When does insurance cover contractor overhead and profit Idea

Home » Trending » When does insurance cover contractor overhead and profit IdeaYour When does insurance cover contractor overhead and profit images are ready in this website. When does insurance cover contractor overhead and profit are a topic that is being searched for and liked by netizens now. You can Download the When does insurance cover contractor overhead and profit files here. Find and Download all royalty-free vectors.

If you’re looking for when does insurance cover contractor overhead and profit pictures information related to the when does insurance cover contractor overhead and profit interest, you have visit the ideal site. Our website always provides you with suggestions for refferencing the maximum quality video and picture content, please kindly surf and find more enlightening video articles and images that fit your interests.

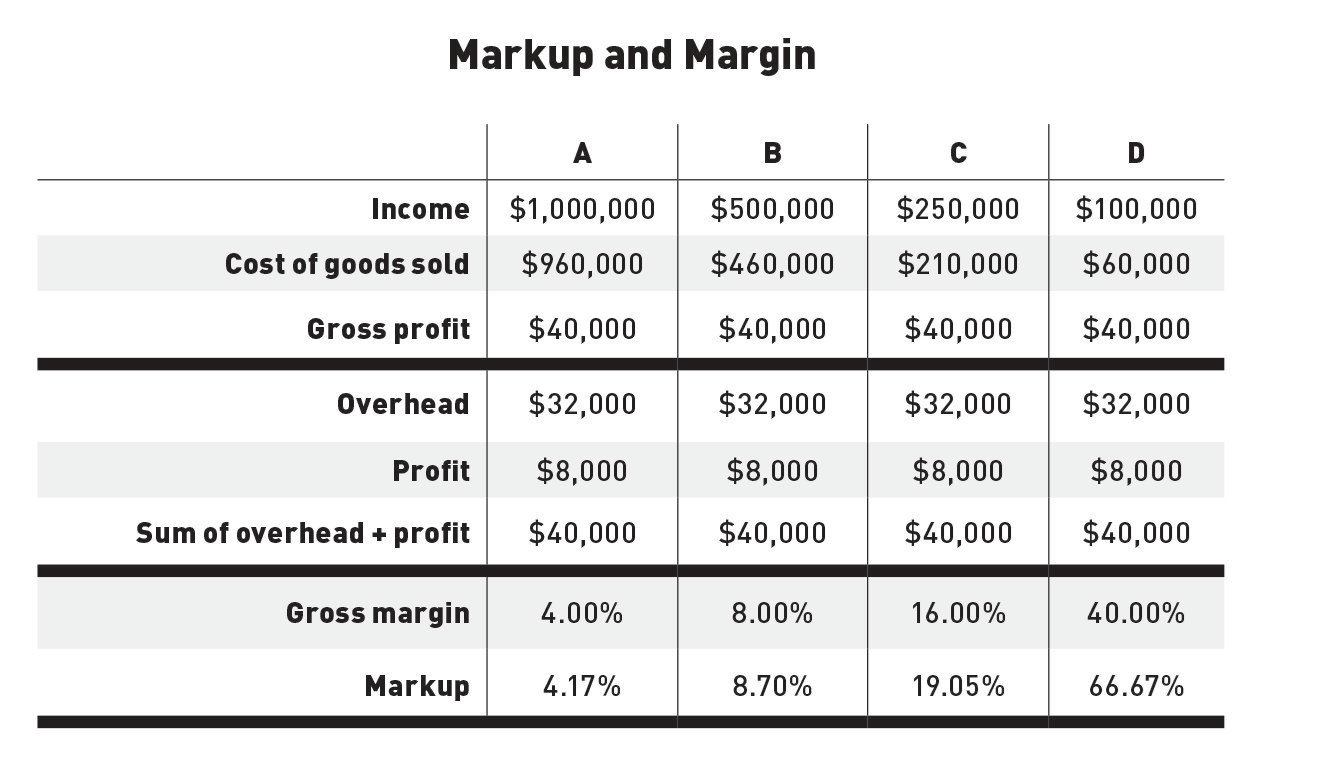

When Does Insurance Cover Contractor Overhead And Profit. Contractor expenditures, often stated to as overhead and profit is meant to cover the general contractor’s overhead and operating costs, as well as profit. Posted in insurance the prevailing view is that overhead and profit is due if a policyholder can show the services of a general contractor is “reasonably likely.” in mee v. In this scenario, a job that costs $100,000 will have to be marked up nearly $67,000 to cover a contractor’s gross profit (30% overhead plus 10% net profit) which is equal to 40 percent of the gross sale. In the insurance industry, overhead (10%) and profit (10%), commonly referred to as o&p, is owed when it becomes necessary to have multiple subcontractors perform work to repair damages to your property cause by a covered peril in the policy.

