When must insurable interest exist in life insurance Idea

Home » Trend » When must insurable interest exist in life insurance IdeaYour When must insurable interest exist in life insurance images are ready in this website. When must insurable interest exist in life insurance are a topic that is being searched for and liked by netizens today. You can Get the When must insurable interest exist in life insurance files here. Find and Download all free photos and vectors.

If you’re searching for when must insurable interest exist in life insurance images information linked to the when must insurable interest exist in life insurance keyword, you have visit the right blog. Our site always provides you with hints for downloading the maximum quality video and image content, please kindly surf and find more enlightening video articles and images that fit your interests.

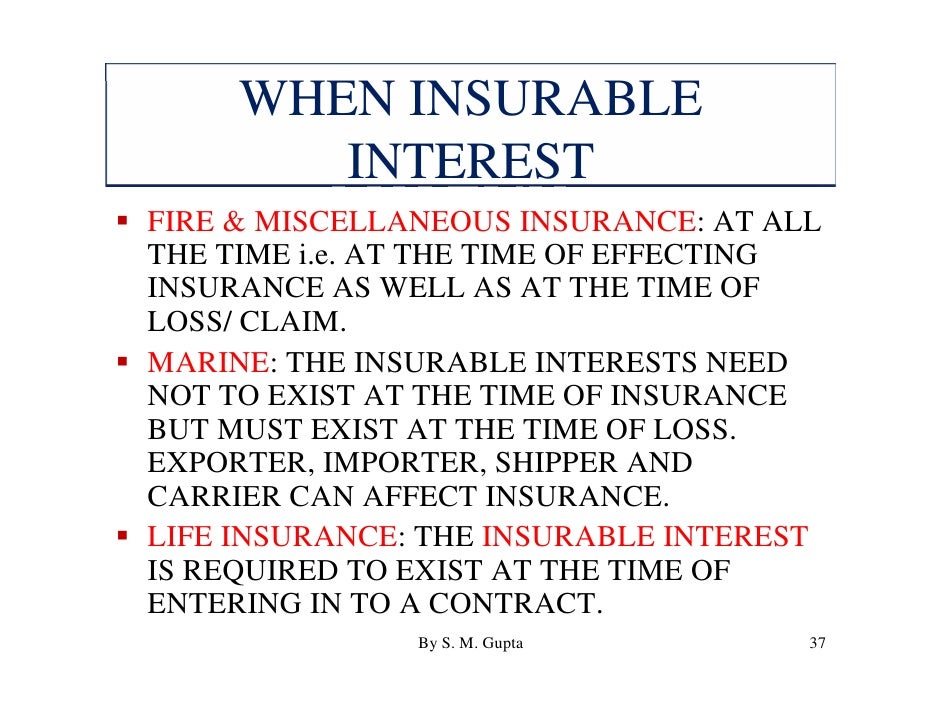

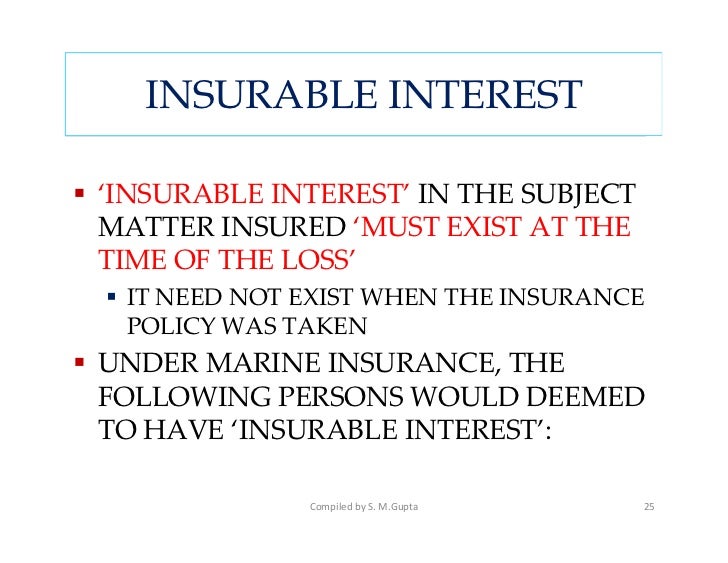

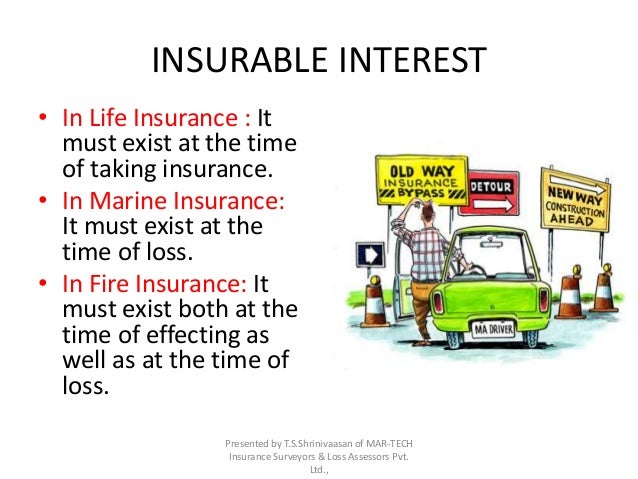

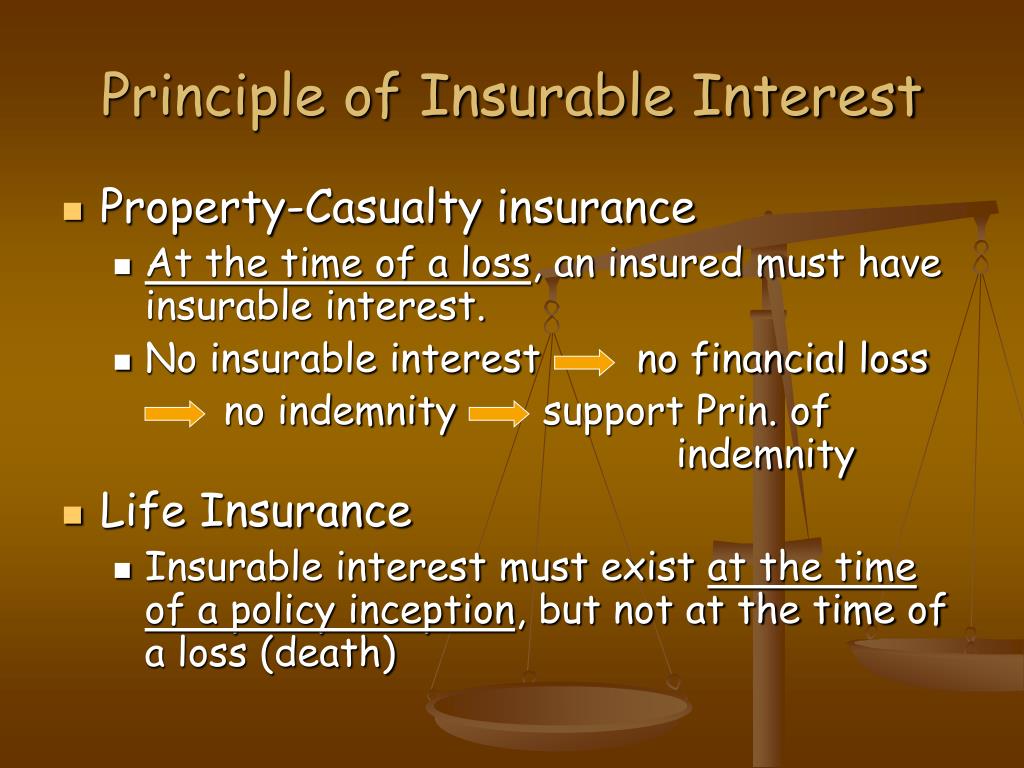

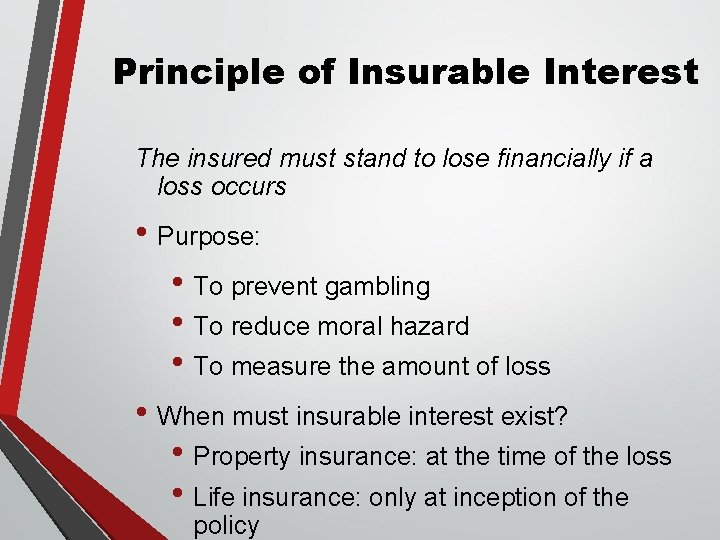

