When does life insurance pay out information

Home » Trending » When does life insurance pay out informationYour When does life insurance pay out images are ready. When does life insurance pay out are a topic that is being searched for and liked by netizens now. You can Get the When does life insurance pay out files here. Find and Download all free photos.

If you’re looking for when does life insurance pay out pictures information linked to the when does life insurance pay out interest, you have pay a visit to the right site. Our site frequently gives you hints for refferencing the maximum quality video and picture content, please kindly surf and locate more informative video articles and images that fit your interests.

When Does Life Insurance Pay Out. Ten times a life insurance policy will not pay out. That’s why by the end of 2018 life insurance coverage in the united states totaled $19.6 trillion. A suicide clause states that the insurance company does not have to pay the death benefit if the insured commits suicide within two years of taking out the policy. Life insurance providers usually pay out within 60 days of receiving a death claim filing.

Denied Life Insurance for Drug Overdose Will a Policy Pay From life-insurance-lawyer.com

Denied Life Insurance for Drug Overdose Will a Policy Pay From life-insurance-lawyer.com

However, if your cover includes critical or terminal illness cover, your life insurance can be paid out when a terminal illness is diagnosed and the insured person has less than 12 months to live. The vast majority of life insurance policies pay out. A life insurance policy pays out a death benefit when an insured person dies. Death benefit payout life insurance companies often take their time when processing death claims to ensure that the beneficiary genuinely deserves the death benefit and that no fraud. When you sign your name at the bottom of a life insurance policy, the goal is to protect your family in the event you die of natural cause or disease. To secure coverage for yourself (or someone else), you purchase a policy and pay premiums to an insurance company.

When does life insurance not pay.

After two years even then the policy would pay out. There are very exceptions which would be fraud or misrepresentation at the time of application or suicide. When is your life insurance paid out? A suicide clause states that the insurance company does not have to pay the death benefit if the insured commits suicide within two years of taking out the policy. A payout received because of. However, there are situations where a life insurance policy will not pay out.

Source: lovewordssss.blogspot.com

Source: lovewordssss.blogspot.com

A life insurance policy pays out a death benefit when an insured person dies. When you sign your name at the bottom of a life insurance policy, the goal is to protect your family in the event you die of natural cause or disease. How does life insurance pay out? Beneficiaries must file a death claim and verify their identity before receiving payment. Any claim will be paid as a lump sum in pound sterling to a uk bank account.

Source: funender.com

Source: funender.com

Any claim will be paid as a lump sum in pound sterling to a uk bank account. Generally, they may void a claim based on how or when you die. Who we pay out to: Both are excluded for the first two years the policy is in force. Typically, after death, the beneficiary contacts the insurer to notify them and start the claims process.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

A life insurance pay out is the money paid to your beneficiaries if you were to pass away while the life insurance policy is in effect. Typically, term life insurance benefits are paid when the insured has died and the beneficiary files a death claim with the insurance company. Sometimes it’s a missed detail or an intentionally dishonest. When is your life insurance paid out? The average life insurance payout can take as little as two weeks, up to two months, to receive the death benefit.

