Which of the following does the insuring clause not specify Idea

Home » Trend » Which of the following does the insuring clause not specify IdeaYour Which of the following does the insuring clause not specify images are ready. Which of the following does the insuring clause not specify are a topic that is being searched for and liked by netizens today. You can Download the Which of the following does the insuring clause not specify files here. Get all free images.

If you’re looking for which of the following does the insuring clause not specify pictures information related to the which of the following does the insuring clause not specify topic, you have pay a visit to the ideal blog. Our site frequently gives you hints for seeing the highest quality video and image content, please kindly hunt and locate more informative video content and images that match your interests.

Which Of The Following Does The Insuring Clause Not Specify. An insurer issues an individual health insurance policy that is guaranteed renewable, the insurer agrees: A nonforfeiture option that provides continuing cash value buildup is. In other words, this clause details exactly the risks the insurer is liable for paying and defines the scope of the coverage. • incoterms1 set out who is to arrange the insurance, but do not specify anything further such as the level of cover, the basis of settlement, or the policy deductible.

Required information Problem 45A Record transactions From homeworklib.com

Required information Problem 45A Record transactions From homeworklib.com

B a list of available doctors. The act does not specify what type of insurance is required but merely states: The face amount of the policy the contingent beneficiary the name of the insurer the name of the insured: The specific exemption of 11580.2(c)(6) would not take effect at all without the conforming clause because, as discussed above, section 11580.2 is a minimum coverage only. Which of the following does the insuring clause not specify? An interpretation of the conforming clause to require notice does not render that clause inoperative.

(a) actual cash value (b) estoppel and policy waiver (c) insurable interest (d) subrogation (e) proof of loss.

A susbequent definition of covered events referring to events described in the insuring clause did not alter this. Payment of premiums and representation on the application. The insuring clause of the allstate policy provided coverage for defined “bodily injury” and “property damage” caused by an “occurrence.” To renew the policy until the insured has reached age 65. Which of the following does the insuring clause not specify. In other words, this clause details exactly the risks the insurer is liable for paying and defines the scope of the coverage.

Source: slideshare.net

Source: slideshare.net

A the name of the insured. Clause (c) assignment (d) subrogation (e) replacement cost coverage. The policy contained a clause called extension 1 which extended cover under its primary business interruption insuring clause to include the following circumstances: It is current industry practice for protection works insurance policies to have some of the following characteristics: Payment of premiums and representation on the application.

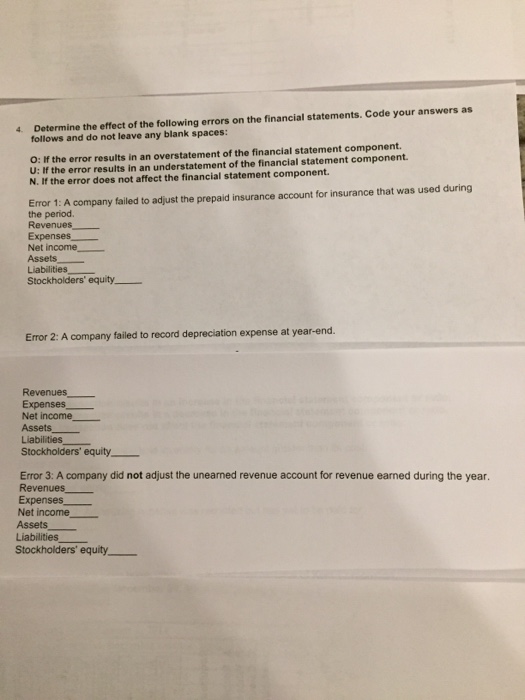

Source: chegg.com

Source: chegg.com

The closing down or sealing off of the premises or property in the vicinity of the premises in. Which of the following does the insuring clause not specify? A) that a loss must result directly from stated accidents or sicknesses b) the identities of the insurance company and the insured c) the method of premium payment d) that insurance against loss is provided A nonforfeiture option that provides continuing cash value buildup is. B) the identities of the insurance company and the insured.