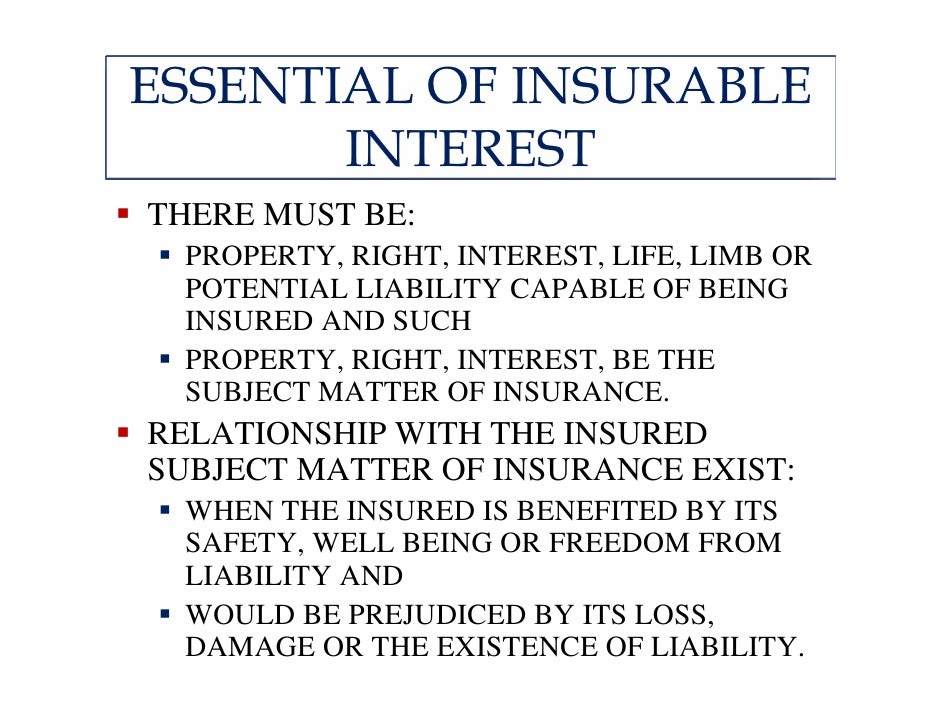

When Must Insurable Interest Exist In Life Insurance. Decided cases have established that the interest only has to exist at the inception of the contract and not at the time of loss. When must an insurable interest exist for a life insurance policy to be valid? Insurable interest must exist only at the time the applicant enters into a life insurance contract. Proof of insurable interest in life insurance is required at the time of application filling and buying the policy.

