Which term insurance is renewable information

Home » Trend » Which term insurance is renewable informationYour Which term insurance is renewable images are ready in this website. Which term insurance is renewable are a topic that is being searched for and liked by netizens today. You can Get the Which term insurance is renewable files here. Find and Download all free images.

If you’re searching for which term insurance is renewable pictures information connected with to the which term insurance is renewable keyword, you have come to the ideal blog. Our site always provides you with suggestions for viewing the maximum quality video and image content, please kindly search and find more informative video content and graphics that match your interests.

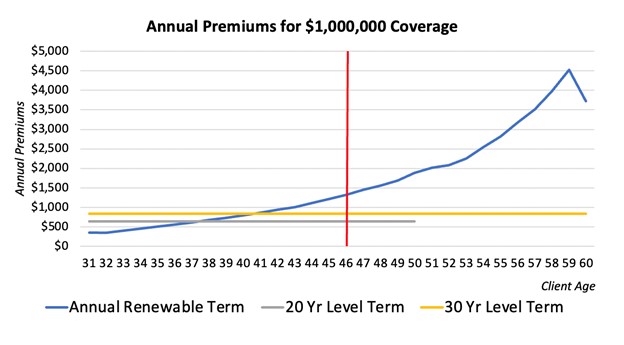

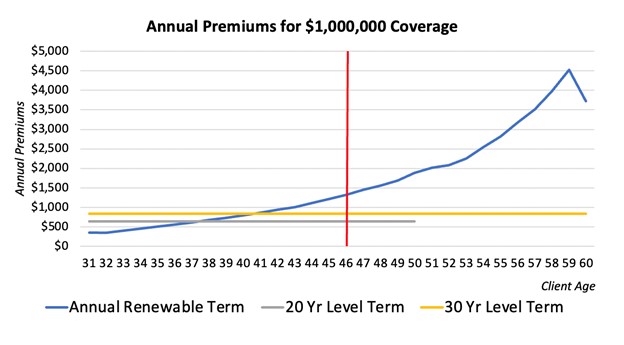

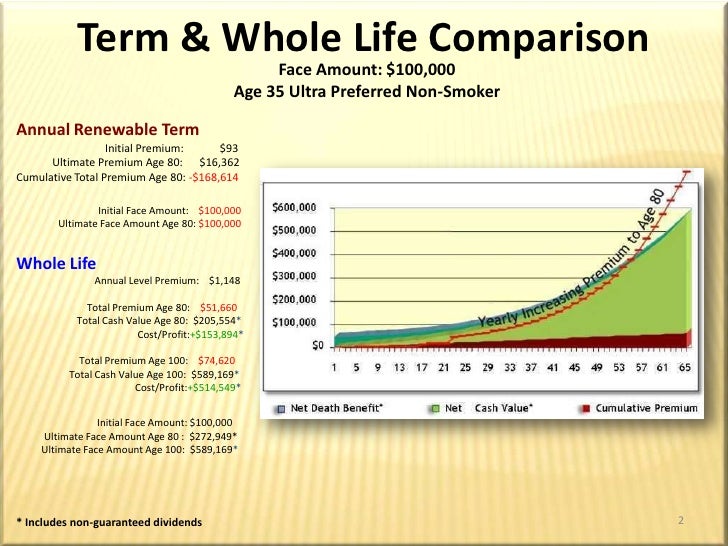

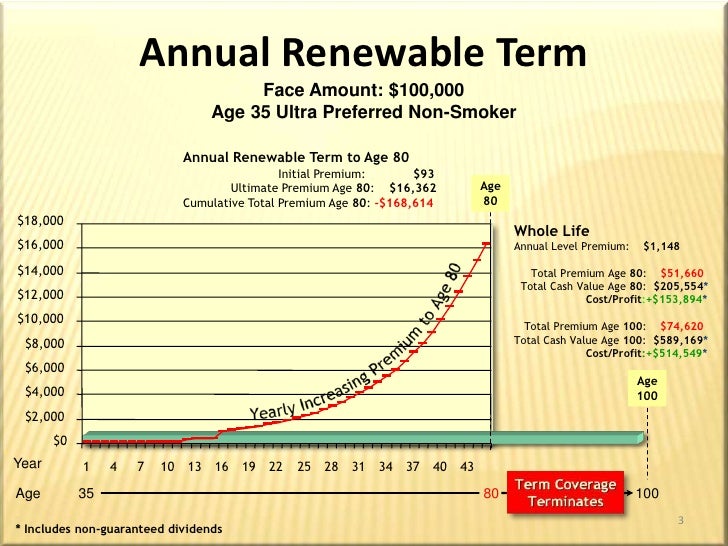

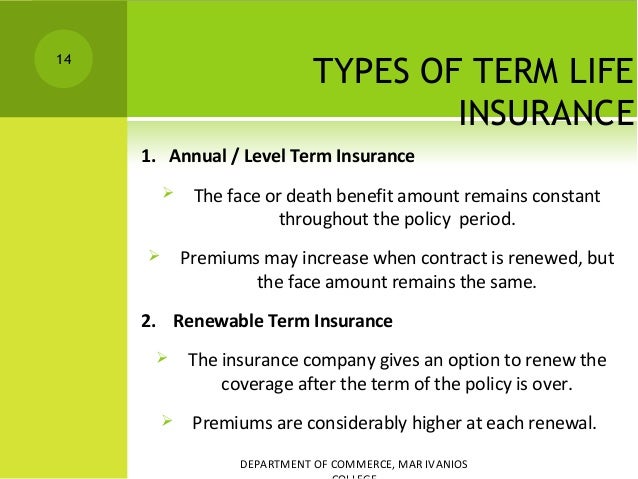

Which Term Insurance Is Renewable. Generally speaking, the premiums remain the same throughout the term: A renewable term insurance policy is an option through which you can extend your life insurance cover when the original term is about to end. A term policy, by definition, offers a life cover only for a limited period of time. Art or annual renewable term insurance is a great option for short term insurance.

