Which type of insurance policy would someone information

Home » Trend » Which type of insurance policy would someone informationYour Which type of insurance policy would someone images are available. Which type of insurance policy would someone are a topic that is being searched for and liked by netizens now. You can Get the Which type of insurance policy would someone files here. Download all free photos.

If you’re looking for which type of insurance policy would someone pictures information linked to the which type of insurance policy would someone interest, you have come to the right blog. Our website always provides you with suggestions for seeking the highest quality video and picture content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

Which Type Of Insurance Policy Would Someone. $25,000 for bodily injury of one person, $50,000 for injuries resulting in the death of one person, $50,000 for bodily injury of two or more people in one accident, $100,000 for injuries resulting in the death of two or more people in any single accident, $10,000 for property damage liability per accident. An entity which provides insurance is known as an insurer, an insurance company, an insurance carrier or an underwriter.a person or entity who buys insurance is known as a policyholder, while a person or entity. You can transfer the rights on your insurance policy to another person / entity for various reasons. It is usually effected for consideration of natural love and affection.

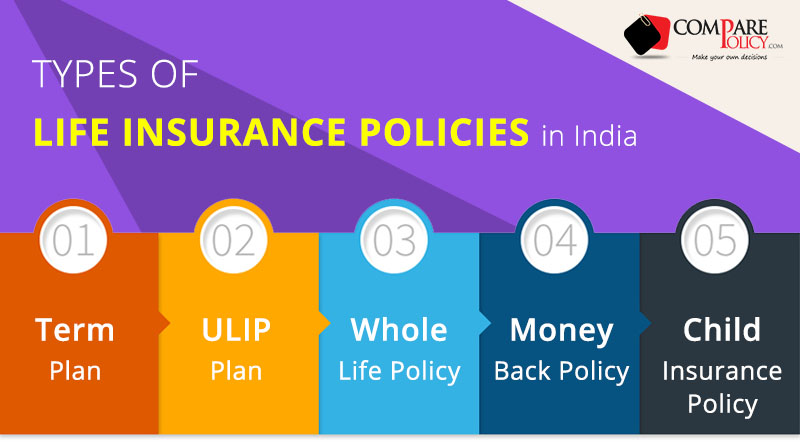

Types of Life Insurance Policies in India ComparePolicy From comparepolicy.com

Types of Life Insurance Policies in India ComparePolicy From comparepolicy.com

To provide financial protection to your loved ones if you’re not there.the way a policy carries out that promise is defined by a few key features: At its core, a life insurance policy is a promise: The person who assigns the insurance policy is called the assignor (policyholder) and the one to whom the policy has been assigned, i.e. So, you get coverage for a defined period. The payout to beneficiaries is made when both have passed away. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

