When must insurable interest exist Idea

Home » Trend » When must insurable interest exist IdeaYour When must insurable interest exist images are ready in this website. When must insurable interest exist are a topic that is being searched for and liked by netizens now. You can Download the When must insurable interest exist files here. Get all free vectors.

If you’re searching for when must insurable interest exist pictures information connected with to the when must insurable interest exist topic, you have pay a visit to the right site. Our site always provides you with suggestions for seeing the maximum quality video and image content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

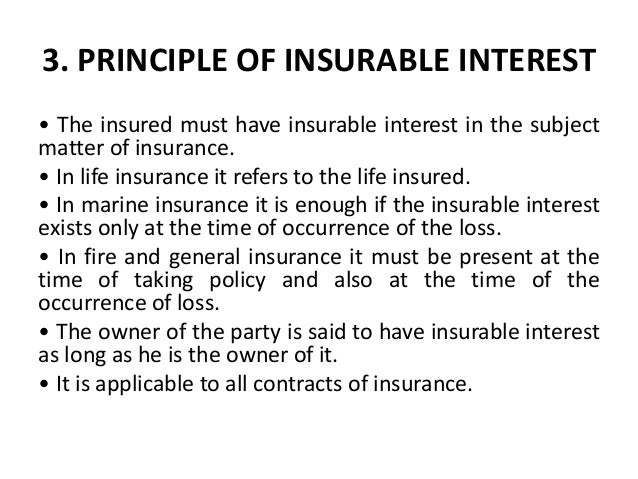

When Must Insurable Interest Exist. Life insurance policies always have an insurable interest requirement. At the time the property loss occurs. When must insurable interest exist in a life insurance policy? It must exist when a claim is submitted.

When must insurable interest exist for a life insurance From greatoutdoorsabq.com

When must insurable interest exist for a life insurance From greatoutdoorsabq.com

