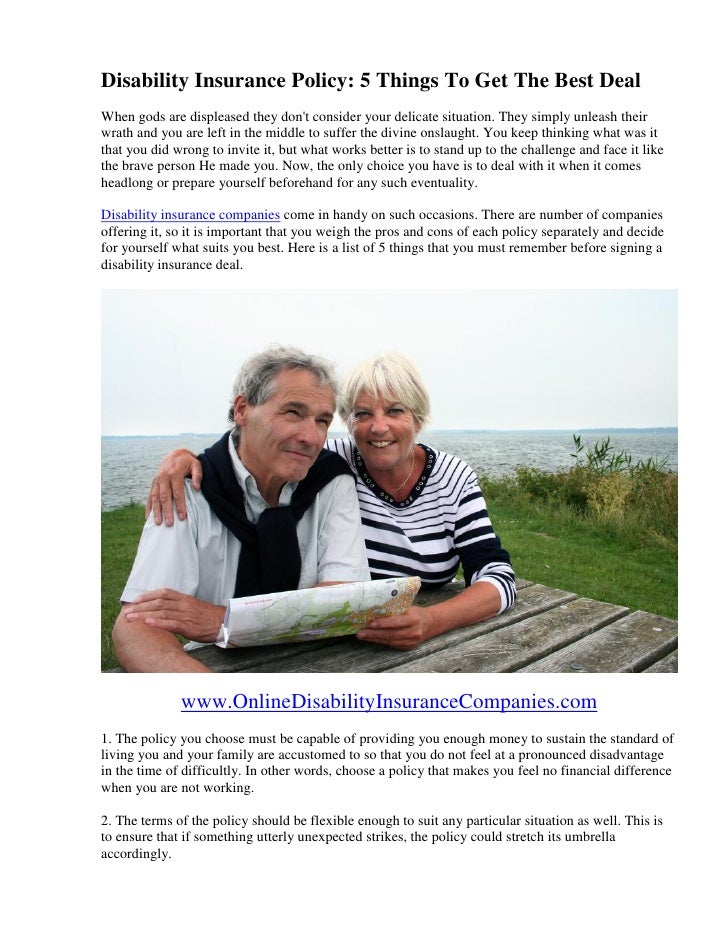

Source: slideshare.net

Source: slideshare.net

There are a lot of moving parts to understand in order to create the right kind of coverage, which may be one reason why many people are reluctant to look into it. Below, we compared some of the biggest disability insurance companies by looking at their a.m. Statistics show that the unemployment rate for persons with disabilities is 26%, over five times higher than the 5% rate for persons without disabilities. Disability insurance is also known as disability income, income protection insurance, or di. Buying more than one policy is a way to avoid being limited by those maximums.

Source: classiccinemagold.com

Source: classiccinemagold.com

While some programs will provide disability income payments at 60% or 66% or salary, many have a relatively low dollar limitation, such as $3,000 per month. Statistics show that the unemployment rate for persons with disabilities is 26%, over five times higher than the 5% rate for persons without disabilities. The first thing you�ll want to know at a glance is what type of policy you�re looking at. ¹ “own occupation” generally means the insured’s current occupation. There are a lot of moving parts to understand in order to create the right kind of coverage, which may be one reason why many people are reluctant to look into it.

Source: pinterest.com

Source: pinterest.com

¹ “own occupation” generally means the insured’s current occupation. The bottom line is that you should look for the broadest definition of “total disability” and have your disability insurance broker fully explain the circumstances under which the policy would pay benefits. There are a lot of moving parts to understand in order to create the right kind of coverage, which may be one reason why many people are reluctant to look into it. There are a lot of moving parts to understand in order to create the right kind of coverage, which may be one reason why many people are reluctant to look into it. Disability insurance is also known as disability income, income protection insurance, or di.

Source: strittmatterwealth.com

Source: strittmatterwealth.com

There is a risk that an accident or […] Some things to look for in a disability insurance policy are how long the elimination period is, how long the benefit will last, whether it pays if you are unable to go back to work for your own occupation, if there are opportunities to buy additional coverage in the future without evidence of insurability, and the amount of income that you would receive if you were to. This is a feature of the insurance policy that will pay you a certain amount of money if you lose your sight, hearing, speech, or limbs and you can still work. The bottom line is that you should look for the broadest definition of “total disability” and have your disability insurance broker fully explain the circumstances under which the policy would pay benefits. Unquestionably, disability insurance is more complicated than other forms of insurance.

Source: keymurraylaw.com

Source: keymurraylaw.com

Buying more than one policy is a way to avoid being limited by those maximums. Shopping for disability insurance—any insurance policy for that matter—can be a confusing and frustrating experience. No one likes to pay for something they don’t understand; But, with some policies, you would have to be unable to work in any capacity in order to receive benefits. Residual benefits will help you make up your income if you can only work partly.