Principle Of Insurance Interest Chapter 5 Legal From peterperfectsports.blogspot.com

Principle Of Insurance Interest Chapter 5 Legal From peterperfectsports.blogspot.com

Once the policy has been properly created, the policyholder does not need to continue to. It must continue for the life of the policy. Insurable interest must exist only at the time the applicant enters into a life insurance contract. What are some common personal uses of life insurance? Insurable interest must exist only at the time the applicant enters into a life insurance contract. In life insurance contracts, the required insurable interest must exist at the time the policy was issued.

In the case of a life insurance policy, the owner of the policy must always have an insurable interest in the life of the insured.

This would answer the question with regard to whether insurable interest is to exist at the formation of the contract, at the time of claims, or it should continue existing until it is discharged. Also asked, when must insurable interest exist in a life insurance policy quizlet? Faith owes $50,000 to investment lenders, inc.,. It must continue for the life of the policy. If no insurable interest exists when a policyowner buys a life insurance policy, the contract may still be enforced. In order to purchase a policy, insurable interest must exist.

Source: slideshare.net

Source: slideshare.net

Life insurance policies always have an insurable interest requirement. In fire insurance, it exist both at the time of making contract and incurring losses. Insurable interest must exist only at the time the applicant enters into a life insurance contract. With regards to life insurance, someone having an insurable interest in you means that they would experience financial loss and hardship should you die. If no insurable interest exists when a policyowner buys a life insurance policy, the contract may still be enforced.

Source: slideserve.com

Source: slideserve.com

If no insurable interest exists when a policyowner buys a life insurance policy, the contract may still be enforced. The person who owns the policy and names the beneficiary or beneficiaries, will suffer financial loss if the insured dies unexpectedly. Life insurance policies always have an insurable interest requirement. Insurable interest means you have an interest in the continuation of the life of the person who’s insured—it could be financial and/or emotional. It must exist when a claim is submitted.

Source: chartattack.com

Source: chartattack.com

At what time the insurable interest must be present in the case of life insurance is an important concern for a policy buyer. Insurable interest must exist only at the time the applicant enters into a life insurance contract. Proof of insurable interest in life insurance is required at the time of application filling and buying the policy. In life insurance contracts, the required insurable interest must exist at the time of the insured�s death. When someone purchases life insurance, he or she must have an “insurable interest” in the insured.

Source: thebalance.com

Source: thebalance.com

In order to buy a policy on your life, the policy owner must show life insurance insurable interest. When must an insurable interest exist in life insurance policy? Inception of the contract b. The law states that insurable interest must be present both when buying the life insurance policy and at the time of loss. Read on to know more in detail:

Source: slideshare.net

Source: slideshare.net

In order to buy a policy on your life, the policy owner must show life insurance insurable interest. When must insurable interest exist in a life insurance policy? When someone purchases life insurance, he or she must have an “insurable interest” in the insured. It must exist when a claim is submitted. When must the interest exist?

Source: fhleoa.org

Source: fhleoa.org

Proof of insurable interest in life insurance is required at the time of application filling and buying the policy. For example, a husband who takes out a policy on his wife and names himself as the beneficiary can prove insurable interest at. When someone purchases life insurance, he or she must have an “insurable interest” in the insured. Also, if the owner of the policy is not the beneficiary then the beneficiary named in the contract would also need an insurable interest in the insured person. It must exist when a claim is submitted.

Source: slideserve.com

Source: slideserve.com

In life insurance, it is important to prove insurable interest to protect both the insured as well as the insurer from insurance fraud.a person must prove insurable interest in the application process by proving their relationship to the insured. For life insurance policy, the insurable interest just requires to exist at the time the plan is bought It does not have to continue once the policy is in force. It must exist when a claim is submitted. When must the interest exist?

Source: slideshare.net

Source: slideshare.net

An insurable interest in life insurance is a legal term that refers to the relationship between the policyholder and the person or entity being insured. Insurable interest only needs to exist when a life insurance policy is initially issued. Insurable interest must exist only at the time the applicant enters into a life insurance contract. 1)survivor protection 2)estate creation 3) cash accumulation 4) liquidity 5) estate conservation. This means that the policyholder, i.e.

