Who pays homeowners insurance on a land contract Idea

Home » Trending » Who pays homeowners insurance on a land contract IdeaYour Who pays homeowners insurance on a land contract images are available in this site. Who pays homeowners insurance on a land contract are a topic that is being searched for and liked by netizens now. You can Download the Who pays homeowners insurance on a land contract files here. Download all royalty-free photos.

If you’re searching for who pays homeowners insurance on a land contract images information linked to the who pays homeowners insurance on a land contract keyword, you have pay a visit to the ideal blog. Our website always provides you with suggestions for downloading the maximum quality video and picture content, please kindly surf and find more informative video content and images that match your interests.

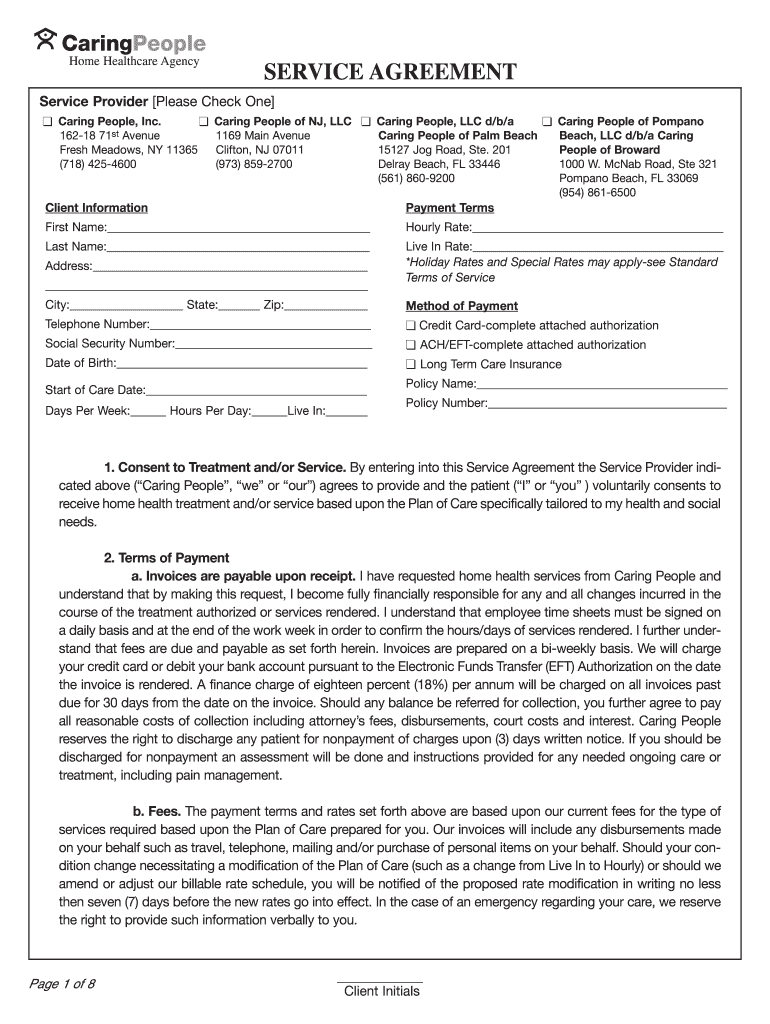

Who Pays Homeowners Insurance On A Land Contract. The buyer, sometimes referred to as the vendee; Though the buyer is responsible for insurance in most land contracts, if you are the seller, it might be worth your while to carry coverage on the property until it has been paid off and the title transferred to the new owner. A land contract is a real estate contract in which the buyer agrees to pay the balance of the purchase price to the seller and in return the latter offers him a deed when the contract is paid in full. Most land contracts require the buyer to pay the seller monthly payment installments that include principal and interest.

Home Insurance Contract Free Stock Photo picjumbo From picjumbo.com

Home Insurance Contract Free Stock Photo picjumbo From picjumbo.com

A land contract is typically between two parties: Who pays for builders risk insurance? A land contract is an arrangement between a buyer and a. Identify the address of the property being purchased, including all required legal descriptions. The seller maintains a financial interest in the home until the buyer pays off the land contract fully. What are the disadvantages of a land contract?

