When a misrepresentation on a life insurance policy information

Home » Trend » When a misrepresentation on a life insurance policy informationYour When a misrepresentation on a life insurance policy images are available. When a misrepresentation on a life insurance policy are a topic that is being searched for and liked by netizens now. You can Get the When a misrepresentation on a life insurance policy files here. Get all royalty-free photos and vectors.

If you’re searching for when a misrepresentation on a life insurance policy pictures information related to the when a misrepresentation on a life insurance policy interest, you have come to the ideal blog. Our website frequently provides you with suggestions for viewing the maximum quality video and image content, please kindly surf and locate more informative video content and graphics that match your interests.

When A Misrepresentation On A Life Insurance Policy. An example of a lie of omission is failing to tell the insurer that you installed a swimming pool. When the insurer misrepresents the details of the policy you’re being sold or the claim you have filed, it is acting in bad faith, opening the door for you to pursue a bad faith insurance claim to. Ask many health questions, making some of them very vague and open ended. The policy may well have renewed one or more times since then.

(PDF) Insurance, Misrepresentation, Causation, and From researchgate.net

(PDF) Insurance, Misrepresentation, Causation, and From researchgate.net

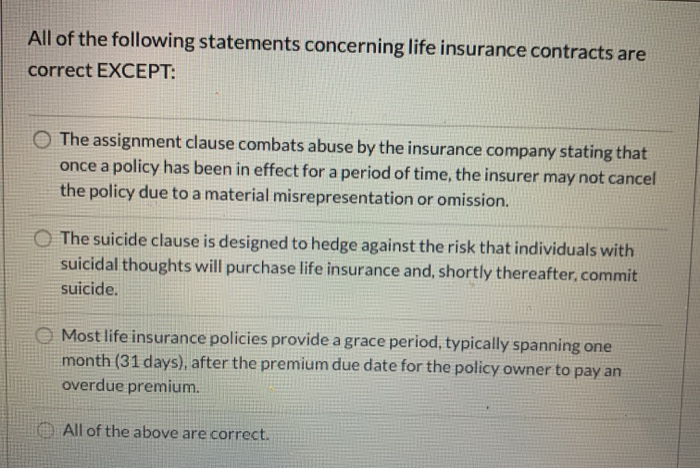

The company is looking for information that reveals evidence of misrepresentation or dishonesty in the initial insurance coverage application. Misrepresentation is an active form of concealment. Misrepresentation when dealing with an insurance company can occur in a number of ways. However, in some circumstances, an insurance company may deny the claim leaving the grieving family in a difficult position. Within the context of life insurance, this means that the misrepresentation must have substantially affected the insurer’s decision to issue the policy in question. When the insurer misrepresents the details of the policy you’re being sold or the claim you have filed, it is acting in bad faith, opening the door for you to pursue a bad faith insurance claim to.

She dies within two years of her application, and the insurer discovers sh.

Under the insurance contracts act 1984, there are… Although misrepresentation doesn’t necessarily void a policy, tennessee law (t.c.a. Misrepresentation is a false statement of fact. Life insurance is a way of providing a financial safety net for your family and loved ones. Five states (kansas, missouri, nebraska, rhode island, and south carolina) provide that misrepresentations cannot void a life insurance policy unless they “contribute” to the insurer’s “loss.”. An example of a lie of omission is failing to tell the insurer that you installed a swimming pool.

Source: farzanaselamat.blogspot.com

Source: farzanaselamat.blogspot.com

The life insurance company plays it like this: A misrepresentation by the insured renders the insurance contract voidable at the option of the insurer, although the policy is not thereby rendered void ab initio. In insurance law, material misrepresentation occurs when an individual provides false information in his or her application for coverage that, if provided truthfully, would have impacted the insurance company’s decision to issue the policy. If the misrepresentation or failure to disclose is fraudulent, the insurer can avoid or set aside the policy from when it started. Five states (kansas, missouri, nebraska, rhode island, and south carolina) provide that misrepresentations cannot void a life insurance policy unless they “contribute” to the insurer’s “loss.”.

