What type of life insurance can you borrow from Idea

Home » Trending » What type of life insurance can you borrow from IdeaYour What type of life insurance can you borrow from images are ready. What type of life insurance can you borrow from are a topic that is being searched for and liked by netizens now. You can Find and Download the What type of life insurance can you borrow from files here. Find and Download all free vectors.

If you’re searching for what type of life insurance can you borrow from pictures information linked to the what type of life insurance can you borrow from keyword, you have pay a visit to the ideal blog. Our website frequently provides you with suggestions for downloading the highest quality video and picture content, please kindly surf and find more informative video content and graphics that match your interests.

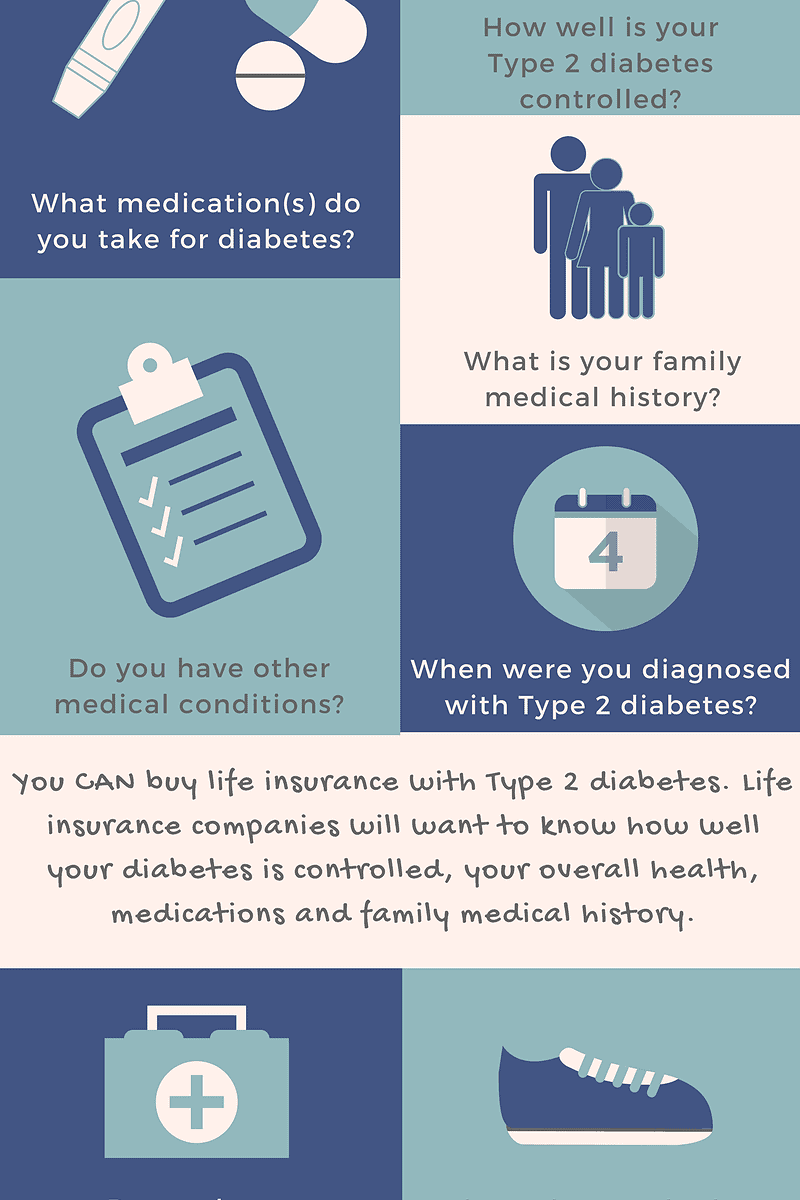

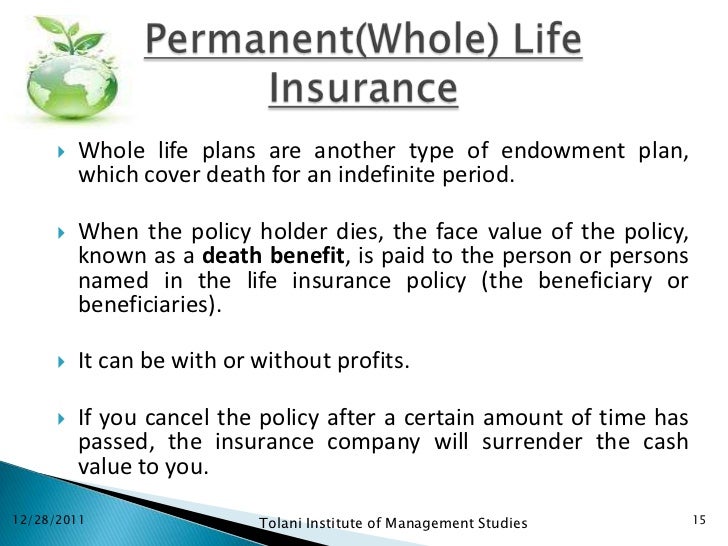

What Type Of Life Insurance Can You Borrow From. What’s permanent or cash value life insurance, anyway? Policy loans are borrowed against the death benefit, and the insurance company uses the policy as. You can borrow against any permanent life insurance policy. Two types of life insurance policies that provide cash value are whole life insurance and universal life insurance.

How Can I Borrow Money From My Life Insurance Policy From youtuberocks.com

How Can I Borrow Money From My Life Insurance Policy From youtuberocks.com

3 verify that your policy has enough cash value available for the loan. Policy loans are borrowed against the death benefit, and the insurance company uses the policy as. Those benefits include being able to borrow money from the cash value of the policy after you�ve paid premiums. And when you borrow against your insurance policy, you can design your own repayment schedule, modify it as needed, or even continue down the path of life without repaying it if your circumstances require. What is whole life cash value? Term life insurance policies do not come with a cash value account, so policyholders can’t borrow money from their insurer against these.

You can repay the loan on your own schedule.

Cash value life insurance policies are those that you can borrow against. Cash value life insurance policies are those that you can borrow against. You can borrow or withdraw money from your life insurance policy. Life insurance loans use cash value accounts as collateral. Whole life and universal life are both permanent policies that can be borrowed against, as long as enough cash value has accumulated to borrow from. Whole life insurance often builds cash value which policyholders can borrow against, depending on the policy.

Source: ipbcustomize.com

Source: ipbcustomize.com

Compare term life insurance quotes. Term life insurance policies do not come with a cash value account, so policyholders can’t borrow money from their insurer against these. Policy loans are borrowed against the death benefit, and the insurance company uses the policy as. This type of policy doesn’t expire if you pay your premiums, and some even have a cash value component. You can also use the money to pay for your premiums.

