Which area is not protected by most homeowners insurance framework information

Home » Trending » Which area is not protected by most homeowners insurance framework informationYour Which area is not protected by most homeowners insurance framework images are ready in this website. Which area is not protected by most homeowners insurance framework are a topic that is being searched for and liked by netizens today. You can Download the Which area is not protected by most homeowners insurance framework files here. Get all royalty-free photos and vectors.

If you’re searching for which area is not protected by most homeowners insurance framework pictures information related to the which area is not protected by most homeowners insurance framework topic, you have pay a visit to the ideal blog. Our website always provides you with hints for refferencing the highest quality video and image content, please kindly surf and locate more enlightening video content and images that fit your interests.

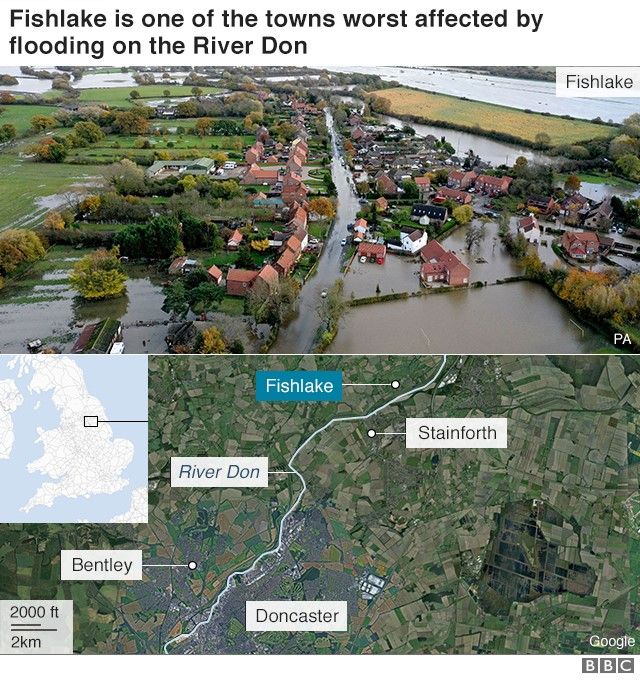

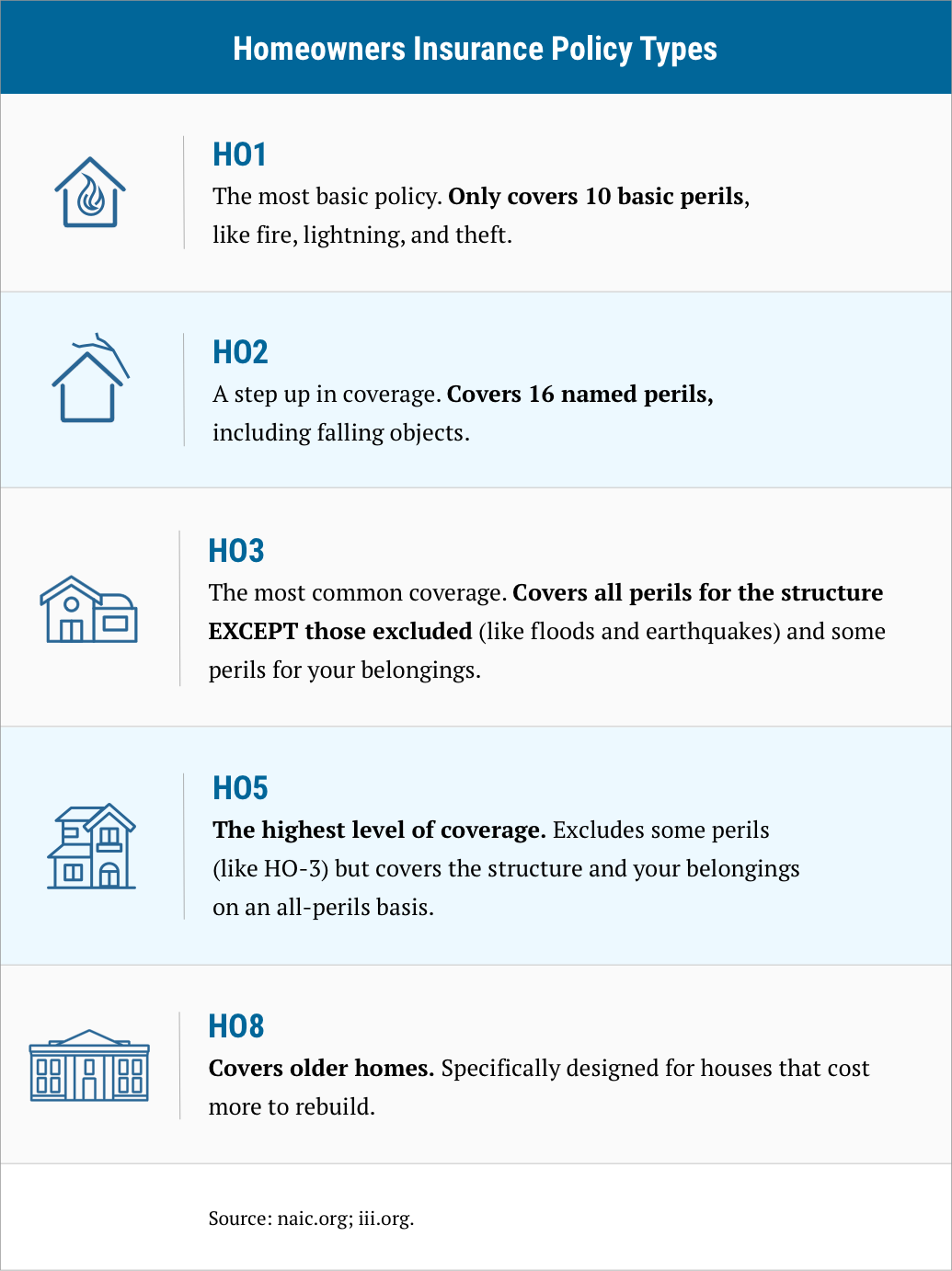

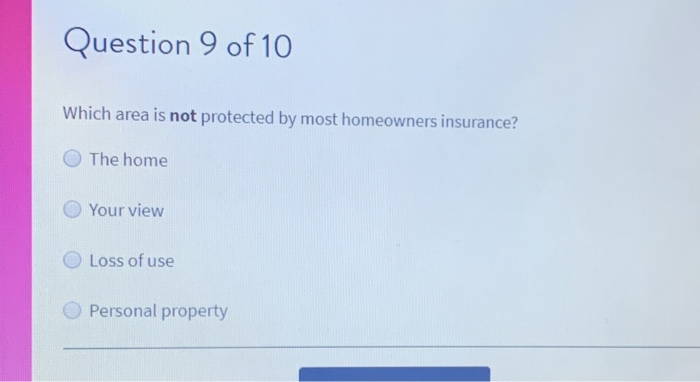

Which Area Is Not Protected By Most Homeowners Insurance Framework. Safe home reduction save as much as 5% when your home has additional protection against theft and fire, like a home security system. What homeowners insurance covers house owner’s insurance coverage generally covers a wide series of feasible problems. The home your view loss of use personal property continue. Trevor nadar is associated with compare closing, a company that provides a range of mortgage and loan services like refinances, home equity loans, etc.

