Whole life insurance vs roth ira Idea

Home » Trend » Whole life insurance vs roth ira IdeaYour Whole life insurance vs roth ira images are available. Whole life insurance vs roth ira are a topic that is being searched for and liked by netizens now. You can Download the Whole life insurance vs roth ira files here. Download all free images.

If you’re searching for whole life insurance vs roth ira images information linked to the whole life insurance vs roth ira interest, you have pay a visit to the right blog. Our website always provides you with hints for refferencing the maximum quality video and image content, please kindly search and find more informative video articles and graphics that fit your interests.

Whole Life Insurance Vs Roth Ira. Roth iras and life insurance are very different, and the rules that apply to one dont always apply to the other. Immediate cash value, with growth that gets better every year What is the downside of a roth ira? Each can be adopted to provide a source of regular income in retirement,.

Should You Invest in a Roth IRA, a Traditional IRA, or a From toughnickel.com

Should You Invest in a Roth IRA, a Traditional IRA, or a From toughnickel.com

Roth ira vs whole life insurance; Compare this to someone who buys a much cheaper term life insurance policy, which has no savings feature, and invests the difference in an ira. Ul premiums pay for the insurance as well as funding the investments, so overall performance won�t match investing the same amount in a roth ira, but the added protection is. Whole life insurance, or any other type of permanent life insurance with cash value, can help fund retirement. They can dip into their savings at any time after. Roth iras give you many investment options and generally pay a higher rate of interest than an lirp based on a whole life insurance policy.

However, assets held within them grow free of federal income tax, and you can draw tax free income from either one of them.

Whole life insurance, or any other type of permanent life insurance with cash value, can help fund retirement. This ability to overfund life insurance for later use makes whole life insurance an excellent means of building up substantial savings in a shorter amount of time versus a roth ira. Compare this to someone who buys a much cheaper term life insurance policy, which has no savings feature, and invests the difference in an ira. What is the downside of a roth ira? You may earn a higher rate of interest by using variable life or some forms of universal life for an lirp. All life insurance is cheaper the younger and healthier you are, and whole life insurance is especially worth purchasing as soon as you can because it usually has a savings element that can grow over time.

Source: pinterest.com

Source: pinterest.com

Generally, life insurance is a more expensive way to save for retirement. Roth iras give you many investment options and generally pay a higher rate of interest than an lirp based on a whole life insurance policy. Roth iras and life insurance are very different, and the rules that apply to one dont always apply to the other. Immediate cash value, with growth that gets better every year What is the downside of a roth ira?

Source: pinterest.com

Source: pinterest.com

This ability to overfund life insurance for later use makes whole life insurance an excellent means of building up substantial savings in a shorter amount of time versus a roth ira. You can access your principal and growth, with no taxes due under current tax law; Roth ira vs whole life insurance; All life insurance is cheaper the younger and healthier you are, and whole life insurance is especially worth purchasing as soon as you can because it usually has a savings element that can grow over time. Immediate cash value, with growth that gets better every year

