When an individual purchases insurance what risk information

Home » Trend » When an individual purchases insurance what risk informationYour When an individual purchases insurance what risk images are available in this site. When an individual purchases insurance what risk are a topic that is being searched for and liked by netizens today. You can Find and Download the When an individual purchases insurance what risk files here. Get all royalty-free images.

If you’re searching for when an individual purchases insurance what risk pictures information linked to the when an individual purchases insurance what risk keyword, you have visit the right blog. Our website always gives you suggestions for refferencing the highest quality video and picture content, please kindly surf and find more informative video articles and images that match your interests.

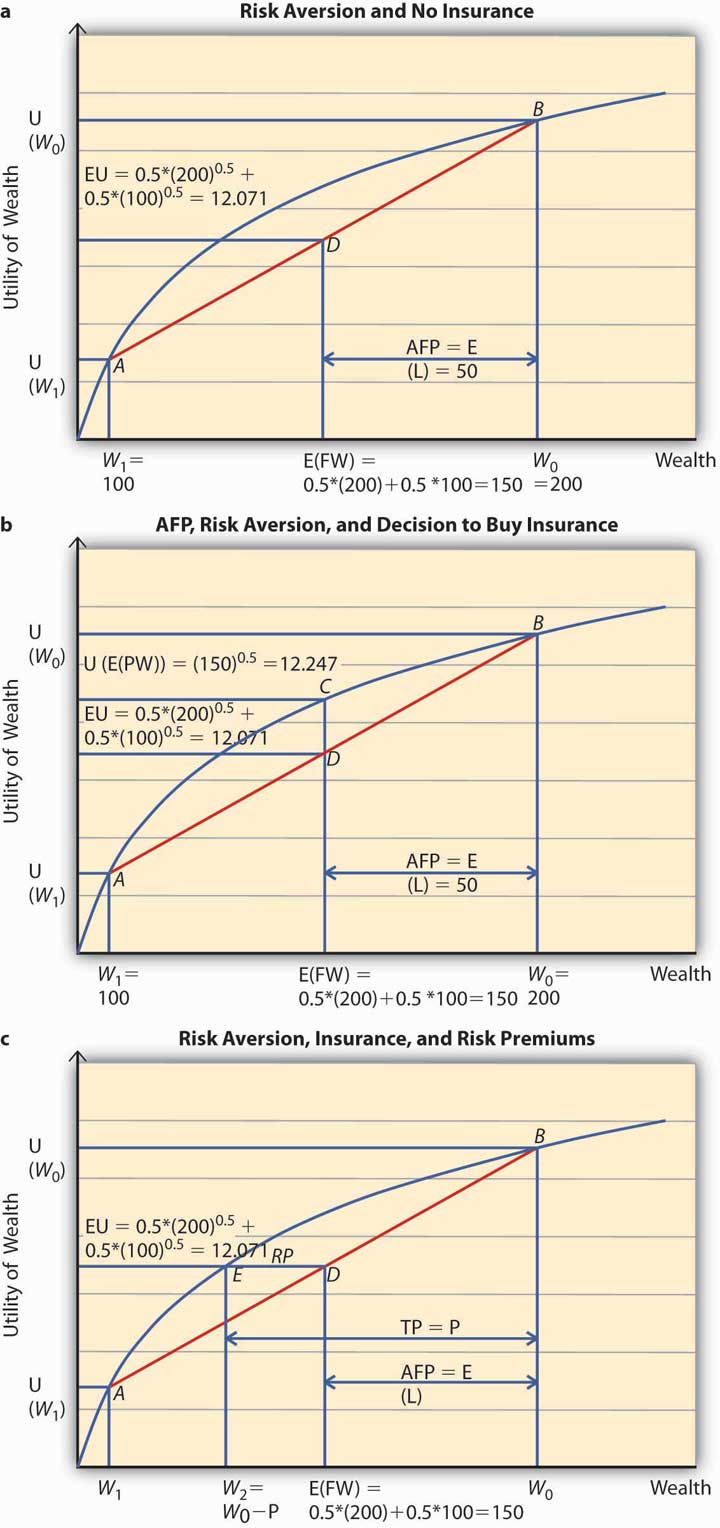

When An Individual Purchases Insurance What Risk. Insurance is a complement to loss reduction measures. In this section we focus on risk aversion and the price of hedging risk. Risk will be willing to pay more for insurance. For example, an individual who purchases car insurance is.