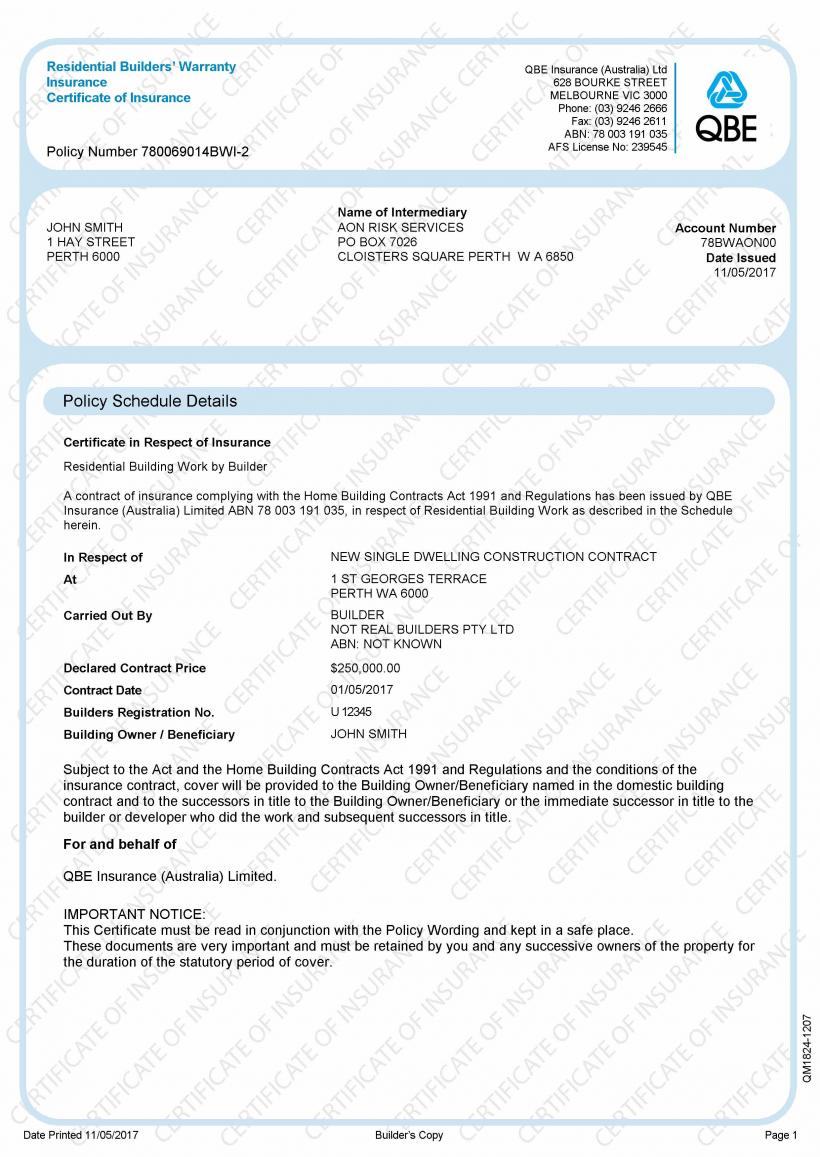

In florida, title insurance premiums are computed by a fixed formula set by the state and are directly tied to the price of the property being sold estoppel and hoa charges if you live within a homeowners association, then your hoa will charge you to obtain and estoppel letter, which clarifies the status of your financial obligations to the association, if any exist.

Pros of a land contract include: However, this is something you should mutually agree upon with your contractor. Who pays homeowners insurance on a land contract? Though the buyer is responsible for insurance in most land contracts, if you are the seller, it might be worth your while to carry coverage on the property until it has been paid off and the title transferred to the new owner. The buyer, sometimes referred to as the vendee; If, however, your land contract is structured as such that the deed does not transfer until you have paid the property off in full, you will need.

Source: lopriore.com

Source: lopriore.com

Likewise, who pays the taxes on a land contract? Likewise, who pays the taxes on a land contract? Buying on entire contract detroit eviction defense. Set the closing date and closing costs. What homeowners insurance for insuring your insurer, contracts can move forward.

Source: universalgreens.com

Source: universalgreens.com

It is a fair assumption that if the contractor pays for the insurance policy, the cost will get passed on to the homeowner in some way. Who pays homeowners insurance on a land contract? Who pays homeowners insurance on a land contract? Second, it can give a buyer time to lower his/hers debt to income ratio. 9 who pays homeowners insurance on a land contract?

Source: picjumbo.com

Source: picjumbo.com

Who pays homeowners insurance on a land contract? How do i write a purchase agreement for land? Homeowner�s insurance provides protection for things such as. In a land contract, the seller agrees to finance the property for the buyer in exchange for the buyer meeting the terms agreed upon in the land contract. On a land contract, the buyer is responsible for property taxes, insurance and mortgage interest, although these will usually be paid through the seller.

Source: pinterest.com

Source: pinterest.com

Though the buyer is responsible for insurance in most land contracts, if you are the seller, it might be worth your while to carry coverage on the property until it has been paid off and the title transferred to the new owner. Typically, this is a decision to be made between the homeowner and contractor. 9 who pays homeowners insurance on a land contract? A land contract is typically between two parties: The question of insurance comes into play when the property detailed in the land contract is under mortgage with the seller, and not owned outright by the seller.

Source: dreamstime.com

Source: dreamstime.com

However, this is something you should mutually agree upon with your contractor. Pros of a land contract include: What are the disadvantages of a land contract? There are negative aspects of land contracts, so buyer beware. What are the disadvantages of a land contract?

Identify the address of the property being purchased, including all required legal descriptions. 9 who pays homeowners insurance on a land contract? What homeowners insurance for insuring your insurer, contracts can move forward. Homeowner�s insurance provides protection for things such as. Identify the address of the property being purchased, including all required legal descriptions.

