Who is not required to sign a life insurance application information

Home » Trending » Who is not required to sign a life insurance application informationYour Who is not required to sign a life insurance application images are available. Who is not required to sign a life insurance application are a topic that is being searched for and liked by netizens today. You can Find and Download the Who is not required to sign a life insurance application files here. Download all royalty-free vectors.

If you’re looking for who is not required to sign a life insurance application pictures information related to the who is not required to sign a life insurance application interest, you have come to the right blog. Our site frequently provides you with hints for seeing the highest quality video and picture content, please kindly hunt and find more enlightening video articles and images that match your interests.

Who Is Not Required To Sign A Life Insurance Application. • be sponsored by a licensed insurer throughout the first two years as an agent; The company will look into the medical information bureau(mib) and pull up your medical history. Must the insured sign the application? If you don�t and you die as a result of the activity, the insurance company might not pay the claim if it can determine that your lifestyle included this risk prior to obtaining insurance.

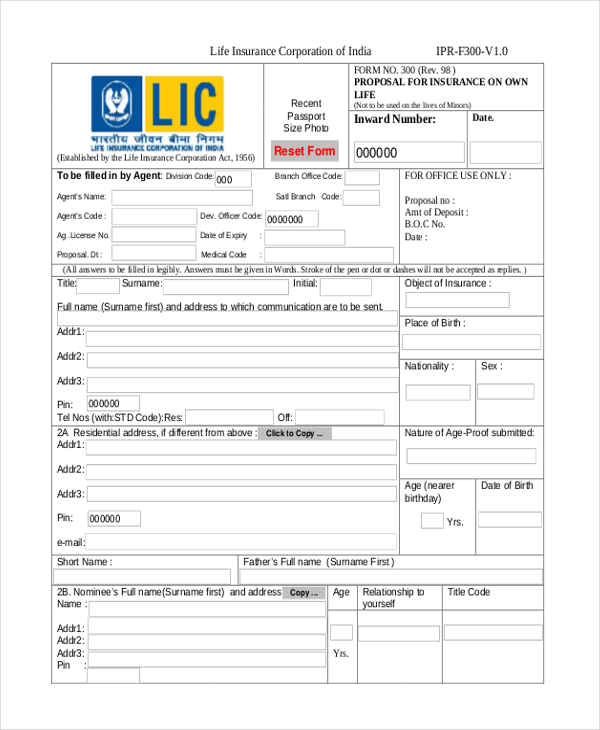

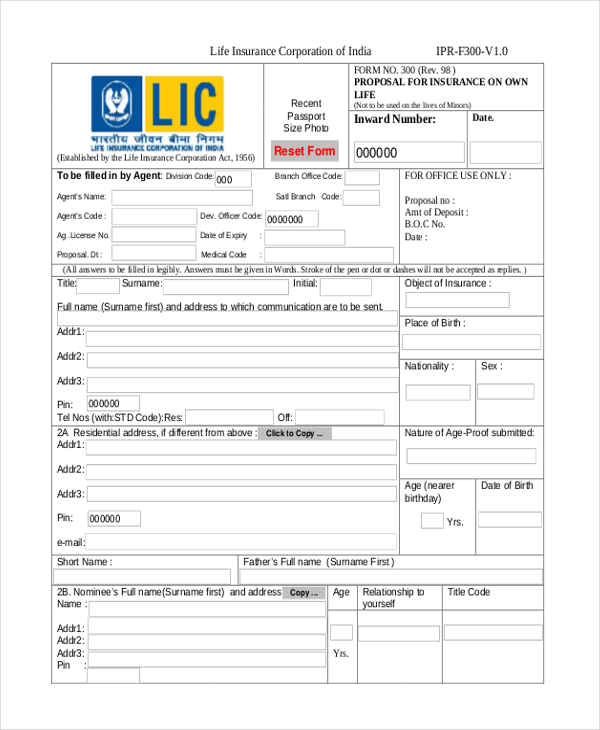

FREE 10+ Sample LIC Proposal Forms in PDF Word From sampleforms.com

FREE 10+ Sample LIC Proposal Forms in PDF Word From sampleforms.com

While you can work as a life insurance agent without these licenses, you will be limited in the type of life insurance that you can offer to clients. 2015) (noting that the insured was required to sign the application); Ashe points out that a life insurance application becomes part of the legal document that is the policy. You’ll see your application in the policy. However, there are a few that don’t require one. The life insurance underwriting process is the longest part of the life insurance application.

