Whole life insurance cash surrender value calculator Idea

Home » Trend » Whole life insurance cash surrender value calculator IdeaYour Whole life insurance cash surrender value calculator images are ready. Whole life insurance cash surrender value calculator are a topic that is being searched for and liked by netizens today. You can Download the Whole life insurance cash surrender value calculator files here. Find and Download all royalty-free vectors.

If you’re searching for whole life insurance cash surrender value calculator images information related to the whole life insurance cash surrender value calculator interest, you have come to the right blog. Our website frequently gives you suggestions for viewing the highest quality video and image content, please kindly hunt and find more enlightening video content and graphics that match your interests.

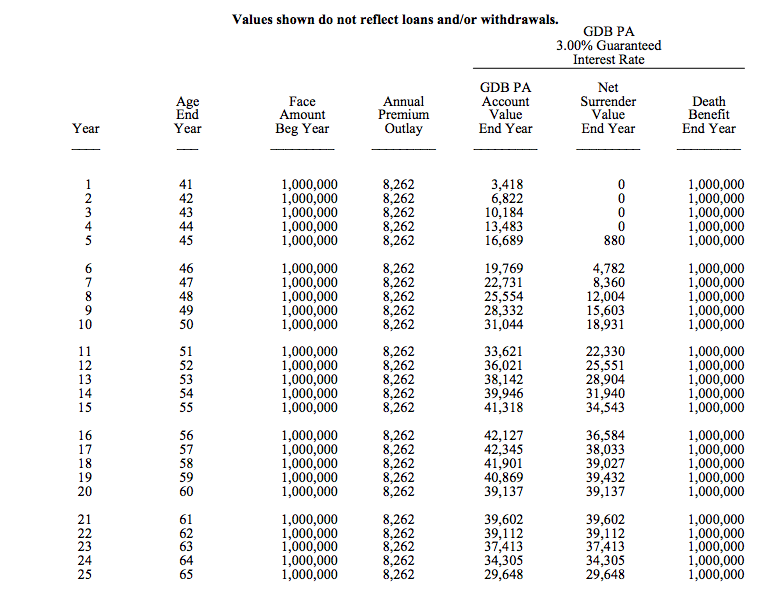

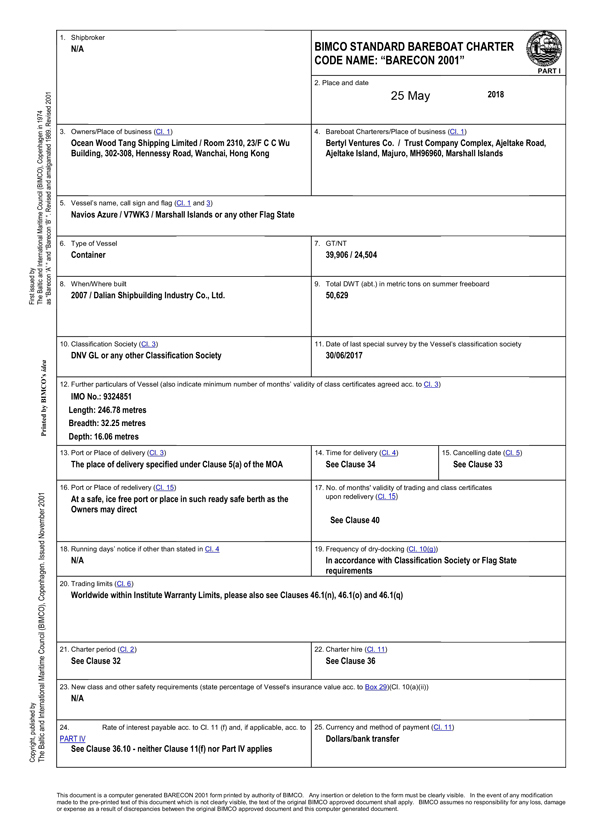

Whole Life Insurance Cash Surrender Value Calculator. You pay $1,000 in surrender charges and receive a check from the insurance company for $12,000. Almost all policies have a surrender charge, which can be as high as 35% or more, depending on the elapsed period of time since the policy was taken out. Not all types of life insurance provide cash value. The cash surrender value of life insurance is basically the same as the cash value of a life insurance policy.

