Who is a mutual insurance company owned by Idea

Home » Trending » Who is a mutual insurance company owned by IdeaYour Who is a mutual insurance company owned by images are available. Who is a mutual insurance company owned by are a topic that is being searched for and liked by netizens today. You can Find and Download the Who is a mutual insurance company owned by files here. Find and Download all royalty-free images.

If you’re searching for who is a mutual insurance company owned by images information linked to the who is a mutual insurance company owned by keyword, you have come to the ideal blog. Our website always provides you with hints for viewing the maximum quality video and image content, please kindly surf and locate more informative video content and images that match your interests.

Who Is A Mutual Insurance Company Owned By. Mutual company policyholder’s membership rights include: The policyholder may be asked to. The company was founded as a mutual company, a structure in which an insurance company is owned by its policyholders. What is a mutual insurance company?

Liberty Mutual Insurance Actual Cash Value Calculation From classactionsreporter.com

Liberty Mutual Insurance Actual Cash Value Calculation From classactionsreporter.com

Liberty mutual was formed in 1912 as the massachusetts employees insurance association (meia), following passage of a 1911 massachusetts law requiring employers to protect their employees with workers’ compensation insurance. Membership rights that are contractual, such as company dividends declared by the board of directors Examples of such companies are gore mutual insurance, trillum mutual insurance and yarmouth mutual. A mutual insurance company is an insurance company owned entirely by its policyholders. Guardian life is a mutual insurance company, that is owned by their policyholders. A mutual insurance company is technically owned and controlled by its policyholders.

The sole purpose of a mutual insurance company is to provide insurance coverage for its members and policyholders, and its members are given the right to select management.

A mutual insurance company is an insurance company owned entirely by its policyholders. The sole purpose of a mutual insurance company is to provide insurance coverage for its members and policyholders, and its members are given the right to select management. The key difference of these insurers is that any profit earned by these companies is distributed back to the policyholders either as dividends or in the form of reduced insurance rates. A mutual insurer is a company “owned” by qualified policyholders, people who have purchased certain insurance products from the business. In other words, the policyholder cannot sell his or her interest to another person. Federated mutual insurance company has 2,270 total employees across all of its locations and generates $1.54 billion in sales (usd).

Source: prweb.com

A mutual company is a type of company wherein the ownership is held by the depositors, customers, or policyholders of an institution. Since mutual insurers are owned by their policyholders, every qualifying policyholder gets votes for the board of directors. Mutual companies are actually owned by the policyholders who are considered shareholders and can receive dividend payment distributions and may not be penalized by an increase in premium due to losses. The policyholder may be asked to. These are single insurance companies that are jointly owned by their policyholders.

