What year did car insurance become a legal requirement Idea

Home » Trending » What year did car insurance become a legal requirement IdeaYour What year did car insurance become a legal requirement images are available. What year did car insurance become a legal requirement are a topic that is being searched for and liked by netizens now. You can Get the What year did car insurance become a legal requirement files here. Get all royalty-free photos and vectors.

If you’re looking for what year did car insurance become a legal requirement images information linked to the what year did car insurance become a legal requirement topic, you have visit the ideal blog. Our site frequently provides you with hints for downloading the highest quality video and image content, please kindly surf and find more enlightening video articles and images that fit your interests.

What Year Did Car Insurance Become A Legal Requirement. If your car is more than three years old you also need a valid mot certificate. Vehicle insurance (also known as car insurance, motor insurance, or auto insurance) is insurance for cars, trucks, motorcycles, and other road vehicles.its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Proof of this coverage must be carried when behind the wheel. $50,000 for total bodily injury or death liability in an accident caused by the.

Best Auto Insurance Coverage Comprehensive insurance From goodtogoinsurance.org

Best Auto Insurance Coverage Comprehensive insurance From goodtogoinsurance.org

This means liability coverage of $25,000.00 for all claims for bodily injury damages sustained by any one person. For most of us who own cars in the u.s., there is a legal requirement to have our vehicles insured. This covers the entire liability requirement. It�s also an offence to keep an uninsured car on a driveway or in a garage. $25,000 for bodily injury or death of one person in an accident caused by the owner/driver of the insured vehicle. Additionally, texas drivers must have coverage for property damage of at least $25,000.

Up to $50,000 for liability and $25,000 for property damage.

The first state to make auto insurance mandatory was massachusetts and the law went into effect in 1927. Insurance and legal professionals refer to these coverage […] This means liability coverage of $25,000.00 for all claims for bodily injury damages sustained by any one person. Furthermore, this proof must be shown at the request of any law enforcement official. $15,000 per person, per accident. Why is car insurance required by law?

Source: carinsurancecompanies.net

Source: carinsurancecompanies.net

It�s also an offence to keep an uninsured car on a driveway or in a garage. Vehicle insurance, car insurance, or auto insurance in the united states and elsewhere, is designed to cover the risk of financial liability or the loss of a motor vehicle that the owner may face if their vehicle is involved in a collision that results in property or physical damage.most states require a motor vehicle owner to carry some minimum level of liability insurance. Read on to find out more about mandatory car insurance in nebraska as. You must give your insurance policy number every time you register a vehicle, or when you buy a light vehicle trip permit. Some car insurance carriers offer a single limit of $35,000;

Source: bemoneyaware.com

Source: bemoneyaware.com

Insurance and legal professionals refer to these coverage […] Car insurance requirements in nevada. The latest state to mandate automobile coverage was wisconsin which only began requiring drivers to become insured on january 1, 2010. $10,000 for property damage per accident caused by. Car insurance is not mandatory in new hampshire, but residents are still responsible for damages resulting from a car accident:

Source: boomerandecho.com

Source: boomerandecho.com

Car insurance requirements in nevada. The latest state to mandate automobile coverage was wisconsin which only began requiring drivers to become insured on january 1, 2010. Car insurance is not mandatory in new hampshire, but residents are still responsible for damages resulting from a car accident: Having proof of insurance is mandatory in georgia, and must be shown at the behest of any law enforcement official. Filing a claim will increase car insurance premiums from 3% to 32% on average for three to five years in almost all cases.

Source: farzanaselamat.blogspot.com

Source: farzanaselamat.blogspot.com

There are just two states that don�t require car insurance: Texas law requires all drivers to have adequate car insurance. Furthermore, this proof must be shown at the request of any law enforcement official. The first of these policies was bought by dr. Car insurance is not mandatory in new hampshire, but residents are still responsible for damages resulting from a car accident:

Source: goodtogoinsurance.org

Source: goodtogoinsurance.org

Furthermore, this proof must be shown at the request of any law enforcement official. The first state to make auto insurance mandatory was massachusetts and the law went into effect in 1927. $25,000 for injury/death of one person. This means liability coverage of $25,000.00 for all claims for bodily injury damages sustained by any one person. Nebraska law requires that all drivers carry certain levels of car insurance coverage in order to be legal.