Source: ipbcustomize.com

Source: ipbcustomize.com

That’s because it’s insurance that does one thing and one thing only: Those benefits include being able to borrow money from the cash value of the policy after you�ve paid premiums. You can only borrow from life insurance that has cash value. The two major types of permanent life insurance are whole life and universal life. You’re able to borrow without a credit check or any questions from a lender if you have built up cash value on your policy.

Source: spikysnail.com

Source: spikysnail.com

For instance, term life insurance only provides coverage for a specified term. The cash value is used as collateral. Cash value life insurance policies are those that you can borrow against. Life insurance loans use cash value accounts as collateral. Check on your insurance company’s website or with your agent to find out the cash value of your policy.

Source: lifeinsurancepost.com

Source: lifeinsurancepost.com

Life insurance loans use cash value accounts as collateral. Whole life insurance often builds cash value which policyholders can borrow against, depending on the policy. Learn more about the factors to consider if you are thinking about borrowing from a whole life policy. For instance, term life insurance only provides coverage for a specified term. Two types of life insurance policies that provide cash value are whole life insurance and universal life insurance.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Only the owner of the permanent life insurance policy can borrow from it, not the insured or beneficiaries, unless they are also the owner. Permanent life insurance policies all build up cash value. Cash value life insurance is a type of permanent life insurance that includes an investment feature. You can usually borrow around 95% of a life insurance policy�s cash surrender value in any given year. Whole life and universal life are both permanent policies that can be borrowed against, as long as enough cash value has accumulated to borrow from.

Source: getabusinessinsurance.com

Source: getabusinessinsurance.com

Those benefits include being able to borrow money from the cash value of the policy after you�ve paid premiums. Cash value insurance policies are permanent, which means that they won’t expire. Compare term life insurance quotes. Whole life and universal life are both permanent policies that can be borrowed against, as long as enough cash value has accumulated to borrow from. You’re able to borrow without a credit check or any questions from a lender if you have built up cash value on your policy.

Source: npa1.org

Source: npa1.org

In most cases, you won’t have to pay taxes on the money you borrow, but the insurance company will. Some insurance agents tout the benefits of life insurance with investment components. Permanent life insurance policies all build up cash value. The basis is the total of all the premiums you have paid—minus any previous withdrawals and dividends received. With permanent life insurance, your insurance company will usually put a portion of your annual or monthly payments in a cash fund which can earn interest as it grows.