Defining Overhead & Profit Within Insurance Claims J.S. Held From jsheld.com

Defining Overhead & Profit Within Insurance Claims J.S. Held From jsheld.com

Overhead and profit is generally charged by contractors, and so as a policyholder, it is ultimately part of your cost. O&p, as it�s called, is typically 20% of the total amount of the estimate. With a rc policy, the insurer should not hold back gcop until the structure is completely repaired. Understanding profit margin for contractors. It is normally projected at twenty percent of the total amount of the contractor’s own rebuild or renovation assessment. This is how they get paid.

The internal revenue service definition is what

Most property insurance companies provide. General contractor overhead and profit are often estimated at 20 percent of the total estimate. Contractor expenditures, often stated to as overhead and profit is meant to cover the general contractor’s overhead and operating costs, as well as profit. The hard costs include labor, material, supplies and more. In the insurance industry, overhead (10%) and profit (10%), commonly referred to as o&p, is owed when it becomes necessary to have multiple subcontractors perform work to repair damages to your property cause by a covered peril in the policy. Pennsylvania’s highest court sides with the insurance company claiming that farmers (truck insurance) contracted around the requirement to include general contractor overhead and profit in the actual cash value (acv) payment.

Source: mychampionroofing.com

Source: mychampionroofing.com

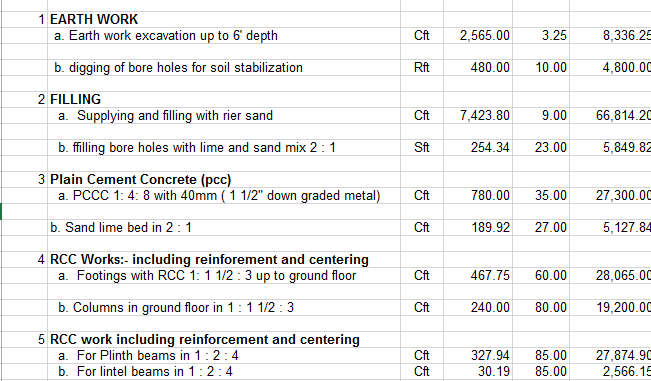

An insurer that holds back gcop until repairs are completed puts the. In this scenario, a job that costs $100,000 will have to be marked up nearly $67,000 to cover a contractor’s gross profit (30% overhead plus 10% net profit) which is equal to 40 percent of the gross sale. Your policy provides coverage for the cost to repair or replace the property damaged by a covered loss. Typical overhead and profit for contractors. In construction, overhead typically includes the cost of subcontractors, machinery, equipment, insurances, office staff, office supplies, vehicles, and other costs.

Source: easypaleorecipes123.blogspot.com

Source: easypaleorecipes123.blogspot.com

Here is the closing excerpt “the department has concluded that an insurer providing property coverage under replacement cost residential policies that allow for the adjustment of covered losses to structures on an actual cash value basis may not calculate actual cash value on the basis of replacement cost with proper deduction for depreciation, less contractor´s. General contractors routinely charge overhead and profit (gcop), usually at a rate of 10% for each. In this example, the contractor cannot cover all of his overhead costs, let alone realize any net profit. Each will have an overhead burden, and each will need a profit margin to sustain the business and reward the effort. Includes costs such as insurance, bonds, office supplies, payroll, vehicle expenses, utilities, accounting expenses, etc.

Source: cy2204imageculture.blogspot.com

Source: cy2204imageculture.blogspot.com

Many of them say 10% overhead and 10% profit. Advertising, training, legal, insurance, and other costs of being in. Each will have an overhead burden, and each will need a profit margin to sustain the business and reward the effort. Contractor expenditures, often stated to as overhead and profit is meant to cover the general contractor’s overhead and operating costs, as well as profit. In this scenario, a job that costs $100,000 will have to be marked up nearly $67,000 to cover a contractor’s gross profit (30% overhead plus 10% net profit) which is equal to 40 percent of the gross sale.