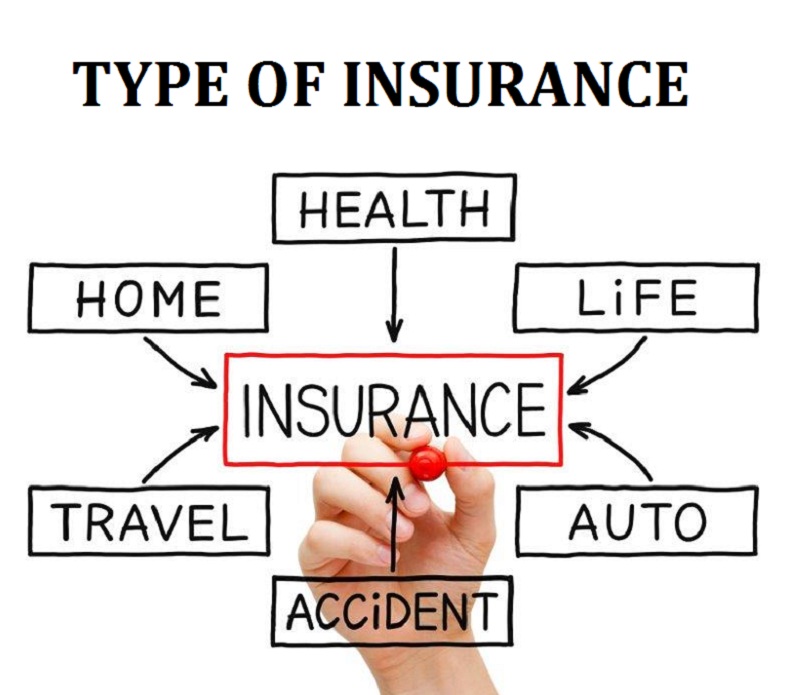

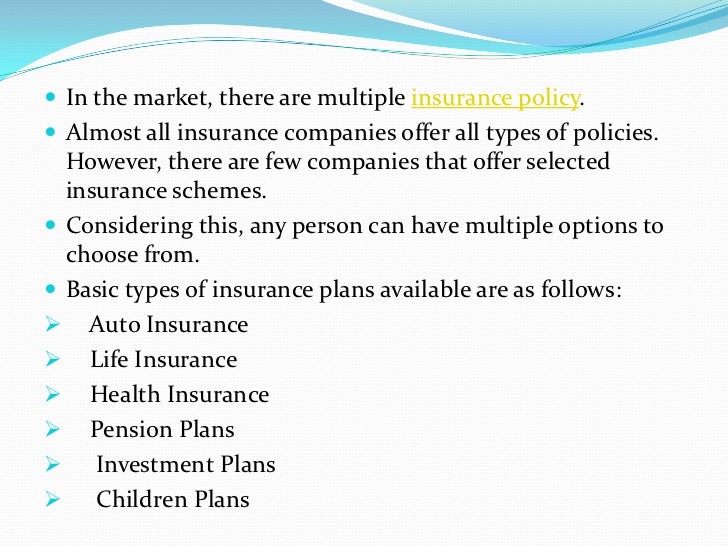

Auto, property, health, disability, and life are the top types of insurance that help you protect yourself and your assets.

$25,000 for bodily injury of one person, $50,000 for injuries resulting in the death of one person, $50,000 for bodily injury of two or more people in one accident, $100,000 for injuries resulting in the death of two or more people in any single accident, $10,000 for property damage liability per accident. The payout to beneficiaries is made when both have passed away. To provide financial protection to your loved ones if you’re not there.the way a policy carries out that promise is defined by a few key features: Final expense and burial insurance are both types of whole life insurance policies that focus on people between the ages of 50 to 85. While many people understand the importance of this coverage, choosing exactly the right policy can be difficult. 6 types of term life insurance policies.

Source: trendytarzan.com

Source: trendytarzan.com

The person who assigns the insurance policy is called the assignor (policyholder) and the one to whom the policy has been assigned, i.e. Term life insurance lasts for a term.”. Liability insurance (bodily injury and property damage): “there are different types of life insurance, and choosing a policy is an important decision,” says brian bayerle, senior actuary at the american council of life insurers. So, you get coverage for a defined period.

Source: nipun-frendshipspot.blogspot.com

Source: nipun-frendshipspot.blogspot.com

“there are different types of life insurance, and choosing a policy is an important decision,” says brian bayerle, senior actuary at the american council of life insurers. There is a wide range of insurance policies, each aimed at safeguarding certain aspects of your health or assets. Auto, property, health, disability, and life are the top types of insurance that help you protect yourself and your assets. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. Talk with licensed agents to find out the best ways to make these policies work for you.

