Who is exempt from workers compensation insurance california information

Home » Trending » Who is exempt from workers compensation insurance california informationYour Who is exempt from workers compensation insurance california images are ready in this website. Who is exempt from workers compensation insurance california are a topic that is being searched for and liked by netizens now. You can Download the Who is exempt from workers compensation insurance california files here. Get all royalty-free vectors.

If you’re searching for who is exempt from workers compensation insurance california images information linked to the who is exempt from workers compensation insurance california keyword, you have visit the right blog. Our website frequently gives you hints for viewing the highest quality video and image content, please kindly hunt and locate more enlightening video articles and images that match your interests.

Who Is Exempt From Workers Compensation Insurance California. In some cases, you can elect to be included in your own workers’ comp policy. Casual employees casual workers or employees with irregular work schedules may be exempt from workers compensation coverage. California workers’ compensation exemption laws apply to different types of business owners, such as corporate officers, directors and members of a llc if they aren’t employees of the business. In california, the general rule for workers’ comp is that all companies� employees must be covered in all industries.

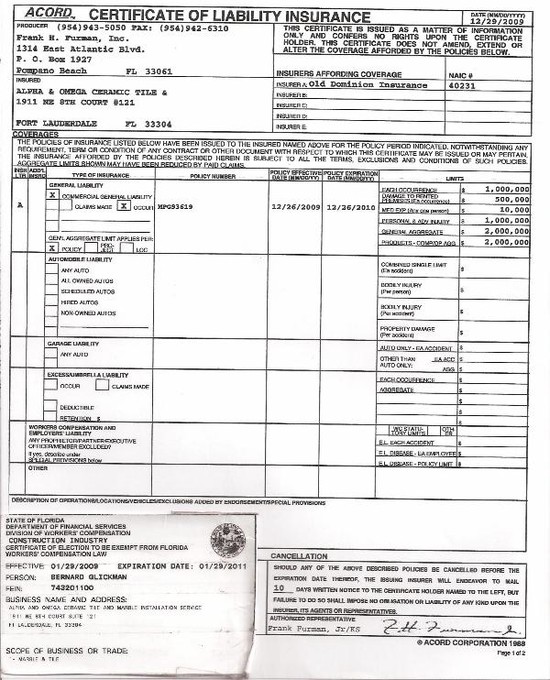

Workers Compensation Exemption Form Florida Free Download From formsbirds.com

Workers Compensation Exemption Form Florida Free Download From formsbirds.com

New jersey workers’ compensation law exempts unpaid interns, unpaid volunteers, independent contractors and sole proprietors with no employees from its workers’ comp law. Sole proprietors, partners, and corporate officers; Employees of instrumentalities owned by a foreign government are similarly exempt when there is a formal agreement. You cannot be exempt from workers� compensation if: With the state, from federal employees working in california and military personnel who are california residents stationed in california. All employers are required to carry coverage.

Be aware that corporate officers and llc owners receiving exemptions are not allowed to receive workers’ compensation benefits if they get hurt or become ill on the job.

Other exemptions include partnerships, who don’t have to cover themselves (but must provide coverage for employees). • foreign government employees are not subject to ui, ett, sdi, or pit withholding. Sole proprietors who have no employees other than themselves officers of corporations with full ownership of their companies Corporate officers and llc owners can choose to exempt themselves from workers’ compensation coverage by filing for an exemption with the state’s division of workers’ compensation. In california, the general rule for workers’ comp is that all companies� employees must be covered in all industries. The answer, somewhat surprisingly, is yes;

Source: formsbirds.com

Source: formsbirds.com

Any employer who has even one employee must have workers’ compensation insurance. Executive officers and directors of corporations must be included in workers’ compensation coverage, unless the corporation is fully owned by the directors and officers. Employers are required to maintain workers’ compensation insurance california law requires that employers, including those in the construction industry, carry workers’ compensation insurance, even if they have only one employee subject to california workers’ compensation laws1. However, certain employees are exempt from having workers’ compensation policies, such as the following: Or if you have employees (including home improvement salespersons (his).