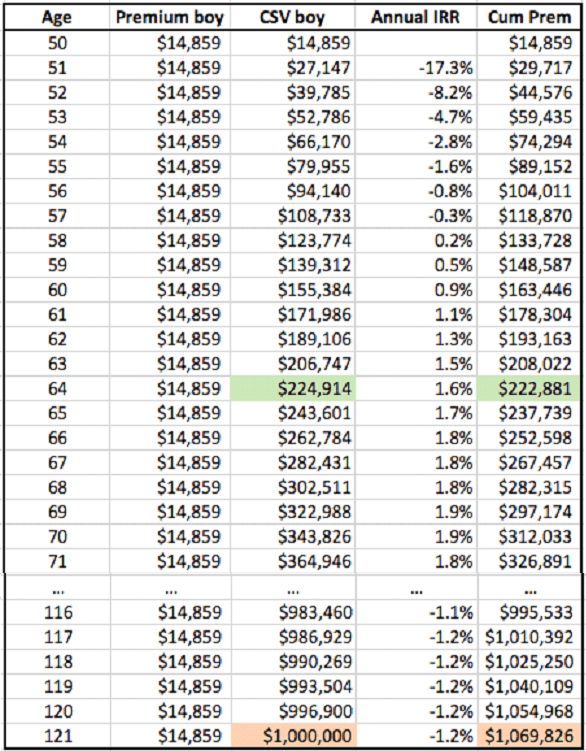

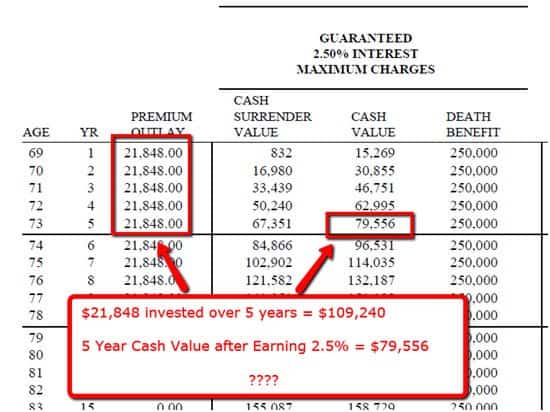

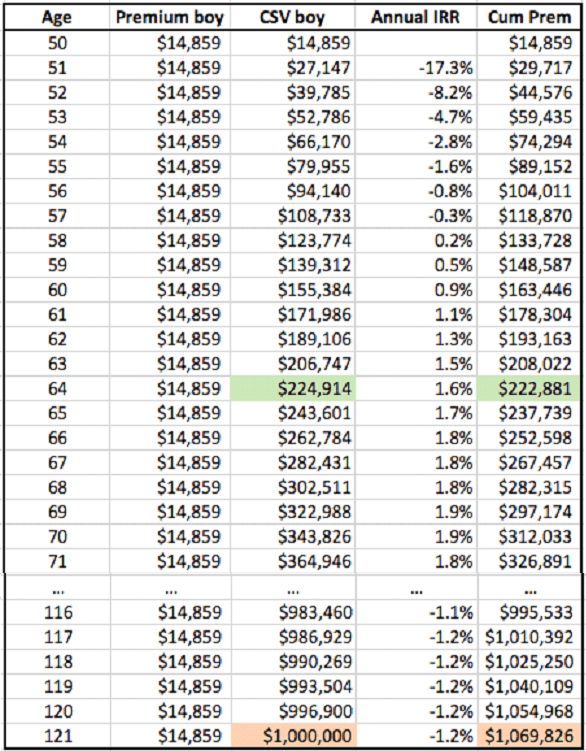

Does IBC Work for Older People, Part 2 of 2 The Official From infinitebanking.org

Does IBC Work for Older People, Part 2 of 2 The Official From infinitebanking.org

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. This is due to the way that cash value is accumulated for different types of policies. Cash surrender value is the amount left over after fees when you cancel a permanent life insurance policy (or annuity). Just as it sounds, a withdrawal allows you to receive money from your policy. To calculate the amount of taxable income, subtract the total amount you paid in premiums from the amount of money you received in the cash surrender. It is an amount that an insurance company pays when you decide to “surrender” your insurance policy back to the insurance company.

