Whole life insurance vs indexed universal life Idea

Home » Trend » Whole life insurance vs indexed universal life IdeaYour Whole life insurance vs indexed universal life images are ready. Whole life insurance vs indexed universal life are a topic that is being searched for and liked by netizens now. You can Download the Whole life insurance vs indexed universal life files here. Download all free photos and vectors.

If you’re looking for whole life insurance vs indexed universal life images information related to the whole life insurance vs indexed universal life keyword, you have come to the right site. Our website always provides you with hints for refferencing the highest quality video and image content, please kindly surf and find more enlightening video articles and images that fit your interests.

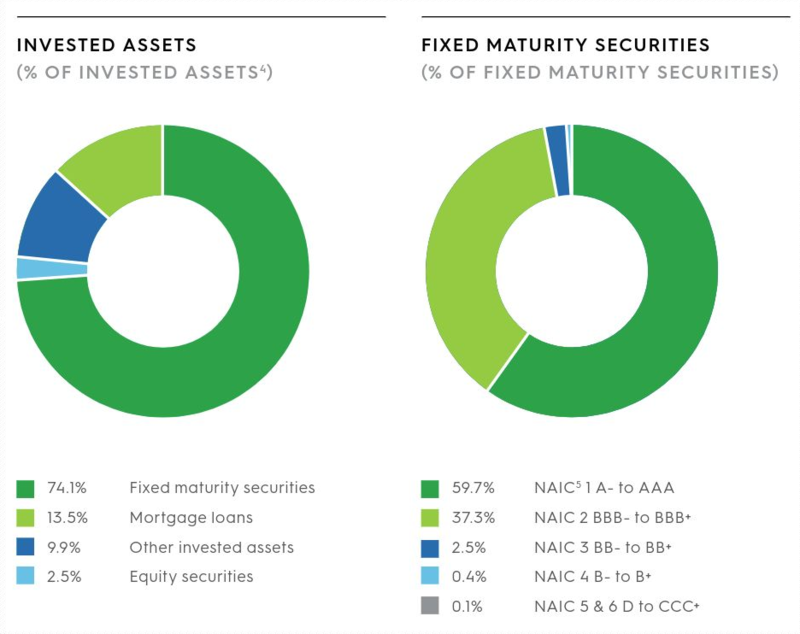

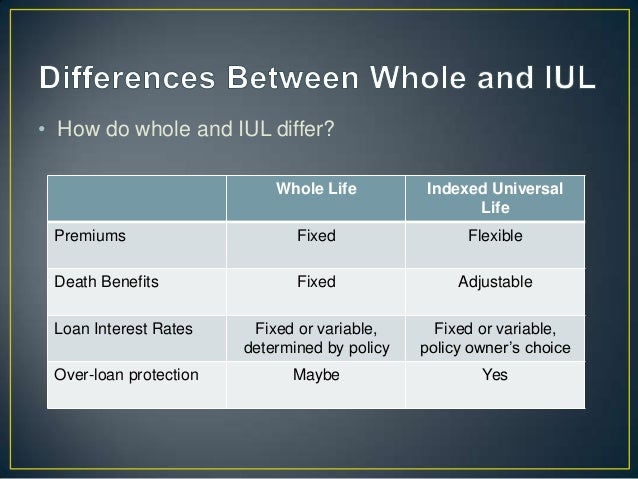

Whole Life Insurance Vs Indexed Universal Life. Iul is how the interest is calculated on the policy’s cash value. Whole life insurance is more expensive than term life insurance, but it can be less expensive than indexed universal life insurance. The two most popular types of permanent life insurance are: With a whole life insurance policy, the cash value is guaranteed by the insurance company.

What is the difference between Whole Life and Indexed From slideshare.net

What is the difference between Whole Life and Indexed From slideshare.net

But before we jump into all of those juicy. When shopping for a life insurance policy, consumers have a large number of choices. The “index” policy allows your cash value to grow in a linked market index, such as the s&p 500, grows. Please remember all of the prices can change based on all of the factors we already mentioned. The products are designed to do completely different things. Especially with variable universal life policies, it’s possible to lose money in the markets.

The two most popular types of permanent life insurance are:

