When an employee terminates coverage under a group insurance policy Idea

Home » Trending » When an employee terminates coverage under a group insurance policy IdeaYour When an employee terminates coverage under a group insurance policy images are available in this site. When an employee terminates coverage under a group insurance policy are a topic that is being searched for and liked by netizens today. You can Download the When an employee terminates coverage under a group insurance policy files here. Find and Download all royalty-free photos.

If you’re searching for when an employee terminates coverage under a group insurance policy images information connected with to the when an employee terminates coverage under a group insurance policy interest, you have visit the right site. Our website always provides you with suggestions for viewing the highest quality video and picture content, please kindly search and find more informative video content and graphics that match your interests.

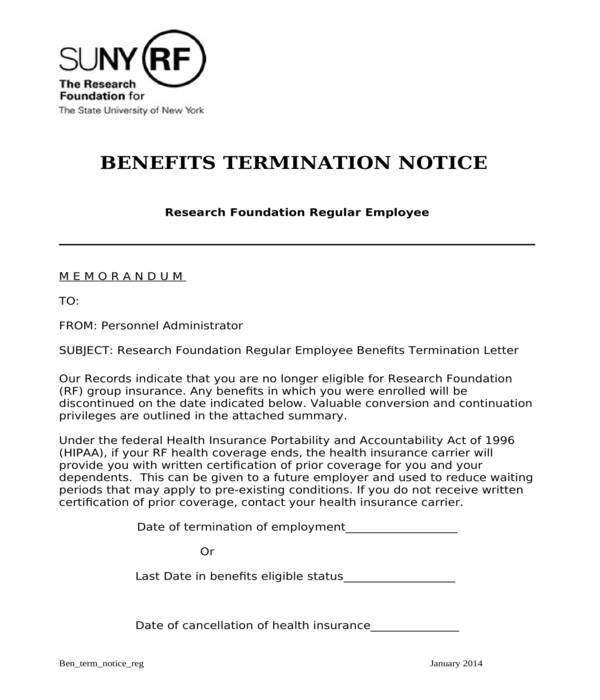

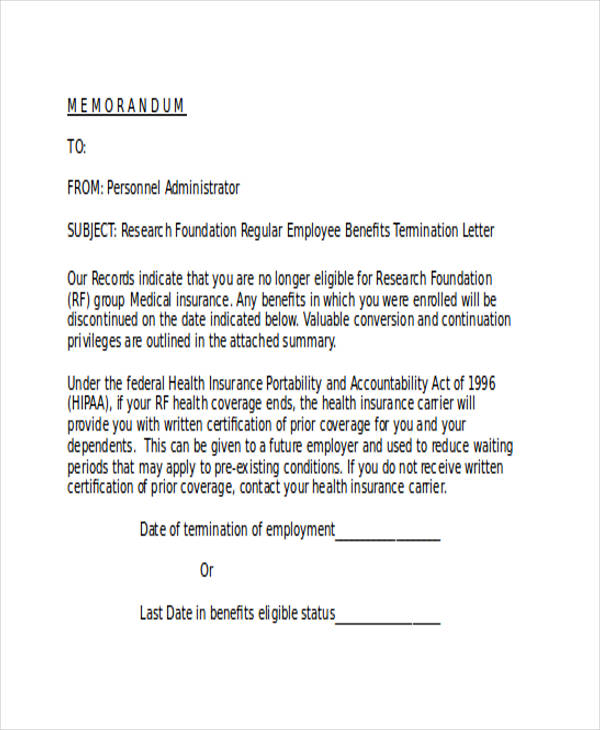

When An Employee Terminates Coverage Under A Group Insurance Policy. The premium for individual coverage will be based upon the insureds attained age. If approved, coverage may be continued for a maximum of 24 months, provided premiums are paid. She elects tcc coverage and decides to enroll in the same plan that she was enrolled in under her father�s coverage. For example, a group health insurance policy often will not have any limit on total benefits paid during your lifetime, while individual coverage often limits total lifetime benefits.

