Which of the following policy provisions prohibits an insurance company Idea

Home » Trending » Which of the following policy provisions prohibits an insurance company IdeaYour Which of the following policy provisions prohibits an insurance company images are ready in this website. Which of the following policy provisions prohibits an insurance company are a topic that is being searched for and liked by netizens today. You can Find and Download the Which of the following policy provisions prohibits an insurance company files here. Download all royalty-free vectors.

If you’re searching for which of the following policy provisions prohibits an insurance company images information related to the which of the following policy provisions prohibits an insurance company keyword, you have visit the right blog. Our site frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly surf and find more informative video articles and images that fit your interests.

Which Of The Following Policy Provisions Prohibits An Insurance Company. A) insurers are not permitted to place time limits on filing claims or providing proof of loss. If an insurance company issues a disability income policy that it cannot cancel or for which it cannot increase premiums, the type of renewability that best desribes this policy is called. A) health care reform act b) drug amendment of the fdca act c) medical device amendment act d) food, drug, and cosmetic act. When the state prohibits this by law.

Talent Resources Certified Creative Agency From certifiedcreativeagency.com

Talent Resources Certified Creative Agency From certifiedcreativeagency.com

( an entire contract policy provision prohibits an insurance company from incorporating external documents into an insurance policy. This clause provides that if the policyholder fails to pay the premiums on a life insurance policy, the insurance company may automatically use the accumulated cash value to pay the premiums. Which of the following policy provisions prohibits an insurance company from incorporating external documents into an insurance policy? ( an entire contract policy provision prohibits an insurance company from incorporating external documents into an insurance policy. Which of the following health policy provisions states that the producer doesn’t have the authority to change the policy or waive any of its provisions. The legal actions provision prohibits insureds from taking legal action against the insurer due to a claim for 60 days from the date of proof of loss if the claim is disputed.

Which of the following policy provisions prohibits an insurance company from incorporating?

When the state prohibits this by law. When does a probationary period provision become effective in a health insurance contract? A disability income policyowner recently submitted a claim for a chronic neck problem that has now resulted in total disability. Which of the following policy provisions prohibits an insurance company from incorporating? With optionally renewable health policies, the insurer may. A) health care reform act b) drug amendment of the fdca act c) medical device amendment act d) food, drug, and cosmetic act.

Source: virtual-design-and-construction.blogspot.com

Source: virtual-design-and-construction.blogspot.com

The 11 optional provisions are considered to be at the discretion of the insurance company in order to better service their individual policy needs. With optionally renewable health policies, the insurer may. When foul play was a contributing factor. When the state prohibits this by law. C) the usual length of the grace period is 180 days.

Source: coursepaper.com

Source: coursepaper.com

Which of the following provisions of the contract prohibits the insurance company? The _____ prohibits health insurance companies from terminating health insurance coverage when a person gets sick. Premiums normally increase at time of renewal. Which of the following provisions of the contract prohibits the insurance company? When the state prohibits this by law.

Source: detroithotnews.blogspot.com

Source: detroithotnews.blogspot.com

The 11 optional provisions are considered to be at the discretion of the insurance company in order to better service their individual policy needs. Premiums normally increase at time of renewal. A) health care reform act b) drug amendment of the fdca act c) medical device amendment act d) food, drug, and cosmetic act. Which of the following policy provisions prohibits an insurance company from incorporating external documents into an insurance policy? This clause provides that if the policyholder fails to pay the premiums on a life insurance policy, the insurance company may automatically use the accumulated cash value to pay the premiums.

Source: coursepaper.com

Source: coursepaper.com

When does a probationary period provision become effective in a health insurance contract? Which of the following policy provisions prohibits an insurance company from incorporating external documents into an insurance policy? If an insurance company issues a disability income policy that it cannot cancel or for which it cannot increase premiums, the type of renewability that best desribes this policy is called. When foul play was a contributing factor. When a claim is submitted

Source: thephotofans.blogspot.com

Source: thephotofans.blogspot.com

The legal actions provision prohibits insureds from taking legal action against the insurer due to a claim for 60 days from the date of proof of loss if the claim is disputed. A) health care reform act b) drug amendment of the fdca act c) medical device amendment act d) food, drug, and cosmetic act. Specifies the formal request to an insurance company asking for a payment based on the terms of the insurance policy. Which of the following policy provisions prohibits an insurance company from incorporating? Which of the following health policy provisions states that the producer doesn’t have the authority to change the policy or waive any of its provisions.