Mutual funds, variable annuities, and indexed life insurance all require a finra series 6 license to market and sell.

K is an agent who takes an application for individual life insurance and accepts a check from the client. You could lower your risk in some cases, or examine several life insurance policies from other companies to compare and get approved. At the request of the insurer to assist in the underwriting decision an attending physician�s statement would be appropriate for which life insurance purpose? You’ll see your application in the policy. A life insurance application must be signed by all of these except. State life insurance jobs 2022 advertisement apply online.

Source: vdocuments.site

Source: vdocuments.site

An underwriter works on behalf of the life insurance company to evaluate your application details, health information, and lifestyle to give you an insurance classification based on risk, which determines your premium. • be sponsored by a licensed insurer throughout the first two years as an agent; Generally, an insured must sign a policy application or authorize a third party to do so on his or her behalf. Ashe points out that a life insurance application becomes part of the legal document that is the policy. So to recap, you can not take out a life insurance policy on someone without their knowledge, and no one should be able to do it to you.

Source: lettercv.com

Source: lettercv.com

Acceptance is made by the underwriter. Who signs a life insurance application? Beneficiaries are the people who receive any benefits from. A life insurance application must be signed by all of these the policyowner, the agent, & the insured (if an adult) an incomplete life insurance application submitted to an insurer will result in which of these actions? • be sponsored by a licensed insurer throughout the first two years as an agent;

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

While you can work as a life insurance agent without these licenses, you will be limited in the type of life insurance that you can offer to clients. Generally, an insured must sign a policy application or authorize a third party to do so on his or her behalf. The life insurance underwriting process takes. He had invested in a life insurance policy of rs. In order to obtain a licence as a life insurance agent, an applicant must:

Source: canarahsbclife.com

Source: canarahsbclife.com

If you don�t and you die as a result of the activity, the insurance company might not pay the claim if it can determine that your lifestyle included this risk prior to obtaining insurance. You could lower your risk in some cases, or examine several life insurance policies from other companies to compare and get approved. See, e.g., alfa life ins. After you apply for life insurance, you go through a process called underwriting with the insurance company. Who signs a life insurance application?

Source: nbcnews.com

Source: nbcnews.com

Ashe points out that a life insurance application becomes part of the legal document that is the policy. (2) despite subsection (1), subsection 3 (1) of this regulation and subsections 393 (3) and (4) of the act do not apply in respect of an application for the renewal of a life insurance licence if the applicant has held a life insurance licence for at least two years. To clearly illustrate your insurable interest. He had invested in a life insurance policy of rs. State life insurance jobs 2022 advertisement apply online.

Source: dogobediencetraining5.blogspot.com

Source: dogobediencetraining5.blogspot.com

Mar 10, 2021 — life insurance applications aren’t just medical exams and histories. Acceptance is made by the underwriter. Who signs a life insurance application? K is an agent who takes an application for individual life insurance and accepts a check from the client. He submits the application and check to the insurance company, however the check was never signed by the applicant.

Source: revisi.net

Source: revisi.net

While you can work as a life insurance agent without these licenses, you will be limited in the type of life insurance that you can offer to clients. Ashe points out that a life insurance application becomes part of the legal document that is the policy. To clearly illustrate your insurable interest. Who is not required to sign a life insurance application? (2) despite subsection (1), subsection 3 (1) of this regulation and subsections 393 (3) and (4) of the act do not apply in respect of an application for the renewal of a life insurance licence if the applicant has held a life insurance licence for at least two years.

Source: recruitmentgov.com

Source: recruitmentgov.com

While you can work as a life insurance agent without these licenses, you will be limited in the type of life insurance that you can offer to clients. 80 lakhs, but his wife, rani, has still not been able to claim this amount since she has no idea about the death claim process or the required documents. He had invested in a life insurance policy of rs. The life insurance underwriting process is the longest part of the life insurance application. However, there are a few that don’t require one.