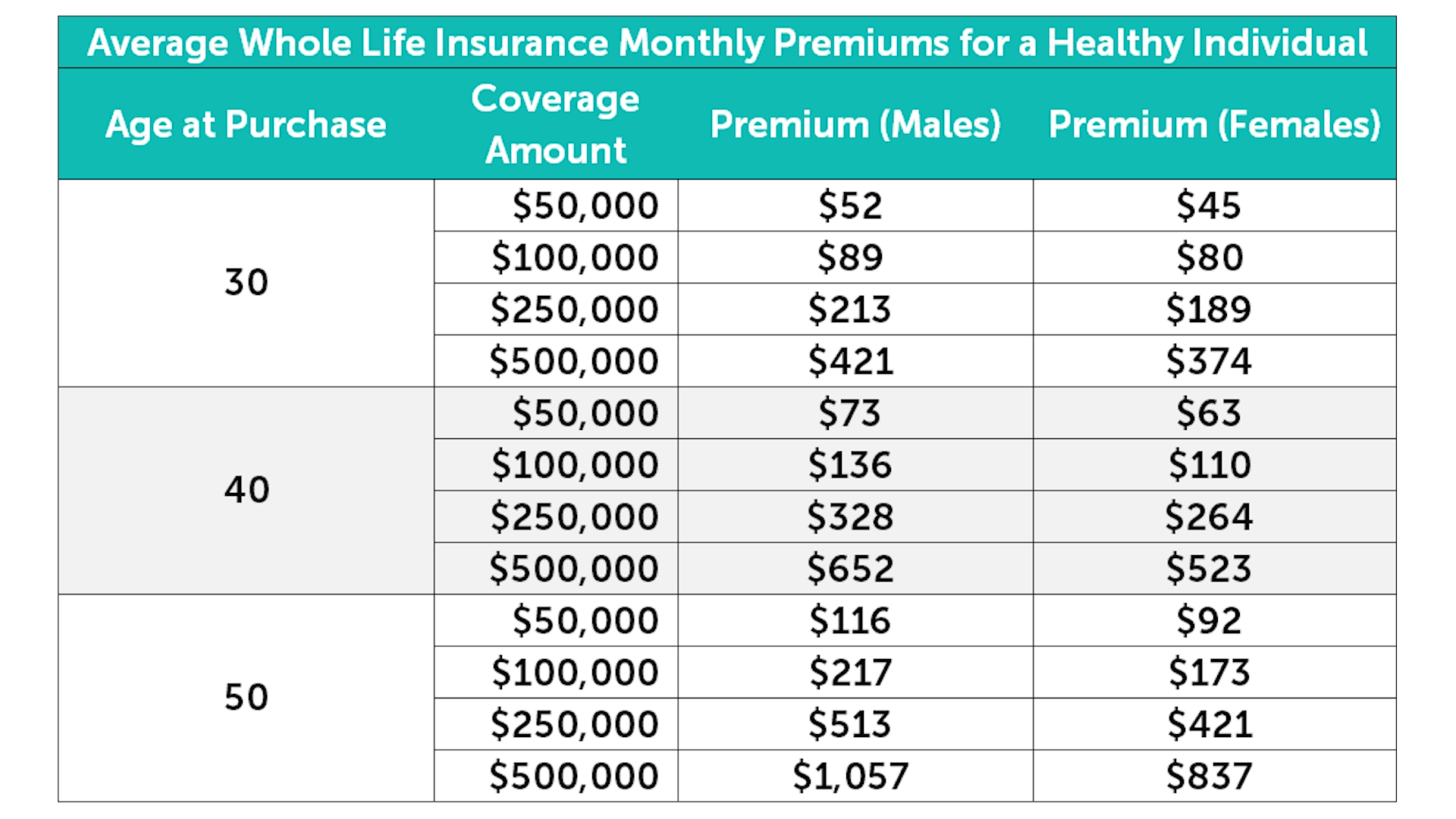

Term life insurance offers low cost protection with guaranteed level premiums for a fixed duration, typically 10, 15, 20, or 30 years.

