Which of these life insurance riders allows the applicant Idea

Home » Trending » Which of these life insurance riders allows the applicant IdeaYour Which of these life insurance riders allows the applicant images are available in this site. Which of these life insurance riders allows the applicant are a topic that is being searched for and liked by netizens now. You can Get the Which of these life insurance riders allows the applicant files here. Find and Download all royalty-free images.

If you’re looking for which of these life insurance riders allows the applicant pictures information connected with to the which of these life insurance riders allows the applicant interest, you have visit the ideal site. Our site always gives you hints for seeking the highest quality video and picture content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

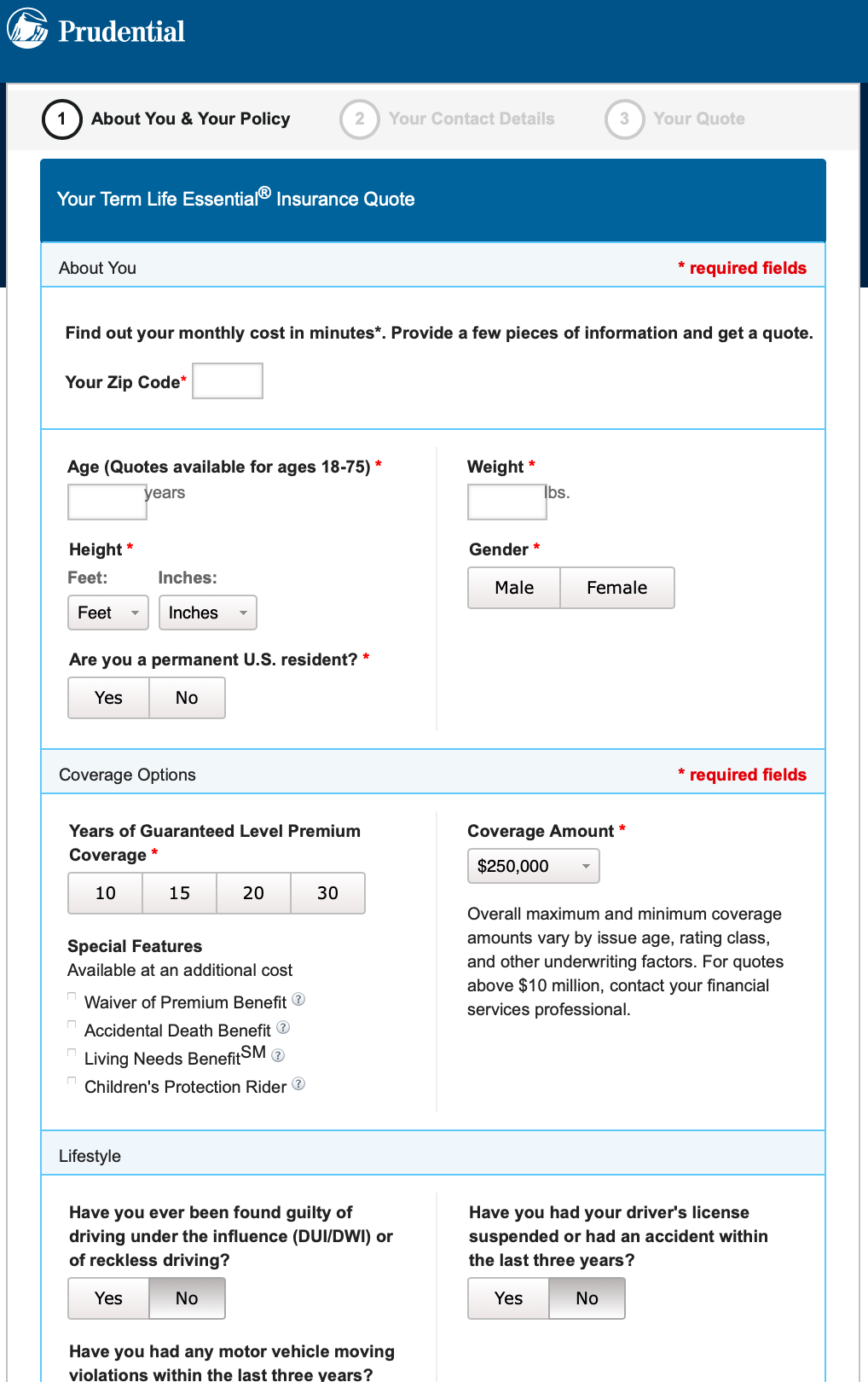

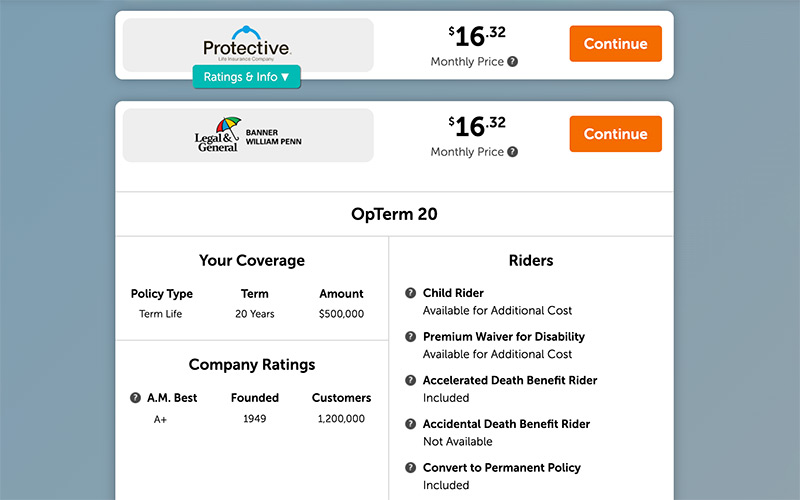

Which Of These Life Insurance Riders Allows The Applicant. Which life insurance rider allows an applicant to have access to coverage? While these riders may be used to enhance the quality of coverage for the applicant, they also increase the potential risk or total amount of payout for the insurance company. Whole life insurance lasts the duration of the applicant’s life and allows the policyholder to take out loans against the cash value of their policy. There are many life insurance riders you can choose from to add additional layers of protection onto your life insurance policy.

Types of Life Insurance Emma.ca From emma.ca

Types of Life Insurance Emma.ca From emma.ca

Waiver of premium rider c. This rider allows you to purchase additional insurance coverage in the stated period without the need for further medical examination. Which of these life insurance riders allows the applicant to have excess coverage? Insurers often set children�s term rider limits on the basis of which of the following? The insured may also surrender their policy in exchange for a percentage of the cash value. Genuinelly added to a life insurance policy to cover a juvenile on i life insurance policy:

Is signed by the applicant and is part of the insurance policy if it it issued.

Of information received from the applicant. Accidental death and dismemberment rider (ad&d) which of these life insurance riders allows the applicant to have excess coverage? One of the questions on the application ask if p engages in scuba diving, to which p answers no. Issuing the rider for a specified amount or for a specified percentage of the base policy a common approach to setting children�s term rider limits is to issue the rider for a specified amount (such as $5,000 or $10,000). Life insurance riders are typically added to insurance policies at the time of submitting the application or during the underwriting process. Insurers often set children�s term rider limits on the basis of which of the following?