A) that a loss must result directly from stated accidents or sicknesses b) the identities of the insurance company and the insured c) the method of premium payment d) that insurance against loss is provided In simpler terms, these provisions describe the liability of an insurer and outline how much coverage they are required to provide. D) the types of losses covered. In other words, this clause details exactly the risks the insurer is liable for paying and defines the scope of the coverage. The face amount of the policy the contingent beneficiary the name of the insurer the name of the insured:

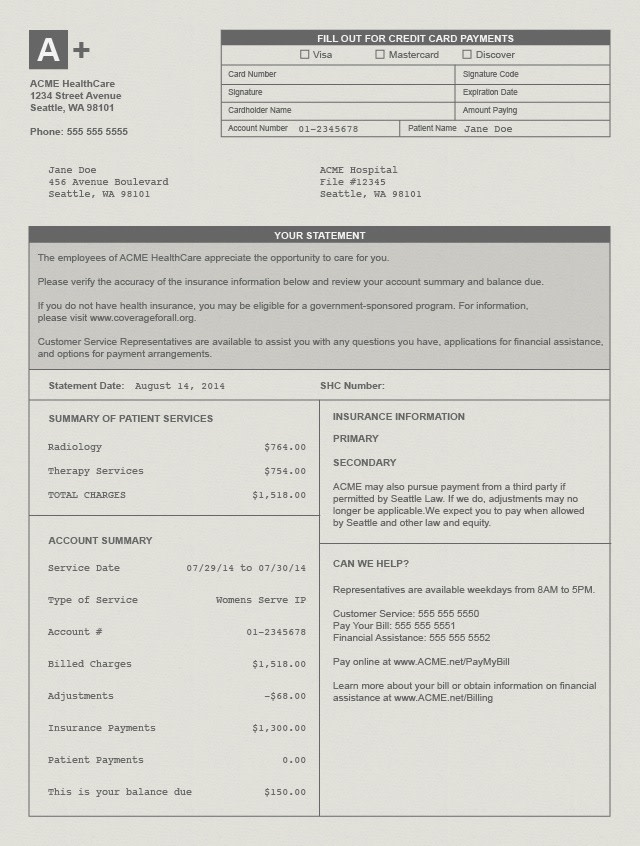

Source: medicalbillingandcoding.org

Source: medicalbillingandcoding.org

A the name of the insured. A susbequent definition of covered events referring to events described in the insuring clause did not alter this. A the name of the insured. If the insured dies, the insurer promises to pay the beneficiary the death benefit as laid out in the policy. The policy contained a clause called extension 1 which extended cover under its primary business interruption insuring clause to include the following circumstances:

Source: shipownersclub.com

Source: shipownersclub.com

The act does not specify what type of insurance is required but merely states: Insuring clauses are one of the building blocks of an effective insurance contract. Notice that this clause does not specify that the insurer has requested the assistance.] most attorneys don’t use the claims preparation expense clause in their client’s policy. Which of the following does the insuring clause not specify? • overseas suppliers will generally have arranged insurance with insurers in their home territory, which can lead to issues

The insuring clause is an integral part of any insurance contract and one that all insureds should pay close attention to. In other words, this clause details exactly the risks the insurer is liable for paying and defines the scope of the coverage. Which of the following does the insuring clause not specify? If the insured dies, the insurer promises to pay the beneficiary the death benefit as laid out in the policy. The insuring clause is the section of an insurance policy that outlines the risks assumed by the insurer.

Insuring clauses are one of the building blocks of an effective insurance contract. Which of the following items does not reinforce the principal of indemnity? Which of the following is not included in the insuring clause? In simpler terms, these provisions describe the liability of an insurer and outline how much coverage they are required to provide. A) that a loss must result directly from stated accidents or sicknesses b) the identities of the insurance company and the insured c) the method of premium payment d) that insurance against loss is provided • overseas suppliers will generally have arranged insurance with insurers in their home territory, which can.

Source: slideshare.net

Source: slideshare.net

D) the types of losses covered. The insuring clause states the very purpose of the life policy; The insuring clause of the allstate policy provided coverage for defined “bodily injury” and “property damage” caused by an “occurrence.” Payment of premiums and representation on the application. That does not specify replacement cost coverage) a.

Source: sec.gov

Source: sec.gov

Insuring clauses are used to prevent a profit from a loss that is insured, which is required by the indemnity principle. A susbequent definition of covered events referring to events described in the insuring clause did not alter this. The specific exemption of 11580.2(c)(6) would not take effect at all without the conforming clause because, as discussed above, section 11580.2 is a minimum coverage only. To renew the policy until the insured has reached age 65. Notice that this clause does not specify that the insurer has requested the assistance.] most attorneys don’t use the claims preparation expense clause in their client’s policy.