What kinds of life insurance have cash surrender values? Special surrender value can be calculated using a simple formula which is: In this context, “surrender” is another word for terminate or return. The other $10,000 is considered a. Then, subtract the fees that will be changed by the insurance carrier for surrendering the policy. Almost all policies have a surrender charge, which can be as high as 35% or more, depending on the elapsed period of time since the policy was taken out.

Source: newyorklifeinsurancecompanyreviewswoy.blogspot.com

Source: newyorklifeinsurancecompanyreviewswoy.blogspot.com

When you take life insurance, there are two options; A cash surrender value is the total payout an insurance company will pay to a policy holder or an annuity contract owner for the sale of a life insurance policy. This is subject to surrender charges and the like. The cash surrender value of life insurance is basically the same as the cash value of a life insurance policy. It is an amount that an insurance company pays when you decide to “surrender” your insurance policy back to the insurance company.

Source: bankonyourself.com

Source: bankonyourself.com

Your cash value is now worth $13,000, and you decide to surrender your policy. Add total payments made to an insurance policy and subtract of fees charged by the agency. You paid $115,000 in total premiums to date. To calculate your cash surrender value, take the total cash value (premiums you’ve paid minus the death benefit premiums) and subtract any surrender fees and charges the life insurance company charges (read the fine print on your policy). Just as it sounds, a withdrawal allows you to receive money from your policy.

Source: dollarsandsense.sg

Source: dollarsandsense.sg

This way you will learn the total actual payout you would receive from surrendering a life insurance policy. Paying premiums could build the cash value and help increase your financial security. The calculation of cash surrender value is based on the savings component of whole life insurance policies. This is due to the way that cash value is accumulated for different types of policies. People have many options when it comes to securing their loved ones� futures in the.

Source: infinitebanking.org

Source: infinitebanking.org

The cash surrender value of life insurance is basically the same as the cash value of a life insurance policy. To calculate your cash surrender value, take the total cash value (premiums you’ve paid minus the death benefit premiums) and subtract any surrender fees and charges the life insurance company charges (read the fine print on your policy). So, although your cash value is £10,000, the provider could charge you a 35% early withdrawal fee of £3,500, leaving you with a surrender value of £6,500. Unfortunately, there isn’t a simple answer for how to calculate cash value of life insurance policy. In addition, you can always contact your insurance company to get an exact cash surrender value for your policy.

Source: partners4prosperity.com

Source: partners4prosperity.com

This way you will learn the total actual payout you would receive from surrendering a life insurance policy. This way you will learn the total actual payout you would receive from surrendering a life insurance policy. In this context, “surrender” is another word for terminate or return. The cash surrender value of life insurance is the amount an insurance company will pay you when you surrender or voluntarily terminate your policy before it reaches its maturity or before the events covered in the policy occurs. To calculate the cash surrender value of a life insurance policy, add up the total payments made to the insurance policy.then, subtract the fees that will be changed by the insurance carrier for surrendering the policy.