Source: easypaleorecipes123.blogspot.com

Source: easypaleorecipes123.blogspot.com

They expect their adjusters, by whatever means, to get contractors (and by default owners) to abide by these x and y standards for overhead and profit. After all, insurance to value provides for new construction replacement costs, which are lower than repair construction values. Contractor expenditures, often stated to as overhead and profit is meant to cover the general contractor’s overhead and operating costs, as well as profit. Typical overhead and profit for contractors. This is how they get paid.

Source: easypaleorecipes123.blogspot.com

Source: easypaleorecipes123.blogspot.com

All of these overhead expenses need to be considered when working out how much to charge as a general contractor. This is true no matter if the classification of the contractor is as a subcontractor or a general contractor. The hard costs include labor, material, supplies and more. It is normally projected at twenty percent of the total amount of the contractor’s own rebuild or renovation assessment. For those not aware, overhead and profit (generally estimated at 20% of the total amount of the estimate) is intended to cover the overhead/operating costs of a general contractor as well as the amount of profit that the.

Source: claimspages.com

Source: claimspages.com

After all, insurance to value provides for new construction replacement costs, which are lower than repair construction values. They expect their adjusters, by whatever means, to get contractors (and by default owners) to abide by these x and y standards for overhead and profit. The hard costs include labor, material, supplies and more. O&p, as it�s called, is typically 20% of the total amount of the estimate. Safeco insurance company, 1 james mee purchased homeowners coverage from safeco.

Source: jlconline.com

Source: jlconline.com

It is usually insufficient to replace the damaged item. Each will have an overhead burden, and each will need a profit margin to sustain the business and reward the effort. Posted in insurance the prevailing view is that overhead and profit is due if a policyholder can show the services of a general contractor is “reasonably likely.” in mee v. In construction, overhead typically includes the cost of subcontractors, machinery, equipment, insurances, office staff, office supplies, vehicles, and other costs. Here is the closing excerpt “the department has concluded that an insurer providing property coverage under replacement cost residential policies that allow for the adjustment of covered losses to structures on an actual cash value basis may not calculate actual cash value on the basis of replacement cost with proper deduction for depreciation, less contractor´s.

Source: propertyinsurancecoveragelaw.com

Source: propertyinsurancecoveragelaw.com

Example job cost markup table Overhead and profit is generally charged by contractors, and so as a policyholder, it is ultimately part of your cost. For those not aware, overhead and profit (generally estimated at 20% of the total amount of the estimate) is intended to cover the overhead/operating costs of a general contractor as well as the amount of profit that the. Safeco insurance company, 1 james mee purchased homeowners coverage from safeco. An insurer that holds back gcop until repairs are completed puts the property owner in an impossible financial position.

Source: jsheld.com

Source: jsheld.com

In this scenario, a job that costs $100,000 will have to be marked up nearly $67,000 to cover a contractor’s gross profit (30% overhead plus 10% net profit) which is equal to 40 percent of the gross sale. One common problem that has been arising is when overhead and profit should be paid in response to a property insurance claim. Overhead and profit is generally charged by contractors, and so as a policyholder, it is ultimately part of your cost. Contractor expenditures, often stated to as overhead and profit is meant to cover the general contractor’s overhead and operating costs, as well as profit. Each will have an overhead burden, and each will need a profit margin to sustain the business and reward the effort.

Source: cy2204imageculture.blogspot.com

Source: cy2204imageculture.blogspot.com

General contractors routinely charge overhead and profit (gcop), usually at a rate of 10% for each. The truth is, no contractor can survive on 10% overhead and 10% profit. For those not aware, overhead and profit (generally estimated at 20% of the total amount of the estimate) is intended to cover the overhead/operating costs of a general contractor as well as the amount of profit that the. Contractor overhead and profits (gcop) is almost always justified. In the insurance industry, overhead (10%) and profit (10%), commonly referred to as o&p, is owed when it becomes necessary to have multiple subcontractors perform work to repair damages to your property cause by a covered peril in the policy.