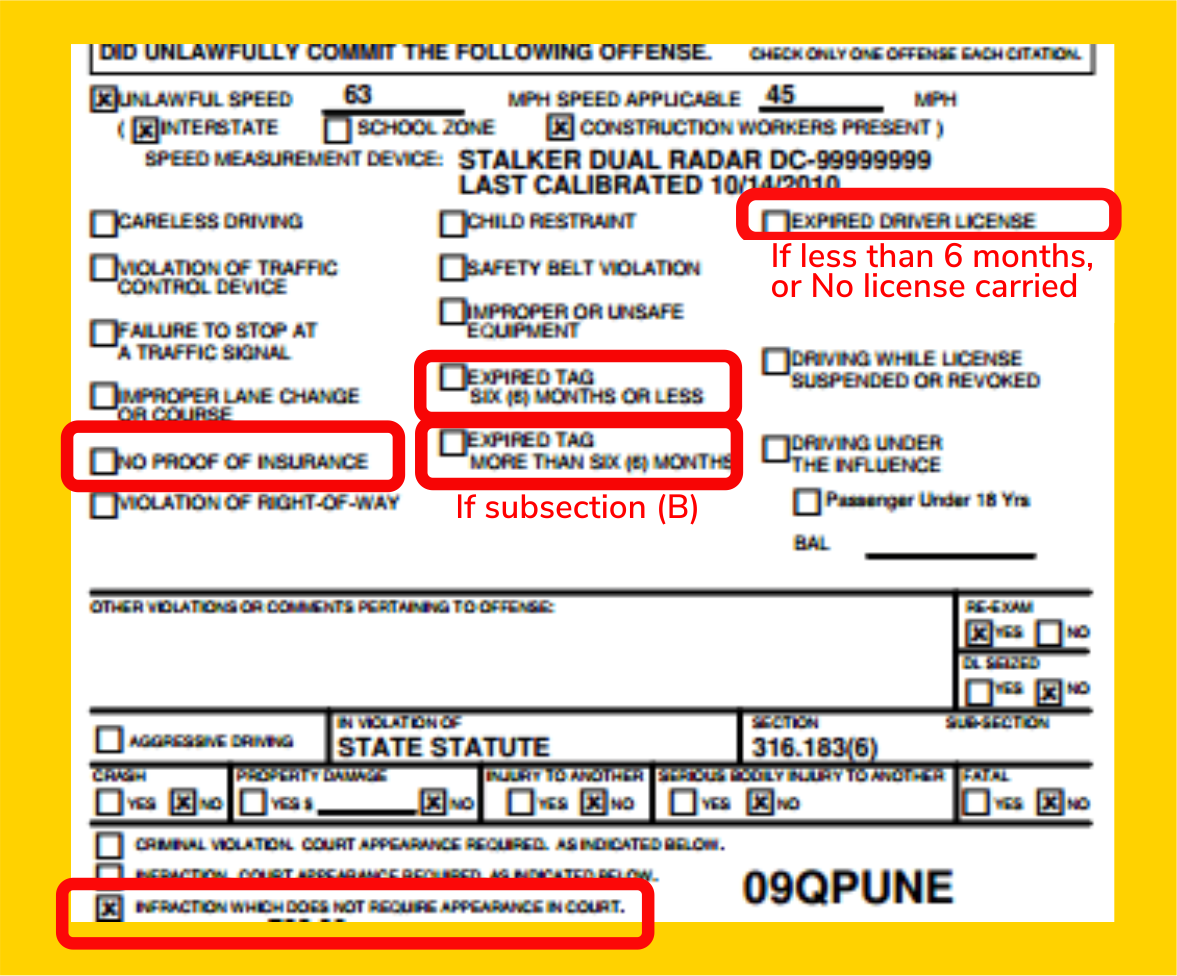

Source: hillsclerk.com

Source: hillsclerk.com

• incoterms1 set out who is to arrange the insurance, but do not specify anything further such as the level of cover, the basis of settlement, or the policy deductible. B) the identities of the insurance company and the insured. B a list of available doctors. The face amount of the policy the contingent beneficiary the name of the insurer the name of the insured: (a) actual cash value (b) estoppel and policy waiver (c) insurable interest (d) subrogation (e) proof of loss.