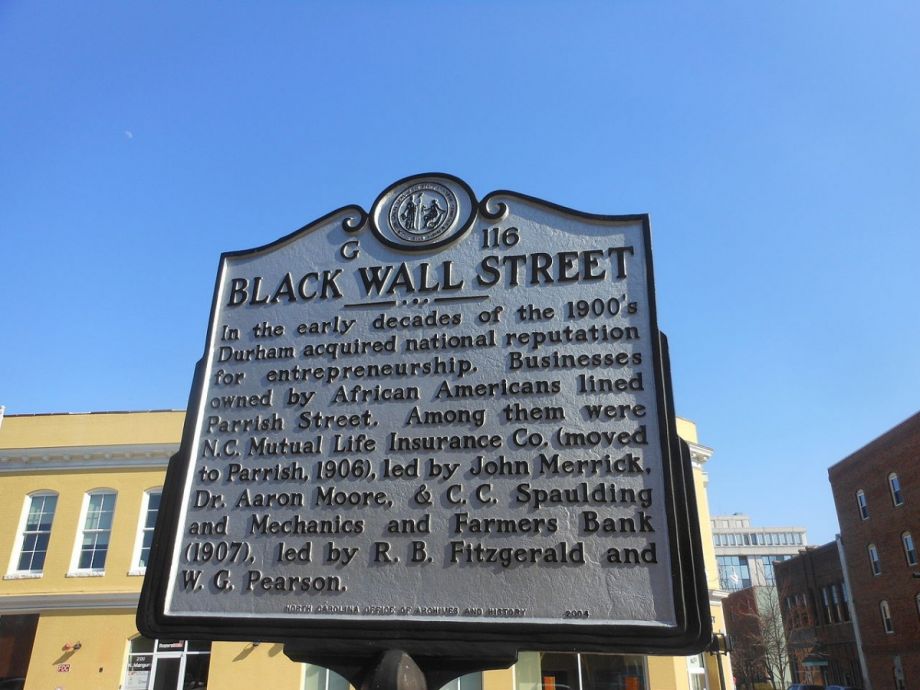

Source: blackpast.org

Source: blackpast.org

A mutual insurance company is an insurance company whose policyholders are also the owners. Federated mutual insurance company has 2,270 total employees across all of its locations and generates $1.54 billion in sales (usd). Examples of such companies are gore mutual insurance, trillum mutual insurance and yarmouth mutual. Mutual companies are actually owned by the policyholders who are considered shareholders and can receive dividend payment distributions and may not be penalized by an increase in premium due to losses. Privately held company a privately held company is a company’s whose shares are owned by individuals or.

Source: prodtemp.preferredmutual.com

Source: prodtemp.preferredmutual.com

Life insurance, disability income, annuities, investments, individual dental insurance, workplace benefits, retirement services. The company was founded as a mutual company, a structure in which an insurance company is owned by its policyholders. Federated mutual insurance company is located in owatonna, mn, united states and is part of the insurance carriers industry. A mutual company is a type of company wherein the ownership is held by the depositors, customers, or policyholders of an institution. Examples of such companies are gore mutual insurance, trillum mutual insurance and yarmouth mutual.

Source: africansonchina.com

Source: africansonchina.com

A mutual insurance company is an insurance company that is owned by policyholders. The mutual company’s policy owners are the corporation’s members, controlling the mutual insurer and giving them rights of membership. What is a mutual insurance company? A mutual insurance company is an insurance company owned entirely by its policyholders. Often a stock holding company will be placed between the mutual holding company and the insurance entity to offer the company greater flexibility.

Source: vermontmutual.com

Source: vermontmutual.com

This structure exists solely to provide insurance protection to the policyholders who often have the right to elect management personnel. These are single insurance companies that are jointly owned by their policyholders. Since mutual insurers are owned by their policyholders, every qualifying policyholder gets votes for the board of directors. Examples of such companies are gore mutual insurance, trillum mutual insurance and yarmouth mutual. The sole purpose of a mutual insurance company is to provide insurance coverage for its members and policyholders.

Source: masondesignsca.blogspot.com

Source: masondesignsca.blogspot.com

Moreover, as owners, the policyholders are entitled to a share of the company�s profits. It is almost always a private corporation. In this type of conversion, the mutual insurance company is converted to a stock insurance company that is fully owned by a mutual holding company. The mutual company’s policy owners are the corporation’s members, controlling the mutual insurer and giving them rights of membership. What is a mutual insurance company?

Source: insuremesgb.com

Source: insuremesgb.com

This structure exists solely to provide insurance protection to the policyholders who often have the right to elect management personnel. The key difference of these insurers is that any profit earned by these companies is distributed back to the policyholders either as dividends or in the form of reduced insurance rates. They are most often insurance companies. Membership rights that are contractual, such as company dividends declared by the board of directors A mutual insurance company is an insurance company owned entirely by its policyholders.

Source: ncmuseumofhistory.org

But no one who is merely a mutual insurance company�s policyholder exercises control of the company. These are single insurance companies that are jointly owned by their policyholders. They are most often insurance companies. In this type of conversion, the mutual insurance company is converted to a stock insurance company that is fully owned by a mutual holding company. A mutual insurance company is technically owned and controlled by its policyholders.