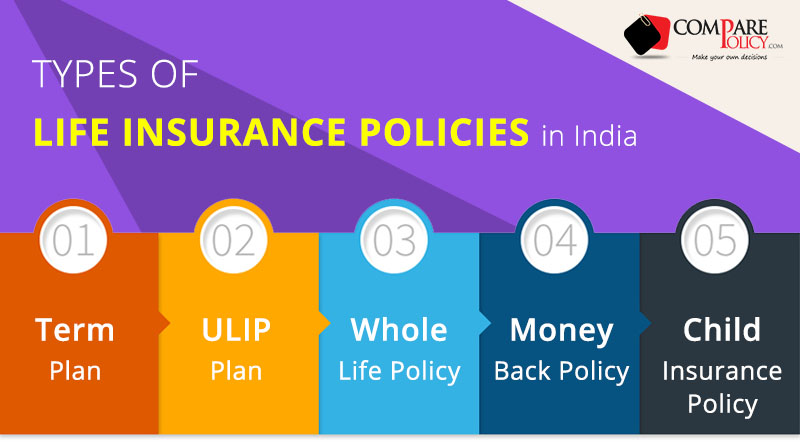

Source: comparepolicy.com

Source: comparepolicy.com

$25,000 for bodily injury of one person, $50,000 for injuries resulting in the death of one person, $50,000 for bodily injury of two or more people in one accident, $100,000 for injuries resulting in the death of two or more people in any single accident, $10,000 for property damage liability per accident. A slip on the walk, a harsh and untrue word spoken in anger, an accident on the ball field. A personal liability policy covers many types of these risks and can give coverage in excess of that provided by homeowner’s and automobile insurance. A portion of premiums go toward the death benefit, while the remaining is invested by the insurer. Liability insurance (bodily injury and property damage):

Source: thebalance.com

Source: thebalance.com

This process is referred to as ‘ assignment ’. Assignment may take two forms: It is usually effected for consideration of natural love and affection. $25,000 for bodily injury of one person, $50,000 for injuries resulting in the death of one person, $50,000 for bodily injury of two or more people in one accident, $100,000 for injuries resulting in the death of two or more people in any single accident, $10,000 for property damage liability per accident. Introduction lesson loyd’s of london is one of the most famous insurance groups in the world.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

It is usually effected for consideration of natural love and affection. A slip on the walk, a harsh and untrue word spoken in anger, an accident on the ball field. An entity which provides insurance is known as an insurer, an insurance company, an insurance carrier or an underwriter.a person or entity who buys insurance is known as a policyholder, while a person or entity. Offer life cover for the whole life of an individual; It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

Source: insureye.com

Source: insureye.com

Final expense and burial insurance are both types of whole life insurance policies that focus on people between the ages of 50 to 85. Gives life coverage for a specific time period. There is a wide range of insurance policies, each aimed at safeguarding certain aspects of your health or assets. It is usually effected for consideration of natural love and affection. To provide financial protection to your loved ones if you’re not there.the way a policy carries out that promise is defined by a few key features:

Source: pimlicodental.com

Source: pimlicodental.com

An entity which provides insurance is known as an insurer, an insurance company, an insurance carrier or an underwriter.a person or entity who buys insurance is known as a policyholder, while a person or entity. Always check with your employer first for. These joint life insurance policies ensure two people under one policy, such as a husband and wife. It has been known to issue insurance policies on several very interesting and unique items, including brooke shields’ and tina turner’s legs, jimmy durante’s nose, It is usually effected for consideration of natural love and affection.

