Which of the following best describes annually renewable term insurance Idea

Home » Trending » Which of the following best describes annually renewable term insurance IdeaYour Which of the following best describes annually renewable term insurance images are available. Which of the following best describes annually renewable term insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Which of the following best describes annually renewable term insurance files here. Get all free images.

If you’re searching for which of the following best describes annually renewable term insurance images information linked to the which of the following best describes annually renewable term insurance topic, you have pay a visit to the right blog. Our website frequently provides you with suggestions for seeking the highest quality video and image content, please kindly search and find more informative video articles and graphics that fit your interests.

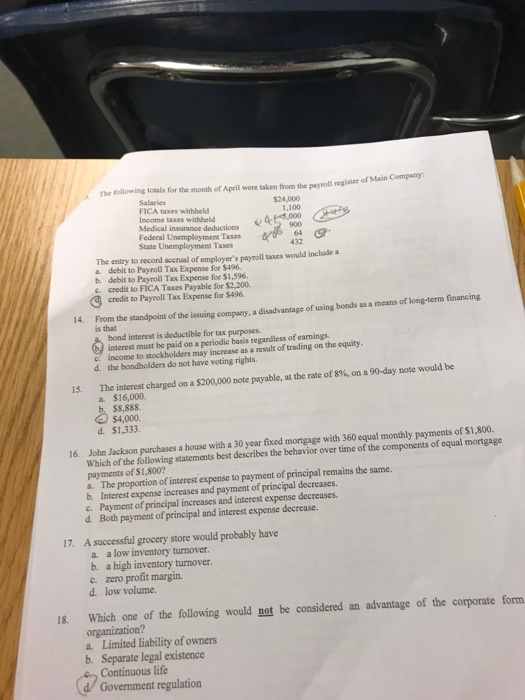

Which Of The Following Best Describes Annually Renewable Term Insurance. A rider attached to a life insurance policy that provides coverage on the insured�s family memebers is called the. It provides an annually increasing death benefit. Which of the following best describes the nonforfeiture value of the annuity? It is level term insurance.

Although that makes later years very (15). Which of the following best describes annually renewable term insurance? Indeed, you have to pay a high price for your initial premium; A rider attached to a life insurance policy that provides coverage on the insured�s family memebers is called the. Depending on the chosen program, you can partially or completely protect yourself from unforeseen expenses. Renewable term life insurance functions the same way, but terms last only one year and the policy must be renewed each year at a higher premium.

A man decided to purchase a $100,000 annually renewable term life policy to provide additional protection until his children finished college.

But the thing is that term life insurance that is not renewable costs higher. Subsidiaries include, for example, cigna health and life insurance company and cigna. But the thing is that term life insurance that is not renewable costs higher. Neither the premium nor the death benefit is affected by the insured’s age. A man decided to purchase a $100,000 annually renewable term life policy to provide additional protection until his children finished college. He discovered that his policy.

Source: myredpetticoat.blogspot.com

Source: myredpetticoat.blogspot.com

This type of coverage helps pay off. Renewable term life insurance functions the same way, but terms last only one year and the policy must be renewed each year at a higher premium. It is a level term insurance. Subsidiaries include, for example, cigna health and life insurance company and cigna. A) neither the premium nor the death benefit is affected by the insured�s age.

Source: brainly.com

Source: brainly.com

The good news about this policy is that the insurer has to pay the installment on the given dates to renew the policy without any medical exam or any other procedure. Depending on the chosen program, you can partially or completely protect yourself from unforeseen expenses. Neither the premium nor the death benefit is affected by the insured’s age. Indeed, you have to pay a high price for your initial premium; Renewable term life insurance guarantees the policy can be renewed to a predetermined date or age, regardless of the insured�s health status.

Source: visual.ly

Source: visual.ly

Annually renewable term is a form of level term insurance that offers the most insurance at the lowest cost. Annually renewable term is a form of level term insurance that offers the most insurance at the lowest cost. Which of the following best describes the nonforfeiture value of the annuity? The surrender value will not be more than 80% of the cash value in the annuity at the time of surrender. The death benefit remains level, but the premium increases each year with the insured�s attained age.

Neither the premium nor the death benefit is affected by the insured’s age. Although that makes later years very (15). Decreased death benefit at each renewal. It provides an annually increasing death benefit. Which of the following best describes annually renewable term insurance and risk reduction.

![Ethos No Exam Life Insurance Review Guide + FAQs]](https://2zncgd19p5j13o7wjrpxbajs-wpengine.netdna-ssl.com/wp-content/uploads/2019/10/application-process-ethos-no-exam-life-insurance-overview.png “Ethos No Exam Life Insurance Review Guide + FAQs]") Source: nophysicaltermlife.com

A) neither the premium nor the death benefit is affected by the insured�s age. Annual renewable term insurance is term life insurance with a guarantee of future insurability for a set period of years on a renewable basis. It is level term insurance. A term life insurance policy covers the insured person (often the policy owner) for a defined period, commonly one to 30 years. He discovered that his policy.