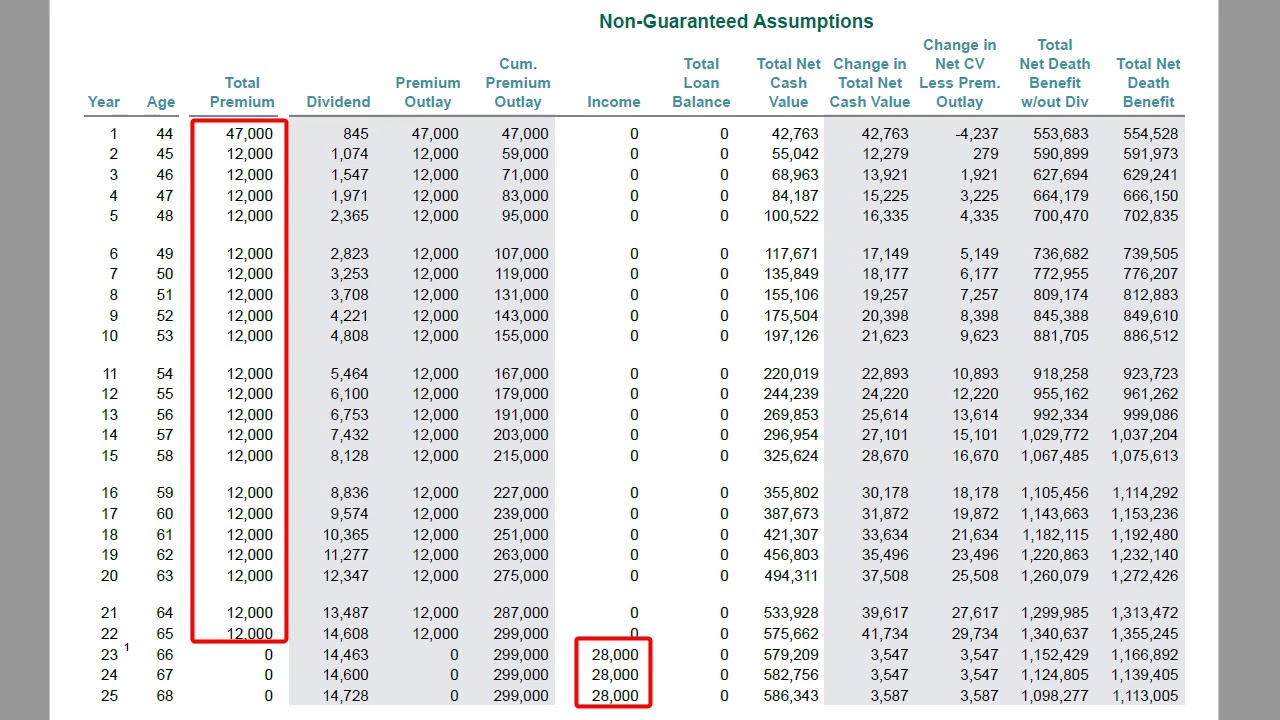

However, in 2018, iul sales grew at record levels as consumers looked for protection from stock market instability. Whole life insurance policies have a fixed premium, meaning you pay the same amount each and every year for your coverage. Indexed universal life (iul) whole life leads the two with 35% of life insurance sales and iul trails at 24%. You can borrow against the cash. Whole life insurance offers consistent premiums and guaranteed cash value accumulation, while a universal policy provides flexible premiums and death benefits. Much like universal life insurance, whole life has the potential to accumulate cash value over time, creating an amount that you may be able to borrow against.

Source: innovativeretirementstrategies.com

Source: innovativeretirementstrategies.com

Let’s take a look at the list of differences first, and then we’ll dig into the specifics down below: Whole life insurance policies have a fixed premium, meaning you pay the same amount each and every year for your coverage. With a whole life insurance policy, the cash value is guaranteed by the insurance company. The “index” policy allows your cash value to grow in a linked market index, such as the s&p 500, grows. Because of the flexibility of universal life insurance premium payments, these premiums are typically lower during periods of high interest rates compared to whole life insurance premiums for the same coverage amount.

Source: youtube.com

Source: youtube.com

Whole life insurance is predictable, making it ideal if you have low risk tolerance. With a whole life insurance policy, the cash value is guaranteed by the insurance company. The products are designed to do completely different things. And while not all universal policies are linked to the markets, with variable universal life or indexed universal life insurance, you may have exposure to stock market gains and losses. Despite the many similarities with whole life insurance, here’s something you need to know:

Source: bestliferates.org

Source: bestliferates.org

Whole life insurance is designed to be exactly that—life insurance. Indexed universal life (iul) whole life vs. From term life insurance that can be purchased for a few dollars per month to whole life insurance that covers you until the day you pass on, there is no shortage of options to consider. Iul is how the interest is calculated on the policy’s cash value. The products are designed to do completely different things.

Source: termlifeadvice.com

Source: termlifeadvice.com

Similar to whole life, this type of policy offers guaranteed death benefit protection, as well as cash value accumulation. Especially with variable universal life policies, it’s possible to lose money in the markets. Universal life, such as indexed universal life (iul) and variable universal life (vul), is a form of permanent life insurance, also known as cash value life insurance. The biggest difference between whole life and iul is how cash value accumulates. You can borrow against the cash.

Source: youtube.com

Source: youtube.com

Despite the many similarities with whole life insurance, here’s something you need to know: You know exactly how much your insurance premiums are for life. Iul is how the interest is calculated on the policy’s cash value. The “index” policy allows your cash value to grow in a linked market index, such as the s&p 500, grows. The biggest difference between whole life and iul is how cash value accumulates.