Accidental death and dismemberment rider (ad&d) which of these life insurance riders allows the applicant to have excess coverage? P purchases a $50,000 term life insurance policy in 2005. Is signed by the applicant and is part of the insurance policy if it it issued. While these riders may be used to enhance the quality of coverage for the applicant, they also increase the potential risk or total amount of payout for the insurance company. It is a great option for applicants who cannot afford the entire death benefit needed at application but they’ll have an option to add coverage later on without having to worry about health issues.

Source: abramsinc.com

Source: abramsinc.com

Term to 100 instant issue group plan. A life insurance rider that allows for the early payment of some portion of the policies face t amoun. Which of these statements about a guaranteed insurability option rider is not true: One of the questions on the application ask if p engages in scuba diving, to which p answers no. And if the accident / insurance event occurs, the insurance company will bear all or all of the costs in full or in part.

![Protective Life Insurance Review [2020] QuickQuote® Protective Life Insurance Review [2020] QuickQuote®](https://res.cloudinary.com/quotellc/image/upload/insurance-site-images/quickquote-live/2020/06/common-life-insurance-riders.png) Source: quickquote.com

Source: quickquote.com

Which of these life insurance riders allows the applicant to have excess coverage? Evidence of insurability is required when the option is exercised. Rob purchased a standard whole life policy with a $500,000 death benefit when we was age 30. Only applicants between the ages of 18 and 69 are eligible for this policy. Which life insurance rider allows an applicant to have access to coverage?

Source: beyondquotes.com

Source: beyondquotes.com

Life insurance riders are typically added to insurance policies at the time of submitting the application or during the underwriting process. The person, organization or charity that receives the life insurance payout (death benefit). A life insurance rider that allows for the early payment of some portion of the policies face t amoun. A policyowner may assign ownership of the policy to a bank as. The policy is then issued with no scuba exclusions.

Source: reviews.com

Source: reviews.com

Among the very best life insurance riders for young adults is the guaranteed insurability rider, aka the guaranteed insurability benefit option, aka policy purchase option rider, and any other names the top life insurance companies give it. Of information received from the applicant. The present cash value of the policy equals $250,000. D and his wife divorce and d remarries, transferring ownership of his policy to his new wife. Term riders allow an applicant to have excess life insurance coverage.

Source: everquote.com

Source: everquote.com

Which is a form of group term life insurance that allows the applicant to add children and grandchildren to their policy, offering coverage up. P purchases a $50,000 term life insurance policy in 2005. A policyowner may assign ownership of the policy to a bank as. 5 star life insurance family protection plan. Rob purchased a standard whole life policy with a $500,000 death benefit when we was age 30.

