Which statement regarding whole life insurance is accurate Idea

Home » Trending » Which statement regarding whole life insurance is accurate IdeaYour Which statement regarding whole life insurance is accurate images are available. Which statement regarding whole life insurance is accurate are a topic that is being searched for and liked by netizens now. You can Find and Download the Which statement regarding whole life insurance is accurate files here. Get all free vectors.

If you’re looking for which statement regarding whole life insurance is accurate pictures information linked to the which statement regarding whole life insurance is accurate topic, you have pay a visit to the ideal site. Our website always provides you with suggestions for seeking the highest quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

Which Statement Regarding Whole Life Insurance Is Accurate. An underwriter works on behalf of the life insurance company to evaluate your application details, health information, and lifestyle to give you an insurance classification based on risk, which determines your premium. This is in contrast to term life insurance , which only guarantees that there will be a payout should you die within the specified term of the policy. If you have a permanent life insurance policy the life insurance company will generally mail out an annual statement around the month of your policy date. These are all accurate statements regarding universal life insurance except.

Obtaining Affordable Life Insurance with Aortic Insufficiency From jrcinsurancegroup.com

Obtaining Affordable Life Insurance with Aortic Insufficiency From jrcinsurancegroup.com

This is in contrast to term life insurance , which only guarantees that there will be a payout should you die within the specified term of the policy. An underwriter works on behalf of the life insurance company to evaluate your application details, health information, and lifestyle to give you an insurance classification based on risk, which determines your premium. Which statement regarding the cash value of a whole life insurance policy is correct? Whole life insurance can be participating which means the insured must participate in self directed investments for the cash. The policy is then issued with no scuba exclusions. Which of the following is true regarding variable annuities?

A nonparticipating whole life insurance policy was surrender for its 20,000 cash value.

September 21, 2021 by peter berg. Life insurance companies rely on your weight to decide your rate class and premiums. Because weight is an important factor in deciding coverage and premiums for all life insurance companies, an inaccurate weight listing will increase the chance that your beneficiary’s claim will be delayed or. This is in contrast to term life insurance , which only guarantees that there will be a payout should you die within the specified term of the policy. One of the questions on the application asks if p engages in scuba diving, to which p answers no. Which statement regarding whole life insurance is accurate?

Source: imsguenstony.blogspot.com

Source: imsguenstony.blogspot.com

Life insurance companies rely on your weight to decide your rate class and premiums. It indicates evidence of an employee�s insurance of coverage S is covered by a whole life policy. Unfortunately, most life insurance companies are still set up on archaic systems which makes the statements difficult to understand. D) the company guarantees a minimum interest rate.

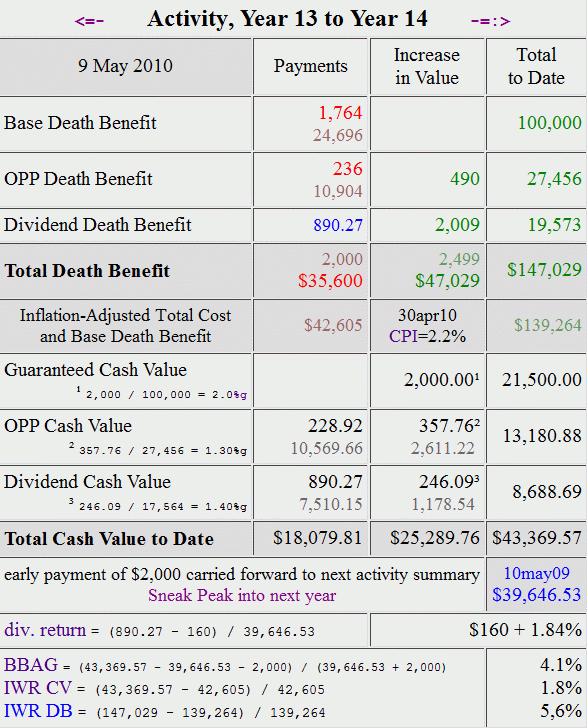

Source: bogleheads.org

Source: bogleheads.org

C) the funds are invested in the company’s general account. Unfortunately, most life insurance companies are still set up on archaic systems which makes the statements difficult to understand. An underwriter works on behalf of the life insurance company to evaluate your application details, health information, and lifestyle to give you an insurance classification based on risk, which determines your premium. Which of the following is true regarding variable annuities? It indicates evidence of an employee�s insurance of coverage

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

One of the questions on the application asks if p engages in scuba diving, to which p answers no. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Cash value accumulation is based on the performance of a separate investment account c. The policy is then issued with no scuba exclusions. What were the federal income tax consequences to the policy owner on receipt of the cash value.