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The answer, somewhat surprisingly, is yes; Full time, nor are there any exceptions for seasonal. If your business is a sole proprietorship, you—as the owner—are automatically excluded from workers’ comp. Employees of instrumentalities owned by a foreign government are similarly exempt when there is a formal agreement. Certain workers are not covered by workers’ compensation in california.

Source: consolidate-a-student-lo-1c8e.blogspot.com

Source: consolidate-a-student-lo-1c8e.blogspot.com

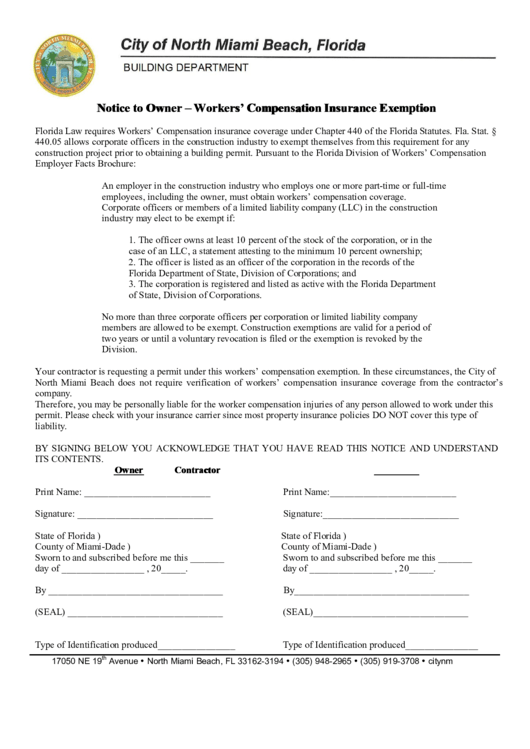

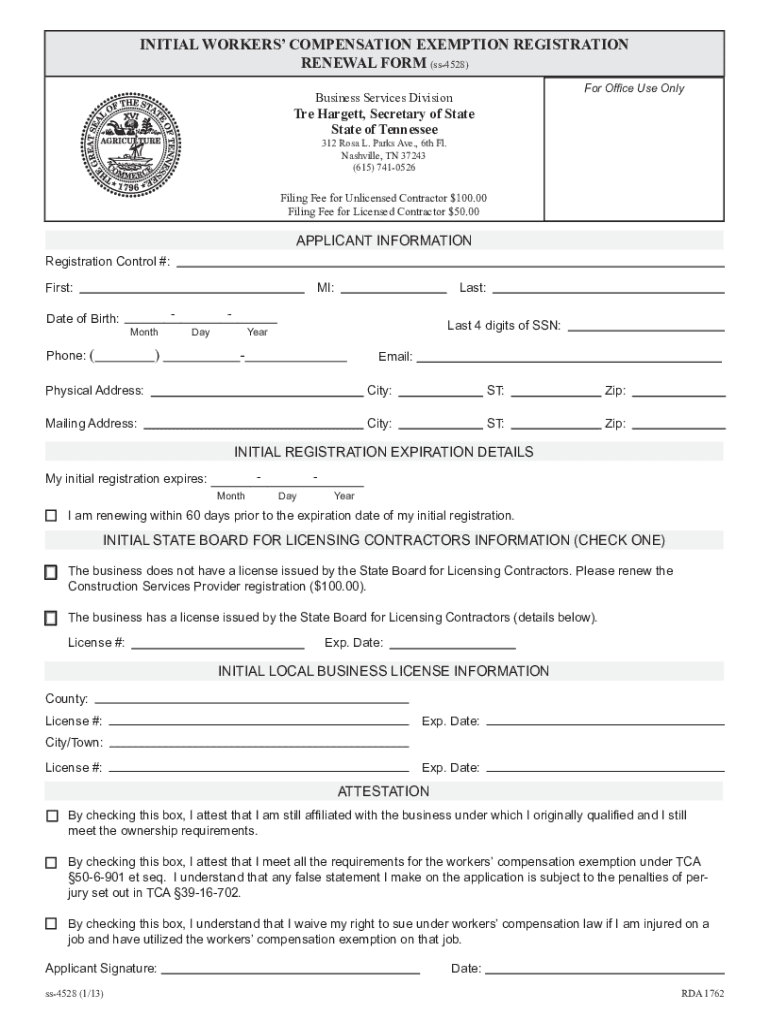

Certain “employment” situations and arrangements are exempt from the requirements of workers’ compensation. Or if you have employees (including home improvement salespersons (his). Exemption from workers� compensation you cannot file an exemption from workers� compensation form if any of the following conditions exist. Family members cannot be excluded from workers comp, unless, like above, they are a titled officer/shareholder if a corporation, a member if an llc, and a partner if a partnership. However, here are some cases where employees may be exempt from coverage.

Source: pinterest.com

Source: pinterest.com

Business owners and employees that qualify for workers’ comp exemptions states often exempt firms that employ few workers. There are no exceptions for employees who work part time vs. Employees of instrumentalities owned by a foreign government are similarly exempt when there is a formal agreement. Business owners/sole proprietors (aside from roofers) independent contractors domestic workers who are related to their employers individuals who work for aid (food, housing, etc.) rather than pay In some cases, you can elect to be included in your own workers’ comp policy.

Source: technomusicsport.blogspot.com

Source: technomusicsport.blogspot.com

Sole proprietors who have no employees other than themselves officers of corporations with full ownership of their companies Or if you have employees (including home improvement salespersons (his). Each state views exempted employment classes differently. Family members cannot be excluded from workers comp, unless, like above, they are a titled officer/shareholder if a corporation, a member if an llc, and a partner if a partnership. Casual employees casual workers or employees with irregular work schedules may be exempt from workers compensation coverage.

