Which provision prevents an insurer from changing the terms Idea

Home » Trend » Which provision prevents an insurer from changing the terms IdeaYour Which provision prevents an insurer from changing the terms images are ready in this website. Which provision prevents an insurer from changing the terms are a topic that is being searched for and liked by netizens now. You can Get the Which provision prevents an insurer from changing the terms files here. Find and Download all royalty-free images.

If you’re searching for which provision prevents an insurer from changing the terms images information linked to the which provision prevents an insurer from changing the terms topic, you have pay a visit to the right blog. Our website frequently gives you hints for refferencing the highest quality video and picture content, please kindly surf and find more enlightening video articles and images that fit your interests.

Which Provision Prevents An Insurer From Changing The Terms. When a life insurance policy stipulates that the beneficiary will receive payments in specified installments or for a specified number of years what provision prevents the beneficiary from changing or borrowing from the planned installments: A disability income policyowner recently submitted a claim for a chronic neck problem that has now resulted in total disability. Entire contract provision nothing may be incorporated by reference, meaning that the policy cannot refer to any outside documents as being part of the contract. This prevents the insurer from making changes by using anything not included in the policy.

Important Legal Provisions Relating to Life Insurance UAE From slideshare.net

Important Legal Provisions Relating to Life Insurance UAE From slideshare.net

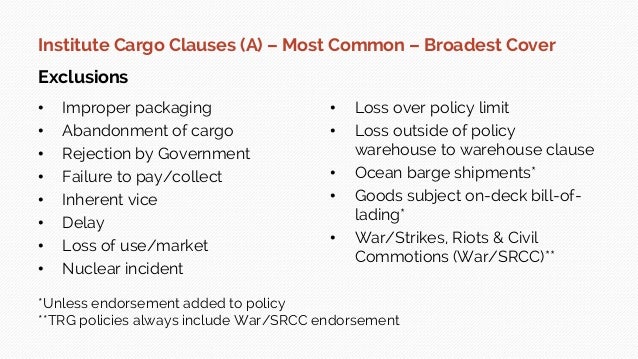

The primary difference between optional and conditional renewal is that conditionally renewable policies may be canceled for specific conditions contained in the policy but optionally renewable policies do not specify a condition or reason for. Prevents delayed claim payments made by the insurer (correct.) the purpose of the time of payment of claims provision is to prevent the insurance company from delaying claim payments. (a) company�s board of directors approves the change (b) modified provision is not less favorable to the insurer (c) applicant directs that it be changed (d) modified provision is not less favorable to the insured (search chapter 6) o a. Which ltci policy feature prevents the insurer from terminating the policy, raising the rates, or making changes in any provisions based on the health of the insured while the policy is in force? Which provision prevents an insurer from changing the terms of the contract?

Entire contract provision nothing may be incorporated by reference, meaning that the policy cannot refer to any outside documents as being part of the contract.

Time limit on certain defenses Restoration of benefits provision b. Which provision prevents an insurer from changing the terms of the contract? The insurance policy itself (including any riders and endorsements/amendments) and the application, if attached to the policy, comprise the entire contract between all parties. Which provision prevents an insurer from changing the terms of the contract with the policyowner by referring to documents not found within the policy itself? The policy provision that entitles the insurer to establish conditions the insured must meet while a claim is pending is.

Source: oswaldcompanies.com

Source: oswaldcompanies.com

(search chapter 6) o a. The policy provision that entitles the insurer to establish conditions the insured must meet while a claim is pending is. Entire contract provision all of these settlements options involve the systematic liquidation of the death proceeds in the event of the insured�s death, except: A producer cannot make any changes to the policy. The entire contract provision states that the insurance policy represents the contract between the insurer and the policyowner in its entirety, assuring the policyowner that no changes to the contract can be made once the contract has been issued.