![Whole Life vs Universal Life [Which Policy is Best?] Whole Life vs Universal Life [Which Policy is Best?]](https://www.insuranceandestates.com/wp-content/uploads/Whole-Life-vs-Universal-Life-e1541648239672.jpg) Source: insuranceandestates.com

Source: insuranceandestates.com

Because of the flexibility of universal life insurance premium payments, these premiums are typically lower during periods of high interest rates compared to whole life insurance premiums for the same coverage amount. From term life insurance that can be purchased for a few dollars per month to whole life insurance that covers you until the day you pass on, there is no shortage of options to consider. Whole life insurance policies have a fixed premium, meaning you pay the same amount each and every year for your coverage. However, the purpose of the charts is to give you an idea of the price ranges, not to be a quote. Universal vs whole life insurance 👪 sep 2021.

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

However, in 2018, iul sales grew at record levels as consumers looked for protection from stock market instability. Cash inside of these policies. In general, whole life insurance is more expensive than universal life insurance. Indexed universal life insurance, you have more flexibility with indexed universal life insurance. Whole life insurance is designed to be exactly that—life insurance.

Source: insurancequotes2day.com

Source: insurancequotes2day.com

And while not all universal policies are linked to the markets, with variable universal life or indexed universal life insurance, you may have exposure to stock market gains and losses. Whole life vs indexed universal life. Iul is how the interest is calculated on the policy’s cash value. In general, whole life insurance is more expensive than universal life insurance. Especially with variable universal life policies, it’s possible to lose money in the markets.

Source: independentcaptiveassociates.com

But before we jump into all of those juicy. But before we jump into all of those juicy. Universal life, such as indexed universal life (iul) and variable universal life (vul), is a form of permanent life insurance, also known as cash value life insurance. What is whole life insurance? Whole life insurance offers consistent premiums and guaranteed cash value accumulation, while a universal policy provides flexible premiums and death benefits.

Source: pinterest.com

Source: pinterest.com

The “index” policy allows your cash value to grow in a linked market index, such as the s&p 500, grows. Indexed universal life (iul) whole life vs. Whole life insurance is designed to be exactly that—life insurance. You can borrow against the cash. Whole life insurance does not participate in financial markets.

Source: wealthstrategist.net

Source: wealthstrategist.net

What is whole life insurance? One of the biggest differences you will find when comparing whole life insurance vs. The two most popular types of permanent life insurance are: Cash inside of these policies. Similar to whole life, this type of policy offers guaranteed death benefit protection, as well as cash value accumulation.

Source: youtube.com

Source: youtube.com

Indexed universal life (iul) whole life vs. You know exactly how much your insurance premiums are for life. It’s a question we hear a lot from clients when we first meet to discuss life insurance policies: “what’s the difference between universal life (ul) and index universal life (iul) insurance?” well, there’s a big difference. Here are four reasons why equity indexed universal life (eiul) policies aren’t recommended when you want predictable, guaranteed growth and/or if you intend to use the policy for becoming your own financing source, as is the case with bank on yourself.

Source: slideshare.net

Source: slideshare.net

Similar to whole life, this type of policy offers guaranteed death benefit protection, as well as cash value accumulation. Universal life, such as indexed universal life (iul) and variable universal life (vul), is a form of permanent life insurance, also known as cash value life insurance. Index universal life is the riskier of the two investments, with the potential for the entire program to implode if cash values are depleted by the cost of insurance. Whole life insurance offers consistent premiums and guaranteed cash value accumulation, while a universal policy provides flexible premiums and death benefits. Whole life insurance is predictable, making it ideal if you have low risk tolerance.

Source: youtube.com

Source: youtube.com

Similar to whole life, this type of policy offers guaranteed death benefit protection, as well as cash value accumulation. But before we jump into all of those juicy. From term life insurance that can be purchased for a few dollars per month to whole life insurance that covers you until the day you pass on, there is no shortage of options to consider. Whole life insurance does not participate in financial markets. You can borrow against the cash.

Source: slideshare.net

Source: slideshare.net

In general, whole life insurance is more expensive than universal life insurance. When it comes to comparing whole life vs indexed universal life many people get it wrong! Let’s take a look at the list of differences first, and then we’ll dig into the specifics down below: Universal life, such as indexed universal life (iul) and variable universal life (vul), is a form of permanent life insurance, also known as cash value life insurance. “what’s the difference between universal life (ul) and index universal life (iul) insurance?” well, there’s a big difference.

Source: slideshare.net

Source: slideshare.net

Here are four reasons why equity indexed universal life (eiul) policies aren’t recommended when you want predictable, guaranteed growth and/or if you intend to use the policy for becoming your own financing source, as is the case with bank on yourself. We will be specifically comparing whole life vs indexed universal life here. Whole life insurance is designed to be exactly that—life insurance. Index universal life is the riskier of the two investments, with the potential for the entire program to implode if cash values are depleted by the cost of insurance. The products are designed to do completely different things.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title whole life insurance vs indexed universal life by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information