Source: mutualtrust.com

Source: mutualtrust.com

A) a person selling variable annuities is required to have only a life agent’s license. Which statement regarding a single premium whole life insurance policy is not correct? In this situation, the policy owner would receive 16,000 tax free and 4,000 as ordinary income. Can be borrowed against, starting in the policy�s fifth year b. B) the annuitant assumes the risks on investment.

Source: newyorklifeinsurancecompanyreviewswoy.blogspot.com

Source: newyorklifeinsurancecompanyreviewswoy.blogspot.com

P purchases a $50,000 whole life insurance policy in 2005. September 21, 2021 by peter berg. A) a person selling variable annuities is required to have only a life agent’s license. In the event of death, the loan amount is deducted from the policy proceeds. Which statement regarding the cash value of a whole life insurance policy is correct?

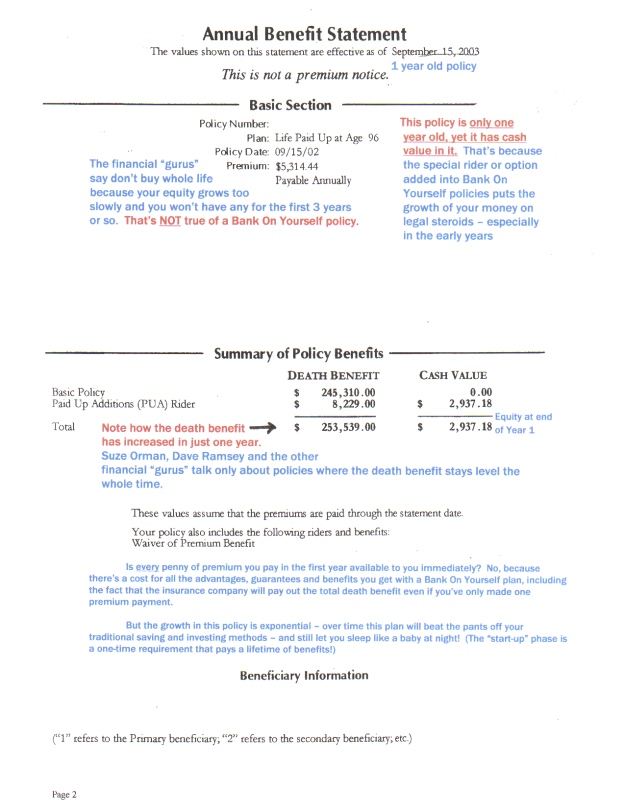

Source: bankonyourself.com

Source: bankonyourself.com

Assume that mindy purchases a whole life policy at age 35 for an annual premium of $325. The policy is then issued with no scuba exclusions. Which of the following statements is true concerning whole life insurance? Which statement regarding the certificate of insurance is accurate? Which statement regarding whole life insurance is accurate?

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

Unfortunately, most life insurance companies are still set up on archaic systems which makes the statements difficult to understand. All of the following statements regarding basic forms of whole life insurance are correct except. Which statement regarding the certificate of insurance is accurate? Inaccurate weight on life insurance application. Cash value accumulation is based on the performance of a separate investment account c.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

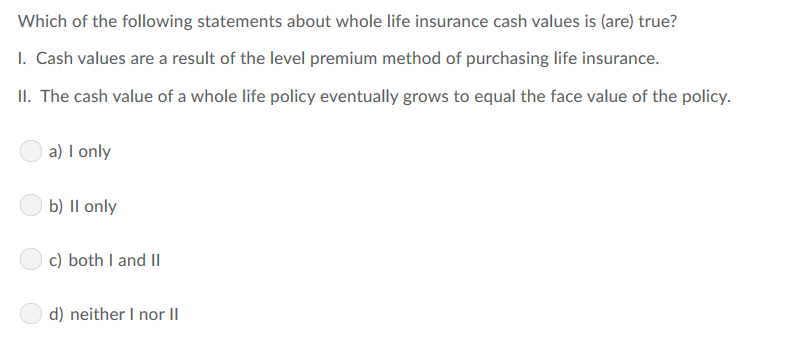

Level premium whole life insurance accumulates a cash value that eventually reaches the face value of the policy at age 100. Whole life insurance can be participating which means the insured must participate in self directed investments for the cash. At age 65, the cost of providing the pure insurance protection for an equivalent face amount is $620. A) a person selling variable annuities is required to have only a life agent’s license. Which statement is correct regarding the premium payment schedule for whole life policies?

