Which area is not protected by most homeowners insurance Idea

Home » Trend » Which area is not protected by most homeowners insurance IdeaYour Which area is not protected by most homeowners insurance images are available in this site. Which area is not protected by most homeowners insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Which area is not protected by most homeowners insurance files here. Download all royalty-free vectors.

If you’re looking for which area is not protected by most homeowners insurance pictures information linked to the which area is not protected by most homeowners insurance interest, you have pay a visit to the right site. Our website frequently gives you suggestions for downloading the maximum quality video and picture content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

Which Area Is Not Protected By Most Homeowners Insurance. Homes with more than two stories. They are told to go adjust claims, according to the insurance contract. Had purchased 200 shares of washington co. What is covered by home insurance?

Solved! How Much Homeowners Insurance Do I Need? Bob Vila From bobvila.com

Solved! How Much Homeowners Insurance Do I Need? Bob Vila From bobvila.com

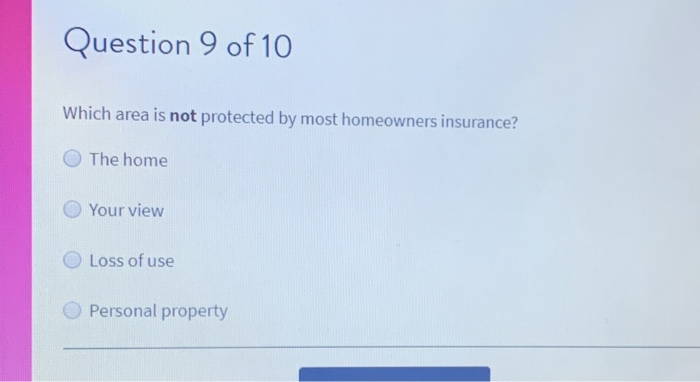

Question 9 of 10 which area is not protected by most homeowners insurance? Areas that home insurance does not protect. Your homeowners insurance policy also covers. In most states, earthquakes, sinkholes, and other earth movements are not covered by your standard. This article lists common areas that homeowner’s insurance does and doesn’t protect against. If there is a gray area, we go in favor of the insured, not the company.

Question 9 of 10 which area is not protected by most homeowners insurance?

Which area is not protected by most homeowners insurance. What is covered by home insurance? Which area is not protected by most homeowners insurance. The areas that are not protected by most homeowners insurance are as follows: If you run a business on your property in a separate structure, it is generally not covered by homeowners insurance.explanation: Another crucial area covered by homeowner’s insurance is legal liability.

Source: bankersinsurance.net

Source: bankersinsurance.net

Question 9 of 10 which area is not protected by most homeowners insurance? Homes with more than two stories. Your homeowners insurance coverage may overlap with. Had purchased 200 shares of washington co. Question 9 of 10 which area is not protected by most homeowners insurance?

Source: riddlebergerinsurance.com

Source: riddlebergerinsurance.com

In comparison, the arizona home insurance average is $927 and the national average is $1,200. Which area is not protected by most homeowners insurance. The home your view loss of use personal property. Knowing what�s covered and what isn�t can save you a lot of money and heartache down the line. The good news is separate policies exist for these types of events.

Source: thefamilylegacydrawer.com

Source: thefamilylegacydrawer.com

The areas that are not protected by most homeowners insurance are as follows: The majority of homeowner insurance policies cover damages caused by fires, windstorms, hail as well as flooding (excluding flooding) as well as explosions, riots, and fire. Which area is not protected by most homeowners insurance framework. Home insurance covers a broad area including the owner occupied home, its attached personal property and the furniture, assets and automobiles associated. Which area is not protected by most homeowners insurance | find out now.

Source: realtor.com

Source: realtor.com

Which area is not protected by most homeowners insurance. Which one of these is covered by a specific type of insurance policy? Which area is not protected by most homeowners insurance? Ordinance or law, intentional acts, war, flood. Most homeowners insurance plans cover damage caused by fires, windstorms, hail, water damage (excluding floods), riots, and explosions.

Source: trenhulk.revolucionww.com

Source: trenhulk.revolucionww.com

The home your view loss of use personal property. O the home your view o loss of use personal property. In most cases, earthquakes, landslides, and sinkholes aren’t covered. Coming in at an average of $960 per year, washington state is in the 10 least expensive states for home insurance premiums. Most homeowners insurance covers certain basics, but policies vary a great deal, so be sure to read the fine print before you purchase one.