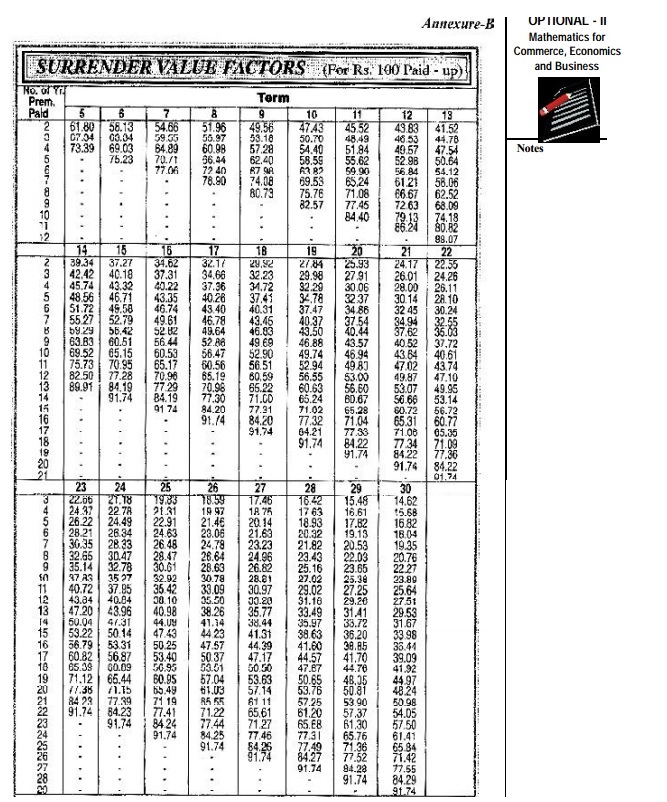

Source: licinsurancereview.blogspot.com

Source: licinsurancereview.blogspot.com

You pay $1,000 in surrender charges and receive a check from the insurance company for $12,000. A whole life insurance policy�s cash surrender value represents the amount of money a policyholder receives if he chooses to terminate the policy. *accessing the cash value of the policy will reduce the available cash surrender value and death benefit. The easiest way to calculate the cash surrender value is to subtract any policy loan interests and balances or surrender fees from the cash value. You pay $1,000 in surrender charges and receive a check from the insurance company for $12,000.

Source: whitecoatinvestor.com

Source: whitecoatinvestor.com

So, here is the basic formula to calculate the cash value account at the end of each year: Not all types of life insurance provide cash value. A taxable payment declared by a company’s board of directors and given to its shareholders out. Then, subtract the fees that will be changed by the insurance carrier for surrendering the policy. If you want to stop making payments on your policy, you have the option to work with your insurance.

Source: dollarsandsense.sg

Source: dollarsandsense.sg

The other $10,000 is considered a. A taxable payment declared by a company’s board of directors and given to its shareholders out. Not all types of life insurance provide cash value. To calculate your cash surrender value, take the total cash value (premiums you’ve paid minus the death benefit premiums) and subtract any surrender fees and charges the life insurance company charges (read the fine print on your policy). Term life insurance offers low cost protection with guaranteed level premiums for a fixed duration, typically 10, 15, 20, or 30 years.

Source: topwholelife.com

Source: topwholelife.com

The other $10,000 is considered a. Whole life insurance offers lifetime guaranteed coverage with the additional benefit of accumulating cash values. To calculate the cash surrender value of a life insurance policy, add up the total payments made to the insurance policy. To calculate the amount of taxable income, subtract the total amount you paid in premiums from the amount of money you received in the cash surrender. *accessing the cash value of the policy will reduce the available cash surrender value and death benefit.

Source: wealthmanagement.com

Source: wealthmanagement.com

The cash surrender value calculation is a way to figure out how much money you will receive if you choose to surrender your life insurance at a. The cash surrender value of life insurance is basically the same as the cash value of a life insurance policy. How is cash surrender value of whole life insurance calculated? You paid $115,000 in total premiums to date. Term life insurance offers low cost protection with guaranteed level premiums for a fixed duration, typically 10, 15, 20, or 30 years.

Source: newyorklifeinsurancecompanyreviewswoy.blogspot.com

Source: newyorklifeinsurancecompanyreviewswoy.blogspot.com

So, here is the basic formula to calculate the cash value account at the end of each year: You will pay tax on $2,000 at a rate of 25%. The cash surrender value calculation is a way to figure out how much money you will receive if you choose to surrender your life insurance at a. This is subject to surrender charges and the like. Not all types of life insurance provide cash value.