Source: iedunote.com

Source: iedunote.com

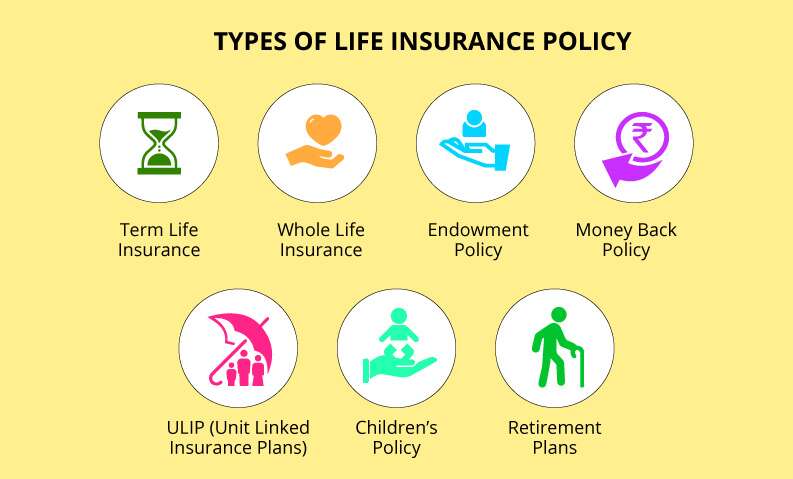

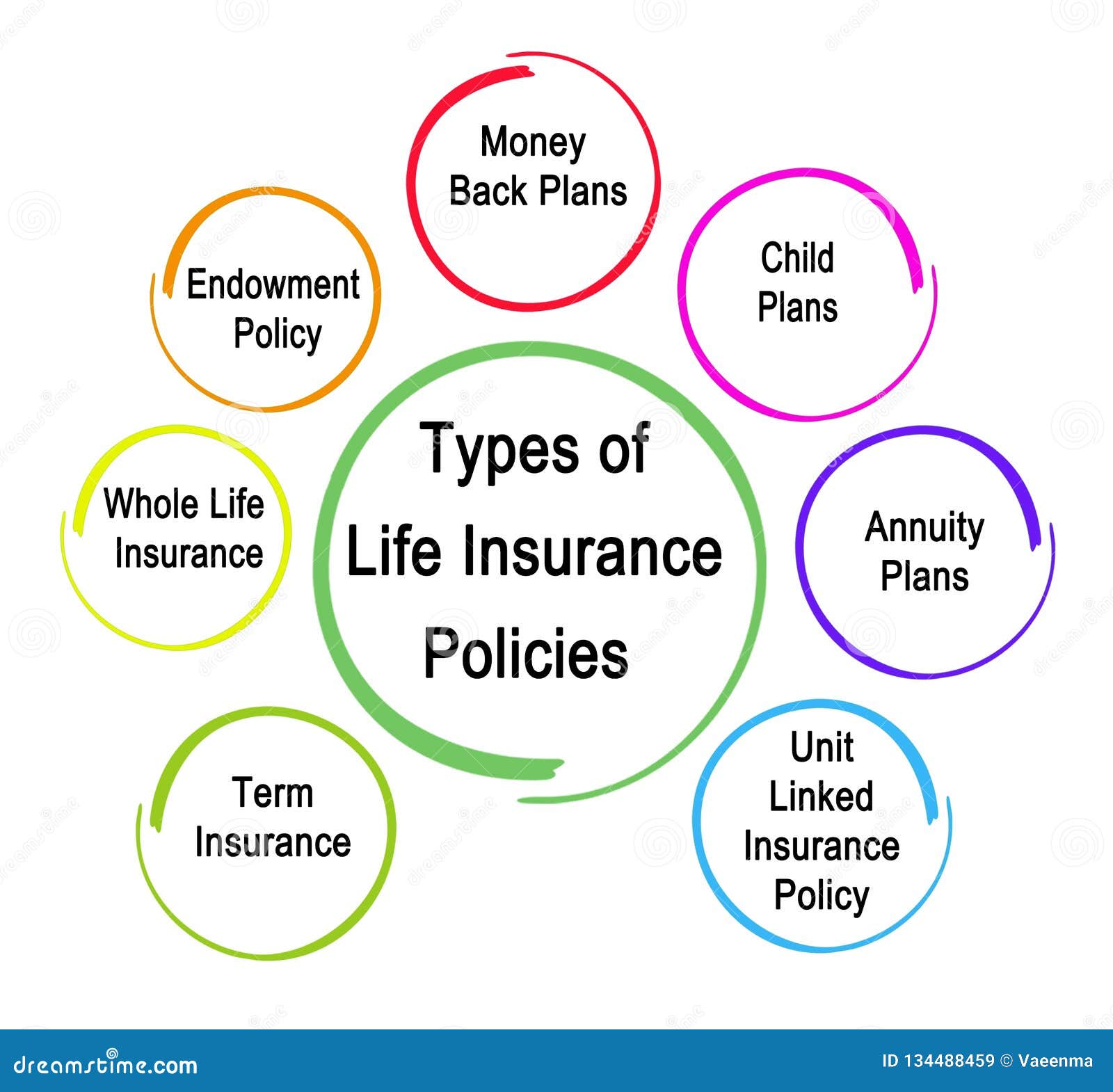

It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. Whole life insurance is a type of permanent type of life insurance that’s active for your life. At its core, a life insurance policy is a promise: Know more about types of life insurance policies in india. To provide financial protection to your loved ones if you’re not there.the way a policy carries out that promise is defined by a few key features:

Source: easyquotes4you.com

Source: easyquotes4you.com

A portion of premiums go toward the death benefit, while the remaining is invested by the insurer. 6 types of term life insurance policies. A slip on the walk, a harsh and untrue word spoken in anger, an accident on the ball field. $25,000 for bodily injury of one person, $50,000 for injuries resulting in the death of one person, $50,000 for bodily injury of two or more people in one accident, $100,000 for injuries resulting in the death of two or more people in any single accident, $10,000 for property damage liability per accident. Liability insurance (bodily injury and property damage):

Source: niveshmarket.com

Source: niveshmarket.com

Term life insurance lasts for a term.”. Offer life cover for the whole life of an individual; Auto, property, health, disability, and life are the top types of insurance that help you protect yourself and your assets. “there are different types of life insurance, and choosing a policy is an important decision,” says brian bayerle, senior actuary at the american council of life insurers. A personal liability policy covers many types of these risks and can give coverage in excess of that provided by homeowner’s and automobile insurance.

Source: comparepolicy.com

Source: comparepolicy.com

Broadly, there are 8 types of insurance, namely: The payout to beneficiaries is made when both have passed away. Offer life cover for the whole life of an individual; These policies won’t offer more than $25,000 in death benefit and are much easier to get approved for. $25,000 for bodily injury of one person, $50,000 for injuries resulting in the death of one person, $50,000 for bodily injury of two or more people in one accident, $100,000 for injuries resulting in the death of two or more people in any single accident, $10,000 for property damage liability per accident.

Source: slideshare.net

Source: slideshare.net

It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. Introduction lesson loyd’s of london is one of the most famous insurance groups in the world. “there are different types of life insurance, and choosing a policy is an important decision,” says brian bayerle, senior actuary at the american council of life insurers. Offer life cover for the whole life of an individual; While many people understand the importance of this coverage, choosing exactly the right policy can be difficult.

Source: findependencehub.com

Source: findependencehub.com

Term life insurance lasts for a term.”. But you should also think about your needs. At its core, a life insurance policy is a promise: Broadly, there are 8 types of insurance, namely: In case of the insured person’s demise, the nominee gets the sum assured or fund value, whichever is higher.

Source: thenews-syp.blogspot.com

Source: thenews-syp.blogspot.com

In this litigious society, a person can be sued for just about anything: In this litigious society, a person can be sued for just about anything: This process is referred to as ‘ assignment ’. Final expense and burial insurance are both types of whole life insurance policies that focus on people between the ages of 50 to 85. An entity which provides insurance is known as an insurer, an insurance company, an insurance carrier or an underwriter.a person or entity who buys insurance is known as a policyholder, while a person or entity.

Source: basicfinancecare.com

Source: basicfinancecare.com

Auto, property, health, disability, and life are the top types of insurance that help you protect yourself and your assets. At its core, a life insurance policy is a promise: “there are different types of life insurance, and choosing a policy is an important decision,” says brian bayerle, senior actuary at the american council of life insurers. Talk with licensed agents to find out the best ways to make these policies work for you. Liability insurance (bodily injury and property damage):

Source: coverfox.com

Source: coverfox.com

Talk with licensed agents to find out the best ways to make these policies work for you. But you should also think about your needs. These policies won’t offer more than $25,000 in death benefit and are much easier to get approved for. Insurers offer many types of life insurance policies, but in the end, most choose either a traditional whole or term life option. The payout to beneficiaries is made when both have passed away.

Source: oikarinsurancetips.blogspot.com

Source: oikarinsurancetips.blogspot.com

The fee paid for insurance protection. It has been known to issue insurance policies on several very interesting and unique items, including brooke shields’ and tina turner’s legs, jimmy durante’s nose, A portion of premiums go toward the death benefit, while the remaining is invested by the insurer. Assignment may take two forms: A slip on the walk, a harsh and untrue word spoken in anger, an accident on the ball field.

![]() Source: paisabazaar.com

Source: paisabazaar.com

A portion of premiums go toward the death benefit, while the remaining is invested by the insurer. It is usually effected for consideration of natural love and affection. In this litigious society, a person can be sued for just about anything: Assignment may take two forms: The payout to beneficiaries is made when both have passed away.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title which type of insurance policy would someone by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information