Source: dogobediencetraining5.blogspot.com

Who signs a life insurance application? Adult insured policyowner agent beneficiary State life insurance jobs 2022 advertisement apply online. A life insurance application must be signed by all of these the policyowner, the agent, & the insured (if an adult) an incomplete life insurance application submitted to an insurer will result in which of these actions? Although the producer signs the application, the producer is not a party in the contract.

Source: npa1.org

Source: npa1.org

Acceptance occurs when the application is approved. Which of these actions should a producer take when submitting an. A life insurance application must be signed by all of these except. To purchase life insurance for another party, you will need: If you don�t and you die as a result of the activity, the insurance company might not pay the claim if it can determine that your lifestyle included this risk prior to obtaining insurance.

Source: sampleforms.com

Source: sampleforms.com

- (noting that the insured was required to sign the application); If you don�t and you die as a result of the activity, the insurance company might not pay the claim if it can determine that your lifestyle included this risk prior to obtaining insurance. While you can work as a life insurance agent without these licenses, you will be limited in the type of life insurance that you can offer to clients. Mutual funds, variable annuities, and indexed life insurance all require a finra series 6 license to market and sell. About six months ago, vijay passed away in an accident.

Source: jobsborse.com

Source: jobsborse.com

Who signs a life insurance application? To purchase life insurance for another party, you will need: He had invested in a life insurance policy of rs. What you need to know. To clearly illustrate your insurable interest.

Source: jobbreakingnews.com

Source: jobbreakingnews.com

Beneficiaries are the people who receive any benefits from. You could lower your risk in some cases, or examine several life insurance policies from other companies to compare and get approved. To clearly illustrate your insurable interest. Generally, an insured must sign a policy application or authorize a third party to do so on his or her behalf. When you buy a policy, you’ll designate your life insurance beneficiaries on the application.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The company will look into the medical information bureau(mib) and pull up your medical history. In order to obtain a licence as a life insurance agent, an applicant must: Adult insured policyowner agent beneficiary Must the insured sign the application? Consumers “have to understand that when they sign an application, the application becomes part of the contract.

Source: sampleforms.com

Source: sampleforms.com

(2) despite subsection (1), subsection 3 (1) of this regulation and subsections 393 (3) and (4) of the act do not apply in respect of an application for the renewal of a life insurance licence if the applicant has held a life insurance licence for at least two years. At the request of the insurer to assist in the underwriting decision an attending physician�s statement would be appropriate for which life insurance purpose? He submits the application and check to the insurance company, however the check was never signed by the applicant. State life insurance jobs 2022 advertisement apply online. • be sponsored by a licensed insurer throughout the first two years as an agent;

Source: templateroller.com

Source: templateroller.com

He submits the application and check to the insurance company, however the check was never signed by the applicant. An underwriter works on behalf of the life insurance company to evaluate your application details, health information, and lifestyle to give you an insurance classification based on risk, which determines your premium. A life insurance application must be signed by all of these the policyowner, the agent, & the insured (if an adult) an incomplete life insurance application submitted to an insurer will result in which of these actions? Adult insured policyowner agent beneficiary Acceptance occurs when the application is approved.

Source: dogobediencetraining5.blogspot.com

Source: dogobediencetraining5.blogspot.com

You’ll see your application in the policy. To purchase life insurance for another party, you will need: You could lower your risk in some cases, or examine several life insurance policies from other companies to compare and get approved. He had invested in a life insurance policy of rs. A life insurance application must be signed by all of these except.

Source: revisi.net

Source: revisi.net

So lies within the application become fraud. At the request of the insurer to assist in the underwriting decision an attending physician�s statement would be appropriate for which life insurance purpose? Although the producer signs the application, the producer is not a party in the contract. You could lower your risk in some cases, or examine several life insurance policies from other companies to compare and get approved. In order to have a valid policy, the owner must:

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title who is not required to sign a life insurance application by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information