![[Solved] Connie Young, an architect, opened an office on [Solved] Connie Young, an architect, opened an office on](https://viviendayraices.netlify.app/img/placeholder.svg)

To renew the policy until the insured has reached age 65. “…interruption of or interference with the business in consequence of:. It outlines the conditions under which the policy will pay. Insuring clause definition, the clause in an insurance policy setting forth the kind and degree of coverage granted by the insurer. The insuring clause of a disability policy usually states all of the following, except:

Source: bartleby.com

Source: bartleby.com

If the insured dies, the insurer promises to pay the beneficiary the death benefit as laid out in the policy. • incoterms1 set out who is to arrange the insurance, but do not specify anything further such as the level of cover, the basis of settlement, or the policy deductible. A) that a loss must result directly from stated accidents or sicknesses b) the identities of the insurance company and the insured c) the method of premium payment d) that insurance against loss is provided • overseas suppliers will generally have arranged insurance with insurers in their home territory, which can. A nonforfeiture option that provides continuing cash value buildup is. A the name of the insured.

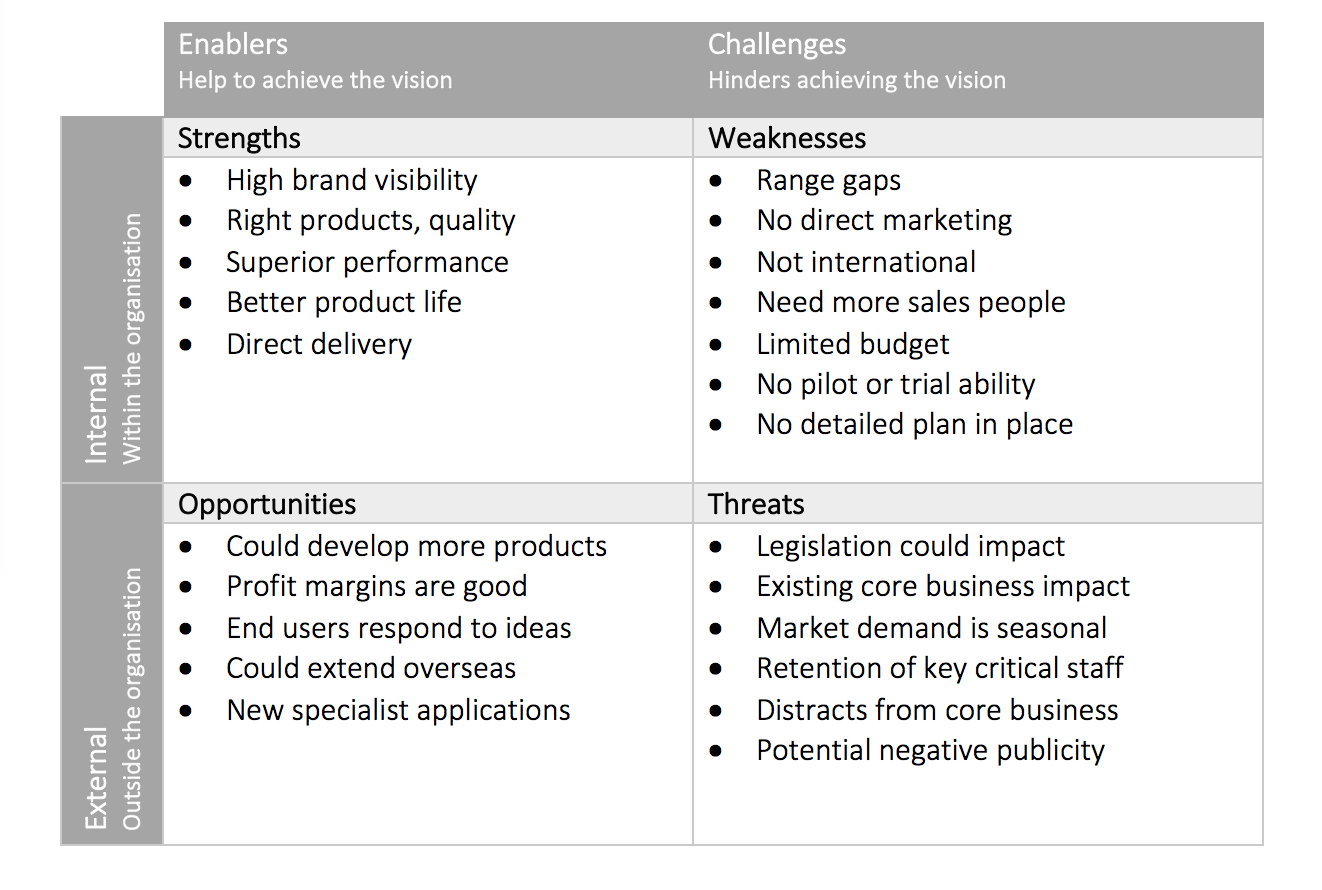

Source: intrafocus.com

Source: intrafocus.com

The specific exemption of 11580.2(c)(6) would not take effect at all without the conforming clause because, as discussed above, section 11580.2 is a minimum coverage only. Insuring clauses are used to prevent a profit from a loss that is insured, which is required by the indemnity principle. Which of the following does the insuring clause not specify. The act does not specify what type of insurance is required but merely states: It outlines the conditions under which the policy will pay.

Source: help.vertafore.com

Source: help.vertafore.com

A the name of the insured. In other words, this clause details exactly the risks the insurer is liable for paying and defines the scope of the coverage. The insuring clause is the section of an insurance policy that outlines the risks assumed by the insurer. Insuring clause definition, the clause in an insurance policy setting forth the kind and degree of coverage granted by the insurer. The insuring clause is an integral part of any insurance contract and one that all insureds should pay close attention to.