Source: termly.io

Source: termly.io

The policy provision that entitles the insurer to establish conditions the insured must meet while a claim is pending is. Which provision prevents an insurer from changing the terms of the contract with the policyowner by referring to documents not found within the policy itself? When a life insurance policy stipulates that the beneficiary will receive payments in specified installments or for a specified number of years what provision prevents the beneficiary from changing or borrowing from the planned installments: An exclusion is a provision that eliminates coverage for a specified condition; Restoration of benefits provision b.

Which ltci policy feature prevents the insurer from terminating the policy, raising the rates, or making changes in any provisions based on the health of the insured while the policy is in force? A disability income policyowner recently submitted a claim for a chronic neck problem that has now resulted in total disability. The insurance policy itself (including any riders and endorsements/amendments) and the application, if attached to the policy, comprise the entire contract between all parties. When a life insurance policy stipulates that the beneficiary will receive payments in specified installments or for a specified number of years what provision prevents the beneficiary from changing or borrowing from the planned installments: Which provision prevents an insurer from changing the terms of the contract with the policyowner by referring to documents not found within the policy itself the correct answer is.

Source: resources.ehealthinsurance.com

Source: resources.ehealthinsurance.com

Entire contract provision all of these settlements options involve the systematic liquidation of the death proceeds in the event of the insured�s death, except: An exclusion is a provision that eliminates coverage for a specified condition; Restoration of benefits provision b. Which ltci policy feature prevents the insurer from terminating the policy, raising the rates, or making changes in any provisions based on the health of the insured while the policy is in force? Entire contract provision nothing may be incorporated by reference, meaning that the policy cannot refer to any outside documents as being part of the contract.

Source: fiercehealthcare.com

Source: fiercehealthcare.com

The entire contract provision states that the insurance policy represents the contract between the insurer and the policyowner in its entirety, assuring the policyowner that no changes to the contract can be made once the contract has been issued. The entire contract provision states that the insurance policy represents the contract between the insurer and the policyowner in its entirety, assuring the policyowner that no changes to the contract can be made once the contract has been issued. Which provision prevents an insurer from changing the terms of the contract with the policyowner by referring to documents not found within the policy itself? Time limit on certain defenses Entire contract provision nothing may be incorporated by reference, meaning that the policy cannot refer to any outside documents as being part of the contract.

Source: seniormarketadvisors.com

Source: seniormarketadvisors.com

In most cases, incontestability clauses prevent insurers from voiding the insurance contract after a period of two to three years after its activation. A disability income policyowner recently submitted a claim for a chronic neck problem that has now resulted in total disability. Prevents the insurer from voiding coverage due to a misstatement by the insured after a specific amount of time has passed. The incontestability provision prevents the insurer, following a specifically stated period of time, from rescinding (contesting) the policy on the basis of misstatements made or omission of facts on the original application. Which provision prevents an insurer from changing the terms of the contract with the policyowner by referring to documents not found within the policy itself?

Source: ar.casact.org

Source: ar.casact.org

In most cases, incontestability clauses prevent insurers from voiding the insurance contract after a period of two to three years after its activation. Entire contract provision nothing may be incorporated by reference, meaning that the policy cannot refer to any outside documents as being part of the contract. When an insured changes to a more hazardous occupation, which disability policy provision allows an insurer to adjust policy benefits and rates? Part of most all life and health insurance policies, these clauses act as one of the strongest consumer protections for policyholders and their beneficiaries. The primary difference between optional and conditional renewal is that conditionally renewable policies may be canceled for specific conditions contained in the policy but optionally renewable policies do not specify a condition or reason for.