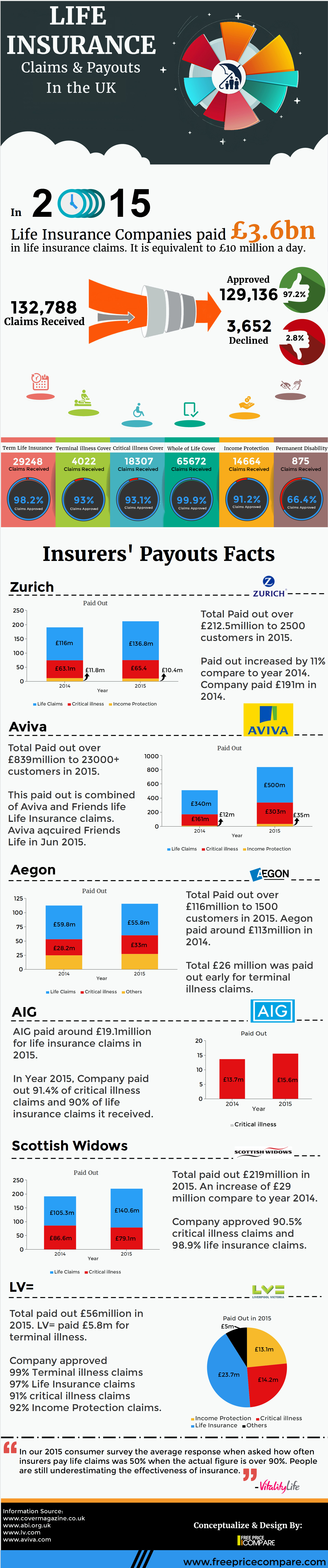

Source: freepricecompare.com

Source: freepricecompare.com

Reasons term life insurance does not pay out. Any claim will be paid as a lump sum in pound sterling to a uk bank account. How long does it take to cash out a life insurance policy? When you sign your name at the bottom of a life insurance policy, the goal is to protect your family in the event you die of natural cause or disease. That money is often free from federal income.

Source: iselect.com.au

Source: iselect.com.au

After two years even then the policy would pay out. With an installment plan, the life insurance company pays you a certain amount of money on a regular schedule (usually monthly, quarterly or yearly). For example, let’s say paul had a $750,000 life insurance policy. The vast majority of life insurance policies pay out. When is your life insurance paid out?

Source: moneytothemasses.com

Source: moneytothemasses.com

You should be able to collect the life insurance payout within 30 to 60 days after you have submitted the completed claim forms and the supporting documents. Sometimes it’s a missed detail or an intentionally dishonest. Any claim will be paid as a lump sum in pound sterling to a uk bank account. For example, let’s say paul had a $750,000 life insurance policy. However, there are situations where a life insurance policy will not pay out.

Source: life-insurance-lawyer.com

Source: life-insurance-lawyer.com

When is your life insurance paid out? You should be able to collect the life insurance payout within 30 to 60 days after you have submitted the completed claim forms and the supporting documents. Sometimes it’s a missed detail or an intentionally dishonest. Both are excluded for the first two years the policy is in force. Who we pay out to:

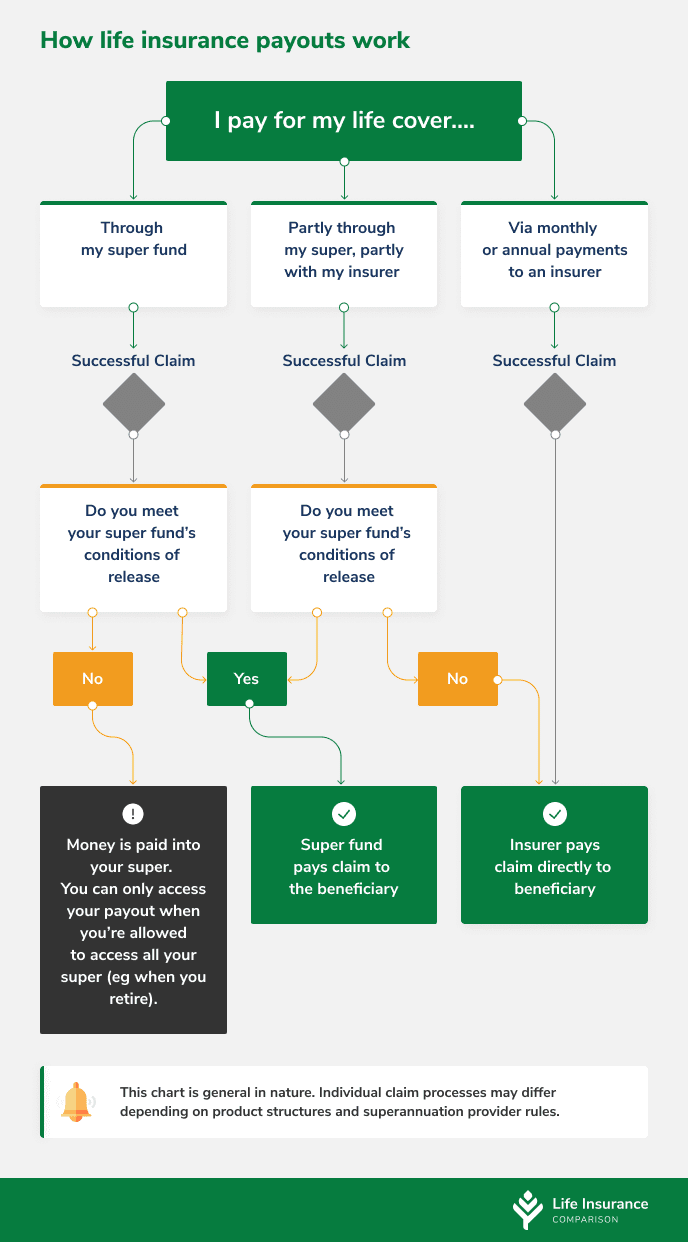

Source: lifeinsurancecomparison.com.au

Source: lifeinsurancecomparison.com.au

However, the timeline depends on several factors. When does life insurance not pay. Ten times a life insurance policy will not pay out. Then insurers can payout benefits, deny the claim, or ask for additional information to. When is your life insurance paid out?

Source: everquote.com

Source: everquote.com

Beneficiaries must file a death claim and verify their identity before receiving payment. The average life insurance payout can take as little as two weeks, up to two months, to receive the death benefit. When you reach the age of maturity, your policy will pay out the cash value of the policy and your life insurance coverage ends. Typically, term life insurance benefits are paid when the insured has died and the beneficiary files a death claim with the insurance company. Beneficiaries must file a death claim and verify their identity before receiving payment.

Source: thelambertagency.com

Source: thelambertagency.com

If you can’t find the policy, contact your life insurance agent, the company that issued. Locate the life insurance policy. How does life insurance pay out? Death benefit payout life insurance companies often take their time when processing death claims to ensure that the beneficiary genuinely deserves the death benefit and that no fraud. When setting up a policy, the policy owner names one or more beneficiaries who receive the death benefit.