Source: revisi.net

Source: revisi.net

If there is an insufficient insurable interest between the policyholder and the insured, the policy is voided. For example, you can’t buy a life insurance policy on a person and then not be in their lives or financially dependent on them when they pass away and expect a payout. Decided cases have established that the interest only has to exist at the inception of the contract and not at the time of loss. The person who owns the policy and names the beneficiary or beneficiaries, will suffer financial loss if the insured dies unexpectedly. At what time the insurable interest must be present in the case of life insurance is an important concern for a policy buyer.

Source: paneladacomedia.blogspot.com

Source: paneladacomedia.blogspot.com

It must continue for the life of the policy. Insurable interest must exist only at the time the applicant enters into a life insurance contract. Decided cases have established that the interest only has to exist at the inception of the contract and not at the time of loss. You need to have an insurable interest to take out a life insurance policy on someone else. It must exist when a claim is submitted.

Source: slideserve.com

Source: slideserve.com

At what time the insurable interest must be present in the case of life insurance is an important concern for a policy buyer. This means that the policyholder, i.e. It must continue for the life of the policy. Read on to know more in detail: Insurable interest must exist only at the time the applicant enters into a life insurance contract.it must continue for the life of the policy.if no insurable interest exists when a policyowner buys a life insurance policy, the contract may still be enforced.

Source: peterperfectsports.blogspot.com

Source: peterperfectsports.blogspot.com

Proof of insurable interest in life insurance is required at the time of application filling and buying the policy. Why is insurable interest important? 1)survivor protection 2)estate creation 3) cash accumulation 4) liquidity 5) estate conservation. Insurable interest must exist only at the time the applicant enters into a life insurance contract. When must an insurable interest exist in life insurance policy?

Source: slideshare.net

Source: slideshare.net

An insurable interest in life insurance is a legal term that refers to the relationship between the policyholder and the person or entity being insured. You automatically have an unlimited insurable interest in your own life. When must insurable interest exist in a life insurance policy? In life insurance, insurable interest must exist between the policyowner and the insured at the time of the application. If there is an insufficient insurable interest between the policyholder and the insured, the policy is voided.

Source: slideshare.net

Source: slideshare.net

When insurable interest must exist. When insurable interest must exist. What are some common personal uses of life insurance? In order for an individual to purchase life insurance on another person, they must. This means that the policyholder, i.e.

Source: fhleoa.org

Source: fhleoa.org

In life insurance, insurable interest must exist between the policyowner and the insured at the time of the application. The law states that insurable interest must be present both when buying the life insurance policy and at the time of loss. Insurable interest must exist only at the time the applicant enters into a life insurance contract.it must continue for the life of the policy.if no insurable interest exists when a policyowner buys a life insurance policy, the contract may still be enforced. When must an insurable interest exist in life insurance policy? This would answer the question with regard to whether insurable interest is to exist at the formation of the contract, at the time of claims, or it should continue existing until it is discharged.

Source: smartasset.com

Source: smartasset.com

For example, you can’t buy a life insurance policy on a person and then not be in their lives or financially dependent on them when they pass away and expect a payout. This would answer the question with regard to whether insurable interest is to exist at the formation of the contract, at the time of claims, or it should continue existing until it is discharged. In fire insurance, it exist both at the time of making contract and incurring losses. It must continue for the life of the policy. You automatically have an unlimited insurable interest in your own life.

Source: peterperfectsports.blogspot.com

Source: peterperfectsports.blogspot.com

(below, we’ve included insurable interest examples of the people who can typically claim insurable interest.) It must continue for the life of the policy. It must continue for the life of the policy. If no insurable interest exists when a policyowner buys a life insurance policy, the contract may still be enforced. What are some common personal uses of life insurance?

Source: revisi.net

Source: revisi.net

It must continue for the life of the policy. It must exist when a claim is submitted. When must the interest exist? Insurable interest must exist only at the time the applicant enters into a life insurance contract. It must continue for the life of the policy.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title when must insurable interest exist in life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information