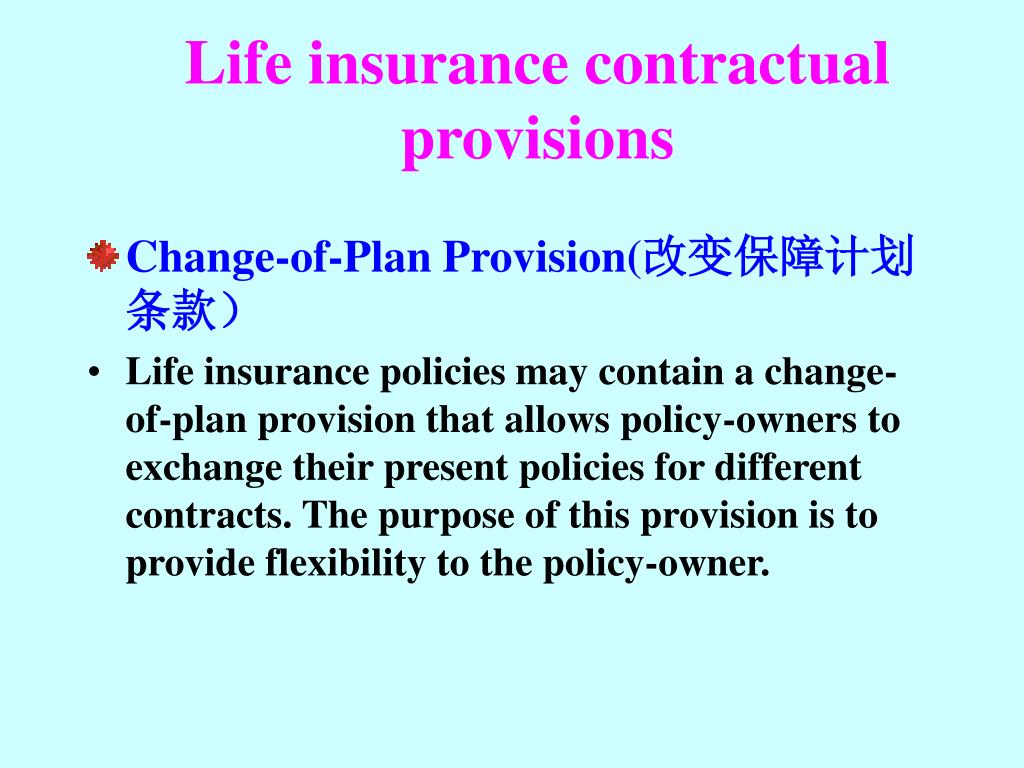

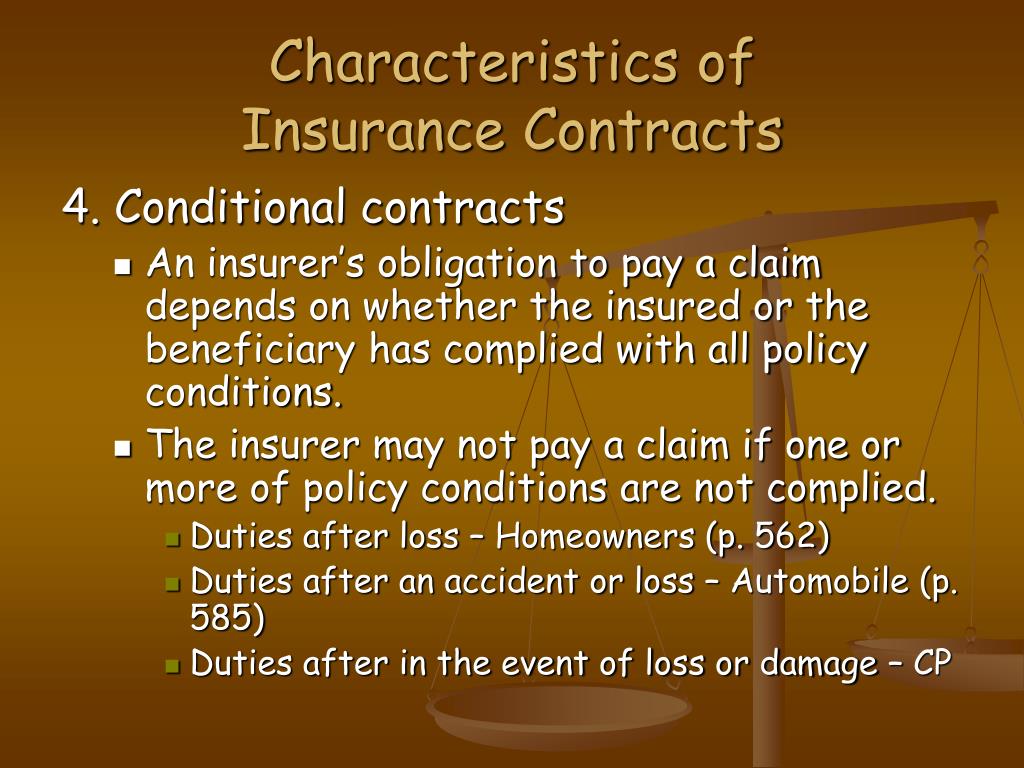

Source: slideserve.com

Source: slideserve.com

(search chapter 6) o a. Which provision prevents an insurer from changing the terms? The primary difference between optional and conditional renewal is that conditionally renewable policies may be canceled for specific conditions contained in the policy but optionally renewable policies do not specify a condition or reason for. Which provision prevents an insurer from changing the terms of the contract with the policyowner by referring to documents not found within the policy itself? Which provision prevents an insurer from changing the terms of the contract with the policyowner by referring to documents not found within the policy itself?

Source: absolutefootandankleclinic.com

Source: absolutefootandankleclinic.com

A company may change the wording of a uniform policy provision in its health insurance policies only if the: Which provision prevents an insurer from changing the terms of the contract with the policyowner by referring to documents not found within the policy itself? When an insured changes to a more hazardous occupation, which disability policy provision allows an insurer to adjust policy benefits and rates? Entire contract provision nothing may be incorporated by reference, meaning that the policy cannot refer to any outside documents as being part of the contract. Which provision prevents an insurer from changing the terms of the contract with the policyowner by referring to documents not found within the policy itself the correct answer is.

![Contingencies and provisioning[1] Contingencies and provisioning[1]](https://image.slidesharecdn.com/contingenciesandprovisioning1-111024070333-phpapp01/95/contingencies-and-provisioning1-7-728.jpg?cb=1319439847) Source: slideshare.net

Source: slideshare.net