FREE 5+ Insurance Termination Letters in PDF MS Word From sampleforms.com

FREE 5+ Insurance Termination Letters in PDF MS Word From sampleforms.com

When an employee terminates coverage under a group insurance policy, coverage continues in force for 31 days. What happens when an employee is terminated, under erisa? In a single employer group plan, what is. The employee or dependent must request special enrollment within 30 days of losing other coverage. It offers affordable healthcare benefits for the employees. Such policies are termed as group plans.

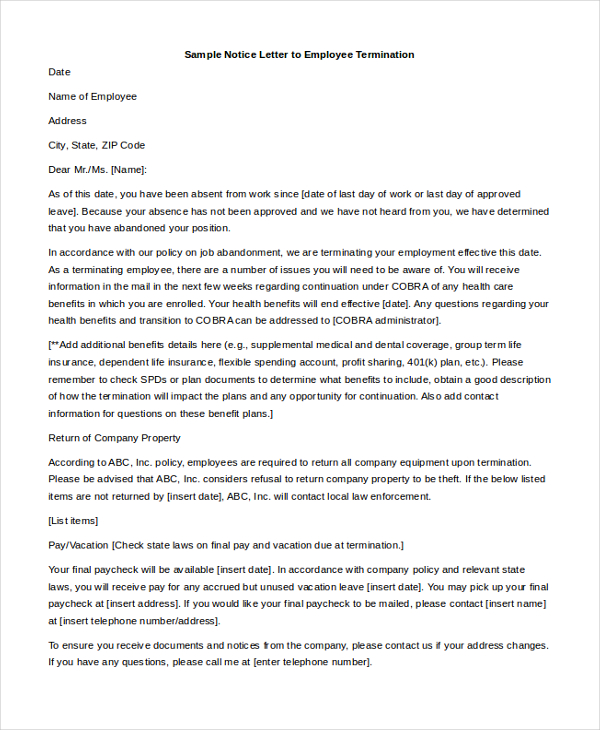

Generally speaking, employers are not familiar with the responsibility and potential liability for failing to notify employees of their right to convert group life insurance coverage to an individual life insurance policy upon termination of employment, or their right to apply for a waiver of premiums if they are disabled and absent from work.

