Which one is better life insurance or mutual fund Idea

Home » Trend » Which one is better life insurance or mutual fund IdeaYour Which one is better life insurance or mutual fund images are available. Which one is better life insurance or mutual fund are a topic that is being searched for and liked by netizens today. You can Get the Which one is better life insurance or mutual fund files here. Download all free images.

If you’re searching for which one is better life insurance or mutual fund images information connected with to the which one is better life insurance or mutual fund keyword, you have come to the ideal site. Our website always gives you hints for viewing the maximum quality video and picture content, please kindly search and find more informative video articles and graphics that match your interests.

Which One Is Better Life Insurance Or Mutual Fund. Also, it depends on the choice of investment avenues. Advantages of investing in mutual funds. A high risk / high reward type pacific rim fund? One can invest in a mutual fund through monthly investments through sips or in one lump sum.

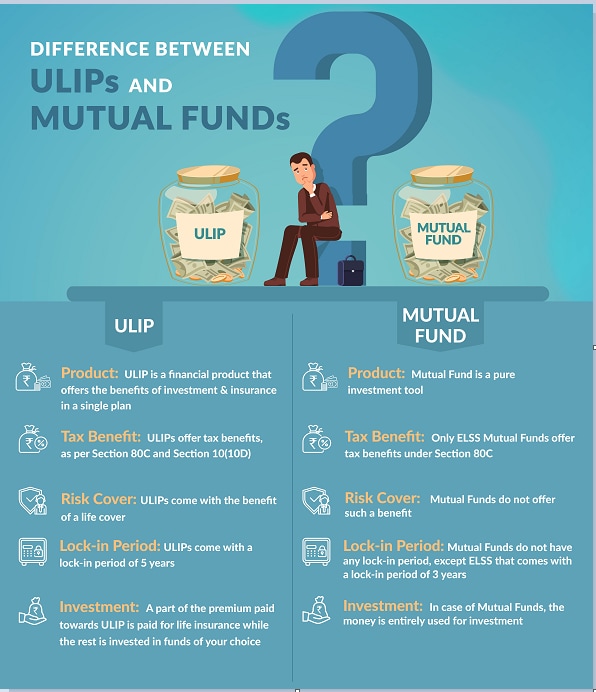

ULIP vs Mutual Fund? Which One Is Better For You? Insurance From theworldbeast.com

ULIP vs Mutual Fund? Which One Is Better For You? Insurance From theworldbeast.com

Mutual funds, on the other hand, vary depending upon the market performance. They are affordable starting from as low as inr 500 per month. When it comes to budgeting discretionary cash, it�s critical for families to talk about what risks they want to avoid and what goals they want to achieve. So is life insurance corporation of india (lic). In any event, life insurance is the protector of your wealth fund and mutual fund is the creator of the wealth fund. Before considering other aspects of term insurance, such as the return of premium riders, families should make sure the death benefit is.

Looks like individuals find insurance much more appealing than compared to mutual fund schemes.

I guess i would ask for what? The team makes buying decisions on the basis of continuous research and analysis. However, choosing debt market investments exposes you to lesser risks but offers you slightly lower returns. However, one major disadvantage of using life insurance as an investment is the associated high fees and expenses make it difficult to compete with the returns of mutual funds. A life insurance policy involves a lesser amount of risk as compared to mutual funds. They allow individuals to save small amounts in a disciplined manner.

Source: quora.com

A type of life insurance known as variable life insurance combines the protection element of insurance with the investment component of mutual funds. An investor invests in life insurance for availing a lump sum either on maturity or upon death. Since a mutual fund actually can be literally thousands of possibilities, which type of mutual fund are you thinking about? Advantages of investing in mutual funds. When it comes to budgeting discretionary cash, it�s critical for families to talk about what risks they want to avoid and what goals they want to achieve.

A bankbazaar study titled ‘aspiration index 2018: Child life insurance plans and mutual funds are a good choice for investment but before purchasing either one of them you must know about them and must which one of them is a better investment option for you. There is a guaranteed death benefit. The team makes buying decisions on the basis of continuous research and analysis. Furthermore, insurance is an eee product, whereas mutual funds attract ltcg/stcg.

Source: pinterest.com

Source: pinterest.com

If you borrow money against your insurance policy, you’ll reduce the death benefit and cash surrender value. Likewise, you can make your financial goals. In any event, life insurance is the protector of your wealth fund and mutual fund is the creator of the wealth fund. Also, it depends on the choice of investment avenues. They allow individuals to save small amounts in a disciplined manner.

Source: zeebiz.com

Source: zeebiz.com

If you borrow money against your insurance policy, you’ll reduce the death benefit and cash surrender value. Compared to mutual funds, life insurance poses lower risks; There is a guaranteed death benefit. A high risk / high reward type pacific rim fund? An investor invests in life insurance for availing a lump sum either on maturity or upon death.

