Which part of a property insurance policy describes the perils Idea

Home » Trend » Which part of a property insurance policy describes the perils IdeaYour Which part of a property insurance policy describes the perils images are available. Which part of a property insurance policy describes the perils are a topic that is being searched for and liked by netizens now. You can Find and Download the Which part of a property insurance policy describes the perils files here. Get all royalty-free images.

If you’re searching for which part of a property insurance policy describes the perils pictures information related to the which part of a property insurance policy describes the perils interest, you have pay a visit to the ideal site. Our website always gives you hints for viewing the highest quality video and image content, please kindly hunt and locate more enlightening video articles and images that match your interests.

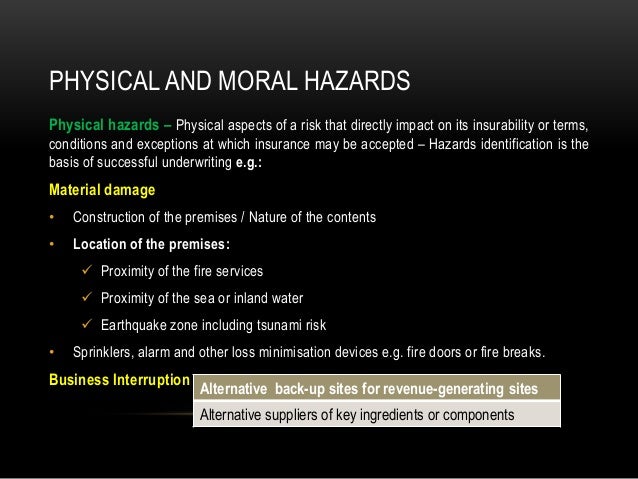

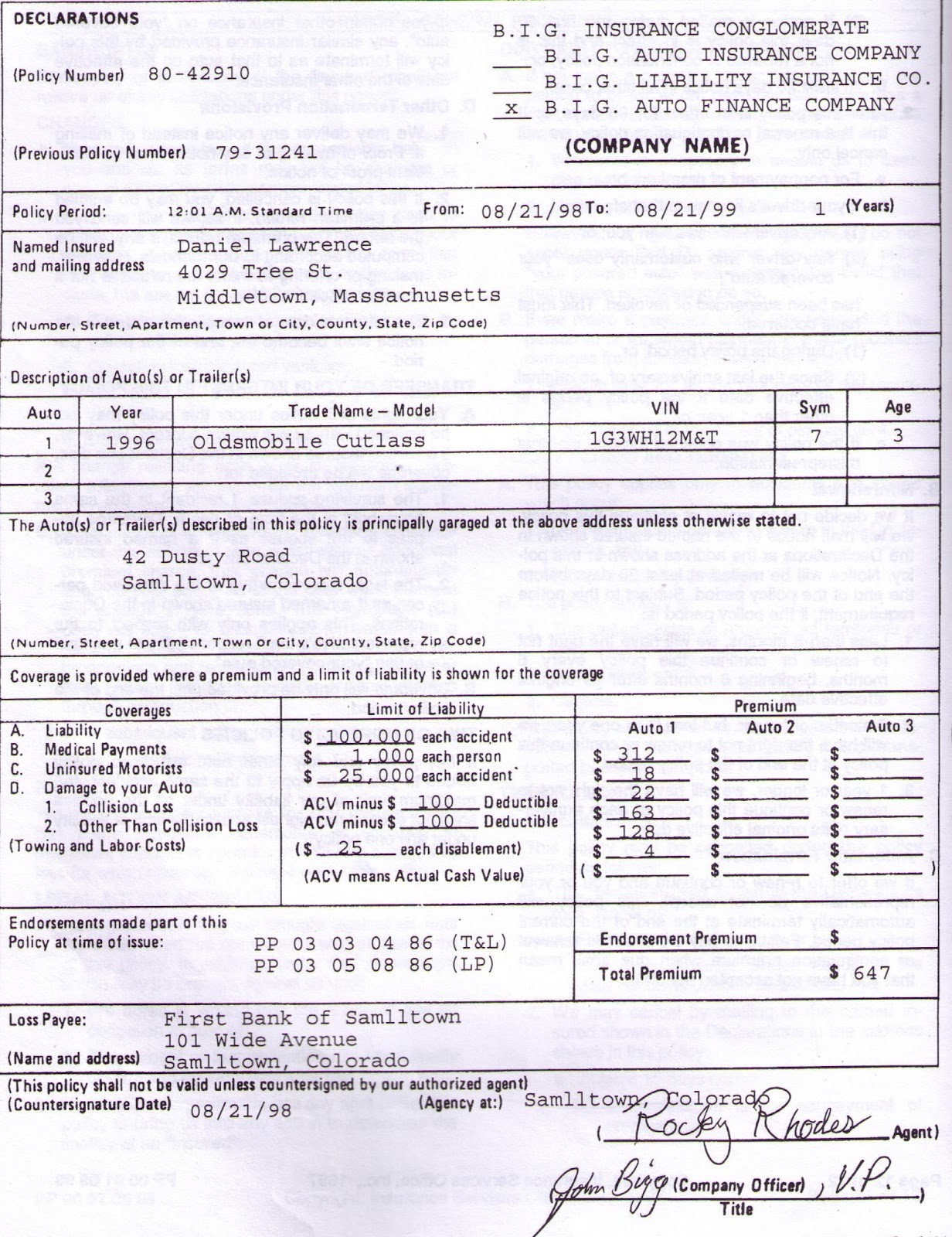

Which Part Of A Property Insurance Policy Describes The Perils. In insurance, a peril is a specific cause of bodily injury or property damage. The declarations page of the homeowners policy provides all of the following information except. Which part of a property insurance policy describes the perils? Also known as dwelling coverage, hazard insurance describes the part of your homeowners insurance policy that protects your home�s structure from various perils.

Which part of an insurance policy describes what property From proprofs.com

Which part of an insurance policy describes what property From proprofs.com

What deductible amount applies to each loss covered by the policy. Lenders use the term to underscore the minimum home insurance requirements before they�ll approve your mortgage loan, as they have an interest in protecting your home�s foundation and structure. A insuring agreement b conditions c declarations d policy provisions Various insurance property policies refer use the terms hazard, peril, or cause of loss. in any instance, the reference is to any number of events that could create damage that the policy covers. However, your policy may exclude certain perils, depending on where you live and what kind of insurance you have. This section also describes the type of property covered and the perils agains which it is insured.