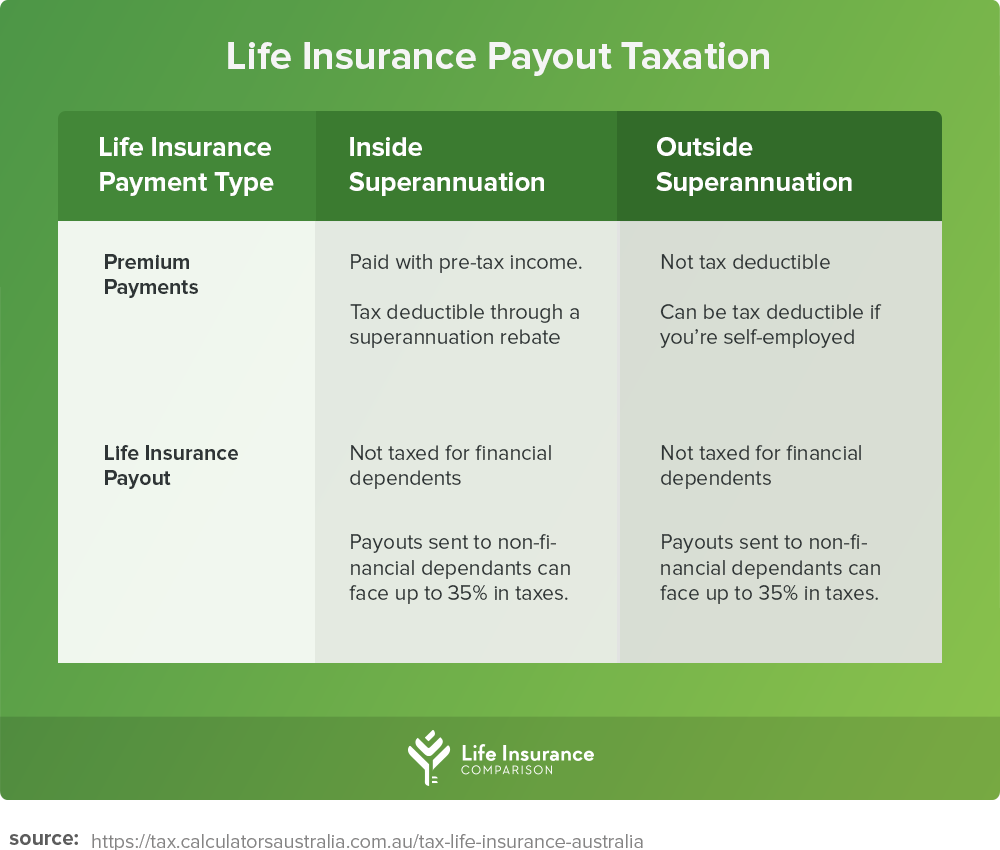

Source: lifeinsurancecomparison.com.au

Source: lifeinsurancecomparison.com.au

We will make a payment directly to the legal owner of the policy, unless that person is deceased, in which case it will be paid to their personal representative, usually the executor of their will. Americans believe in life insurance. If you can’t find the policy, contact your life insurance agent, the company that issued. A life insurance company should be. Life insurance providers usually pay out within 60 days of receiving a death claim filing.

Source: motogp-news-hot.blogspot.com

Source: motogp-news-hot.blogspot.com

Typically, after death, the beneficiary contacts the insurer to notify them and start the claims process. A life insurance policy pays out a death benefit when an insured person dies. Any claim will be paid as a lump sum in pound sterling to a uk bank account. Life insurance providers usually pay out within 60 days of receiving a death claim filing. And that money gets paid out over a certain period of time.

Source: thefinancesection.com

Source: thefinancesection.com

Life insurance is a contract between a policyholder and an insurance company that�s designed to pay out a death benefit when the insured person passes away. Many states allow insurers 30 days to review the claim after receiving a certified copy of the death certificate. That year, life insurance companies paid more than $290 billion in benefits. A life insurance pay out is the money paid to your beneficiaries if you were to pass away while the life insurance policy is in effect. Ten times a life insurance policy will not pay out.

Source: iii.org

Source: iii.org

A life insurance policy pays out a death benefit when an insured person dies. Typically, term life insurance benefits are paid when the insured has died and the beneficiary files a death claim with the insurance company. Americans believe in life insurance. That money is often free from federal income. With an installment plan, the life insurance company pays you a certain amount of money on a regular schedule (usually monthly, quarterly or yearly).

Source: tomorrowmakers.com

The average life insurance payout can take as little as two weeks, up to two months, to receive the death benefit. Insurers pay out the vast majority of life insurance claims. A life insurance company should be. With an installment plan, the life insurance company pays you a certain amount of money on a regular schedule (usually monthly, quarterly or yearly). Life insurance companies pay out the proceeds when the insured dies and the beneficiary of the policy files a life insurance claim.

Source: reassured.co.uk

Source: reassured.co.uk

When does life insurance not pay. When you sign your name at the bottom of a life insurance policy, the goal is to protect your family in the event you die of natural cause or disease. Sometimes it’s a missed detail or an intentionally dishonest. There are very exceptions which would be fraud or misrepresentation at the time of application or suicide. With an installment plan, the life insurance company pays you a certain amount of money on a regular schedule (usually monthly, quarterly or yearly).

Source: toplifeinsurancereviews.com

Source: toplifeinsurancereviews.com

For example, let’s say paul had a $750,000 life insurance policy. People get life insurance with the expectation that if they pass away during. How long does it take to cash out a life insurance policy? Many states allow insurers 30 days to review the claim after receiving a certified copy of the death certificate. Typically, term life insurance benefits are paid when the insured has died and the beneficiary files a death claim with the insurance company.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

A suicide clause states that the insurance company does not have to pay the death benefit if the insured commits suicide within two years of taking out the policy. You should be able to collect the life insurance payout within 30 to 60 days after you have submitted the completed claim forms and the supporting documents. The benefit could be delayed or denied due to policy lapses, fraud, or certain causes of death. Insurers pay out the vast majority of life insurance claims. Life insurance companies pay out the proceeds when the insured dies and the beneficiary of the policy files a life insurance claim.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title when does life insurance pay out by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information