Source: bajajfinservmarkets.in

Source: bajajfinservmarkets.in

They allow individuals to save small amounts in a disciplined manner. Mutual funds also carry fees, similar to certain types of annuities, which vary depending on the type of fund, and some even charge penalties for early withdrawals. Child life insurance plans and mutual funds are a good choice for investment but before purchasing either one of them you must know about them and must which one of them is a better investment option for you. A type of life insurance known as variable life insurance combines the protection element of insurance with the investment component of mutual funds. Life insurance works, there is no substitute for it…not bonds, not stocks, not mutual funds, not real estate, and not even limited partnerships.

Source: coverfox.com

Source: coverfox.com

A type of life insurance known as variable life insurance combines the protection element of insurance with the investment component of mutual funds. Also, it depends on the choice of investment avenues. They are affordable starting from as low as inr 500 per month. Compared to mutual funds, life insurance poses lower risks; Your best friend for a life time!

Source: fanimaginationth.blogspot.com

Source: fanimaginationth.blogspot.com

For investors, term insurance and mutual funds serve various purposes. The team makes buying decisions on the basis of continuous research and analysis. A type of life insurance known as variable life insurance combines the protection element of insurance with the investment component of mutual funds. Compared to mutual funds, life insurance poses lower risks; For investors, term insurance and mutual funds serve various purposes.

![ULIP vs Mutual Fund Where to Invest? [Step by Step] ULIP vs Mutual Fund Where to Invest? [Step by Step]](https://www.tomorrowmakers.com/sites/default/files/migration/destination_image/where-to-invest-mutual-funds-or-ulips.jpg) Source: tomorrowmakers.com

Source: tomorrowmakers.com

There is a guaranteed death benefit. Life insurance works, there is no substitute for it…not bonds, not stocks, not mutual funds, not real estate, and not even limited partnerships. Decoding indian millennials’ on millennials shows that millennials prefer having life insurance to investing in. A bankbazaar study titled ‘aspiration index 2018: Advantages of investing in mutual funds.

Source: blog.bodhik.com

Source: blog.bodhik.com

Also, it depends on the choice of investment avenues. Additionally, mutual funds are much riskier to invest into as compared to life insurance policies. A type of life insurance known as variable life insurance combines the protection element of insurance with the investment component of mutual funds. Child life insurance plans and mutual funds are a good choice for investment but before purchasing either one of them you must know about them and must which one of them is a better investment option for you. Advantages of investing in mutual funds.

Source: economictimes.indiatimes.com

Source: economictimes.indiatimes.com

Life insurance works, there is no substitute for it…not bonds, not stocks, not mutual funds, not real estate, and not even limited partnerships. For investors, term insurance and mutual funds serve various purposes. Before considering other aspects of term insurance, such as the return of premium riders, families should make sure the death benefit is. What do you want it to do? Looks like individuals find insurance much more appealing than compared to mutual fund schemes.

Source: niveshmarket.com

Source: niveshmarket.com

Since a mutual fund actually can be literally thousands of possibilities, which type of mutual fund are you thinking about? Decoding indian millennials’ on millennials shows that millennials prefer having life insurance to investing in. Looks like individuals find insurance much more appealing than compared to mutual fund schemes. Also, it depends on the choice of investment avenues. Before considering other aspects of term insurance, such as the return of premium riders, families should make sure the death benefit is.