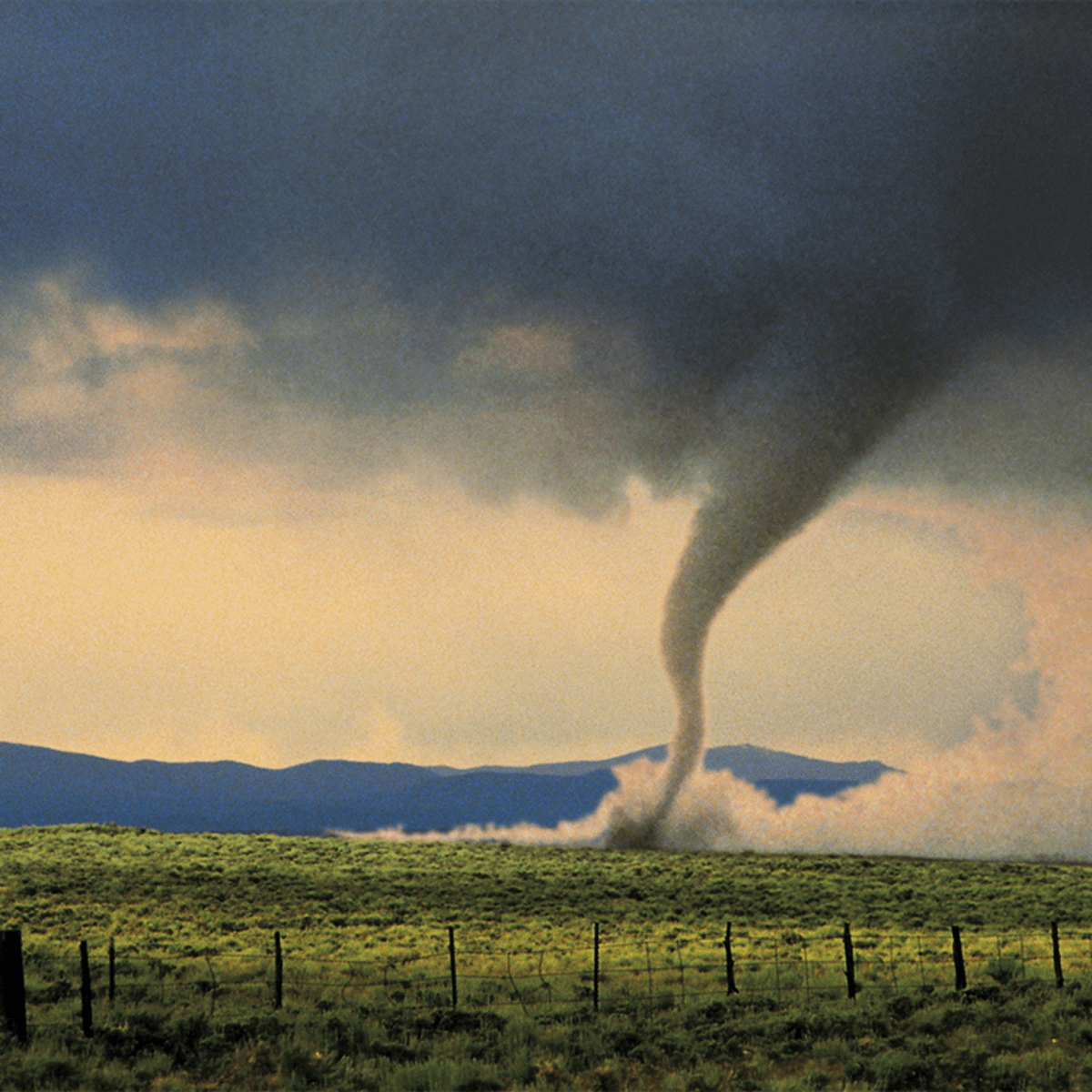

This can be a fire, storm, theft or vandalism, etc.

Which part of a property insurance policy describes the perils? The insuring agreement state what types of losses the insured will be indemnified for. The declarations page of the homeowners policy provides all of the following information except. Various insurance property policies refer use the terms hazard, peril, or cause of loss. in any instance, the reference is to any number of events that could create damage that the policy covers. The cause of the damage determines whether or not you�re covered. This section also describes the type of property covered and the perils agains which it is insured.

![]() Source: voleyball-games.blogspot.com

Source: voleyball-games.blogspot.com

Which part of a property insurance policy describes the perils? Which part of an insurance policy describes what property and/or perils will be covered by the contract? Examples of perils are fire, wind, an accident and acts of vandalism. The exclusions section of an insurance policy is also very important. In insurance, a peril is a specific cause of bodily injury or property damage.

Source: tambovirtual.blogspot.com

Source: tambovirtual.blogspot.com

It describes property, losses, causes of losses, or perils that are not covered. In insurance, a peril is a specific cause of bodily injury or property damage. The cause of the damage determines whether or not you�re covered. What deductible amount applies to each loss covered by the policy. If you only read the policy declarations page and the insuring agreement, you may think you’re paying for coverage that you don’t actually have.

Source: coursepaper.com

Source: coursepaper.com

The part of the property policy that gives basic information such as the named insured, a description of the property, the location of the property, and the amount of premium involved, is known as the: The insuring agreement state what types of losses the insured will be indemnified for. The exclusions section of an insurance policy is also very important. Named perils policies only provide coverage for losses brought about by causes specifically listed in the policy document. Insurance exists in part to help you recover after being affected by a peril.