Source: statusmarkets.in

Source: statusmarkets.in

Question 9 of 10 which area is not protected by most homeowners insurance? In comparison, the arizona home insurance average is $927 and the national average is $1,200. Which area is not protected by most homeowners insurance framework. O the home your view o loss of use personal property. This article lists common areas that homeowner’s insurance does and doesn’t protect against.

Source: marketingrealestateideas.com

Source: marketingrealestateideas.com

If the damage is covered by the insurance contract, to pay it. In comparison, the arizona home insurance average is $927 and the national average is $1,200. Please keep in mind, not all natural disasters are covered. Question 9 of 10 which area is not protected by most homeowners insurance? The home your view loss of use personal property.

Source: chegg.com

Source: chegg.com

The home your view loss of use personal property. If the damage is covered by the insurance contract, to pay it. If there is a gray area, we go in favor of the insured, not the company. The home your view loss of use personal property. In comparison, the arizona home insurance average is $927 and the national average is $1,200.

Source: baldersoninsurance.com

Source: baldersoninsurance.com

If there is a gray area, we go in favor of the insured, not the company. You could save up to 10 percent, homebuyer discount if you buy a newly constructed house. Which area is not protected by most homeowners insurance framework. If there is a gray area, we go in favor of the insured, not the company. This article lists common areas that homeowner’s insurance does and doesn’t protect against.

Source: quezon-city.primegateoffice.com

Source: quezon-city.primegateoffice.com

Which area is not protected by most homeowners insurance framework. Safe home reduction save as much as 5% when your home has additional protection against theft and fire, like a home security system. Ordinance or law, intentional acts, war, flood. Homes with more than two stories. Your view home insurance covers a broad area including the owner occupied home, its attached.

Source: pinterest.com

Source: pinterest.com

The home your view loss of use personal property continue. Which area is not protected by most homeowners insurance framework. The areas that are not protected by most homeowners insurance are as follows: If you’re looking to protect your home from risks like these please look into earthquake and flood insurance specifically. The majority of homeowner insurance policies cover damages caused by fires, windstorms, hail as well as flooding (excluding flooding) as well as explosions, riots, and fire.

Source: revisi.net

Source: revisi.net

What is covered by home insurance? If the damage is not covered by the contract, then deny the claim. If the damage is covered by the insurance contract, to pay it. Which area is not protected by most homeowners insurance. Homes with more than two stories.

Source: realweddinglist.blogspot.com

Source: realweddinglist.blogspot.com

Other potential sources of loss were burglary and the additional cost of living elsewhere while the structure was being repaired or rebuilt. Most homeowners insurance plans cover damage caused by fires, windstorms, hail, water damage (excluding floods), riots, and explosions. Home insurance covers a broad area including the owner occupied home, its attached personal property and the furniture, assets and automobiles associated. Which area is not protected by most homeowners insurance ? 1 answer · top answer:

Source: bobvila.com

Source: bobvila.com

So, which area is not protected by most homeowners insurance? Which area is not protected by most homeowners insurance. Safe home reduction save as much as 5% when your home has additional protection against theft and fire, like a home security system. Other potential sources of loss were burglary and the additional cost of living elsewhere while the structure was being repaired or rebuilt. If the damage is covered by the insurance contract, to pay it.

Your homeowners insurance coverage may overlap with. Homes with more than two stories. Which area is not protected by most homeowners insurance? The areas that are not protected by most homeowners insurance are as follows: Home insurance covers a broad area including the owner occupied home, its attached personal property and the furniture, assets and automobiles associated.

Source: coverhound.com

Source: coverhound.com

Other potential sources of loss were burglary and the additional cost of living elsewhere while the structure was being repaired or rebuilt. Which one of these is covered by a specific type of insurance policy? The areas that are not protected by most homeowners insurance are as follows: Most homeowners insurance covers certain basics, but policies vary a great deal, so be sure to read the fine print before you purchase one. In comparison, the arizona home insurance average is $927 and the national average is $1,200.

Source: houselogic.com

Source: houselogic.com

If the damage is covered by the insurance contract, to pay it. The home your view loss of use personal property continue. Home insurance covers a broad area including the owner occupied home, its attached personal property and the furniture, assets and automobiles associated. Other potential sources of loss were burglary and the additional cost of living elsewhere while the structure was being repaired or rebuilt. Question 9 of 10 which area is not protected by most homeowners insurance?

Source: realtor.com

Source: realtor.com

Which area is not protected by most homeowners insurance. Trevor nadar is associated with compare closing, a company that provides a range of mortgage and loan services like refinances, home equity loans, etc. Ordinance or law, intentional acts, war, flood. Please keep in mind, not all natural disasters are covered. Which area is not protected by most homeowners insurance.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title which area is not protected by most homeowners insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information