Source: designedgps.blogspot.com

Source: designedgps.blogspot.com

How much your rate goes up depends on several factors, like the claim type and amount, your insurance company, your claims history, your location, and whether or not you have accident forgiveness. Vehicle insurance (also known as car insurance, motor insurance, or auto insurance) is insurance for cars, trucks, motorcycles, and other road vehicles.its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. In addition, the vehicle owner, as well as the vehicle driver, are subject to a fine of $500.00 to $1,000.00, up to 90 days in jail, or both. But when did car insurance become mandatory? Having proof of insurance is mandatory in georgia, and must be shown at the behest of any law enforcement official.

Source: businessinsider.com

Source: businessinsider.com

$10,000 for property damage per accident caused by. $50,000 for total bodily injury or death liability in an accident caused by the owner/driver of the insured vehicle, and. $50,000 for total bodily injury or death liability in an accident caused by the. In addition, the vehicle owner, as well as the vehicle driver, are subject to a fine of $500.00 to $1,000.00, up to 90 days in jail, or both. There can be a lot of information to provide when you arrange your car insurance so it’s understandable that errors can sometimes be made but, as mistakes could.

Source: carsurer.com

Source: carsurer.com

Having proof of insurance is mandatory in georgia, and must be shown at the behest of any law enforcement official. Insurance and legal professionals refer to these coverage […] All owners of motor vehicles in kentucky are required to carry minimum liability coverage. Minimum required for insurance coverage: Put simply, the aca has made it much easier for uninsured americans to obtain health insurance.

Source: designedgps.blogspot.com

Source: designedgps.blogspot.com

Proof of insurance must be shown at traffic stops, accident scenes, and vehicle inspections. As we all know, car insurance is a legal requirement on uk roads and since continuous enforcement legislation came into effect in 2011 it’s essential there aren’t any gaps in your car insurance cover. Some vehicles aren�t required to have insurance. When did it become a requirement to have auto insurance coverage? $25,000 for bodily injury or death of one person in an accident caused by the owner/driver of the insured vehicle.

Source: designedgps.blogspot.com

Source: designedgps.blogspot.com

Truman martin in buffalo, new york in february of 1898. It�s also an offence to keep an uninsured car on a driveway or in a garage. It would become the template for future policies. $15,000 per person, per accident. Additionally, texas drivers must have coverage for property damage of at least $25,000.

Source: electronicink.com

Source: electronicink.com

According to state law, texas drivers need to have minimum insurance coverages of $30,000 per injured person, up to at least $60,000 per accident. Having proof of insurance is mandatory in georgia, and must be shown at the behest of any law enforcement official. Why is car insurance required by law? There are currently 2 types of insurance cover that are required by law in the uk. Read on to learn about the first auto insurance policy, the first auto insurance requirements, and today’s car insurance laws.

Source: designedgps.blogspot.com

Source: designedgps.blogspot.com

(minimum limits if a driver purchases car insurance, which is optional. Vehicle insurance (also known as car insurance, motor insurance, or auto insurance) is insurance for cars, trucks, motorcycles, and other road vehicles.its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Vehicle insurance, car insurance, or auto insurance in the united states and elsewhere, is designed to cover the risk of financial liability or the loss of a motor vehicle that the owner may face if their vehicle is involved in a collision that results in property or physical damage.most states require a motor vehicle owner to carry some minimum level of liability insurance. When did it become a requirement to have auto insurance coverage? If your car is more than three years old you also need a valid mot certificate.

Source: farzanaselamat.blogspot.com

Source: farzanaselamat.blogspot.com

Some car insurance carriers offer a single limit of $35,000; But when did car insurance become mandatory? Vehicle insurance (also known as car insurance, motor insurance, or auto insurance) is insurance for cars, trucks, motorcycles, and other road vehicles.its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. According to state law, texas drivers need to have minimum insurance coverages of $30,000 per injured person, up to at least $60,000 per accident. States with no car insurance requirement.