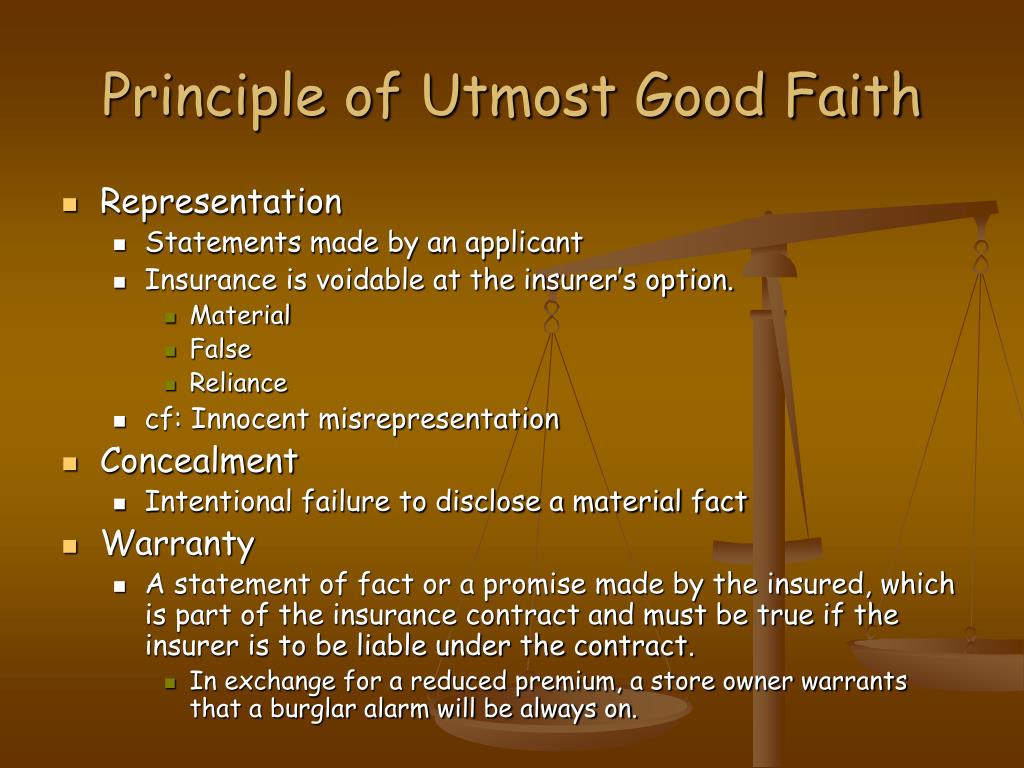

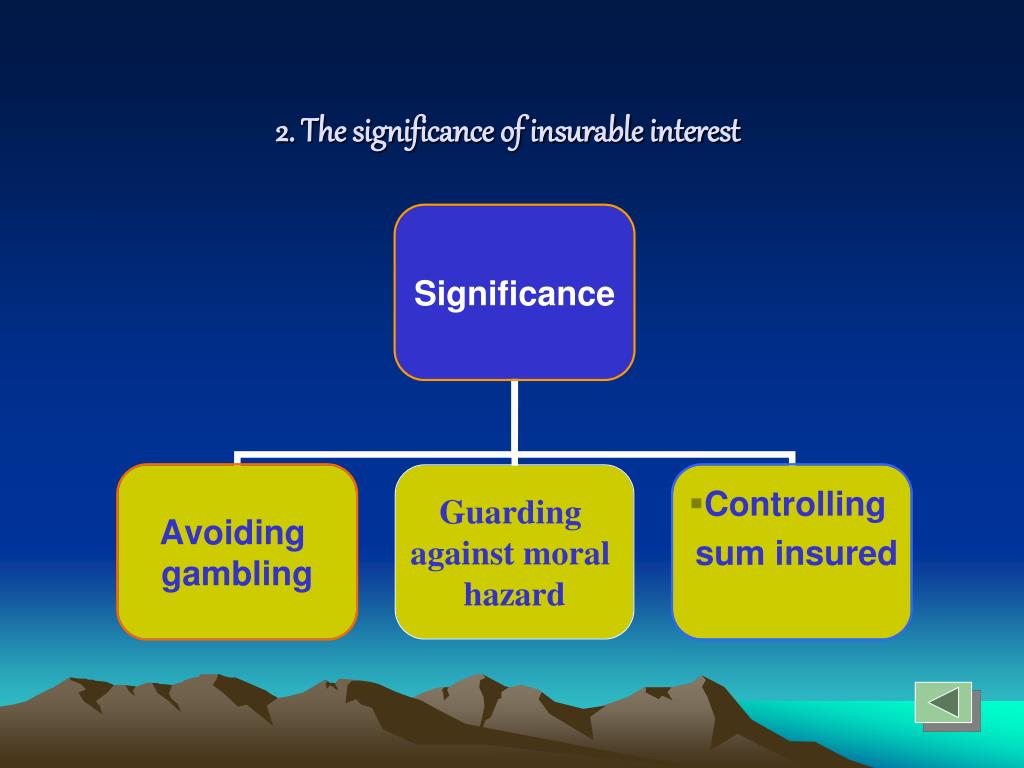

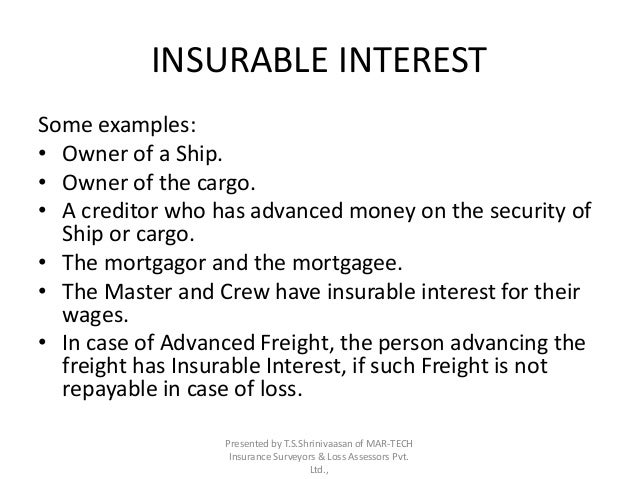

For example, if a creditor takes out a policy on the life of a debtor and subsequently the debtor pays back the loan, nevertheless the creditor can continue the policy as per original terms and shall be entitled to sum assured either on death of the debtor. Insurable interest must exist only at the time the applicant enters into a life insurance contract. Insurable interest is a financial benefit that the insured derives from the existence of the product that is insured. It must exist when a claim is submitted. Insurable interest also exists when you have an interest in another person based on love and affection, providing that there is a blood or legal relationship involved, such as through family. If no insurable interest exists when a policyowner buys a life insurance policy, the contract may still be enforced.

In order to buy a policy on your life, the policy owner must show life insurance insurable interest.

When must insurable interest exist for a life insurance contract to be valid? It must continue for the life of the policy. It must exist when a claim is submitted. When must insurable interest exist in a life insurance policy? If no insurable interest exists when a policyowner buys a life insurance policy, the contract may still be enforced. A person or entity has an insurable interest in an item, event or action when the damage or loss of the object would cause a financial loss or other hardships.