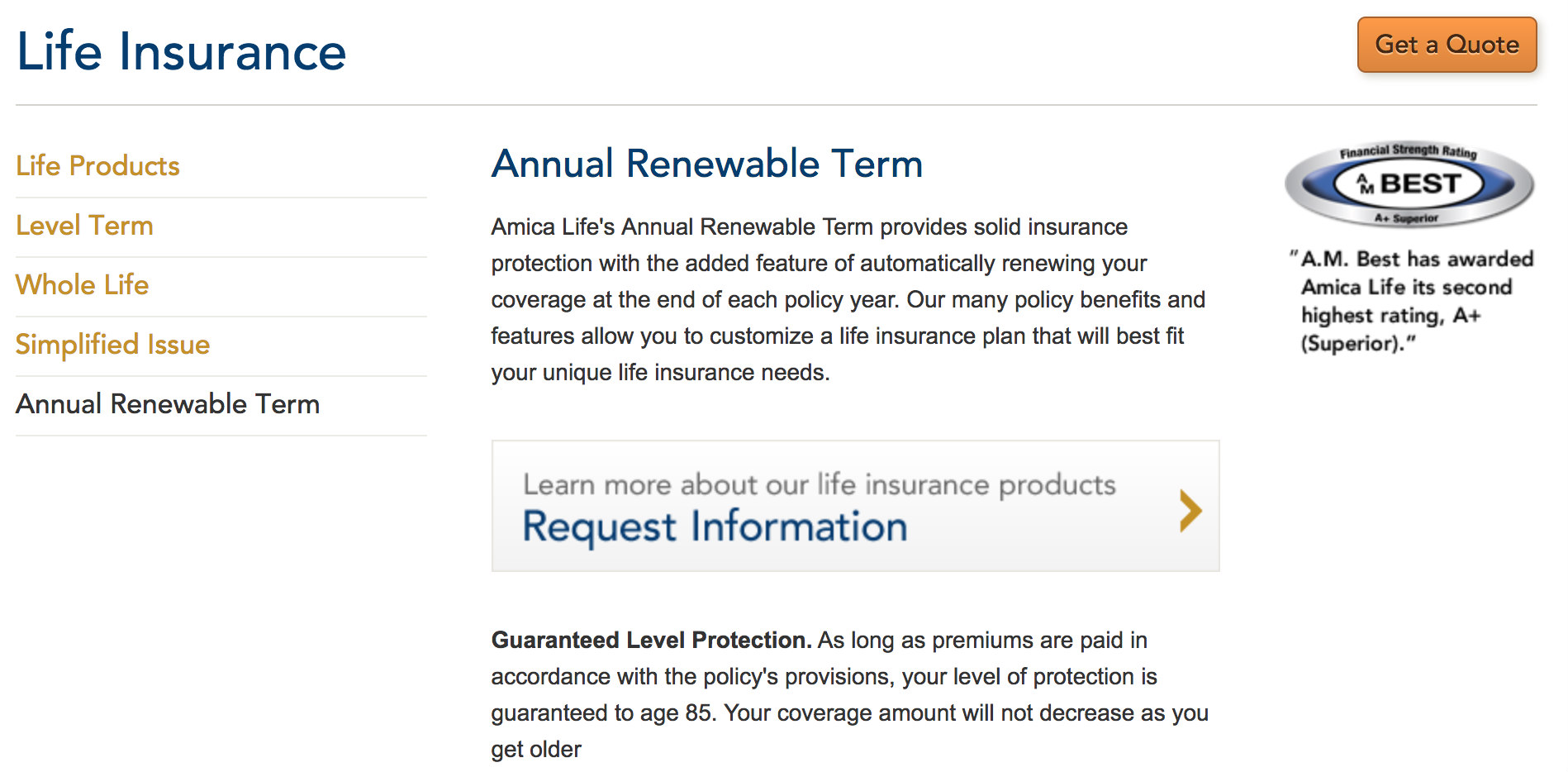

Fixed term plans provide coverage for a specified period of time. How annual renewable term insurance works If you pass away during this time, your beneficiary receives money from the life insurance company. Your insurer will guarantee insurability for a set number of years, and your policy renews each year unless you cancel it. Up to age 55, 60, 65, 70, 75, 80 or 85). Instead, your coverage is automatically renewable by paying your premiums.

A term policy, by definition, offers a life cover only for a limited period of time.

The insurance company guarantees to renew the policy yearly for a set number of years. Most term life policies are convertible — that is, you can convert a term life policy into a permanent one Your insurer will guarantee insurability for a set number of years, and your policy renews each year unless you cancel it. Every insurer has set different criteria, and,. What is annual renewable term insurance? Up to age 55, 60, 65, 70, 75, 80 or 85).

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

Renewal of a life insurance policy is generally allowed until the policy holder reaches a specific age. The policy lasts for one year: Up to age 55, 60, 65, 70, 75, 80 or 85). You might know about art but do you know about art? Not all term insurance plans come with the provision for renewability.

Source: effortlessinsurance.com

Source: effortlessinsurance.com

Although the premiums of the aforementioned policies are reassessed annually, their benefits far. Fixed term plans provide coverage for a specified period of time. A renewable term life insurance policy is term life coverage with a clause that allows the policy owner to renew coverage at the end of the term without undergoing new underwriting. This makes it even more affordable compared to individual term insurance policies. How annual renewable term insurance works

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