Source: designedgps.blogspot.com

Source: designedgps.blogspot.com

When did it become a requirement to have auto insurance coverage? Proof of insurance must be shown at traffic stops, accident scenes, and vehicle inspections. The minimum auto insurance limits for the state of georgia can be found below. $50,000 for total bodily injury or death liability in an accident caused by the owner/driver of the insured vehicle, and. But when did car insurance become mandatory?

Source: ratelab.ca

Source: ratelab.ca

There are just two states that don�t require car insurance: It would become the template for future policies. Some car insurance carriers offer a single limit of $35,000; $25,000 for property damage in an accident. Kansas law mandates that every automobile insurance policy sold in the state must have these minimum coverages:

Source: cestarcollege.com

Source: cestarcollege.com

Proof of this coverage must be carried when behind the wheel. The first of these policies was bought by dr. States with no car insurance requirement. Put simply, the aca has made it much easier for uninsured americans to obtain health insurance. The liability car insurance requirements in missouri are.

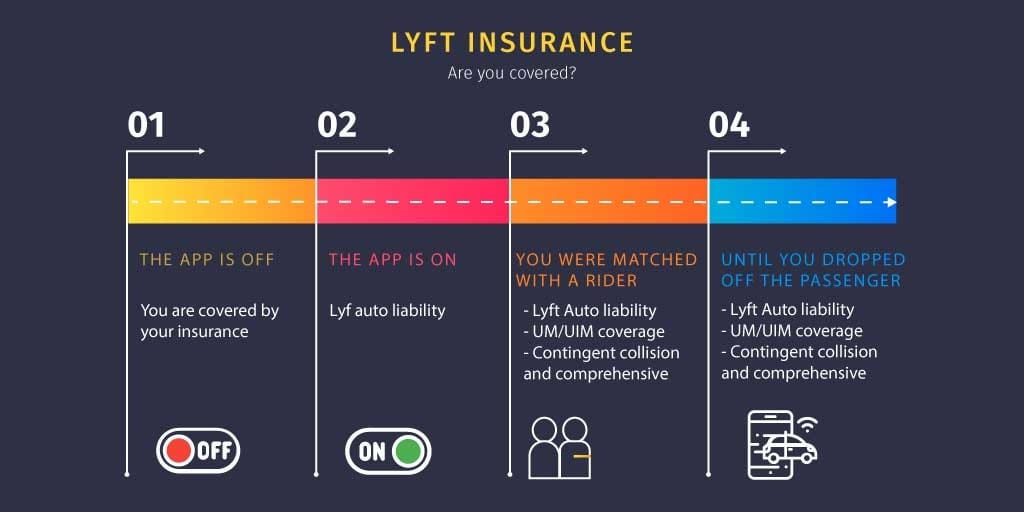

Source: bestreferraldriver.com

Source: bestreferraldriver.com

$25,000 for property damage in an accident. Vehicle insurance, car insurance, or auto insurance in the united states and elsewhere, is designed to cover the risk of financial liability or the loss of a motor vehicle that the owner may face if their vehicle is involved in a collision that results in property or physical damage.most states require a motor vehicle owner to carry some minimum level of liability insurance. All drivers are required by law (under the road traffic act of 1930) to have in force an insurance policy to cover their liability for bodily injury to or damage to third party property which arises from the use of a motor vehicle. The minimum auto insurance limits for the state of georgia can be found below. Texas law requires all drivers to have adequate car insurance.

Source: coverage.com

Source: coverage.com

You can find those exemptions in ors 806.020. Vehicle insurance (also known as car insurance, motor insurance, or auto insurance) is insurance for cars, trucks, motorcycles, and other road vehicles.its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. It would become the template for future policies. Put simply, the aca has made it much easier for uninsured americans to obtain health insurance. Auto insurance requirements in nebraska.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what year did car insurance become a legal requirement by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information