Source: compensationinsurancezuein.blogspot.com

Source: compensationinsurancezuein.blogspot.com

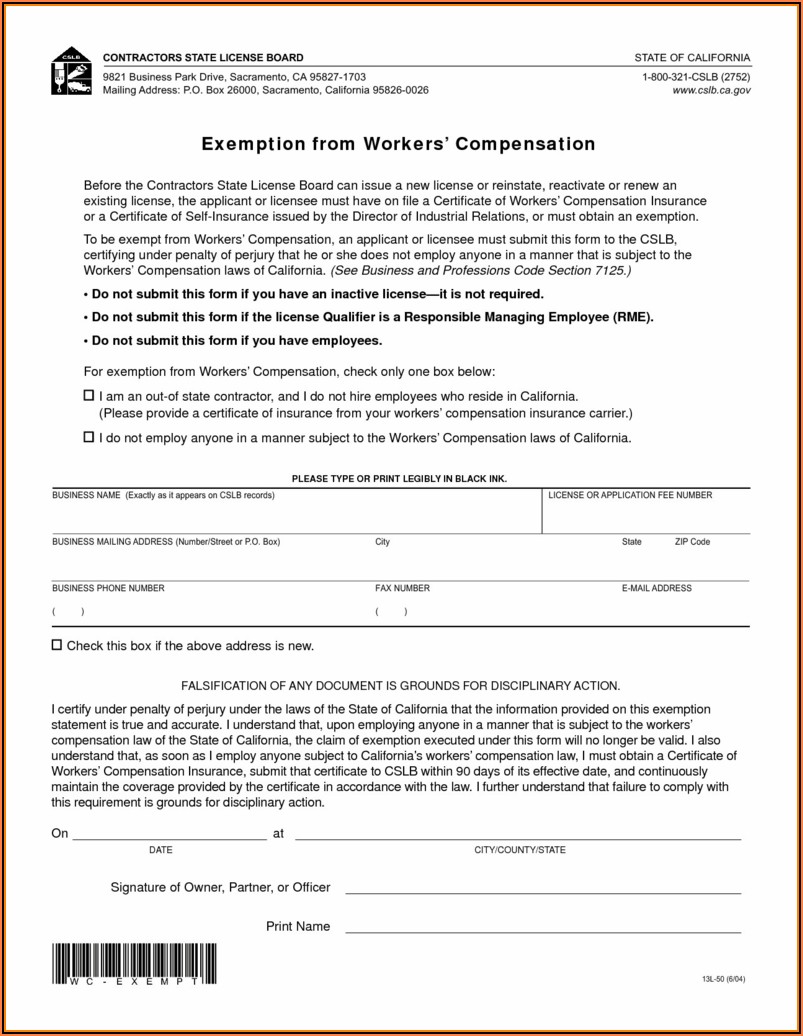

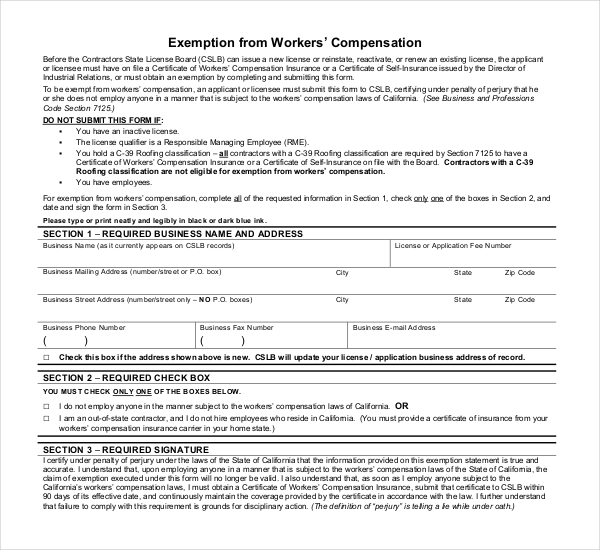

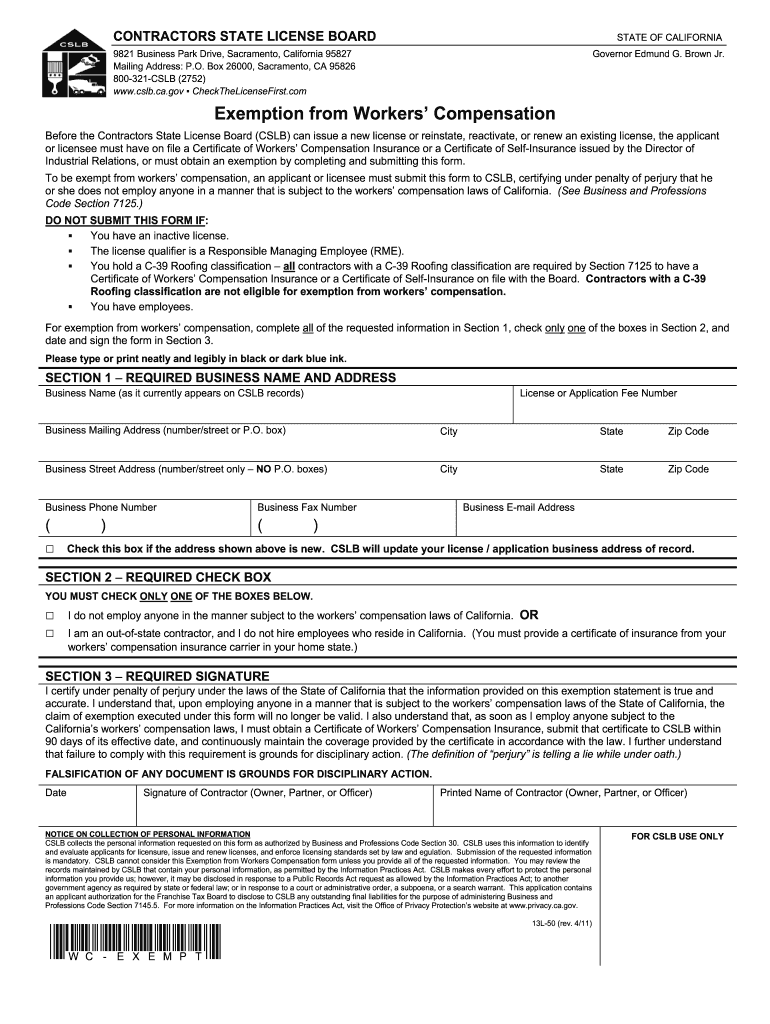

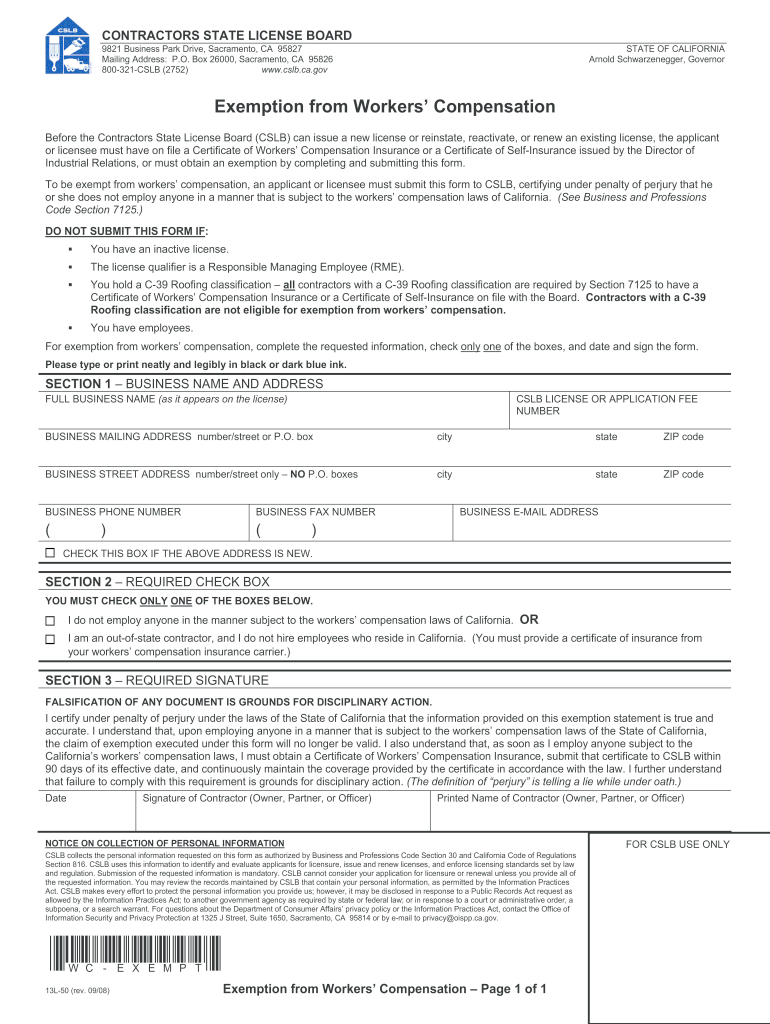

Exemption from workers� compensation you cannot file an exemption from workers� compensation form if any of the following conditions exist. The answer, somewhat surprisingly, is yes; Exemption from workers� compensation you cannot file an exemption from workers� compensation form if any of the following conditions exist. However, small business owners are typically exempt if they�re: Executive officers and directors of corporations must be included in workers’ compensation coverage, unless the corporation is fully owned by the directors and officers.

Source: contrapositionmagazine.com

Source: contrapositionmagazine.com

Certain “employment” situations and arrangements are exempt from the requirements of workers’ compensation. Exemption from workers� compensation you cannot file an exemption from workers� compensation form if any of the following conditions exist. Anyway, the answer is simply: You employ anyone in a manner that is subject to california workers� compensation laws. • foreign government employees are not subject to ui, ett, sdi, or pit withholding.

Source: ansaroo.com

Source: ansaroo.com

Employers or workers who work in or around a private home for 26 hours or less per week are also exempt. Or if you have employees (including home improvement salespersons (his). In some cases, you can elect to be included in your own workers’ comp policy. Legally, a sole proprietor with no employees is exempt from workers� compensation insurance, not just in california but in all of the united states. It’s always important to check with your government office to make sure you’re compliant with all workers compensation requirements.

Source: formsbank.com

Source: formsbank.com

It’s always important to check with your government office to make sure you’re compliant with all workers compensation requirements. You employ anyone in a manner that is subject to california workers� compensation laws. However, small business owners are typically exempt if they�re: All llc members who work in the business are included under coverage in california. Do i have to have workers’ compensation insurance?