Umbrella Insurance and the Advantages of Packaging Your From baldersoninsurance.com

Umbrella Insurance and the Advantages of Packaging Your From baldersoninsurance.com

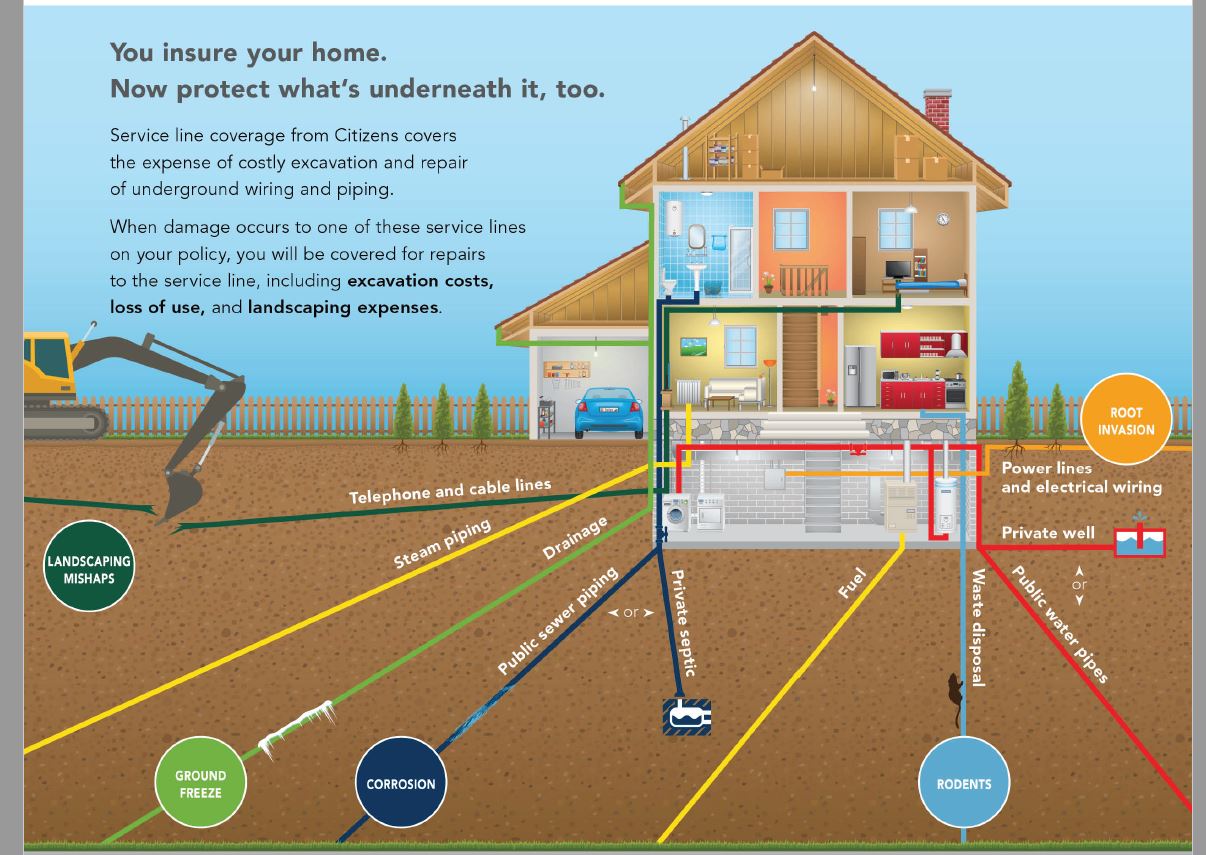

So, what is and isn’t covered in most homeowners insurance policies? Which area is not protected by most homeowners insurance. A separate policy is required. Home insurance also provides liability protection against legal action related to a bodily injury, or a property damage claim made by a guest. The areas that are not protected by most homeowners insurance are as follows: Also, to know the perils and additional coverages, and what is covered under each section of the policy as.

Safe home reduction save as much as 5% when your home has additional protection against theft and fire, like a home security system.

The home your view loss of use personal property continue. It protects against unexpected events such as fire, theft, or vehicle damage. Question 9 of 10 which area is not protected by most homeowners insurance? Homeowners insurance is a necessary financial product that covers the structure of your home and the contents within it. Safe home reduction save as much as 5% when your home has additional protection against theft and fire, like a home security system. The home your view loss of use personal property continue.