How annual renewable term insurance works A term policy, by definition, offers a life cover only for a limited period of time. What is annual renewable term insurance? Renewal of a life insurance policy is generally allowed until the policy holder reaches a specific age. An annual renewable term policy is a type of renewable term life insurance policy.

Source: lifeinsurancewithoutamedicalexams.com

Source: lifeinsurancewithoutamedicalexams.com

Sedpi’s group yearly renewable term has php500,000 life benefits and php500,000 accident benefits. What is annual renewable term insurance? A renewable term insurance policy is an option through which you can extend your life insurance cover when the original term is about to end. Sedpi’s group yearly renewable term has php500,000 life benefits and php500,000 accident benefits. The coverage can be sought for a duration of as low as five years.

Source: aaronpeacock.com

Source: aaronpeacock.com

An annual renewable term policy is a type of renewable term life insurance policy. Every insurer has set different criteria, and,. A renewable term is a clause in many term life insurance contracts that lets you extend coverage without buying a new policy. When you purchase a term life insurance policy, it will last for a specific term length, usually from 5, 10, 15, 20, and 30 years. Renewable term plans on the other hand will only provide coverage for a short period of time.

Source: insurancebrokersusa.com

Source: insurancebrokersusa.com

At the end of this term period, almost every company gives you the option to renew your policy without having to prove proof of insurability. A renewable term is a clause in many term life insurance contracts that lets you extend coverage without buying a new policy. At the end of this term period, almost every company gives you the option to renew your policy without having to prove proof of insurability. Up to age 55, 60, 65, 70, 75, 80 or 85). Your insurer will guarantee insurability for a set number of years, and your policy renews each year unless you cancel it.