Source: newatvs.info

Source: newatvs.info

With the state, from federal employees working in california and military personnel who are california residents stationed in california. Yes, every california employer using employee labor, including family members, must purchase workers’ compensation insurance (labor code section 3700). Certain “employment” situations and arrangements are exempt from the requirements of workers’ compensation. There are no exceptions for employees who work part time vs. Business owners/sole proprietors (aside from roofers) independent contractors domestic workers who are related to their employers individuals who work for aid (food, housing, etc.) rather than pay

Source: coverwallet.com

Source: coverwallet.com

Family members cannot be excluded from workers comp, unless, like above, they are a titled officer/shareholder if a corporation, a member if an llc, and a partner if a partnership. Business owners and employees that qualify for workers’ comp exemptions states often exempt firms that employ few workers. Legally, a sole proprietor with no employees is exempt from workers� compensation insurance, not just in california but in all of the united states. New jersey workers’ compensation law exempts unpaid interns, unpaid volunteers, independent contractors and sole proprietors with no employees from its workers’ comp law. Or if you have employees (including home improvement salespersons (his).

Source: pdffiller.com

Source: pdffiller.com

Your license is qualified by a responsible managing employee (rme). Sole proprietors who have no employees other than themselves officers of corporations with full ownership of their companies Sole proprietors, partners, and corporate officers; The qualifier is a responsible managing employee (rme); • foreign government employees are not subject to ui, ett, sdi, or pit withholding.

Source: signnow.com

Source: signnow.com

Sole proprietors, partners, and corporate officers; The qualifier is a responsible managing employee (rme); However, here are some cases where employees may be exempt from coverage. Legally, a sole proprietor with no employees is exempt from workers� compensation insurance, not just in california but in all of the united states. Sole proprietors who have no employees other than themselves officers of corporations with full ownership of their companies

Source: formsbirds.com

Source: formsbirds.com

Any employer who has even one employee must have workers’ compensation insurance. The answer, somewhat surprisingly, is yes; Family members cannot be excluded from workers comp, unless, like above, they are a titled officer/shareholder if a corporation, a member if an llc, and a partner if a partnership. Sole proprietors who have no employees other than themselves officers of corporations with full ownership of their companies If you fail to have workers’ compensation insurance for your employees, it can be expensive as the

Source: amulettejewelry.com

Source: amulettejewelry.com

If you fail to have workers’ compensation insurance for your employees, it can be expensive as the Exemption from workers� compensation you cannot file an exemption from workers� compensation form if any of the following conditions exist. Executive officers and directors of corporations must be included in workers’ compensation coverage, unless the corporation is fully owned by the directors and officers. Or if you have employees (including home improvement salespersons (his). Corporate officers and llc owners can choose to exempt themselves from workers’ compensation coverage by filing for an exemption with the state’s division of workers’ compensation.

Source: lpinsurance.com

Source: lpinsurance.com

Be aware that corporate officers and llc owners receiving exemptions are not allowed to receive workers’ compensation benefits if they get hurt or become ill on the job. Sole proprietors, partners, and corporate officers; Employers or workers who work in or around a private home for 26 hours or less per week are also exempt. If you fail to have workers’ compensation insurance for your employees, it can be expensive as the Anyway, the answer is simply:

Source: signnow.com

Source: signnow.com

Casual employees casual workers or employees with irregular work schedules may be exempt from workers compensation coverage. Your license is qualified by a responsible managing employee (rme). Business owners and employees that qualify for workers’ comp exemptions states often exempt firms that employ few workers. Other exemptions include partnerships, who don’t have to cover themselves (but must provide coverage for employees). If the directors and officers fully own the corporation, then they may elect.

Source: cslea.com

Source: cslea.com

Anyway, the answer is simply: Employees of instrumentalities owned by a foreign government are similarly exempt when there is a formal agreement. If the directors and officers fully own the corporation, then they may elect. In some cases, you can elect to be included in your own workers’ comp policy. The answer, somewhat surprisingly, is yes;

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title who is exempt from workers compensation insurance california by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information