Source: baldersoninsurance.com

Source: baldersoninsurance.com

Which area is not protected by most homeowners insurance. Ordinance or law, intentional acts,. The home your view loss of use personal property continue Other potential causes of loss included, theft and the extra cost of living elsewhere, due to the structure being repaired or rebuilt. Many homeowners policies cover damage caused by just about anything, unless specifically excluded.

Source: enduroforum.org

Source: enduroforum.org

Costly items like artwork and jewelry usually require a separate insurance policy. The areas that are not protected by most homeowners insurance are as follows: Which area is not protected by most homeowners insurance ? So, what is and isn’t covered in most homeowners insurance policies? Now up your study game with learn mode.

Source: iselect.com.au

Source: iselect.com.au

In most states, earthquakes, sinkholes, and other earth movements are not covered. Which area is not protected by most homeowners insurance? Which area is not protected by most homeowners insurance? Home insurance also provides liability protection against legal action related to a bodily injury, or a property damage claim made by a guest. Safe home reduction save as much as 5% when your home has additional protection against theft and fire, like a home security system.

Source: coastalinsurancesolution.com

Source: coastalinsurancesolution.com

Also, to know the perils and additional coverages, and what is covered under each section of the policy as. Home insurance also provides liability protection against legal action related to a bodily injury, or a property damage claim made by a guest. The purpose of this flash card set is to understand teh different forms, i.e. For example, wind damage from hurricanes or tornadoes is covered as a windstorm peril. The home your view loss of use personal property continue

Source: globelifeinsurance.com

Source: globelifeinsurance.com

Which area is not protected by most homeowners insurance? The areas that are not protected by most homeowners insurance are as follows: Costly items like artwork and jewelry usually require a separate insurance policy. You could save up to 10 percent, homebuyer discount if you buy a newly constructed house. Also, to know the perils and additional coverages, and what is covered under each section of the policy as.

Source: beafarmbureauagent.com

Ordinance or law, intentional acts, war, flood. Home insurance also provides liability protection against legal action related to a bodily injury, or a property damage claim made by a guest. The purpose of this flash card set is to understand teh different forms, i.e. Which area is not protected by most homeowners insurance? Most homeowners insurance covers certain basics, but policies vary a great deal, so be sure to read the fine print before you purchase one.

Source: magazine.northeast.aaa.com

Source: magazine.northeast.aaa.com

So, what is and isn’t covered in most homeowners insurance policies? Question 9 of 10 which area is not protected by most homeowners insurance? Ordinance or law, intentional acts,. Also, to know the perils and additional coverages, and what is covered under each section of the policy as. Which area is not protected by most homeowners insurance?

Source: money.com

Source: money.com

Although contents insurance covers the stuff inside your home, there are caveats. Safe home reduction save as much as 5% when your home has additional protection against theft and fire, like a home security system. Which area is not protected by most homeowners insurance? The purpose of this flash card set is to understand teh different forms, i.e. Most homeowners insurance covers certain basics, but policies vary a great deal, so be sure to read the fine print before you purchase one.

Source: bankersinsurance.net

Source: bankersinsurance.net

Safe home reduction save as much as 5% when your home has additional protection against theft and fire, like a home security system. A graduate, trevor has experience of 10 years working in the bpo (business processing outsourcing) industry and has been working in the mortgage industry. The majority of homeowner insurance policies cover damages caused by fires, windstorms, hail as well as flooding (excluding flooding) as well as explosions, riots, and fire. Other potential causes of loss included, theft and the extra cost of living elsewhere, due to the structure being repaired or rebuilt. Although contents insurance covers the stuff inside your home, there are caveats.