The entire contract provision states that the insurance policy represents the contract between the insurer and the policyowner in its entirety, assuring the policyowner that no changes to the contract can be made once the contract has been issued. A company may change the wording of a uniform policy provision in its health insurance policies only if the: Which provision prevents an insurer from changing the terms of the contract with the policyowner by referring to documents not found within the policy itself the correct answer is. Which provision prevents an insurer from changing the terms of the contract with the policyowner by referring to documents not found within the policy itself? Which provision prevents an insurer from changing the terms of the contract with the policyowner by referring to documents not found within the policy itself?

Source: slideshare.net

Source: slideshare.net

Which ltci policy feature prevents the insurer from terminating the policy, raising the rates, or making changes in any provisions based on the health of the insured while the policy is in force? (a) company�s board of directors approves the change (b) modified provision is not less favorable to the insurer (c) applicant directs that it be changed (d) modified provision is not less favorable to the insured Restoration of benefits provision b. A company may change the wording of a uniform policy provision in its health insurance policies only if the: An exclusion is a provision that eliminates coverage for a specified condition;

Source: slideshare.net

Source: slideshare.net

An exclusion is a provision that eliminates coverage for a specified condition; Which provision prevents an insurer from changing the terms? Time limit on certain defenses (incontestability) provision: Prevents the insurer from voiding coverage due to a misstatement by the insured after a specific amount of time has passed. In most cases, incontestability clauses prevent insurers from voiding the insurance contract after a period of two to three years after its activation.