Source: yourarticlelibrary.com

Source: yourarticlelibrary.com

Specifies the formal request to an insurance company asking for a payment based on the terms of the insurance policy. Study health insurance policy provisions flashcards. Asked mar 5, 2020 in business by fluffynut. Which of the following provisions of the contract prohibits the insurance company? With optionally renewable health policies, the insurer may.

Source: embroker.com

Source: embroker.com

The _____ prohibits health insurance companies from terminating health insurance coverage when a person gets sick. Which of the following health policy provisions states that the producer doesn’t have the authority to change the policy or waive any of its provisions. A disability income policyowner recently submitted a claim for a chronic neck problem that has now resulted in total disability. Which of the following policy provisions prohibits an insurance company from including external documents in an insurance. A) insurers are not permitted to place time limits on filing claims or providing proof of loss.

Source: hoganwillig.com

Source: hoganwillig.com

The _____ prohibits health insurance companies from terminating health insurance coverage when a person gets sick. If an insurance company issues a disability income policy that it cannot cancel or for which it cannot increase premiums, the type of renewability that best desribes this policy is called. When a claim is submitted There are some mandatory provisions, such as: When the state prohibits this by law.

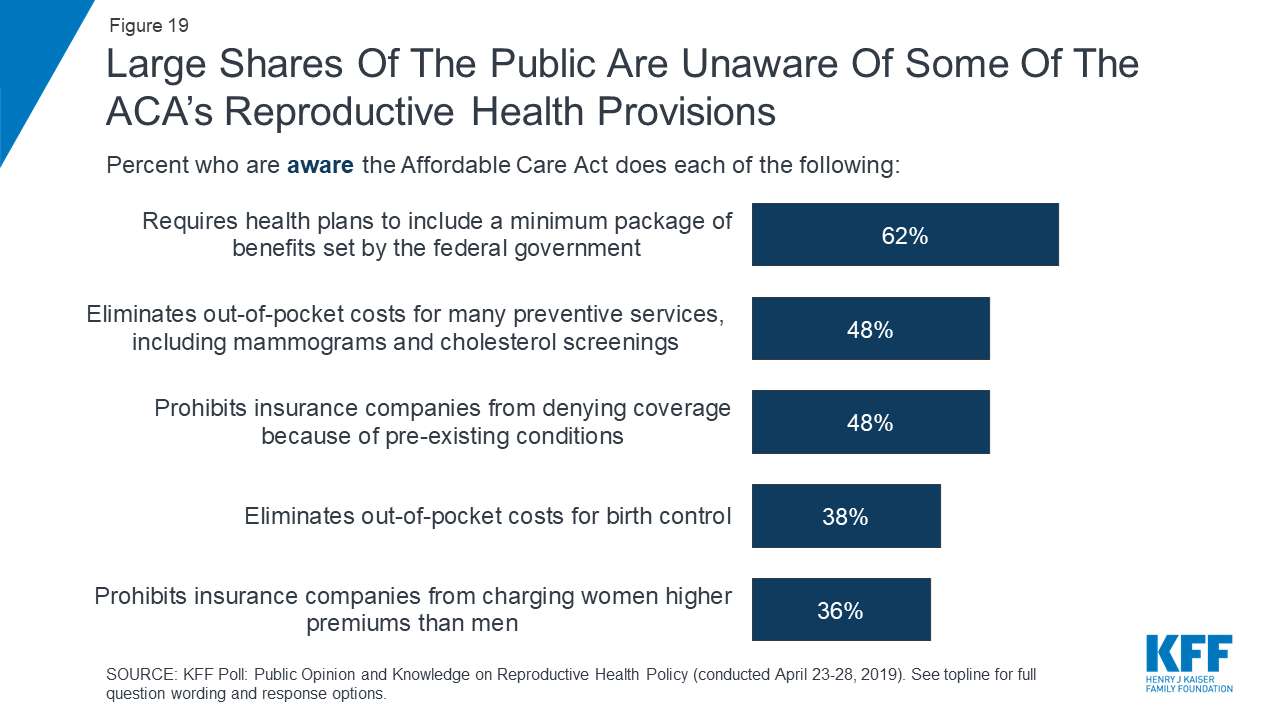

Source: kff.org

Source: kff.org

Also know, what is the legal action provision? Prohibits insurers from using genetic information to determine an individual’s eligibility for health insurance or to set the amount of an individual’s premium for either individual or group health care coverage. Which of the following health policy provisions states that the producer doesn’t have the authority to change the policy or waive any of its provisions. C) the usual length of the grace period is 180 days. ( an entire contract policy provision prohibits an insurance company from incorporating external documents into an insurance policy.

