When does cobra insurance begin information

Home » Trending » When does cobra insurance begin informationYour When does cobra insurance begin images are available in this site. When does cobra insurance begin are a topic that is being searched for and liked by netizens now. You can Find and Download the When does cobra insurance begin files here. Find and Download all free photos and vectors.

If you’re searching for when does cobra insurance begin images information related to the when does cobra insurance begin interest, you have visit the ideal blog. Our site frequently gives you hints for viewing the maximum quality video and picture content, please kindly hunt and locate more informative video content and graphics that match your interests.

When Does Cobra Insurance Begin. That window started on april 1. After that, cobra plan members will again pay the full cost of cobra insurance. You must maintain and pay for cobra coverage for up to 18 months in the event of a termination or a reduction in hours. In certain circumstances, coverage for your spouse and dependent children can last up to 36 months.

Cobra Health Insurance Forms Health Insurance From fotohijrah.blogspot.com

Cobra Health Insurance Forms Health Insurance From fotohijrah.blogspot.com

When does cobra coverage begin and how long does it last? Coverage begins on the date that coverage would otherwise have been lost by reason of a qualifying event and will end at the end of the maximum period. Cobra coverage is retroactive to the date you would have otherwise lost coverage. Check with your benefits manager to find out whether your state extends cobra benefits. Cobra premium assistance under the american rescue plan act of 2021 was available april 1, 2021 through september 30, 2021. Make sure you understand when you have exhausted your cobra coverage benefits and need to seek out alternative coverages.

Cobra coverage begins on the date that health care coverage would otherwise have been lost by reason of a qualifying event.

Anyone eligible for cobra insurance benefits has 2 months following the date of the end of their coverage, or the day they receive a cobra notification, to enroll in a cobra coverage plan. Cobra coverage starts on the date the qualifying event occurred and ends after a period of 18 to 36 months. How does cobra work for employers? For an employee covered under a qualifying event, cobra coverage can. Usually this means that the first day of the month following termination of employment or other qualifying event. Although cobra is temporary, you’ll have time to find another plan.

Source: lowcosthealthinsurance.com

Source: lowcosthealthinsurance.com

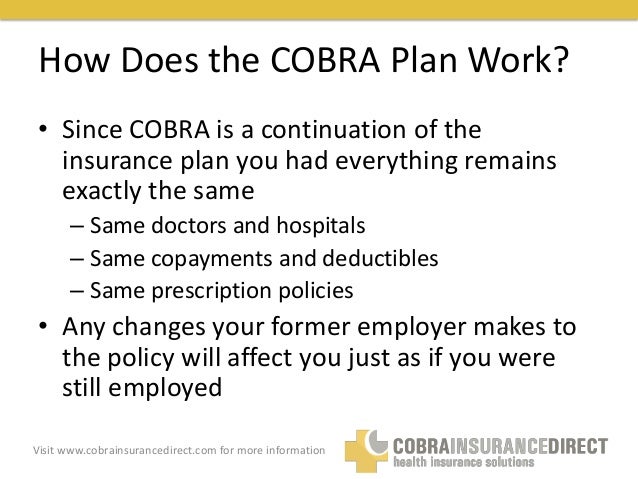

When does my cobra coverage begin? When does cobra coverage begin and how long does it last? Cobra premium assistance under the american rescue plan act of 2021 was available april 1, 2021 through september 30, 2021. Check with your benefits manager to find out whether your state extends cobra benefits. The cobra coverage you provide to employees must be the same as that provided to current employees under your company�s health plan.

Source: slideshare.net

Source: slideshare.net

Federal cobra is available for a minimum of 18 months following a qualifying event and may be available up to 36 months for certain circumstances (or under state cobra rules). Does cobra include prescription coverage? The cobra coverage you provide to employees must be the same as that provided to current employees under your company�s health plan. Since this help ended on september 30, you can enroll in a marketplace plan with a special enrollment period. You cannot save premium dollars by skipping a few months or even a few days before cobra begins.

Source: entresuaspalavras.blogspot.com

Source: entresuaspalavras.blogspot.com

Check with your benefits manager to find out whether your state extends cobra benefits. How does cobra work for employers? Check with your benefits manager to find out whether your state extends cobra benefits. Does cobra insurance start immediately? When does my cobra coverage begin?

Source: revisi.net

Source: revisi.net

- you become eligible for medicare Make sure you understand when you have exhausted your cobra coverage benefits and need to seek out alternative coverages. Assuming one pays all required premiums, cobra coverage starts on the date of the qualifying event, and the length of the period of cobra coverage will depend on the type of qualifying event which caused the qualified beneficiary to lose group health plan coverage. The cobra coverage you provide to employees must be the same as that provided to current employees under your company�s health plan. Cobra alternate coverage usually begins on the day after application.

Source: healthmarkets.com

Source: healthmarkets.com

Cobra coverage begins on the date that health care coverage would otherwise have been lost by reason of a qualifying event. If you lost your job, you’re generally entitled to 18 months of continuous coverage. You must pay all of your health insurance premiums under cobra. Cobra health insurance was created with the comprehensive budget and reconciliation act in 1985 and became effective in 1986. Anyone eligible for cobra insurance benefits has 2 months following the date of the end of their coverage, or the day they receive a cobra notification, to enroll in a cobra coverage plan.

Source: slideshare.net

Source: slideshare.net

The coverage begins on the date of the job loss or other qualifying event. Cobra coverage is retroactive to the date you would have otherwise lost coverage. Regardless when in the enrollment period you complete the form and pay your premiums, cobra coverage always begins the day after your standard coverage ends. Our programs and what we do. Cobra health insurance was created with the comprehensive budget and reconciliation act in 1985 and became effective in 1986.