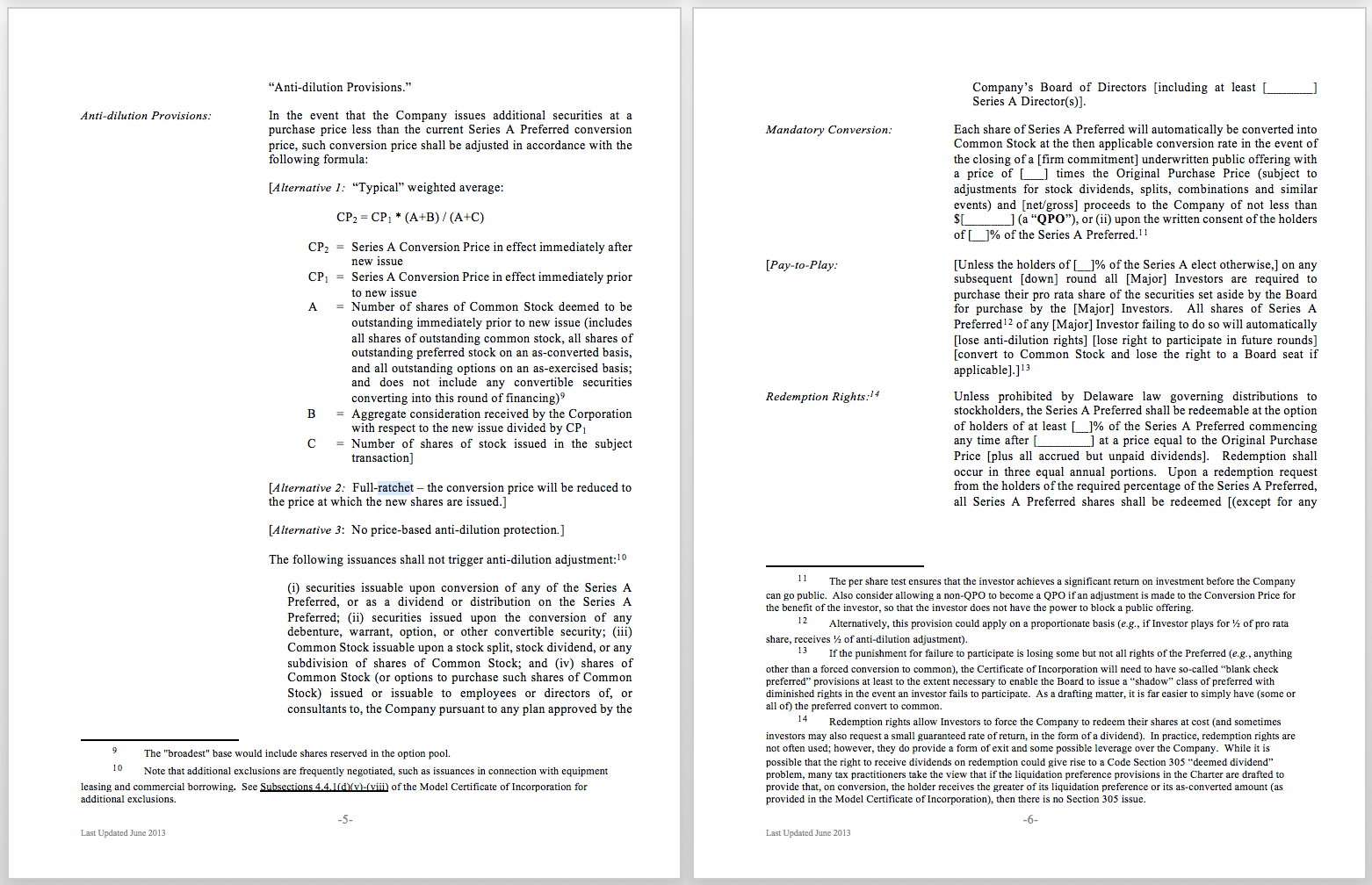

Source: toptal.com

Source: toptal.com

Entire contract provision all of these settlements options involve the systematic liquidation of the death proceeds in the event of the insured�s death, except: This prevents the insurer from making changes by using anything not included in the policy. The incontestability provision prevents the insurer, following a specifically stated period of time, from rescinding (contesting) the policy on the basis of misstatements made or omission of facts on the original application. Entire contract provision nothing may be incorporated by reference, meaning that the policy cannot refer to any outside documents as being part of the contract. An exclusion is a provision that eliminates coverage for a specified condition;