Source: money.stackexchange.com

Source: money.stackexchange.com

Which types of term insurance can i renew? The good news about this policy is that the insurer has to pay the installment on the given dates to renew the policy without any medical exam or any other procedure. Although the premiums of the aforementioned policies are reassessed annually, their benefits far. Sedpi’s group yearly renewable term has php500,000 life benefits and php500,000 accident benefits. Typically, the term period lasts 10, 20, or 30 years:

Source: termlife360.insure

Source: termlife360.insure

Renewal of a life insurance policy is generally allowed until the policy holder reaches a specific age. Your premiums increase every year or every few years: There are two types of term insurance, namely fixed term and renewable term plans. Term life insurance guarantees a death benefit to your beneficiary for a set time, such as 10, 20 or 30 years. Due to its affordability, participation in group insurance is high.

Source: integon-life-insurance.blogspot.com

Source: integon-life-insurance.blogspot.com

Which types of term insurance can i renew? A renewable term life insurance policy is term life coverage with a clause that allows the policy owner to renew coverage at the end of the term without undergoing new underwriting. Renewable term plans on the other hand will only provide coverage for a short period of time. Not all term insurance plans come with the provision for renewability. The policy lasts for one year:

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Annual renewable term (art) is temporary protection for a duration of one year. At the end of this term period, almost every company gives you the option to renew your policy without having to prove proof of insurability. Typically, the term period lasts 10, 20, or 30 years: Sedpi’s group yearly renewable term has php500,000 life benefits and php500,000 accident benefits. The insurance company guarantees to renew the policy yearly for a set number of years.

Source: fiscalwisdom.com

Source: fiscalwisdom.com

How annual renewable term insurance works There are specific insurance policies are do not consider the renewal if the policy holder age is more than 80 years old. At the end of this term period, almost every company gives you the option to renew your policy without having to prove proof of insurability. Although the premiums of the aforementioned policies are reassessed annually, their benefits far. Typically, the term period lasts 10, 20, or 30 years:

Source: effortlessinsurance.com

Source: effortlessinsurance.com

An annual renewable term policy is a type of renewable term life insurance policy. If you pass away during this time, your beneficiary receives money from the life insurance company. Art or annual renewable term insurance is a great option for short term insurance. Unlike traditional term life insurance, premiums start low and increase every time you renew your policy. The coverage can be sought for a duration of as low as five years.

Source: simplyinsurance.com

Source: simplyinsurance.com

A renewable term life insurance policy is term life coverage with a clause that allows the policy owner to renew coverage at the end of the term without undergoing new underwriting. Up to age 55, 60, 65, 70, 75, 80 or 85). Your insurer will guarantee insurability for a set number of years, and your policy renews each year unless you cancel it. This makes it even more affordable compared to individual term insurance policies. Annual renewable term (art) life insurance, also known as yearly renewable term (yrt) life insurance falls under the term life insurance category.

Although the premiums of the aforementioned policies are reassessed annually, their benefits far. Generally speaking, the premiums remain the same throughout the term: You might know about art but do you know about art? When you purchase a term life insurance policy, it will last for a specific term length, usually from 5, 10, 15, 20, and 30 years. Not all term insurance plans come with the provision for renewability.

Source: epsuboy.blogspot.com

Source: epsuboy.blogspot.com

Which types of term insurance can i renew? The good news about this policy is that the insurer has to pay the installment on the given dates to renew the policy without any medical exam or any other procedure. Fixed term plans provide coverage for a specified period of time. You might know about art but do you know about art? This makes it even more affordable compared to individual term insurance policies.

Source: slideshare.net

Source: slideshare.net

The coverage can be sought for a duration of as low as five years. The insurance company guarantees to renew the policy yearly for a set number of years. A renewable term life insurance policy is term life coverage with a clause that allows the policy owner to renew coverage at the end of the term without undergoing new underwriting. Typically, the term period lasts 10, 20, or 30 years: What is renewable term life insurance?

Source: slideshare.net

Source: slideshare.net

What is annual renewable term insurance? Due to its affordability, participation in group insurance is high. Sedpi’s group yearly renewable term has php500,000 life benefits and php500,000 accident benefits. This policy guarantees the owner insurability for one year. Generally speaking, the premiums remain the same throughout the term:

Source: slideshare.net

Source: slideshare.net

Numerous insurers have specified varying maximum ages for their term life insurance plans. Your insurer will guarantee insurability for a set number of years, and your policy renews each year unless you cancel it. When you purchase a term life insurance policy, it will last for a specific term length, usually from 5, 10, 15, 20, and 30 years. Every insurer has set different criteria, and,. Renewal of a life insurance policy is generally allowed until the policy holder reaches a specific age.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title which term insurance is renewable by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information