Source: lovelacefamilyinsurance.com

Source: lovelacefamilyinsurance.com

A) health care reform act b) drug amendment of the fdca act c) medical device amendment act d) food, drug, and cosmetic act. When foul play was a contributing factor. A) insurers are not permitted to place time limits on filing claims or providing proof of loss. The policy owner is given a number of days after the premium due date during which time the premium payment may be delayed without. When a claim is submitted

Source: certifiedcreativeagency.com

Source: certifiedcreativeagency.com

If an insurance policy, annuity contract, or annuity or benefit plan described by section 1108.051 prohibits a beneficiary from assigning or commuting benefits to be provided or other rights under the policy, contract, or plan, an assignment or commutation or attempted assignment or commutation of the benefits or. Which of the following policy provisions prohibits an insurance company from incorporating? This clause provides that if the policyholder fails to pay the premiums on a life insurance policy, the insurance company may automatically use the accumulated cash value to pay the premiums. The legal actions provision prohibits insureds from taking legal action against the insurer due to a claim for 60 days from the date of proof of loss if the claim is disputed. Study health insurance policy provisions flashcards.

Source: blessthebullys.com

Source: blessthebullys.com

Specifies the formal request to an insurance company asking for a payment based on the terms of the insurance policy. Which of the following policy provisions prohibits an insurance company from incorporating external documents into an insurance policy? The legal actions provision prohibits insureds from taking legal action against the insurer due to a claim for 60 days from the date of proof of loss if the claim is disputed. A disability income policyowner recently submitted a claim for a chronic neck problem that has now resulted in total disability. When consent for the autopsy is not obtained.

Source: cunninghaminsurancegroup.com

( an entire contract policy provision prohibits an insurance company from incorporating external documents into an insurance policy. ( an entire contract policy provision prohibits an insurance company from incorporating external documents into an insurance policy. Which of the following policy provisions prohibits an insurance company from incorporating external documents into an insurance policy? Specifies the formal request to an insurance company asking for a payment based on the terms of the insurance policy. Prohibits insurers from using genetic information to determine an individual’s eligibility for health insurance or to set the amount of an individual’s premium for either individual or group health care coverage.

Source: ersmuthre.blogspot.com

Source: ersmuthre.blogspot.com

Which of the following policy provisions prohibits an insurance company from incorporating external documents into an insurance policy? A disability income policyowner recently submitted a claim for a chronic neck problem that has now resulted in total disability. When foul play was a contributing factor. If an insurance company issues a disability income policy that it cannot cancel or for which it cannot increase premiums, the type of renewability that best desribes this policy is called. B) the time limit on certain defenses provision prohibits the insurance company from denying a claim based on a fraudulent misstatement by the applicant after the policy has been in force three months.

Source: crazespace.com

Source: crazespace.com

Premiums normally increase at time of renewal. A) health care reform act b) drug amendment of the fdca act c) medical device amendment act d) food, drug, and cosmetic act. A) insurers are not permitted to place time limits on filing claims or providing proof of loss. Also know, what is the legal action provision? Which of the following policy provisions prohibits an insurance company from incorporating external documents into an insurance policy?

Source: kocixsta.blogspot.com

Source: kocixsta.blogspot.com

When consent for the autopsy is not obtained. Which of the following policy provisions prohibits an insurance company from incorporating external documents into an insurance policy? There are some mandatory provisions, such as: A) insurers are not permitted to place time limits on filing claims or providing proof of loss. If an insurance company issues a disability income policy that it cannot cancel or for which it cannot increase premiums, the type of renewability that best desribes this policy is called.

Source: studylib.net

Source: studylib.net

When the state prohibits this by law. There are some mandatory provisions, such as: If an insurance company issues a disability income policy that it cannot cancel or for which it cannot increase premiums, the type of renewability that best desribes this policy is called. Which life insurance clause prohibits an insurance company from questioning the validity of the contract after a stated period of time has passed? Specifies the formal request to an insurance company asking for a payment based on the terms of the insurance policy.

Source: issuu.com

Source: issuu.com

The primary purpose of this provision is to prevent the unintentional lapse of your policy. When the state prohibits this by law. Which of the following policy provisions prohibits an insurance company from incorporating external documents into an insurance policy? Which of the following health policy provisions states that the producer doesn’t have the authority to change the policy or waive any of its provisions. When the state prohibits this by law.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title which of the following policy provisions prohibits an insurance company by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information