Source: accounting-services.net

Source: accounting-services.net

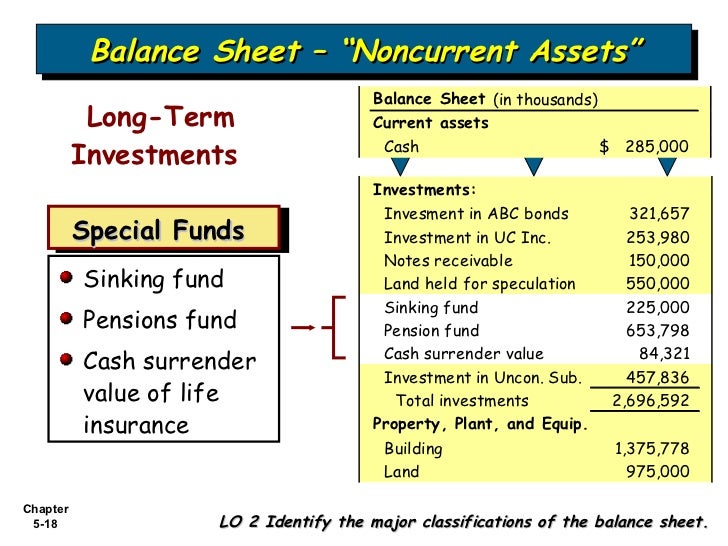

The taxable amount is the net cash surrender value minus the premiums you paid into the policy. Tax treatment of cash value life insurance. Your cash value is now worth $13,000, and you decide to surrender your policy. It is an amount that an insurance company pays when you decide to “surrender” your insurance policy back to the insurance company. A taxable payment declared by a company’s board of directors and given to its shareholders out.

Source: bankingtruths.com

Source: bankingtruths.com

You will pay tax on $2,000 at a rate of 25%. Unfortunately, there isn’t a simple answer for how to calculate cash value of life insurance policy. Almost all policies have a surrender charge, which can be as high as 35% or more, depending on the elapsed period of time since the policy was taken out. To calculate the cash surrender value of a life insurance policy, add up the total payments made to the insurance policy. Cash surrender value life insurance refers to a policy where you pay the insurance premium plus fees and a cash value.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

So, here is the basic formula to calculate the cash value account at the end of each year: The taxable amount is the net cash surrender value minus the premiums you paid into the policy. A taxable payment declared by a company’s board of directors and given to its shareholders out. To calculate the amount of taxable income, subtract the total amount you paid in premiums from the amount of money you received in the cash surrender. The cash surrender value of life insurance is basically the same as the cash value of a life insurance policy.

Source: tempestadealmaletraseimagens.blogspot.com

Source: tempestadealmaletraseimagens.blogspot.com

The cash surrender value calculation is a way to figure out how much money you will receive if you choose to surrender your life insurance at a. Term life insurance offers low cost protection with guaranteed level premiums for a fixed duration, typically 10, 15, 20, or 30 years. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. To calculate your cash surrender value, take the total cash value (premiums you’ve paid minus the death benefit premiums) and subtract any surrender fees and charges the life insurance company charges (read the fine print on your policy). Company to cancel it (and the death benefit) and receive its cash surrender value.

Source: lowcostlifeinsuranceketanru.blogspot.com

Source: lowcostlifeinsuranceketanru.blogspot.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. For instance, if you receive a cash surrender payment of $50,000 and paid $40,000 in premium payments, $10,000 would be subject to taxation. In addition, you can always contact your insurance company to get an exact cash surrender value for your policy. A whole life insurance policy�s cash surrender value represents the amount of money a policyholder receives if he chooses to terminate the policy. To calculate the amount of taxable income, subtract the total amount you paid in premiums from the amount of money you received in the cash surrender.

Source: quotacy.com

Source: quotacy.com

Permanent and term life insurance and both have benefits and downsides. The taxable amount is the net cash surrender value minus the premiums you paid into the policy. You pay $1,000 in surrender charges and receive a check from the insurance company for $12,000. The cash surrender value of life insurance is the amount an insurance company will pay you when you surrender or voluntarily terminate your policy before it reaches its maturity or before the events covered in the policy occurs. To calculate the amount of taxable income, subtract the total amount you paid in premiums from the amount of money you received in the cash surrender.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

*accessing the cash value of the policy will reduce the available cash surrender value and death benefit. To calculate the cash surrender value of a life insurance policy, add up the total payments made to the insurance policy. If you want to stop making payments on your policy, you have the option to work with your insurance. The other $10,000 is considered a. A whole life insurance policy�s cash surrender value represents the amount of money a policyholder receives if he chooses to terminate the policy.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title whole life insurance cash surrender value calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information