FACTORS AFFECTING BUILDERS RISK INSURANCE AND TIPS TO From hitcashnow.com

FACTORS AFFECTING BUILDERS RISK INSURANCE AND TIPS TO From hitcashnow.com

When an individual purchases insurance, what risk management technique is he or she practicing? These groups were often able to secure liability programs that met both the coverage and the pricing needs of the individual group members. A set of legal or regulatory conditions that affect an insurer�s ability to collect premiums commensurate with the level of risk incurred would be considered an. An individual purchases an insurance contract so as to alter his pattern of income across states of nature. When an individual purchases insurance what risk.but also in the procurement process itself. The most common example of risk transfer is insurance.

We discuss the actuarially fair premium (afp) and the risk premium.

An individual who purchases an insurance policy is called is a tool to reduce your risks. In this section we focus on risk aversion and the price of hedging risk. A set of legal or regulatory conditions that affect an insurer�s ability to collect premiums commensurate with the level of risk incurred would be considered an. And if the accident / insurance event occurs, the insurance company will bear all or all of the costs in full or in part. When an individual purchases insurance what risk management techniques is he or she practicing. When an individual purchases insurance, what risk management technique is he or she practicing?

Source: melbourneinsurancebrokers.com.au

Source: melbourneinsurancebrokers.com.au

When an individual purchases insurance what risk.but also in the procurement process itself. When an individual or entity purchases insurance, they are insuring against financial risks. In this section we focus on risk aversion and the price of hedging risk. Difficulties arise when attempts are made to compare the risks as displayed on a risk matrix with the individual risk criteria published by hse [3]. To compensate the third party for bearing the risk, the individual or entity will generally provide the third party with periodic payments.

Source: mymoneysage.in

Source: mymoneysage.in

Financial risk may be shared with the providers participating in the hmo. What is surplus lines insurance? Insurance, as defined by wikipedia, is a means of protection from any kind of loss, be it the loss of life, or of property. Log in for more information. Added 21 seconds ago|2/23/2022 11:09:05 pm.

Source: stone-hedgefinancialgroup.ca

Source: stone-hedgefinancialgroup.ca

- insurance allows someone to a. When an individual purchases insurance what risk.but also in the procurement process itself. Demand for insurance is represented by individuals who buy insurance contract α. Class 2 insurance, also written as class ii insurance, provides a narrower range. We use data on flood risk reduction activities and flood insurance purchases by surveying more than 1000 homeowners in new york city after they experienced hurricane sandy.

Source: slideshare.net

Source: slideshare.net

An individual who purchases an insurance is known as an insured or a policyholder, while the company that offers an insurance is known as an insurance company, or insurer, or underwriter. To compensate the third party for bearing the risk, the individual or entity will generally provide the third party with periodic payments. For example, an individual who purchases car insurance is. Students will learn how these principles are applied to pricing of insurance (one mechanism to hedge individual risks) and the decision to. We discuss the actuarially fair premium (afp) and the risk premium.

Source: tawasulinsurance.ae

Source: tawasulinsurance.ae

When an individual purchases insurance, he or she is practicing transfer risk management technique. In this section, we discuss two broad areas: Insurance is a complement to loss reduction measures. An individual purchases an insurance contract so as to alter his pattern of income across states of nature. Let w 1 denote his income if there is no accident and.

Source: saylordotorg.github.io

Source: saylordotorg.github.io

A set of legal or regulatory conditions that affect an insurer�s ability to collect premiums commensurate with the level of risk incurred would be considered an. Any insurance on items worth more than $25,000 d. We use data on flood risk reduction activities and flood insurance purchases by surveying more than 1000 homeowners in new york city after they experienced hurricane sandy. Managing insurable risks (such as your life and home) and managing investment risk (the variability of returns on your investments). An individual purchases an insurance contract so as to alter his pattern of income across states of nature.

Source: pinterest.com

Source: pinterest.com

Managing your risk constitutes a major element of your financial plan. 253) insurance allows someone to a. Log in for more information. Demand for insurance is represented by individuals who buy insurance contract α. The most common example of risk transfer is insurance.

Source: purgula.com

Source: purgula.com

The most common example of risk transfer is insurance. If an individual purchases property insurance on business equipment, the premiums are deductible, but if that same individual purchases property insurance on his home, the premiums are nondeductible. Insurance that covers individuals that are not specifically named in an auto insurance policy. To compensate the third party for bearing the risk, the individual or entity will generally provide the third party with periodic payments. When an individual purchases insurance, what risk management technique is he or she practicing?