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

The total premium paid had totaled 16,000. What were the federal income tax consequences to the policy owner on receipt of the cash value. Which statement regarding the cash value of a whole life insurance policy is correct? All of these insurance products require an agent to have proper finra securities registration in order to sell them except for. Additional premiums may be charged under certain conditions an insurance policy that can also be classified as a securities product is called

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

Inaccurate weight on life insurance application. If the whole life insurance premiums are to be paid throughout the insured�s lifetime, the insurance is known as limited. The life insurance underwriting process takes. Starts growing with the initial premium Whole life insurance offers permanent protection throughout the insured’s lifetime.

Source: pinterest.com

Source: pinterest.com

All of the following statements concerning whole life insurance are correct except: Which statement is true regarding a variable whole life policy? Generally, straight life premiums are payable, or least annually, for the duration of the insured�s life. Which statement is true regarding a variable whole life policy? Life insurance companies rely on your weight to decide your rate class and premiums.

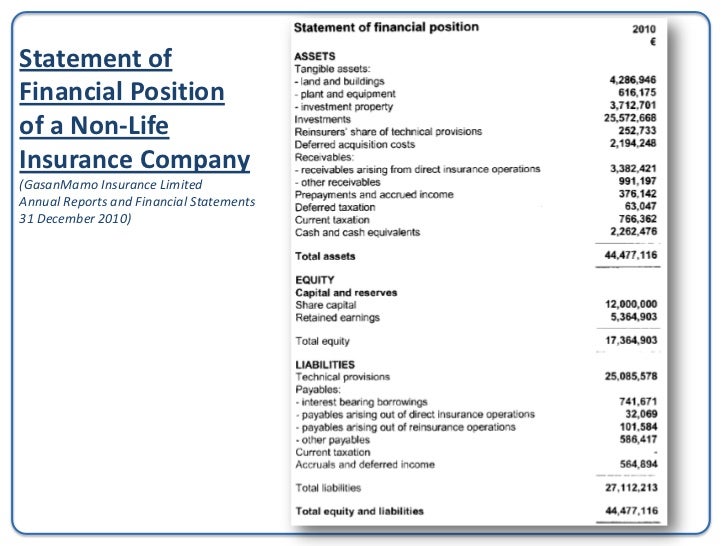

Source: slideshare.net

Source: slideshare.net

Assume that mindy purchases a whole life policy at age 35 for an annual premium of $325. Which statement regarding whole life insurance is accurate? An underwriter works on behalf of the life insurance company to evaluate your application details, health information, and lifestyle to give you an insurance classification based on risk, which determines your premium. The insured only has to pay on this type of policy for a certain number of years. P purchases a $50,000 whole life insurance policy in 2005.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

What were the federal income tax consequences to the policy owner on receipt of the cash value. The insured pays premiums on this type of insurance until his death. In this situation, the policy owner would receive 16,000 tax free and 4,000 as ordinary income. September 21, 2021 by peter berg. By definition, whole life insurance covers your entire life, as long as you continue to make payments for premiums.

Source: youtube.com

Source: youtube.com

Ordinary whole life insurance covers the insured for the states term of the policy. The life insurance underwriting process takes. What were the federal income tax consequences to the policy owner on receipt of the cash value. Which statement regarding a single premium whole life insurance policy is not correct? Whole life insurance offers permanent protection throughout the insured’s lifetime.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Whole life insurance can be participating which means the insured must participate in self directed investments for the cash. Whole life insurance provides for the payment of the policy face amount upon the death of the insured, regardless of when death occurs. The face amount and premiums can be changed simultaneously by the policyowner. Generally, straight life premiums are payable, or least annually, for the duration of the insured�s life. All of the following statements regarding basic forms of whole life insurance are correct except.

Source: bankonyourself.com

Source: bankonyourself.com

In the event of death, the loan amount is deducted from the policy proceeds. P purchases a $50,000 whole life insurance policy in 2005. The insured pays premiums on this type of insurance until his death. Can be borrowed against, starting in the policy�s fifth year b. Additional premiums may be charged under certain conditions an insurance policy that can also be classified as a securities product is called

Source: chegg.com

Source: chegg.com

All of the following statements concerning whole life insurance are correct except: B) the annuitant assumes the risks on investment. This is in contrast to term life insurance , which only guarantees that there will be a payout should you die within the specified term of the policy. Unfortunately, most life insurance companies are still set up on archaic systems which makes the statements difficult to understand. All of the following statements regarding basic forms of whole life insurance are correct except.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

It is frequently called a guaranteed life policy since insurers commit to keeping rates constant during the policy term. It indicates evidence of an employee�s insurance of coverage P purchases a $50,000 whole life insurance policy in 2005. Available to the policyowner when policy has been surrendered d. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title which statement regarding whole life insurance is accurate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information