The part of the insurance contract that describes the covered perils, and the nature of coverage of the contractual agreement between the insurer and the insured is called the a. The part of a property policy that shows the amount of insurance, premium, and policy term is the. In insurance terms, a peril is an event that can cause damage to your property. This can be a fire, storm, theft or vandalism, etc. Named perils policies only provide coverage for losses brought about by causes specifically listed in the policy document.

Source: ppo-hmo.com

Source: ppo-hmo.com

This is why it�s important to know which types of perils are covered by your insurance policy. Also known as dwelling coverage, hazard insurance describes the part of your homeowners insurance policy that protects your home�s structure from various perils. In insurance, a peril is a specific cause of bodily injury or property damage. Which part of an insurance policy describes what property and/or perils will be covered by the contract? If you only read the policy declarations page and the insuring agreement, you may think you’re paying for coverage that you don’t actually have.

Source: proprofs.com

Source: proprofs.com

What part of an insurance policy describes what property and/or perils will be covered by the contract? Which part of a property insurance policy describes the perils? Part of an insurance policy that may describe property, perils, hazards, or losses arising from specific causes that are not covered by the policy. Also known as dwelling coverage, hazard insurance describes the part of your homeowners insurance policy that protects your home�s structure from various perils. The part of the insurance contract that describes the covered perils, and the nature of coverage of the contractual agreement between the insurer and the insured is called the a.

Source: tambovirtual.blogspot.com

Source: tambovirtual.blogspot.com

The part of a property policy that shows the amount of insurance, premium, and policy term is the. A proof of loss the formal statement that verifies details so the insurer can determine liability is called _ _____ __ ____. This can be a fire, storm, theft or vandalism, etc. What part of an insurance policy describes what property and/or perils will be covered by the contract? Also known as dwelling coverage, hazard insurance describes the part of your homeowners insurance policy that protects your home�s structure from various perils.