Source: slideserve.com

Source: slideserve.com

The person who owns the policy and names the beneficiary or beneficiaries, will suffer financial loss if the insured dies unexpectedly. Insurable interest must exist in every insurance contract. Insurable interest is a requirement for all types of insurance and is, generally, the financial interest you have in something or someone that’s insured. It must continue for the life of the policy. If no insurable interest exists when a policyowner buys a life insurance policy, the contract may still be enforced.

Source: garrettuzsh247.wordpress.com

Source: garrettuzsh247.wordpress.com

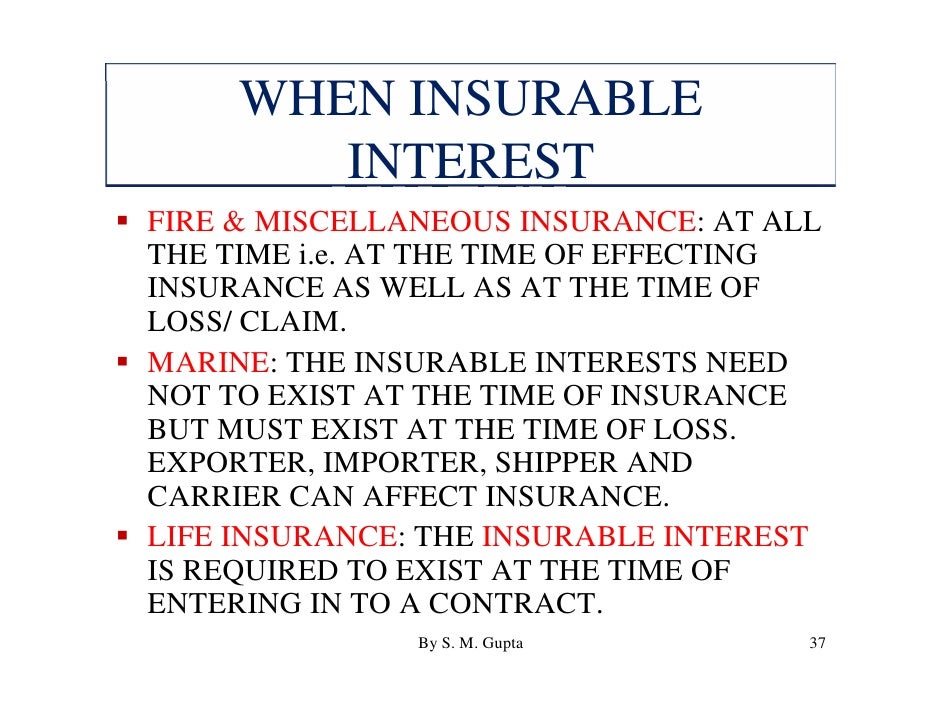

Insurable interest must exist at the time of effecting the policy and it may not exist at the time of claim. Insurable interest must exist both at the time of effecting the policy and at the time of claim. Insurable interest must exist only at the time the applicant enters into a life insurance contract. When must insurable interest exist in a life insurance policy? In a marine insurance, when must the insurable interest exist?

Source: revisi.net

Source: revisi.net

Therefore, if you would like to financially protect someone that does not have an insurable interest in your life, you can purchase a life insurance policy on your life, naming that person as the. It must exist when a claim is submitted. The time when the insurable interest must be present varies with the type of insurance policy. At least 30 days before and after the loss is suffered. It is the duty of the policy owner to prove that they have an insurable interest in the insured party.

Source: revisi.net

Source: revisi.net

A person or entity has an insurable interest in an item, event or action when the damage or loss of the object would cause a financial loss or other hardships. If the applicant deliberately provides misleading information, that person could not only lose the claim but get prosecuted for insurance fraud. Insurable interest must exist only at the time the applicant enters into a life insurance contract. If no insurable interest exists when a policyowner buys a life insurance policy, the contract may still be enforced. For example, a person would have insurable interest in his own car and not in his neighbour�s car.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

When must insurable interest exist for a life insurance contract to be valid? Insurable interest must exist at the time of effecting the policy and it may not exist at the time of claim. For property insurance, an insurable interest must exist: When someone purchases life insurance, he or she must have an “insurable interest” in the insured. (below, we’ve included insurable interest examples of the people who can typically claim insurable interest.)

Source: slideshare.net

Source: slideshare.net

It must continue for the life of the policy. Insurable interest is a requirement for all types of insurance and is, generally, the financial interest you have in something or someone that’s insured. Life insurance policies always have an insurable interest requirement. For example, a person would have insurable interest in his own car and not in his neighbour�s car. Insurable interest must exist only at the time the applicant enters into a life insurance contract.