Source: lifechoiceadvisors.com

Source: lifechoiceadvisors.com

Joint universal life insurance quotes take into consideration the lower costs of covering both a husband and a wife. The guarantee purchase rider allows the insured to purchase additional coverage without evidence of good health; There are many life insurance riders you can choose from to add additional layers of protection onto your life insurance policy. P purchases a $50,000 term life insurance policy in 2005. Which of these life insurance riders allows the applicant to have excess coverage?

Source: noclutter.cloud

Source: noclutter.cloud

Of information received from the applicant. What action can a policyowner take if an application for a bank loan requires collateral? A policyowner may assign ownership of the policy to a bank as. Which of these insurance riders allows the applicant to have excess coverage? It is a great option for applicants who cannot afford the entire death benefit needed at application but they’ll have an option to add coverage later on without having to worry about health issues.

Source: pacificinsurancegroup.com

Source: pacificinsurancegroup.com

Which of these statements about a guaranteed insurability option rider is not true: Of information received from the applicant. These amounts are not included in the employee�s gross income and so are. Cost of living rider gives the insured: Is a tool to reduce your risks.

Source: bankingtruths.com

Source: bankingtruths.com

This may be beneficial if the policyholder has medical needs or other necessities, reducing the death benefit for future. The person, organization or charity that receives the life insurance payout (death benefit). Which of these insurance riders allows the applicant to have excess coverage? The beneficiary is d’s wife. D is the policyowner and insured for a $50,000 life insurance policy.

Source: pacificinsurancegroup.com

Source: pacificinsurancegroup.com

Is signed by the applicant and is part of the insurance policy if it it issued. A life insurance rider that allows for the early payment of some portion of the policies face t amoun. Whole life insurance lasts the duration of the applicant’s life and allows the policyholder to take out loans against the cash value of their policy. The insured may also surrender their policy in exchange for a percentage of the cash value. One of the questions on the application ask if p engages in scuba diving, to which p answers no.

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

Which of these life insurance riders allows the applicant to have excess coverage? While these riders may be used to enhance the quality of coverage for the applicant, they also increase the potential risk or total amount of payout for the insurance company. D is the policyowner and insured for a $50,000 life insurance policy. Whole life insurance lasts the duration of the applicant’s life and allows the policyholder to take out loans against the cash value of their policy. Is signed by the applicant and is part of the insurance policy if it it issued.

Source: emma.ca

Source: emma.ca

Among the very best life insurance riders for young adults is the guaranteed insurability rider, aka the guaranteed insurability benefit option, aka policy purchase option rider, and any other names the top life insurance companies give it. This rider allows you to purchase additional insurance coverage in the stated period without the need for further medical examination. Which is a form of group term life insurance that allows the applicant to add children and grandchildren to their policy, offering coverage up. The person, organization or charity that receives the life insurance payout (death benefit). D is the policyowner and insured for a $50,000 life insurance policy.

Source: quotacy.com

Source: quotacy.com

Life insurance riders are typically added to insurance policies at the time of submitting the application or during the underwriting process. Life insurance riders are typically added to insurance policies at the time of submitting the application or during the underwriting process. Only applicants between the ages of 18 and 69 are eligible for this policy. A life insurance rider that allows for the early payment of some portion of the policies face t amoun. The policy is then issued with no scuba exclusions.

Source: pacificinsurancegroup.com

Source: pacificinsurancegroup.com

Evidence of insurability is required when the option is exercised. The policy is then issued with no scuba exclusions. A policyowner may assign ownership of the policy to a bank as. Which of these life insurance riders allows the applicant to have excess coverage? Rob recently died at age 60.

Source: npa1.org

Source: npa1.org

Life insurance riders are typically added to insurance policies at the time of submitting the application or during the underwriting process. The present cash value of the policy equals $250,000. Among the very best life insurance riders for young adults is the guaranteed insurability rider, aka the guaranteed insurability benefit option, aka policy purchase option rider, and any other names the top life insurance companies give it. This rider allows you to purchase additional insurance coverage in the stated period without the need for further medical examination. The beneficiary is d’s wife.

![Life insurance for children with epilepsy [Updated 2020] Life insurance for children with epilepsy [Updated 2020]](https://onestoplifeinsurance.com/wp-content/uploads/2017/03/Child-Rider-vs.-Individual-life-policy.png) Source: onestoplifeinsurance.com

Source: onestoplifeinsurance.com

D is the policyowner and insured for a $50,000 life insurance policy. Genuinelly added to a life insurance policy to cover a juvenile on i life insurance policy: A potential client, age 40, would like to purchase a whole life policy that will accumulate cash value at. P purchases a $50,000 term life insurance policy in 2005. There are many life insurance riders you can choose from to add additional layers of protection onto your life insurance policy.

Source: everquote.com

Source: everquote.com

The guarantee purchase rider allows the insured to purchase additional coverage without evidence of good health; One of the questions on the application ask if p engages in scuba diving, to which p answers no. The insured may also surrender their policy in exchange for a percentage of the cash value. Life insurance riders are typically added to insurance policies at the time of submitting the application or during the underwriting process. Accidental death and dismemberment rider (ad&d) which of these life insurance riders allows the applicant to have excess coverage?

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title which of these life insurance riders allows the applicant by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information