Source: fbabenefits.com

Source: fbabenefits.com

You cannot save premium dollars by skipping a few months or even a few days before cobra begins. Department of labor (dol) released a new final rule that temporarily extends the period in which eligible employees can elect cobra health insurance coverage, and the deadline for them to begin making cobra premium payments. Make sure you understand when you have exhausted your cobra coverage benefits and need to seek out alternative coverages. Cobra coverage begins on the date that health care coverage would otherwise have been lost by reason of a qualifying event. The duration of your coverage will depend on the type of qualifying event experienced.

Source: revisi.net

Source: revisi.net

For an employee covered under a qualifying event, cobra coverage can. Cobra coverage begins on the date that health care coverage would otherwise have been lost by reason of a qualifying event. By law, you can be charged 100% of the plan’s premiums, plus up to a 2% administrative fee. Similarly, cobra coverage is continuous until you terminate it or until the benefits expire, usually after 18 months. Federal coverage lasts 18 months, starting when your previous benefits end.

Source: npa1.org

Source: npa1.org

If the employee elects cobra coverage, they must be kept under your group insurance. Cobra coverage begins on the date that health care coverage would otherwise have been lost by reason of a qualifying event. If the employee elects cobra coverage, they must be kept under your group insurance. You must pay all of your health insurance premiums under cobra. Our mission, work, and impact;

Source: hrpros.biz

Source: hrpros.biz

Cost is a major factor to consider when buying cobra coverage. People are generally entitled to 18 months of federal cobra continuation coverage after a layoff or a reduction of scheduled work hours. Assuming one pays all required premiums, cobra coverage starts on the date of the qualifying event, and the length of the period of cobra coverage will depend on the type of qualifying event which caused the qualified beneficiary to lose group health plan coverage. You must maintain and pay for cobra coverage for up to 18 months in the event of a termination or a reduction in hours. Some states extend medical coverage (but may not include dental or vision) to 36 months.

Source: slideshare.net

Source: slideshare.net

Cobra coverage begins on the date that health care coverage would otherwise have been lost by reason of a qualifying event. That window started on april 1. Department of labor (dol) released a new final rule that temporarily extends the period in which eligible employees can elect cobra health insurance coverage, and the deadline for them to begin making cobra premium payments. Similarly, cobra coverage is continuous until you terminate it or until the benefits expire, usually after 18 months. Cobra coverage is retroactive to the date you would have otherwise lost coverage.

Source: healthlearner.com

Source: healthlearner.com

This means that, if you elect to participate, cobra always begins as soon as your previous coverage ends. Assuming one pays all required premiums, cobra coverage starts on the date of the qualifying event, and the length of the period of cobra coverage will depend on the type of qualifying event which caused the qualified beneficiary to lose group health plan coverage. You cannot save premium dollars by skipping a few months or even a few days before cobra begins. Cobra coverage begins on the date that health care coverage would otherwise have been lost by reason of a qualifying event. Our programs and what we do.

Source: npa1.org

Source: npa1.org

Cobra alternate coverage usually begins on the day after application. If you lost your job, you’re generally entitled to 18 months of continuous coverage. That window started on april 1. When does my cobra coverage begin? When does the cobra coverage period start and end cobra continuation coverage is only temporary.

Source: moneyunder30.com

Source: moneyunder30.com

Some states extend medical coverage (but may not include dental or vision) to 36 months. If the employee elects cobra coverage, they must be kept under your group insurance. With cobra, the former employee has to pay all the. Usually this means that the first day of the month following termination of employment or other qualifying event. When does the cobra coverage period start and end cobra continuation coverage is only temporary.

Source: programbusiness.com

Source: programbusiness.com

Our programs and what we do. Federal cobra is available for a minimum of 18 months following a qualifying event and may be available up to 36 months for certain circumstances (or under state cobra rules). Cobra coverage begins on the date that health care coverage would otherwise have been lost by reason of a qualifying event. You cannot save premium dollars by skipping a few months or even a few days before cobra begins. 4) you become eligible for medicare

Source: revisi.net

Source: revisi.net

Regardless when in the enrollment period you complete the form and pay your premiums, cobra coverage always begins the day after your standard coverage ends. Make sure you understand when you have exhausted your cobra coverage benefits and need to seek out alternative coverages. Cobra alternate coverage usually begins on the day after application. Usually this means that the first day of the month following termination of employment or other qualifying event. Coverage begins on the date that coverage would otherwise have been lost by reason of a qualifying event and will end at the end of the maximum period.

Source: fotohijrah.blogspot.com

Source: fotohijrah.blogspot.com

After that, cobra plan members will again pay the full cost of cobra insurance. The cobra coverage you provide to employees must be the same as that provided to current employees under your company�s health plan. It provides the option to continue health insurance after you have left a job, provided that the separation was due to a “qualifying event.”. Our programs and what we do. That window started on april 1.

Source: healthinsplans.org

Source: healthinsplans.org

People are generally entitled to 18 months of federal cobra continuation coverage after a layoff or a reduction of scheduled work hours. Anyone eligible for cobra insurance benefits has 2 months following the date of the end of their coverage, or the day they receive a cobra notification, to enroll in a cobra coverage plan. It provides the option to continue health insurance after you have left a job, provided that the separation was due to a “qualifying event.”. Our mission, work, and impact; With cobra, the former employee has to pay all the.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title when does cobra insurance begin by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information