Source: boonswanglaw.com

Source: boonswanglaw.com

Rescission of a life insurance policy is permissible when there is a material misrepresentation in the initial application. If the misrepresentation was “immaterial,” or did not affect the insurability of the. A misrepresentation by the insured renders the insurance contract voidable at the option of the insurer, although the policy is not thereby rendered void ab initio. You may find out there was a misrepresentation when the policy was taken out and it’s been a year or more since it happened. Ask many health questions, making some of them very vague and open ended.

Source: researchgate.net

Source: researchgate.net

The company is looking for information that reveals evidence of misrepresentation or dishonesty in the initial insurance coverage application. Is misrepresentation synonymous with concealment? In insurance law, material misrepresentation occurs when an individual provides false information in his or her application for coverage that, if provided truthfully, would have impacted the insurance company’s decision to issue the policy. Life insurance misrepresentation defined by a national life insurance beneficiary attorney. A misrepresentation is often a lie of commission or omission.

Source: pinterest.com

Source: pinterest.com

In the insurance industry, misrepresentation is a false statement on an application for insurance coverage that, if told truthfully, would affect the company’s decision on issuing the policy. If the misrepresentation was “immaterial,” or did not affect the insurability of the. Misrepresentation or warranty will not void policy exceptions. Second, the insurance company must show the misrepresentations made by the insured were material to the risk, and the insurance company would not have issued the policy or would have done so with higher premiums if it had known of the risk: The company is looking for information that reveals evidence of misrepresentation or dishonesty in the initial insurance coverage application.

Source: esloseguido.blogspot.com

Source: esloseguido.blogspot.com

Rescission of a life insurance policy is permissible when there is a material misrepresentation in the initial application. If your life insurance company finds a misrepresentation in your application while you’re still alive, it can still cancel the policy or increase your (11). She dies within two years of her application, and the insurer discovers sh. Five states (kansas, missouri, nebraska, rhode island, and south carolina) provide that misrepresentations cannot void a life insurance policy unless they “contribute” to the insurer’s “loss.”. Misrepresentation or warranty will not void policy exceptions.

Source: farzanaselamat.blogspot.com

Source: farzanaselamat.blogspot.com

The policy may well have renewed one or more times since then. The life insurance company plays it like this: Five states (kansas, missouri, nebraska, rhode island, and south carolina) provide that misrepresentations cannot void a life insurance policy unless they “contribute” to the insurer’s “loss.”. “[m]isrepresentations, omissions, or concealment of facts may prevent a recovery under an insurance policy if they. When the insurer misrepresents the details of the policy you’re being sold or the claim you have filed, it is acting in bad faith, opening the door for you to pursue a bad faith insurance claim to.

An example of this would be failure to disclose a medical condition known to the (prospective) insured at the time of completing the proposal form for life insurance. Identifying these incidents and potentially defending this position through the australian legal system is therefore a concern for these organisations. When a misrepresentation on a life insurance policy application is discovered. A misrepresentation or failure to disclose is innocent if it is not fraudulent. If your life insurance company finds a misrepresentation in your application while you’re still alive, it can still cancel the policy or increase your (11).

Source: farzanaselamat.blogspot.com

Source: farzanaselamat.blogspot.com

She dies within two years of her application, and the insurer discovers sh. Second, the insurance company must show the misrepresentations made by the insured were material to the risk, and the insurance company would not have issued the policy or would have done so with higher premiums if it had known of the risk: Usually the omission or untrue statement is meant to work. She dies within two years of her application, and the insurer discovers sh. If the misrepresentation or failure to disclose is fraudulent, the insurer can avoid or set aside the policy from when it started.

Source: farzanaselamat.blogspot.com

Source: farzanaselamat.blogspot.com

The company is looking for information that reveals evidence of misrepresentation or dishonesty in the initial insurance coverage application. Is misrepresentation synonymous with concealment? Under the insurance contracts act 1984, there are… An example of this would be failure to disclose a medical condition known to the (prospective) insured at the time of completing the proposal form for life insurance. A misrepresentation or failure to disclose is innocent if it is not fraudulent.