Source: triadculturalarts.org

Source: triadculturalarts.org

A mutual life insurance company, by contrast, is owned by its policyholders, not by shareholders. In other words, the policyholder cannot sell his or her interest to another person. Since mutual insurers are owned by their policyholders, every qualifying policyholder gets votes for the board of directors. This structure exists solely to provide insurance protection to the policyholders who often have the right to elect management personnel. Guardian life is a mutual insurance company, that is owned by their policyholders.

Source: classactionsreporter.com

Source: classactionsreporter.com

Often a stock holding company will be placed between the mutual holding company and the insurance entity to offer the company greater flexibility. The company was founded as a mutual company, a structure in which an insurance company is owned by its policyholders. Since mutual insurers are owned by their policyholders, every qualifying policyholder gets votes for the board of directors. A mutual insurance company is an insurance company that is owned by policyholders. Privately held company a privately held company is a company’s whose shares are owned by individuals or.

Source: investopedia.com

Source: investopedia.com

Examples of such companies are gore mutual insurance, trillum mutual insurance and yarmouth mutual. Membership rights that are contractual, such as company dividends declared by the board of directors Often a stock holding company will be placed between the mutual holding company and the insurance entity to offer the company greater flexibility. A mutual insurance company is an insurance company that is owned by policyholders. What is a mutual insurance company?

Source: blackhistory.com

Source: blackhistory.com

The policyholders elect the board of directors for. Mutual company policyholder’s membership rights include: The sole purpose of a mutual insurance company is to provide insurance coverage for its members and policyholders. A mutual life insurance company, by contrast, is owned by its policyholders, not by shareholders. It is almost always a private corporation.

Source: pikecountymutual.com

Source: pikecountymutual.com

The sole purpose of a mutual insurance company is to provide insurance coverage for its members and policyholders. What is a mutual insurance company? Federated mutual insurance company has 2,270 total employees across all of its locations and generates $1.54 billion in sales (usd). The policyholders elect the board of directors for. But no one who is merely a mutual insurance company�s policyholder exercises control of the company.

Source: mylifewithvoguee.blogspot.com

Privately held company a privately held company is a company’s whose shares are owned by individuals or. Moreover, as owners, the policyholders are entitled to a share of the company�s profits. Membership rights that are contractual, such as company dividends declared by the board of directors These are single insurance companies that are jointly owned by their policyholders. Often a stock holding company will be placed between the mutual holding company and the insurance entity to offer the company greater flexibility.

Source: flickr.com

Source: flickr.com

The key difference of these insurers is that any profit earned by these companies is distributed back to the policyholders either as dividends or in the form of reduced insurance rates. The sole purpose of a mutual insurance company is to provide insurance coverage for its members and policyholders, and its members are given the right to select management. A mutual company is owned by its customers, who share in the profits. Any profits earned by a mutual insurance company are either retained within the company or rebated to policyholders in the form of dividend distributions or reduced future premiums. It is almost always a private corporation.

Source: brocorights.blogspot.com

Source: brocorights.blogspot.com

This structure exists solely to provide insurance protection to the policyholders who often have the right to elect management personnel. The sole purpose of a mutual insurance company is to provide insurance coverage for its members and policyholders, and its members are given the right to select management. Liberty mutual was formed in 1912 as the massachusetts employees insurance association (meia), following passage of a 1911 massachusetts law requiring employers to protect their employees with workers’ compensation insurance. First, let see what is a mutual insurance company and what benefits it provides. A mutual company is owned by its customers, who share in the profits.

Mutual company policyholder’s membership rights include: The main aim of all mutual insurance companies is to provide insurance coverage for its members (policyholders). It is almost always a private corporation. A mutual insurance company is an insurance company owned entirely by its policyholders. What is a mutual insurance company?

Source: pinterest.com

Source: pinterest.com

Privately held company a privately held company is a company’s whose shares are owned by individuals or. But no one who is merely a mutual insurance company�s policyholder exercises control of the company. The main aim of all mutual insurance companies is to provide insurance coverage for its members (policyholders). In this type of conversion, the mutual insurance company is converted to a stock insurance company that is fully owned by a mutual holding company. They are most often insurance companies.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title who is a mutual insurance company owned by by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information