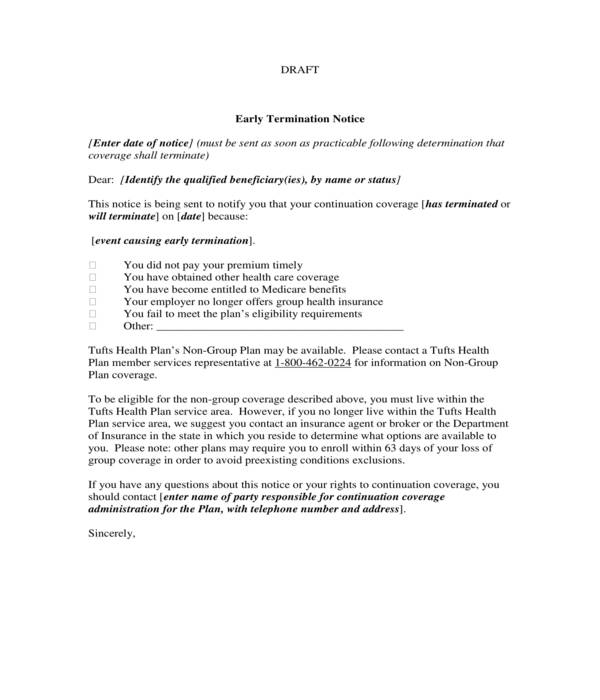

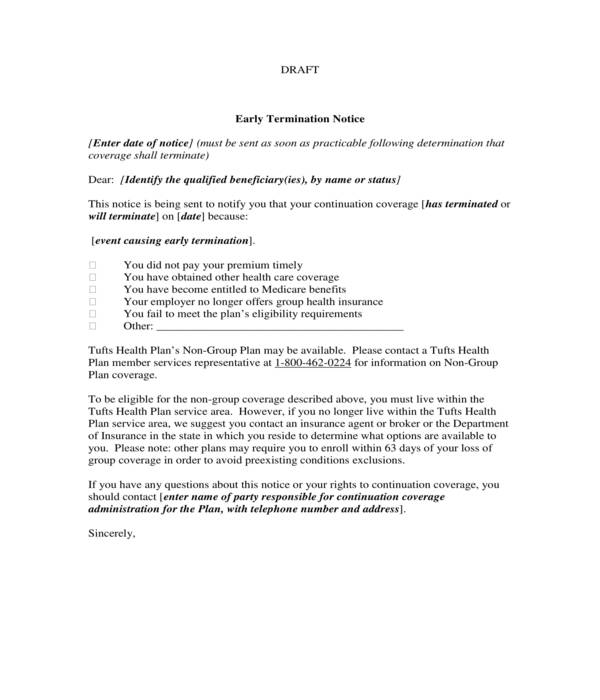

Individual coverage typically is much more expensive than group coverage—and the coverage limits are usually much lower than those offered under group coverage. If an employer cancels the life insurance policy of an employee, the employee must be notified. Please see your policy for any exceptions that may apply. In this case, the risk is distributed across. An insured whose coverage terminates because he or she ceases to be eligible under the group life insurance policy, may convert up to the amount of coverage terminating under the group life insurance policy, but not less than $2,000 (unless your benefit was less than $2,000). The converted policy will be effective 31 days after coverage under the group life insurance policy terminates.

Source: sampleforms.com

Source: sampleforms.com

An employee quits his job and converts his group policy to an individual policy; The insured may convert coverage to a individual policy within 31 days. When an employee terminates coverage under a group insurance policy, coverage continues in force a) for 60 days. The employee or spouse (as defined in the policy) must be porting in order for a dependent child to be eligible to port. In a single employer group plan, what is.

Source: startuphrtoolkit.com

Source: startuphrtoolkit.com

In a single employer group plan, what is. Group life insurance policies are. When an employee terminates coverage under a group insurance policy, coverage continues in force a) for 60 days. Portability is available if the hartford group life insurance policy is still in force and the dependent’s The converted policy will be effective 31 days after coverage under the group life insurance policy terminates.

Source: sampletemplates.com

Source: sampletemplates.com

If an employer cancels the life insurance policy of an employee, the employee must be notified. Employers have to notify you of policy changes. In this case, the risk is distributed across. On the date employment terminates. She elects tcc coverage and decides to enroll in the same plan that she was enrolled in under her father�s coverage.

Source: pinterest.ca

Source: pinterest.ca

If an employer cancels the life insurance policy of an employee, the employee must be notified. An insured employee typically has 31 days following termination of employment in which to convert the group insurance. C) until the employee notifies the group insurance provider that coverage conversion policy is. An employee quits his job and converts his group policy to an individual policy; When individuals have a life insurance policy provided by their employer, such life coverage is called group life insurance.

Source: sampleforms.com

Source: sampleforms.com

Coverage) to show the type of health care coverage a person had (e.g., employee only, family, etc.) and how long the coverage lasted. The premium for individual coverage will be based upon the insureds attained age. The employee or dependent must request special enrollment within 30 days of losing other coverage. When an employee terminates coverage under a group insurance policy, coverage continues in force a) for 60 days. Of the date group life coverage terminates.

Source: doctemplates.net

Source: doctemplates.net

For example, an employee who loses group health coverage may be able to special enroll in a spouse’s health plan. An employee has 31 days under the conversion privilege to convert to an individual policy. The premium for individual coverage will be based upon the insureds attained age. Generally speaking, employers are not familiar with the responsibility and potential liability for failing to notify employees of their right to convert group life insurance coverage to an individual life insurance policy upon termination of employment, or their right to apply for a waiver of premiums if they are disabled and absent from work. Employee health insurance policies are purchased by an employer for the benefit of the employees.

Source: sampleforms.com

Source: sampleforms.com

Coverage) to show the type of health care coverage a person had (e.g., employee only, family, etc.) and how long the coverage lasted. The employee or spouse (as defined in the policy) must be porting in order for a dependent child to be eligible to port. She elects tcc coverage and decides to enroll in the same plan that she was enrolled in under her father�s coverage. The premium for the individual policy will be based on his. When an employee terminates coverage under a group insurance policy, coverage continues in force a) for 60 days.