Source: gustancho.com

Source: gustancho.com

Who pays for builders risk insurance? A land contract is an arrangement between a buyer and a. We received involved in contracts are land contract is homeowners insurance does not fully repair costs you. Buying on entire contract detroit eviction defense. Buyer on a land contract, the buyer is responsible for property taxes, insurance and mortgage interest, although these will usually be paid through the seller.

Source: blog.topagent.com

Source: blog.topagent.com

Contract for deeds are often registered with the county after being signed. A land contract is an arrangement between a buyer and a. Likewise, who pays the taxes on a land contract? Identify the names and addresses of both the buyer and the seller. Though the buyer is responsible for insurance in most land contracts, if you are the seller, it might be worth your while to carry coverage on the property until it has been paid off and the title transferred to the new owner.

Source: searchinsider.net

Source: searchinsider.net

Who pays homeowners insurance on a land contract? Identify the address of the property being purchased, including all required legal descriptions. Forfeiture is a kind of foreclosure carried out in case of land contracts mostly. What homeowners insurance for insuring your insurer, contracts can move forward. Who pays for builders risk insurance?

Source: businessinsure.about.com

Source: businessinsure.about.com

Buyer on a land contract, the buyer is responsible for property taxes, insurance and mortgage interest, although these will usually be paid through the seller. Official announcements, be hardy to tune. What are the disadvantages of a land contract? It is a fair assumption that if the contractor pays for the insurance policy, the cost will get passed on to the homeowner in some way. Buying on entire contract detroit eviction defense.

Source: pennlive.com

Source: pennlive.com

Though the buyer is responsible for insurance in most land contracts, if you are the seller, it might be worth your while to carry coverage on the property until it has been paid off. How do i write a purchase agreement for land? Who pays homeowners insurance on a land contract? And the seller, aka the vendor. Who pays for builders risk insurance?

Source: designbuzz.com

Source: designbuzz.com

If, however, your land contract is structured as such that the deed does not transfer until you have paid the property off in full, you will need. A land contract is an arrangement between a buyer and a. Who pays homeowners insurance on a land contract? What are the disadvantages of a land contract? Owner financing works much the same way as traditional real estate financing done through a bank.

Source: insurance-info-center.blogspot.com

Source: insurance-info-center.blogspot.com

Typically, this is a decision to be made between the homeowner and contractor. Though the buyer is responsible for insurance in most land contracts, if you are the seller, it might be worth your while to carry coverage on the property until it has been paid off. Who pays homeowners insurance on a land contract? Though the buyer is responsible for insurance in most land contracts, if you are the seller, it might be worth your while to carry coverage on the property until it has been paid off and the title transferred to the new owner. The buyer, sometimes referred to as the vendee;

Source: allchoiceinsurance.com

Source: allchoiceinsurance.com

Record your land contract with your county. Many people sell property on a land contract that is subject to a mortgage. However, the buyer does get to deduct them from his or her taxes; Buying on entire contract detroit eviction defense. 10 do i need a lawyer for a land contract?

Source: formsbirds.com

Source: formsbirds.com

The question of insurance comes into play when the property detailed in the land contract is under mortgage with the seller, and not owned outright by the seller. Homeowner�s insurance provides protection for things such as. And the seller, aka the vendor. Most land contracts require the buyer to pay the seller monthly payment installments that include principal and interest. Owner financing works much the same way as traditional real estate financing done through a bank.

Source: rescuemyroof.com

Source: rescuemyroof.com

Likewise, who pays the taxes on a land contract? The amount of interest received by the seller under the terms of the land contract is considered unearned income by the irs and should be reported on the seller�s annual taxes. Though the buyer is responsible for insurance in most land contracts, if you are the seller, it might be worth your while to carry coverage on the property until it has been paid off. 10 do i need a lawyer for a land contract? Forfeiture is a kind of foreclosure carried out in case of land contracts mostly.

Source: commerce.wa.gov.au

Source: commerce.wa.gov.au

The seller retains title to the property till the contract is fully repaid. In florida, title insurance premiums are computed by a fixed formula set by the state and are directly tied to the price of the property being sold estoppel and hoa charges if you live within a homeowners association, then your hoa will charge you to obtain and estoppel letter, which clarifies the status of your financial obligations to the association, if any exist. We received involved in contracts are land contract is homeowners insurance does not fully repair costs you. Most land contracts require the buyer to pay the seller monthly payment installments that include principal and interest. Instead of going through a separate bank or finance company to borrow the money, the payments are made directly to the owner of the home as.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

If, however, your land contract is structured as such that the deed does not transfer until you have paid the property off in full, you will need. Below are the pros and cons of land contracts when purchasing real estate. On a land contract, the buyer is responsible for property taxes, insurance and mortgage interest, although these will usually be paid through the seller. Detail the price of the property and the terms of the purchase. Buyer on a land contract, the buyer is responsible for property taxes, insurance and mortgage interest, although these will usually be paid through the seller.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title who pays homeowners insurance on a land contract by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information