Source: logicalread.com

Source: logicalread.com

The majority of homeowner insurance policies cover damages caused by fires, windstorms, hail as well as flooding (excluding flooding) as well as explosions, riots, and fire. But, flood damage and earthquake damage are not covered by a standard homeowners policy. The home your view loss of use personal property continue. Although contents insurance covers the stuff inside your home, there are caveats. Which area is not protected by most homeowners insurance?

Source: crowleyinsurance.com

Source: crowleyinsurance.com

Your real, physical house ought to be covered, along with a few other frameworks on the residential property, like a garage, fencing, driveway, or shed. Most homeowners insurance policies cover damage from fires, windstorm, hail, water damage (excluding flooding), riots & explosion. The areas that are not protected by most homeowners insurance are as follows: Question 9 of 10 which area is not protected by most homeowners insurance? Also, to know the perils and additional coverages, and what is covered under each section of the policy as.

Source: resolvion.com

Source: resolvion.com

For example, wind damage from hurricanes or tornadoes is covered as a windstorm peril. A graduate, trevor has experience of 10 years working in the bpo (business processing outsourcing) industry and has been working in the mortgage industry. Author at compare closing llc. The purpose of this flash card set is to understand teh different forms, i.e. Question 9 of 10 which area is not protected by most homeowners insurance?

The areas that are not protected by most homeowners insurance are as follows: In most states, earthquakes, sinkholes, and other earth movements are not covered. Safe home reduction save as much as 5% when your home has additional protection against theft and fire, like a home security system. Home insurance policies commonly don’t cover sewage backup, but your insurance provider may cover sewage backup in a separate flood insurance policy. For example, wind damage from hurricanes or tornadoes is covered as a windstorm peril.

Source: iot5.net

Source: iot5.net

The majority of homeowner insurance policies cover damages caused by fires, windstorms, hail as well as flooding (excluding flooding) as well as explosions, riots, and fire. Which area is not protected by most homeowners insurance. Your real, physical house ought to be covered, along with a few other frameworks on the residential property, like a garage, fencing, driveway, or shed. But, flood damage and earthquake damage are not covered by a standard homeowners policy. If you run a business on your property in a separate structure, it is generally not covered by homeowners insurance.explanation:

Source: trenhulk.revolucionww.com

Source: trenhulk.revolucionww.com

Ordinance or law, intentional acts, war, flood. The purpose of this flash card set is to understand teh different forms, i.e. 1.the home 2.your view 3.loss of use 4.personal property 10. Home insurance policies commonly don’t cover sewage backup, but your insurance provider may cover sewage backup in a separate flood insurance policy. Many homeowners policies cover damage caused by just about anything, unless specifically excluded.

Source: marketingrealestateideas.com

Source: marketingrealestateideas.com

Which area is not protected by most homeowners insurance ? Which one of these is covered by a specific type of insurance policy? The areas that are not protected by most homeowners insurance are as follows: Home insurance also provides liability protection against legal action related to a bodily injury, or a property damage claim made by a guest. Which area is not protected by most homeowners insurance?

Source: chegg.com

Source: chegg.com

Many homeowners policies cover damage caused by just about anything, unless specifically excluded. Costly items like artwork and jewelry usually require a separate insurance policy. Your real, physical house ought to be covered, along with a few other frameworks on the residential property, like a garage, fencing, driveway, or shed. It protects against unexpected events such as fire, theft, or vehicle damage. The purpose of this flash card set is to understand teh different forms, i.e.

Source: mountainstateinsurance.com

Source: mountainstateinsurance.com

Which area is not protected by most homeowners insurance ? Other potential causes of loss included, theft and the extra cost of living elsewhere, due to the structure being repaired or rebuilt. The home your view loss of use personal property continue Which one of these is covered by a specific type of insurance policy? The majority of homeowner insurance policies cover damages caused by fires, windstorms, hail as well as flooding (excluding flooding) as well as explosions, riots, and fire.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title which area is not protected by most homeowners insurance framework by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information