Source: nationalgriefawarenessday.com

Source: nationalgriefawarenessday.com

C) until the employee notifies the group insurance provider that coverage conversion policy is. Group life insurance policies are. An employee quits his job and converts his group policy to an individual policy; An insured employee must convert to the same type of coverage that was provided under the group plan (that is, term). An employee has 31 days under the conversion privilege to convert to an individual policy.

Source: examples.com

Source: examples.com

Employers have to notify you of policy changes. An employee quits his job and converts his group policy to an individual policy; The premium for the individual policy will be based on his. She elects tcc coverage and decides to enroll in the same plan that she was enrolled in under her father�s coverage. On the date employment terminates.

Source: livecareer.co.uk

Source: livecareer.co.uk

Portability is available if the hartford group life insurance policy is still in force and the dependent’s Such policies are termed as group plans. Of the date group life coverage terminates. When an employee terminates coverage under a group insurance policy, coverage continues in force for 31 days. The premium for the individual policy will be based on his.

Source: pinterest.es

Source: pinterest.es

The insured may convert coverage to a individual policy within 31 days. If the group life insurance policy terminates, or if coverage for a class of insured’s terminates, the insured’s who were covered under the group life insurance policy for at least three years may convert $10,000 or the amount of terminating group life insurance, if less. • the beneficiary has coverage under a group health plan through the beneficiary’s own current employment, or the current employment of a spouse • the plan pays secondary to medicare • the plan does not provide retiree coverage • the beneficiary’s coverage under the plan terminates when the beneficiary, or the What happens when an employee is terminated, under erisa? Individual coverage typically is much more expensive than group coverage—and the coverage limits are usually much lower than those offered under group coverage.

Source: examples.com

Source: examples.com

When an employee terminates coverage under a group insurance policy, coverage continues in force for 31 days. Coverage) to show the type of health care coverage a person had (e.g., employee only, family, etc.) and how long the coverage lasted. Employers have to notify you of policy changes. The converted policy will be effective 31 days after coverage under the group life insurance policy terminates. No medical examination or other evidence of good health is required for a conversion policy.

Source: xeossolutions.com

Source: xeossolutions.com

Coverage) to show the type of health care coverage a person had (e.g., employee only, family, etc.) and how long the coverage lasted. An insured whose coverage terminates because he or she ceases to be eligible under the group life insurance policy, may convert up to the amount of coverage terminating under the group life insurance policy, but not less than $2,000 (unless your benefit was less than $2,000). It offers affordable healthcare benefits for the employees. Benefit with an individual whole life insurance policy if all or part of his/her coverage under the group life insurance policy terminates. When individuals have a life insurance policy provided by their employer, such life coverage is called group life insurance.

Source: template.net

Source: template.net

The premium for individual coverage will be based upon the insureds attained age. In this case, the risk is distributed across. Under federal law, most group health plans must provide these certificates automatically when a person’s coverage terminates. B) until the employee can obtain coverage under a new group plan. An employee has 31 days under the conversion privilege to convert to an individual policy.

Source: template.net

Source: template.net

When the insured stops working for the employer, continuous coverage may be available if the group plan offers a conversion and/or portability option that allows the insured to port or convert their group coverage into an individual policy. If an employer cancels the life insurance policy of an employee, the employee must be notified. Benefit with an individual whole life insurance policy if all or part of his/her coverage under the group life insurance policy terminates. Coverage) to show the type of health care coverage a person had (e.g., employee only, family, etc.) and how long the coverage lasted. If approved, coverage may be continued for a maximum of 24 months, provided premiums are paid.