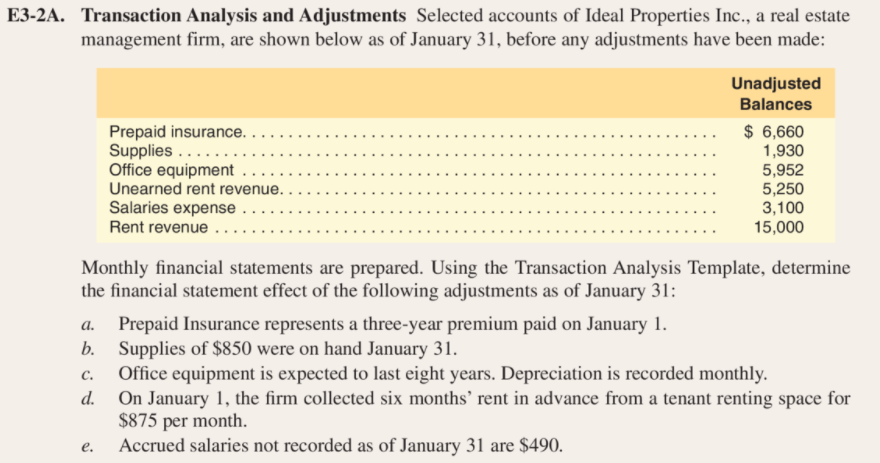

Source: homeworklib.com

Source: homeworklib.com

The insuring clause of a disability policy usually states all of the following, except: It is current industry practice for protection works insurance policies to have some of the following characteristics: Insuring clauses are used to prevent a profit from a loss that is insured, which is required by the indemnity principle. Insuring clauses are one of the building blocks of an effective insurance contract. • overseas suppliers will generally have arranged insurance with insurers in their home territory, which can lead to issues

Source: murdock-law.com

Source: murdock-law.com

Payment of premiums and representation on the application. The insuring clause is the section of an insurance policy that outlines the risks assumed by the insurer. B a list of available doctors. C) that insurance against loss is provided. “…interruption of or interference with the business in consequence of:.

Source: brainly.com

Source: brainly.com

If the insured dies, the insurer promises to pay the beneficiary the death benefit as laid out in the policy. Notice that this clause does not specify that the insurer has requested the assistance.] most attorneys don’t use the claims preparation expense clause in their client’s policy. The deductible does not apply to these expenses. The act does not specify what type of insurance is required but merely states: Which of the following is not included in the insuring clause?

Source: chegg.com

Source: chegg.com

Which of the following does the insuring clause not specify? “…interruption of or interference with the business in consequence of:. The insuring clause states the very purpose of the life policy; (a) actual cash value (b) estoppel and policy waiver (c) insurable interest (d) subrogation (e) proof of loss. The insuring clause of a disability policy usually states all of the following, except:

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title which of the following does the insuring clause not specify by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information