Source: coursepaper.com

Source: coursepaper.com

The part of a property policy that shows the amount of insurance, premium, and policy term is the. Part of an insurance policy that may describe property, perils, hazards, or losses arising from specific causes that are not covered by the policy. This can be a fire, storm, theft or vandalism, etc. Examples of perils are fire, wind, an accident and acts of vandalism. Further, the term that appears in an insurance policy may not mean the same as it does.

Source: thedailyguardian.com

Source: thedailyguardian.com

The declarations page of the homeowners policy provides all of the following information except. The declarations page of the homeowners policy provides all of the following information except. Which part of a property insurance policy describes the perils? In insurance, a peril is a specific cause of bodily injury or property damage. A insuring agreement b conditions c declarations d policy provisions

Source: trvlia.blogspot.com

Source: trvlia.blogspot.com

In insurance terms, a peril is an event that can cause damage to your property. A proof of loss the formal statement that verifies details so the insurer can determine liability is called _ _____ __ ____. The insuring agreement state what types of losses the insured will be indemnified for. However, your policy may exclude certain perils, depending on where you live and what kind of insurance you have. What part of an insurance policy describes what is covered and the perils the policy insures against?

Source: tambovirtual.blogspot.com

Source: tambovirtual.blogspot.com

What part of an insurance policy describes what property and/or perils will be covered by the contract? The part of the property policy that gives basic information such as the named insured, a description of the property, the location of the property, and the amount of premium involved, is known as the: Also known as dwelling coverage, hazard insurance describes the part of your homeowners insurance policy that protects your home�s structure from various perils. In insurance, a peril is a specific cause of bodily injury or property damage. A insuring agreement b conditions c declarations d policy provisions

Source: iireporter.com

Source: iireporter.com

In insurance terms, a peril is an event that can cause damage to your property. Which part of an insurance policy describes what property and/or perils will be covered by the contract? The exclusions section of an insurance policy is also very important. Part of an insurance policy that may describe property, perils, hazards, or losses arising from specific causes that are not covered by the policy. However, your policy may exclude certain perils, depending on where you live and what kind of insurance you have.

Source: chicagotribunenews.blogspot.com

Source: chicagotribunenews.blogspot.com

Examples of perils are fire, wind, an accident and acts of vandalism. Also known as dwelling coverage, hazard insurance describes the part of your homeowners insurance policy that protects your home�s structure from various perils. This is why it�s important to know which types of perils are covered by your insurance policy. The declarations page of the homeowners policy provides all of the following information except. Further, the term that appears in an insurance policy may not mean the same as it does.

Source: esoumapagina.blogspot.com

Source: esoumapagina.blogspot.com

A insuring agreement b conditions c declarations d policy provisions What part of an insurance policy describes what property and/or perils will be covered by the contract? Further, the term that appears in an insurance policy may not mean the same as it does. A policy in which the company and the policyholder agree to the amount to be paid in the event of total loss of property, regardless of the value of the property. The part of a property policy that shows the amount of insurance, premium, and policy term is the.

Source: insuranceplanet.blogspot.com

Source: insuranceplanet.blogspot.com

Named perils policies only provide coverage for losses brought about by causes specifically listed in the policy document. The part of a property policy that shows the amount of insurance, premium, and policy term is the. The exclusions section of an insurance policy is also very important. Lenders use the term to underscore the minimum home insurance requirements before they�ll approve your mortgage loan, as they have an interest in protecting your home�s foundation and structure. The insuring agreement state what types of losses the insured will be indemnified for.

Source: tambovirtual.blogspot.com

Source: tambovirtual.blogspot.com

It describes property, losses, causes of losses, or perils that are not covered. The part of a property policy that shows the amount of insurance, premium, and policy term is the. The part of the insurance contract that describes the covered perils, and the nature of coverage of the contractual agreement between the insurer and the insured is called the a. Which part of an insurance policy describes what property and/or perils will be covered by the contract? Examples of perils are fire, wind, an accident and acts of vandalism.

Source: coursepaper.com

Source: coursepaper.com

Various insurance property policies refer use the terms hazard, peril, or cause of loss. in any instance, the reference is to any number of events that could create damage that the policy covers. This is why it�s important to know which types of perils are covered by your insurance policy. Which part of a property insurance policy describes the perils? Which part of a property insurance policy describes the perils? This can be a fire, storm, theft or vandalism, etc.

Source: generalinsurance.com

The declarations page of the homeowners policy provides all of the following information except. The insuring agreement state what types of losses the insured will be indemnified for. Insurance exists in part to help you recover after being affected by a peril. The exclusions section of an insurance policy is also very important. The declarations page of the homeowners policy provides all of the following information except.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title which part of a property insurance policy describes the perils by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information