Source: cartefinancial.com

Source: cartefinancial.com

Unquestionably, disability insurance is more complicated than other forms of insurance. Statistics show that the unemployment rate for persons with disabilities is 26%, over five times higher than the 5% rate for persons without disabilities. Looking at company ratings, the best disability insurance companies for your specific profession, and policy features can save you time, hassle, and money. Another thing to be sure your disability insurance policy includes is residual benefits. The first thing you�ll want to know at a glance is what type of policy you�re looking at.

Source: thefinitygroup.com

Source: thefinitygroup.com

Disability insurance is also known as disability income, income protection insurance, or di. Unquestionably, disability insurance is more complicated than other forms of insurance. The first thing you�ll want to know at a glance is what type of policy you�re looking at. No one likes to pay for something they don’t understand; A single policy may limit you to a $15,000 monthly benefit, even if you currently earn $35,000 a month in income.

Source: disabilityinsuranceadvisor.com

Source: disabilityinsuranceadvisor.com

This is a feature of the insurance policy that will pay you a certain amount of money if you lose your sight, hearing, speech, or limbs and you can still work. The company believes that its employees should receive some benefits during an. A single policy may limit you to a $15,000 monthly benefit, even if you currently earn $35,000 a month in income. You might also look for an inflation rider with your policy. Best and better business bureau ratings, proving their financial and customer service strength.

Source: businessdeccan.com

Source: businessdeccan.com

Buying more than one policy is a way to avoid being limited by those maximums. While some programs will provide disability income payments at 60% or 66% or salary, many have a relatively low dollar limitation, such as $3,000 per month. Shopping for disability insurance—any insurance policy for that matter—can be a confusing and frustrating experience. Below, we compared some of the biggest disability insurance companies by looking at their a.m. Best and better business bureau ratings, proving their financial and customer service strength.

Source: thefrisky.com

Source: thefrisky.com

You might also look for an inflation rider with your policy. Unquestionably, disability insurance is more complicated than other forms of insurance. Unquestionably, disability insurance is more complicated than other forms of insurance. There are so many types and features out there that not understanding them all can mean getting a policy that does not have what you need. The first thing you�ll want to know at a glance is what type of policy you�re looking at.

Source: financiallysimple.com

Source: financiallysimple.com

While some programs will provide disability income payments at 60% or 66% or salary, many have a relatively low dollar limitation, such as $3,000 per month. Best and better business bureau ratings, proving their financial and customer service strength. The first thing you�ll want to know at a glance is what type of policy you�re looking at. Residual benefits will help you make up your income if you can only work partly. There are a lot of moving parts to understand in order to create the right kind of coverage, which may be one reason why many people are reluctant to look into it.

Source: workerscompensationlawyerga.com

Source: workerscompensationlawyerga.com

Looking at company ratings, the best disability insurance companies for your specific profession, and policy features can save you time, hassle, and money. While some programs will provide disability income payments at 60% or 66% or salary, many have a relatively low dollar limitation, such as $3,000 per month. Buying more than one policy is a way to avoid being limited by those maximums. Shopping for disability insurance—any insurance policy for that matter—can be a confusing and frustrating experience. Disability insurers have maximum benefit amounts they will issue to physicians, regardless of what you earn.

Source: legacyinsuranceagency.com

Source: legacyinsuranceagency.com

But, with some policies, you would have to be unable to work in any capacity in order to receive benefits. No one likes to pay for something they don’t understand; Looking at company ratings, the best disability insurance companies for your specific profession, and policy features can save you time, hassle, and money. This is a feature of the insurance policy that will pay you a certain amount of money if you lose your sight, hearing, speech, or limbs and you can still work. However, once you understand the risk and your need for protection,.