Source: madrasshoppe.com

Source: madrasshoppe.com

When an individual purchases insurance what risk management techniques is he or she practicing. Insurance, as defined by wikipedia, is a means of protection from any kind of loss, be it the loss of life, or of property. In this section we focus on risk aversion and the price of hedging risk. What is surplus lines insurance? When an individual or entity purchases insurance, they are insuring against financial risks.

Source: adviilaw.com.au

Source: adviilaw.com.au

Log in for more information. Insurance placed with an unauthorized insurer b. Students will learn how these principles are applied to pricing of insurance (one mechanism to hedge individual risks) and the decision to. When an individual purchases insurance what risk management techniques is he or she practicing. Insurance, as defined by wikipedia, is a means of protection from any kind of loss, be it the loss of life, or of property.

Source: hitcashnow.com

Source: hitcashnow.com

Class 2 insurance, also written as class ii insurance, provides a narrower range. A set of legal or regulatory conditions that affect an insurer�s ability to collect premiums commensurate with the level of risk incurred would be considered an. Managing insurable risks (such as your life and home) and managing investment risk (the variability of returns on your investments). Depending on the chosen program, you can partially or completely protect yourself from unforeseen expenses. In this section, we discuss two broad areas:

Source: superstarsbiography.com

Source: superstarsbiography.com

Managing insurable risks (such as your life and home) and managing investment risk (the variability of returns on your investments). When an individual purchases insurance, what risk management technique is he or she practicing? Let w 1 denote his income if there is no accident and. Students will learn how these principles are applied to pricing of insurance (one mechanism to hedge individual risks) and the decision to. If an individual purchases property insurance on business equipment, the premiums are deductible, but if that same individual purchases property insurance on his home, the premiums are nondeductible.

Source: tomorrowmakers.com

For example, an individual who purchases car insurance is. For example, an individual who purchases car insurance is. When an individual purchases insurance, he or she is practicing transfer risk management technique. When an individual or entity purchases insurance, they are insuring against financial risks. A) retention b) transfer c) avoidance d) sharing insurance is a transfer of the risk of financial loss from a covered peril from the insured to the insurance company.

Source: caknowledge.com

Source: caknowledge.com

Managing insurable risks (such as your life and home) and managing investment risk (the variability of returns on your investments). In this section we focus on risk aversion and the price of hedging risk. A) retention b) transfer c) avoidance d) sharing insurance is a transfer of the risk of financial loss from a covered peril from the insured to the insurance company. Insurance, as defined by wikipedia, is a means of protection from any kind of loss, be it the loss of life, or of property. Added 21 seconds ago|2/23/2022 11:09:05 pm.

Source: specialtyriskinsuranceagency.com

Source: specialtyriskinsuranceagency.com

Let w 1 denote his income if there is no accident and. We examine mechanisms as to why insurance and individual risk reduction activities are complements instead of substitutes. A set of legal or regulatory conditions that affect an insurer�s ability to collect premiums commensurate with the level of risk incurred would be considered an. A) retention b) transfer c) avoidance d) sharing insurance is a transfer of the risk of financial loss from a covered peril from the insured to the insurance company. Any insurance on items worth more than $25,000 d.

Source: snapdeal.com

Source: snapdeal.com

Added 21 seconds ago|2/23/2022 11:09:05 pm. These groups were often able to secure liability programs that met both the coverage and the pricing needs of the individual group members. When an individual purchases insurance, what risk management technique is he or she practicing? Let w 1 denote his income if there is no accident and. Insurance is a complement to loss reduction measures.

Source: bankrate.com

Source: bankrate.com

Let w 1 denote his income if there is no accident and. When an individual or entity purchases insurance, they are insuring against financial risks. Difficulties arise when attempts are made to compare the risks as displayed on a risk matrix with the individual risk criteria published by hse [3]. When an individual purchases insurance what risk management techniques is he or she practicing. When an individual purchases insurance, what risk management technique is he or she practicing?

Source: forsahub.com

Source: forsahub.com

Log in for more information. An individual who purchases an insurance policy is called is a tool to reduce your risks. When an individual purchases insurance, he or she is practicing transfer risk management technique. What is surplus lines insurance? An individual who purchases an insurance is known as an insured or a policyholder, while the company that offers an insurance is known as an insurance company, or insurer, or underwriter.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title when an individual purchases insurance what risk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information