Source: mwl-law.com

Source: mwl-law.com

All roofers are entitled to overhead and profit. In construction, overhead typically includes the cost of subcontractors, machinery, equipment, insurances, office staff, office supplies, vehicles, and other costs. In this example, the contractor cannot cover all of his overhead costs, let alone realize any net profit. Office expenses, bookkeeping and accounting; Advertising, training, legal, insurance, and other costs of being in.

Source: cy2204imageculture.blogspot.com

Source: cy2204imageculture.blogspot.com

These can split up into two sections: In construction, overhead typically includes the cost of subcontractors, machinery, equipment, insurances, office staff, office supplies, vehicles, and other costs. Correctly calculating overhead and profit can mean the difference between a job making you money or costing you money. Office expenses, bookkeeping and accounting; All roofers are entitled to overhead and profit.

Source: nextinsurance.com

Source: nextinsurance.com

An insurer that holds back gcop until repairs are completed puts the property owner in an impossible financial position. This total amounts for 10% of overhead and 10% of profit, netting a total of 20% to be paid by a homeowner’s insurance. Here is the closing excerpt “the department has concluded that an insurer providing property coverage under replacement cost residential policies that allow for the adjustment of covered losses to structures on an actual cash value basis may not calculate actual cash value on the basis of replacement cost with proper deduction for depreciation, less contractor´s. The internal revenue service definition is what Your profits are what�s leftover from what you were paid, after you’ve subtracted your overhead and the hard costs of the job.

Source: cy2204imageculture.blogspot.com

Source: cy2204imageculture.blogspot.com

An insurer that holds back gcop until repairs are completed puts the. Safeco insurance company, 1 james mee purchased homeowners coverage from safeco. Contractor expenditures, often stated to as overhead and profit is meant to cover the general contractor’s overhead and operating costs, as well as profit. An insurer that holds back gcop until repairs are completed puts the property owner in an impossible financial position. General contractors routinely charge overhead and profit (gcop), usually at a rate of 10% for each.

Source: easypaleorecipes123.blogspot.com

Source: easypaleorecipes123.blogspot.com

Pennsylvania’s highest court sides with the insurance company claiming that farmers (truck insurance) contracted around the requirement to include general contractor overhead and profit in the actual cash value (acv) payment. O&p, as it�s called, is typically 20% of the total amount of the estimate. They expect their adjusters, by whatever means, to get contractors (and by default owners) to abide by these x and y standards for overhead and profit. This seems to be a huge insurance industry fight as we speak with roofers. Each will have an overhead burden, and each will need a profit margin to sustain the business and reward the effort.

Source: cy2204imageculture.blogspot.com

Source: cy2204imageculture.blogspot.com

The ultimate point of overhead and profit is that there’s a certain chunk of money that doesn’t fit into the “actual cash value” of your home. Each will have an overhead burden, and each will need a profit margin to sustain the business and reward the effort. An insurer that holds back gcop until repairs are completed puts the. This seems to be a huge insurance industry fight as we speak with roofers. One common problem that has been arising is when overhead and profit should be paid in response to a property insurance claim.

Source: howtohardscape.com

Source: howtohardscape.com

In this scenario, a job that costs $100,000 will have to be marked up nearly $67,000 to cover a contractor’s gross profit (30% overhead plus 10% net profit) which is equal to 40 percent of the gross sale. Pennsylvania’s highest court sides with the insurance company claiming that farmers (truck insurance) contracted around the requirement to include general contractor overhead and profit in the actual cash value (acv) payment. General contractors routinely charge overhead and profit (gcop), usually at a rate of 10% for each. Typical overhead and profit for contractors. These can split up into two sections:

Source: cy2204imageculture.blogspot.com

Source: cy2204imageculture.blogspot.com

General contractors routinely charge overhead and profit (gcop), usually at a rate of 10% for each. In the insurance industry, overhead (10%) and profit (10%), commonly referred to as o&p, is owed when it becomes necessary to have multiple subcontractors perform work to repair damages to your property cause by a covered peril in the policy. This is how they get paid. Office expenses, bookkeeping and accounting; General contractor overhead and profit are often estimated at 20 percent of the total estimate.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title when does insurance cover contractor overhead and profit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information