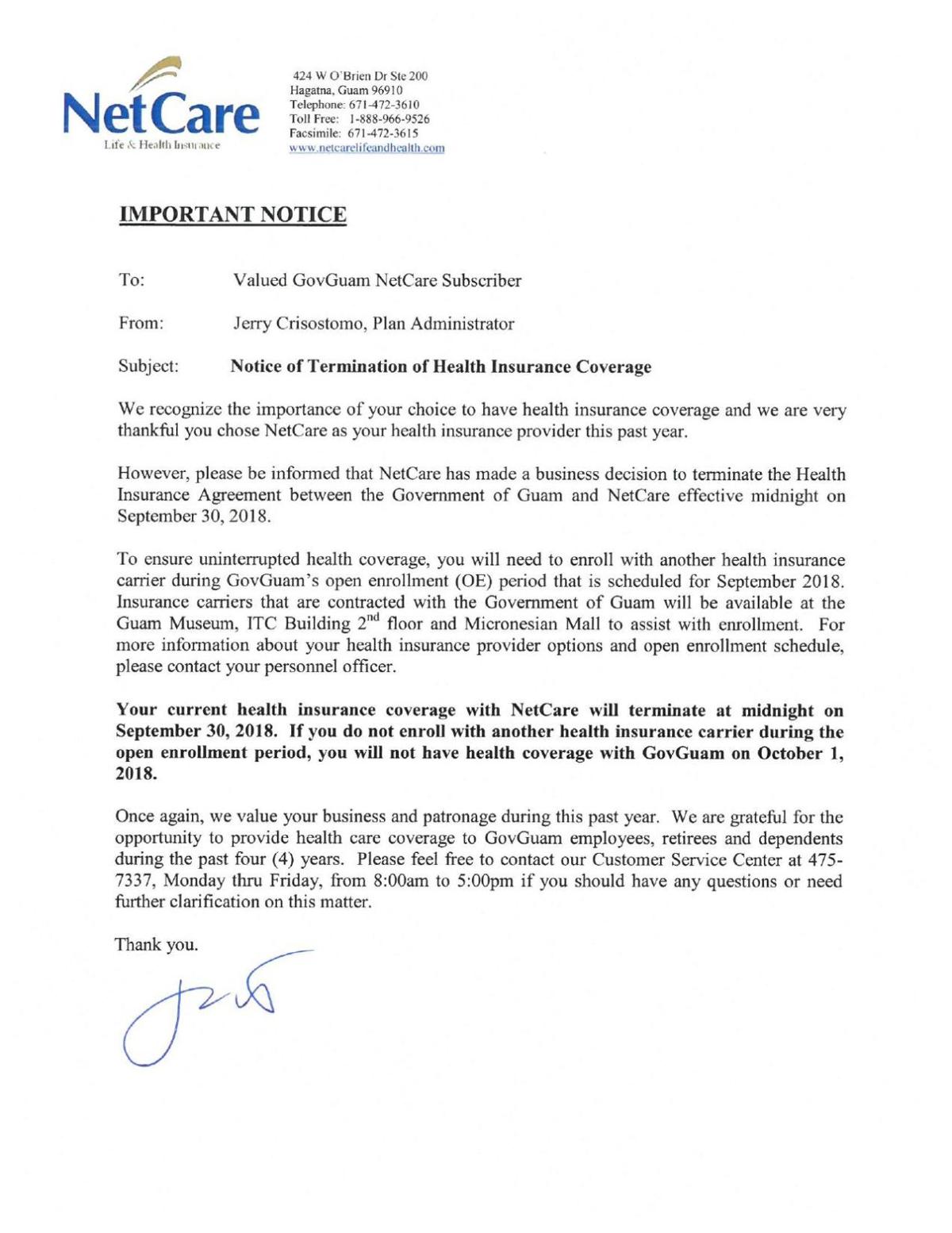

Source: postguam.com

Source: postguam.com

However, if you don’t receive a certificate, you have the right to request one. B) until the employee can obtain coverage under a new group plan. When the insured stops working for the employer, continuous coverage may be available if the group plan offers a conversion and/or portability option that allows the insured to port or convert their group coverage into an individual policy. Under federal law, most group health plans must provide these certificates automatically when a person’s coverage terminates. Coverage) to show the type of health care coverage a person had (e.g., employee only, family, etc.) and how long the coverage lasted.

Source: sampletemplates.com

Source: sampletemplates.com

• have been continuously insured under the group policy or the prior plan for at least 12 consecutive months • When an employee terminates coverage under a group insurance policy, coverage continues in force a) for 60 days. For example, a group health insurance policy often will not have any limit on total benefits paid during your lifetime, while individual coverage often limits total lifetime benefits. Under federal law, most group health plans must provide these certificates automatically when a person’s coverage terminates. Which of the following employees insured under a group life plan would be allowed to convert to individual insurance of the same coverage once the plan is terminated?

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title when an employee terminates coverage under a group insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information