Source: slideshare.net

Source: slideshare.net

Which provision prevents an insurer from changing the terms of the contract with the policyowner by referring to documents not found within the policy itself? A company may change the wording of a uniform policy provision in its health insurance policies only if the: The entire contract provision states: (search chapter 6) o a. (a) company�s board of directors approves the change (b) modified provision is not less favorable to the insurer (c) applicant directs that it be changed (d) modified provision is not less favorable to the insured

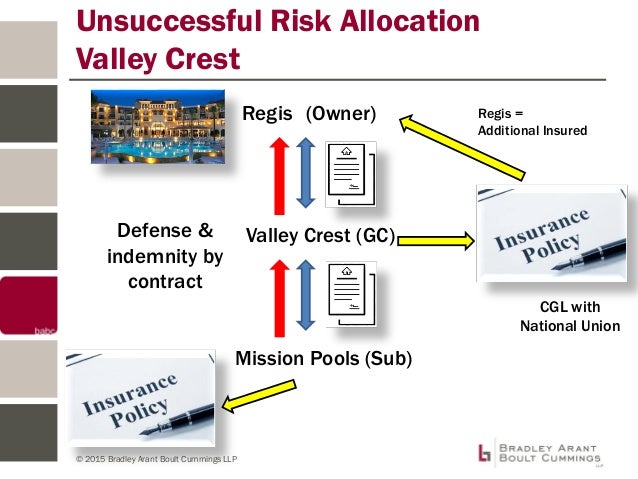

Source: slideserve.com

Source: slideserve.com

The entire contract provision states that the insurance policy represents the contract between the insurer and the policyowner in its entirety, assuring the policyowner that no changes to the contract can be made once the contract has been issued. An exclusion is a provision that eliminates coverage for a specified condition; Which provision prevents an insurer from changing the terms of the contract with the policyowner by referring to documents not found within the policy itself? A disability income policyowner recently submitted a claim for a chronic neck problem that has now resulted in total disability. The incontestability provision prevents the insurer, following a specifically stated period of time, from rescinding (contesting) the policy on the basis of misstatements made or omission of facts on the original application.

Source: dasfinance.co.uk

Source: dasfinance.co.uk

Which provision prevents an insurer from changing the terms of the contract with the policyowner by referring to documents not found within the policy itself? Which provision prevents an insurer from changing the terms of the contract with the policyowner by referring to documents not found within the policy itself? Which provision prevents an insurer from changing the terms of the contract with the policyowner by referring to documents not found within the policy itself the correct answer is. Which provision prevents an insurer from changing the terms of the contract? The entire contract provision states:

Source: tnmservices.com

Source: tnmservices.com

Time limit on certain defenses (incontestability) provision: Part of most all life and health insurance policies, these clauses act as one of the strongest consumer protections for policyholders and their beneficiaries. Entire contract provision nothing may be incorporated by reference, meaning that the policy cannot refer to any outside documents as being part of the contract. A reduction is a provision that decreases benefits as a result of a specific condition The insurance policy itself (including any riders and endorsements/amendments) and the application, if attached to the policy, comprise the entire contract between all parties.

Source: slideshare.net

Source: slideshare.net

A disability income policyowner recently submitted a claim for a chronic neck problem that has now resulted in total disability. The primary difference between optional and conditional renewal is that conditionally renewable policies may be canceled for specific conditions contained in the policy but optionally renewable policies do not specify a condition or reason for. Which provision prevents an insurer from changing the terms of the contract? Entire contract provision nothing may be incorporated by reference, meaning that the policy cannot refer to any outside documents as being part of the contract. Prevents the insurer from voiding coverage due to a misstatement by the insured after a specific amount of time has passed.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title which provision prevents an insurer from changing the terms by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information