Source: farzanaselamat.blogspot.com

Source: farzanaselamat.blogspot.com

Life insurance misrepresentation defined by a national life insurance beneficiary attorney. It may be minor enough that insurer only needs to update or the policy or significant enough that it provides valid grounds to void the contract. An example of this would be failure to disclose a medical condition known to the (prospective) insured at the time of completing the proposal form for life insurance. Is misrepresentation synonymous with concealment? A misrepresentation is often a lie of commission or omission.

Misrepresentation or warranty will not void policy exceptions. The life insurance company plays it like this: Misrepresentation must be relevant to cause of death. Misrepresentation is an active form of concealment. This is called material misrepresentation.

Misrepresentation is a false statement of fact. If the insurer is induced to contract by the insured’s. The insurance company essentially claims that they were misled into selling the policy based on the misrepresentations, and thus the policy was never actually validly agreed upon. Is misrepresentation synonymous with concealment? What happens when misrepresentation on a life insurance policy gets discovered.

Source: pinterest.com

Source: pinterest.com

In insurance law, material misrepresentation occurs when an individual provides false information in his or her application for coverage that, if provided truthfully, would have impacted the insurance company’s decision to issue the policy. What is the effect of a misrepresentation? Is misrepresentation synonymous with concealment? She dies within two years of her application, and the insurer discovers sh. You may find out there was a misrepresentation when the policy was taken out and it’s been a year or more since it happened.

Source: xephula.com

Source: xephula.com

Rescission of a life insurance policy is permissible when there is a material misrepresentation in the initial application. However, it is advisable that you disclose only accurate information during the application process. A misrepresentation by the insured renders the insurance contract voidable at the option of the insurer, although the policy is not thereby rendered void ab initio. Misrepresentation must be relevant to cause of death. The life insurance company plays it like this:

Source: nationalfamily.com

Source: nationalfamily.com

Life insurance misrepresentation defined by a national life insurance beneficiary attorney. If you wouldn’t have offered cover originally, you may avoid the original contract and reject any claims in that first period of insurance. Usually the omission or untrue statement is meant to work. If the misrepresentation or failure to disclose is fraudulent, the insurer can avoid or set aside the policy from when it started. When the insurer misrepresents the details of the policy you’re being sold or the claim you have filed, it is acting in bad faith, opening the door for you to pursue a bad faith insurance claim to.

Source: bemoneyaware.com

Source: bemoneyaware.com

An example of a lie of omission is failing to tell the insurer that you installed a swimming pool. Misrepresentation is a false statement of fact. What happens when misrepresentation on a life insurance policy gets discovered. Material misrepresentation is an untrue statement or omission that affects an insurer’s decision whether to issue a life insurance policy, and if issuing the policy, what premium the insured will pay. Identifying these incidents and potentially defending this position through the australian legal system is therefore a concern for these organisations.

Source: haffnerlawyers.com

Source: haffnerlawyers.com

What is the effect of a misrepresentation? When a misrepresentation on a life insurance policy application is discovered. The insurance company essentially claims that they were misled into selling the policy based on the misrepresentations, and thus the policy was never actually validly agreed upon. Second, the insurance company must show the misrepresentations made by the insured were material to the risk, and the insurance company would not have issued the policy or would have done so with higher premiums if it had known of the risk: Rescission of a life insurance policy is permissible when there is a material misrepresentation in the initial application.

![[Pdf/ePub] Misrepresentation in the Life, Health, and [Pdf/ePub] Misrepresentation in the Life, Health, and](https://image.slidesharecdn.com/misrepresentation-in-the-life-health-and-disability-insurance-application-process-a-national-survey-190829133915/95/pdfepub-misrepresentation-in-the-life-health-and-disability-insurance-application-process-a-national-survey-download-ebook-1-638.jpg?cb=1567085968) Source: es.slideshare.net

Source: es.slideshare.net

Rights of the insurer if breach of the duty. If the misrepresentation was “immaterial,” or did not affect the insurability of the. In insurance law, material misrepresentation occurs when an individual provides false information in his or her application for coverage that, if provided truthfully, would have impacted the insurance company’s decision to issue the policy. A misrepresentation is often a lie of commission or omission. Rescission of a life insurance policy is permissible when there is a material misrepresentation in the initial application.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title when a misrepresentation on a life insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information