Source: eoihuelvaenglish.blogspot.com

Source: eoihuelvaenglish.blogspot.com

It requires proof of insurability at each renewal b. Neither the premium nor the death benefit is affected by the insured’s age. Depending on the chosen program, you can partially or completely protect yourself from unforeseen expenses. Which of the following best describes annually renewable term insurance and risk reduction. Renewable term life insurance guarantees the policy can be renewed to a predetermined date or age, regardless of the insured�s health status.

Source: eoihuelvaenglish.blogspot.com

Source: eoihuelvaenglish.blogspot.com

Although that makes later years very (15). 24 the owner of a life insurance policy wishes to name two. Which of the following best describes annually renewable term insurance? Premium nor death is effected by the the insureds age c. Which of the following best describes annually renewable term insurance is a tool to reduce your risks.

Source: eoihuelvaenglish.blogspot.com

Source: eoihuelvaenglish.blogspot.com

Annual renewable term insurance is term life insurance with a guarantee of future insurability for a set period of years on a renewable basis. The good news about this policy is that the insurer has to pay the installment on the given dates to renew the policy without any medical exam or any other procedure. B) it provides an annually increasing death benefit. Which of the following best describes annually renewable. C) it is level term insurance.

Which of the following best describes annually renewable term insurance/ it is a level term insurance it requires proof of insurability at each renewal neither the premium nor the death benefit is affected by the insured�s age it provides annually increasing death benefit which of tire following statements is true regarding the cash. It is level term insurance. Which of the following best describes the nonforfeiture value of the annuity? Which of the following best describes annually renewable term insurance? Which of the following best describes annually renewable term insurance/ it is a level term insurance it requires proof of insurability at each renewal neither the premium nor the death benefit is affected by the insured�s age it provides annually increasing death benefit which of tire following statements is true regarding the cash.

Source: insurancegeek.com

Source: insurancegeek.com

Definition and examples of annual renewable term life insurance. As future conditions of health are unpredictable, a renewable term provision would allow you to benefit from the life insurance policy. Which of the following best describes annually renewable term insurance/ it is a level term insurance it requires proof of insurability at each renewal neither the premium nor the death benefit is affected by the insured�s age it provides annually increasing death benefit which of tire following statements is true regarding the cash. Decreased death benefit at each renewal. Neither the premium nor the death benefit is affected by the insured’s age.

![]() Source: starlyteimages.blogspot.com

Source: starlyteimages.blogspot.com

It is level term insurance This type of coverage helps pay off. Neither the premium nor the death benefit is affected by the insured’s age. Annually renewable term annually renewable term is the purest form of term insurance. Which of the following best describes annually renewable term insurance and risk reduction.

Source: termlifeinsurancemendana.blogspot.com

Source: termlifeinsurancemendana.blogspot.com

It provides an annually increasing death benefit. A man decided to purchase a $100,000 annually renewable term life policy to provide additional protection until his children finished college. But the thing is that term life insurance that is not renewable costs higher. He discovered that his policy. C) it is level term insurance.

Source: hlgupdates.blogspot.com

Source: hlgupdates.blogspot.com

Indeed, you have to pay a high price for your initial premium; Which of the following best describes annually renewable. It requires proof of insurability at each renewal b. Which of the following best describes annually renewable term insurance? Premium nor death is effected by the the insureds age c.

Source: eoihuelvaenglish.blogspot.com

Source: eoihuelvaenglish.blogspot.com

It provides an annually increasing death benefit. As future conditions of health are unpredictable, a renewable term provision would allow you to benefit from the life insurance policy. Which of the following best describes annually renewable term insurance? It is level term insurance. It’s also called “pure term” or “level premium,” which means it has constant premiums throughout the policy period without increasing at each renewal date.

Source: eoihuelvaenglish.blogspot.com

Annually renewable term insurance is a type of life insurance that offers protection for your family and loved ones in the event of your death. Renewable term life insurance functions the same way, but terms last only one year and the policy must be renewed each year at a higher premium. It is level term insurance Which of the following best describes annually renewable term insurance? Renewable term life insurance guarantees the policy can be renewed to a predetermined date or age, regardless of the insured�s health status.

Source: hamroinsurance.com

Source: hamroinsurance.com

Renewable term life insurance guarantees the policy can be renewed to a predetermined date or age, regardless of the insured’s health status. It is a level term insurance. Which of the following best describes annually renewable term insurance is a tool to reduce your risks. Which of the following best describes annually renewable term insurance? Annually renewable term annually renewable term is the purest form of term insurance.

Annually renewable term annually renewable term is the purest form of term insurance. Which of the following best describes annually renewable term insurance is a tool to reduce your risks. It is level term insurance. Which of the following best describes annually renewable term insurance? The surrender value will not be more than 80% of the cash value in the annuity at the time of surrender.

Source: governing.com

Source: governing.com

It requires proof of insurability at each renewal b. Subsidiaries include, for example, cigna health and life insurance company and cigna. Depending on the chosen program, you can partially or completely protect yourself from unforeseen expenses. Depending on the chosen program, you can partially or completely protect yourself from unforeseen expenses. Definition and examples of annual renewable term life insurance.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title which of the following best describes annually renewable term insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information