Source: thefinancesection.com

Source: thefinancesection.com

This can be whole life, universal life, indexed universal life or variable universal life. What’s permanent or cash value life insurance, anyway? Whole life and universal life are both permanent policies that can be borrowed against, as long as enough cash value has accumulated to borrow from. You can only borrow against a permanent or whole life insurance policy. You can borrow or withdraw money from your life insurance policy.

Source: revisi.net

Source: revisi.net

In most cases, you won’t have to pay taxes on the money you borrow, but the insurance company will. You can borrow from whole life, universal life, indexed universal life, and variable universal life policies. Keep in mind that you may need to wait for a permanent. What’s permanent or cash value life insurance, anyway? You can only borrow from life insurance that has cash value.

Source: pinterest.com

Source: pinterest.com

It is imperative to make sure that you don�t borrow too. Cash value life insurance is a type of permanent life insurance that includes an investment feature. Whole life and universal life are both permanent policies that can be borrowed against, as long as enough cash value has accumulated to borrow from. These include whole life, universal life, and guaranteed life insurance, among others. If the insured passes away before the loan is paid back, the.

Source: youtuberocks.com

Source: youtuberocks.com

It is imperative to make sure that you don�t borrow too. For instance, term life insurance only provides coverage for a specified term. You can borrow from whole life, universal life, indexed universal life, and variable universal life policies. The cash value is used as collateral. Cash value insurance policies are permanent, which means that they won’t expire.

Source: slideshare.net

Source: slideshare.net

Whole life insurance often builds cash value which policyholders can borrow against, depending on the policy. Term life insurance is the simplest (and usually the most affordable) type of life insurance you can buy. You can only borrow against a permanent or whole life insurance policy. The other category of life insurance is term life. Only the owner of the permanent life insurance policy can borrow from it, not the insured or beneficiaries, unless they are also the owner.

Source: topquotelifeinsurance.com

Source: topquotelifeinsurance.com

In most cases, you won’t have to pay taxes on the money you borrow, but the insurance company will. Pays the people you choose—your spouse, children or other beneficiaries—a fixed amount of money if you die. Those benefits include being able to borrow money from the cash value of the policy after you�ve paid premiums. The cash value is used as collateral. And when you borrow against your insurance policy, you can design your own repayment schedule, modify it as needed, or even continue down the path of life without repaying it if your circumstances require.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

And when you borrow against your insurance policy, you can design your own repayment schedule, modify it as needed, or even continue down the path of life without repaying it if your circumstances require. Term life insurance does not have any cash value, so you cannot borrow against term insurance. Universal life includes fixed universal life, indexed universal life and variable universal life. For instance, term life insurance only provides coverage for a specified term. Such life insurance loans are often used to help with home, college, or unexpected medical expenses.

Source: thefinancesection.com

Source: thefinancesection.com

Term life insurance costs less money than other types of life insurance. Term life insurance is a popular option for younger individuals who are looking to offer extra security for their loved ones. Cash value insurance policies are permanent, which means that they won’t expire. You can borrow or withdraw money from your life insurance policy. You’re able to borrow without a credit check or any questions from a lender if you have built up cash value on your policy.

Source: slideshare.net

Source: slideshare.net

You can borrow against permanent life insurance (also called cash value life insurance) policies that have enough cash value for borrowing. You can buy this kind of coverage for a certain period of time, or term, such as 10, 20 or 30 years. Normally, term life does not have a cash value, and therefore is not a policy that can be borrowed from. It is imperative to make sure that you don�t borrow too. The other category of life insurance is term life.

Source: ulearning.com

Source: ulearning.com

You can repay the loan on your own schedule. You can borrow money usually against any permanent life insurance policy that builds cash value, which is one of their advantages over term life insurance. Term life insurance is a popular option for younger individuals who are looking to offer extra security for their loved ones. Such life insurance loans are often used to help with home, college, or unexpected medical expenses. And when you borrow against your insurance policy, you can design your own repayment schedule, modify it as needed, or even continue down the path of life without repaying it if your circumstances require.

Source: ipbcustomize.com

Source: ipbcustomize.com

Term life insurance does not have any cash value, so you cannot borrow against term insurance. Two types of life insurance policies that provide cash value are whole life insurance and universal life insurance. Only the owner of the permanent life insurance policy can borrow from it, not the insured or beneficiaries, unless they are also the owner. The rules that govern life insurance policy loans do vary from company to company , however, so it�s important to understand a few basic rules about how much and when specifically you�ll have the option to borrow money against your policy. Such life insurance loans are often used to help with home, college, or unexpected medical expenses.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what type of life insurance can you borrow from by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information