Source: revisi.net

Source: revisi.net

Insurable interest must only exist at the inception of the contract. For example, a person would have insurable interest in his own car and not in his neighbour�s car. Insurable interest must exist only at the time the applicant enters into a life insurance contract. When must insurable interest exist for a life insurance contract to be valid? Insurable interest must exist at the time of effecting the policy and it may not exist at the time of claim.

Source: bylmes.com

Source: bylmes.com

It must exist when a claim is submitted. Insurable interest must exist both at the time of effecting the policy and at the time of claim. Insurable interest must exist at the time of effecting the policy and it may not exist at the time of claim. If no insurable interest exists when a policyowner buys a life insurance policy, the contract may still be enforced. If no insurable interest exists when a policyowner buys a life insurance policy, the contract may still be enforced.

Source: slideserve.com

Source: slideserve.com

To have an insurable interest a. At the time the property loss occurs. In life insurance contracts, the required insurable interest must exist at the time of the insured�s death. Insurable interest must exist both at the time of effecting the policy and at the time of claim. Insurable interest must exist at the time of effecting the policy and it may not exist at the time of claim.

Source: slideserve.com

Source: slideserve.com

30 days prior to the time the loss is sustained. It must continue for the life of the policy. Insurable interest must exist at the time of effecting the policy and it may not exist at the time of claim. In a lot of cases ownership isn’t just as clear cut as this. The time when the insurable interest must be present varies with the type of insurance policy.

Source: fhleoa.org

Source: fhleoa.org

(a) at the time of making contract (b) at the time of loss of subject matter (c) both at the time of making contract and at the time of loss of subject matter(d) at the time of termination of the policy Insurable interest must exist only at the time the applicant enters into a life insurance contract. 1.4 time duration of insurable interest: A person or entity has an insurable interest in an item, event or action when the damage or loss of the object would cause a financial loss or other hardships. If no insurable interest exists when a policyowner buys a life insurance policy, the contract may still be enforced.

Source: slideshare.net

Source: slideshare.net

Always, but it�s a requirement that applies to the owner with the person being insured. It is the duty of the policy owner to prove that they have an insurable interest in the insured party. Insurable interest must only exist at the inception of the contract. This means that the policyholder, i.e. Insurable interest must exist only at the time the applicant enters into a life insurance contract.

Source: slideserve.com

Source: slideserve.com

Insurable interest must exist at the time of effecting the policy and it may not exist at the time of claim. Always, but it�s a requirement that applies to the owner with the person being insured. It must exist when a claim is submitted. Insurable interest must exist at the time of effecting the policy and it may not exist at the time of claim. It must exist when a claim is submitted.

Source: slideshare.net

Source: slideshare.net

A person or entity has an insurable interest in an item, event or action when the damage or loss of the object would cause a financial loss or other hardships. Insurable interest must exist at the time of effecting the policy and it may not exist at the time of claim. Insurable interest must exist both at the time of effecting the policy and at the time of claim. In a marine insurance, when must the insurable interest exist? Insurable interest must exist only at the time the applicant enters into a life insurance contract.

Source: revisi.net

Source: revisi.net

Additional types of insurable interest. If no insurable interest exists when a policyowner buys a life insurance policy, the contract may still be enforced. If someone steals your bicycle you will suffer financially from that loss. It must exist when a claim is submitted. If no insurable interest exists when a policyowner buys a life insurance policy, the contract may still be enforced.

Source: slideshare.net

Source: slideshare.net

Insurable interest must exist in every insurance contract. It must continue for the life of the policy. In order to buy a policy on your life, the policy owner must show life insurance insurable interest. Insurable interest must exist both at the time of effecting the policy and at the time of claim. Insurable interest must exist only at the time the applicant enters into a life insurance contract.

Source: slideserve.com

Source: slideserve.com

In order to buy a policy on your life, the policy owner must show life insurance insurable interest. 30 days prior to the time the loss is sustained. 1.4 time duration of insurable interest: (below, we’ve included insurable interest examples of the people who can typically claim insurable interest.) If no insurable interest exists when a policyowner buys a life insurance policy, the contract may still be enforced.

Source: revisi.net

Source: revisi.net

An insurable interest mandated by particular statute dealing on insurance is known as statutory interest. If the applicant deliberately provides misleading information, that person could not only lose the claim but get prosecuted for insurance fraud. The person who owns the policy and names the beneficiary or beneficiaries, will suffer financial loss if the insured dies unexpectedly. It must exist when a claim is submitted. If no insurable interest exists when a policyowner buys a life insurance policy, the contract may still be enforced.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title when must insurable interest exist by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information