Source: in.pinterest.com

Source: in.pinterest.com

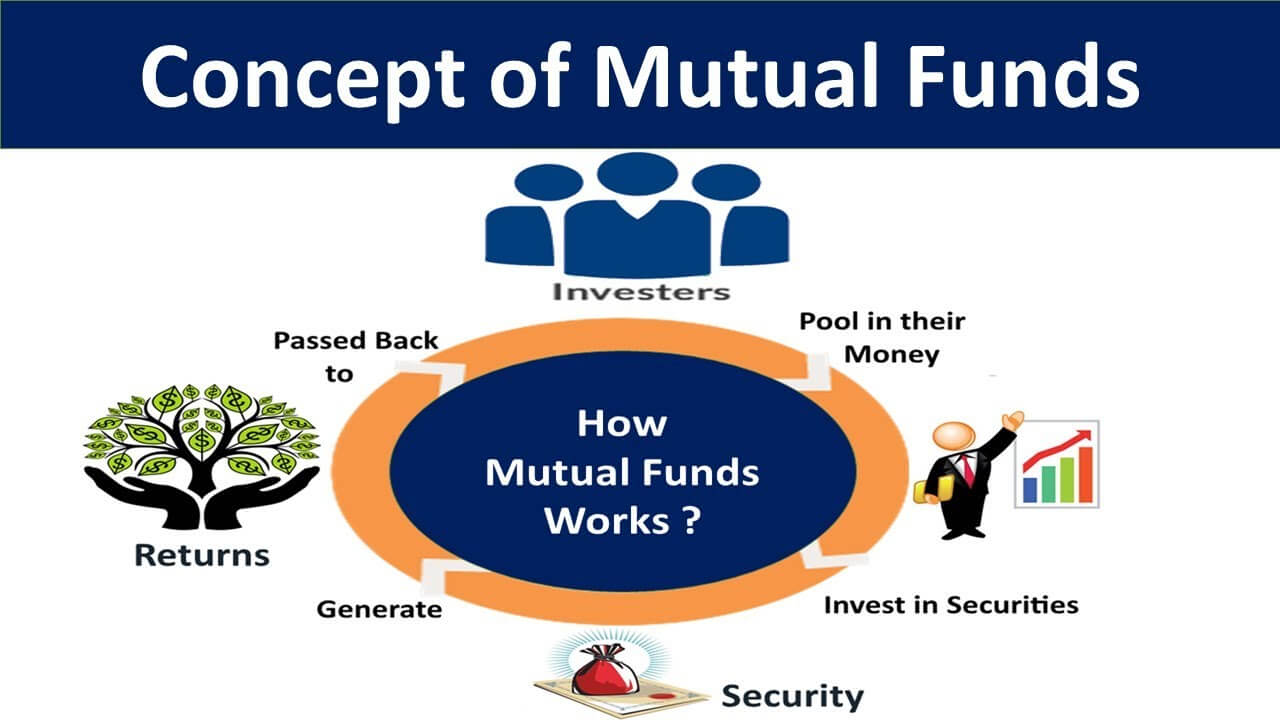

Index funds & income funds guaranteed lifetime income is the primary goal for people who buy annuities, whereas the objectives for people who invest in mutual funds range from aggressive growth to guaranteed. Decoding indian millennials’ on millennials shows that millennials prefer having life insurance to investing in. For investors, term insurance and mutual funds serve various purposes. Mutual funds also carry fees, similar to certain types of annuities, which vary depending on the type of fund, and some even charge penalties for early withdrawals. Which one is better life insurance or mutual fund?

Source: hexagonwealthadvisors.com

Source: hexagonwealthadvisors.com

Which one is better life insurance or mutual fund? Child life insurance plans and mutual funds are a good choice for investment but before purchasing either one of them you must know about them and must which one of them is a better investment option for you. Looks like individuals find insurance much more appealing than compared to mutual fund schemes. What do you want it to do? Also, it depends on the choice of investment avenues.

Source: mymoneykarma.com

Source: mymoneykarma.com

Although funds can be withdrawn within a year, 1% of the fund value (exit load) is deducted, and we have restricted liquidity in insurance due to a minimum lock duration of 5 years. Although funds can be withdrawn within a year, 1% of the fund value (exit load) is deducted, and we have restricted liquidity in insurance due to a minimum lock duration of 5 years. Advantages of investing in mutual funds. For investors, term insurance and mutual funds serve various purposes. However, choosing debt market investments exposes you to lesser risks but offers you slightly lower returns.

Source: moneyexcel.com

Source: moneyexcel.com

In any event, life insurance is the protector of your wealth fund and mutual fund is the creator of the wealth fund. A bankbazaar study titled ‘aspiration index 2018: An investor invests in life insurance for availing a lump sum either on maturity or upon death. They are affordable starting from as low as inr 500 per month. Looks like individuals find insurance much more appealing than compared to mutual fund schemes.

Source: wealthclockadvisors.com

Source: wealthclockadvisors.com

Although funds can be withdrawn within a year, 1% of the fund value (exit load) is deducted, and we have restricted liquidity in insurance due to a minimum lock duration of 5 years. One can invest in a mutual fund through monthly investments through sips or in one lump sum. Additionally, mutual funds are much riskier to invest into as compared to life insurance policies. If you borrow money against your insurance policy, you’ll reduce the death benefit and cash surrender value. However, one major disadvantage of using life insurance as an investment is the associated high fees and expenses make it difficult to compete with the returns of mutual funds.

Source: comparepolicy.com

Source: comparepolicy.com

Before considering other aspects of term insurance, such as the return of premium riders, families should make sure the death benefit is. An investor invests in life insurance for availing a lump sum either on maturity or upon death. Advantages of investing in mutual funds. A bankbazaar study titled ‘aspiration index 2018: What do you want it to do?

Source: aegonlife.com

Source: aegonlife.com

Furthermore, insurance is an eee product, whereas mutual funds attract ltcg/stcg. Which is better life insurance or a mutual fund? One can invest in a mutual fund through monthly investments through sips or in one lump sum. Mutual funds are managed by a team of professionally qualified and experienced fund managers. A type of life insurance known as variable life insurance combines the protection element of insurance with the investment component of mutual funds.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title which one is better life insurance or mutual fund by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information