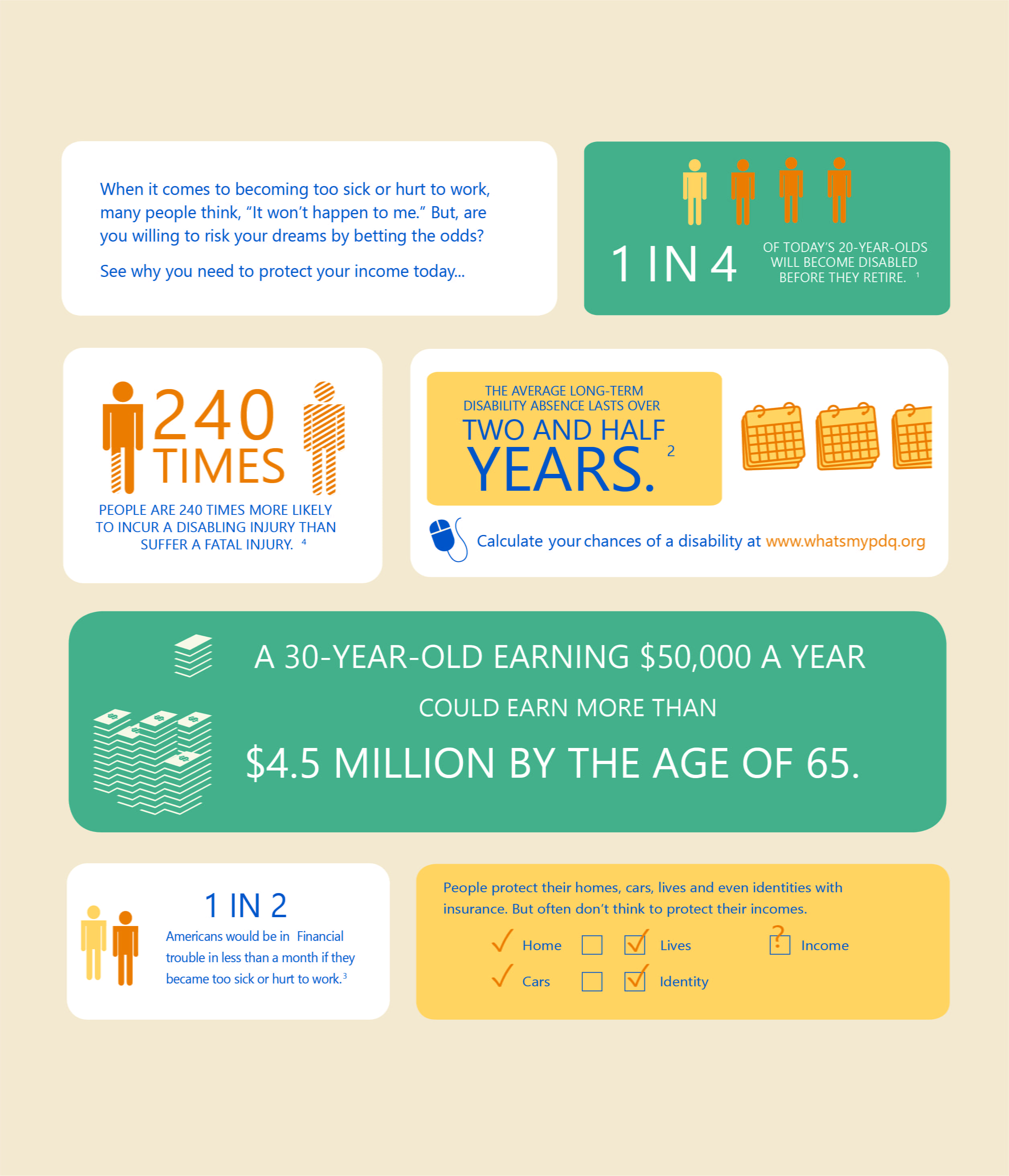

Source: infographicportal.com

Source: infographicportal.com

There are two main types of disability insurance: Residual benefits will help you to make up the rest of your income, making these benefits extremely important. There are so many types and features out there that not understanding them all can mean getting a policy that does not have what you need. Shopping for disability insurance—any insurance policy for that matter—can be a confusing and frustrating experience. Looking at company ratings, the best disability insurance companies for your specific profession, and policy features can save you time, hassle, and money.

Source: aarongroupinsurance.com

Source: aarongroupinsurance.com

But, with some policies, you would have to be unable to work in any capacity in order to receive benefits. This is a feature of the insurance policy that will pay you a certain amount of money if you lose your sight, hearing, speech, or limbs and you can still work. Another thing to be sure your disability insurance policy includes is residual benefits. A single policy may limit you to a $15,000 monthly benefit, even if you currently earn $35,000 a month in income. Disability insurance is a protection policy against income loss resulting from an illness, injury, or other disabling condition that prohibits you from working.

Source: gasparinsurance.com

Source: gasparinsurance.com

Another thing to be sure your disability insurance policy includes is residual benefits. Residual benefits will help you to make up the rest of your income, making these benefits extremely important. Musculoskeletal disorders cancer pregnancy mental health issues including depression and anxiety injuries such as fractures, sprains, and strains of muscles and ligaments as you can see, the scope of disabling events is wide. Here are the top five reasons for filing long term disability claims: While some programs will provide disability income payments at 60% or 66% or salary, many have a relatively low dollar limitation, such as $3,000 per month.

Source: slideshare.net

Source: slideshare.net

Best and better business bureau ratings, proving their financial and customer service strength. No one likes to pay for something they don’t understand; There are a lot of moving parts to understand in order to create the right kind of coverage, which may be one reason why many people are reluctant to look into it. However, once you understand the risk and your need for protection,. Disability insurance is also known as disability income, income protection insurance, or di.

Source: yore-associates.com

Source: yore-associates.com

Disability insurers have maximum benefit amounts they will issue to physicians, regardless of what you earn. Some things to look for in a disability insurance policy are how long the elimination period is, how long the benefit will last, whether it pays if you are unable to go back to work for your own occupation, if there are opportunities to buy additional coverage in the future without evidence of insurability, and the amount of income that you would receive if you were to. Disability insurance is a protection policy against income loss resulting from an illness, injury, or other disabling condition that prohibits you from working. A single policy may limit you to a $15,000 monthly benefit, even if you currently earn $35,000 a month in income. There is a risk that an accident or […]

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what to look for in a disability insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information