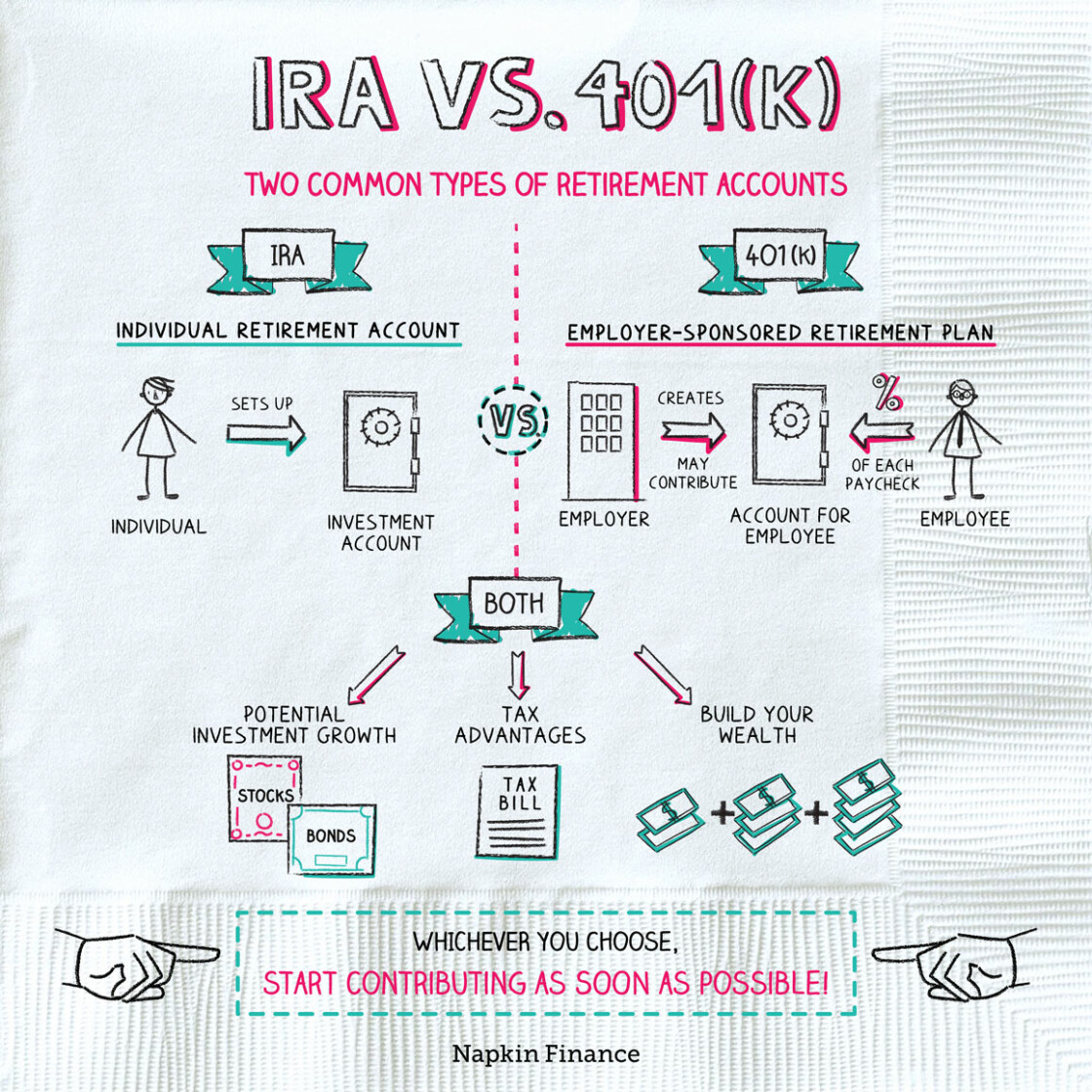

Source: napkinfinance.com

Source: napkinfinance.com

All life insurance is cheaper the younger and healthier you are, and whole life insurance is especially worth purchasing as soon as you can because it usually has a savings element that can grow over time. While they share tax benefits, they are designed to do different things. This ability to overfund life insurance for later use makes whole life insurance an excellent means of building up substantial savings in a shorter amount of time versus a roth ira. They can dip into their savings at any time after. This past weekend we had our first cold front of the season pass through here in south florida.

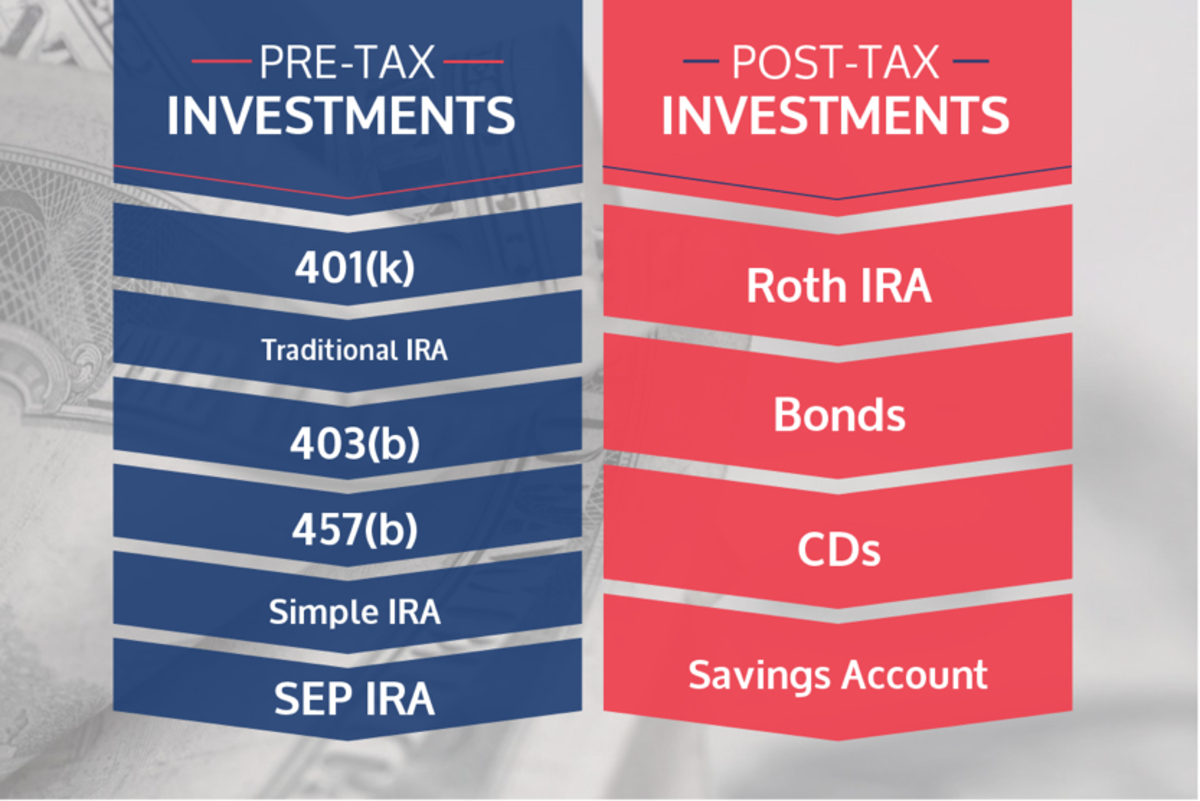

Source: cjwealth.com

Source: cjwealth.com

What is the downside of a roth ira? You can access your principal and growth, with no taxes due under current tax law; Whole life insurance and roth individual retirement accounts both offer tax advantages, but which one is right for you depends on your personal situation. They can dip into their savings at any time after. This past weekend we had our first cold front of the season pass through here in south florida.

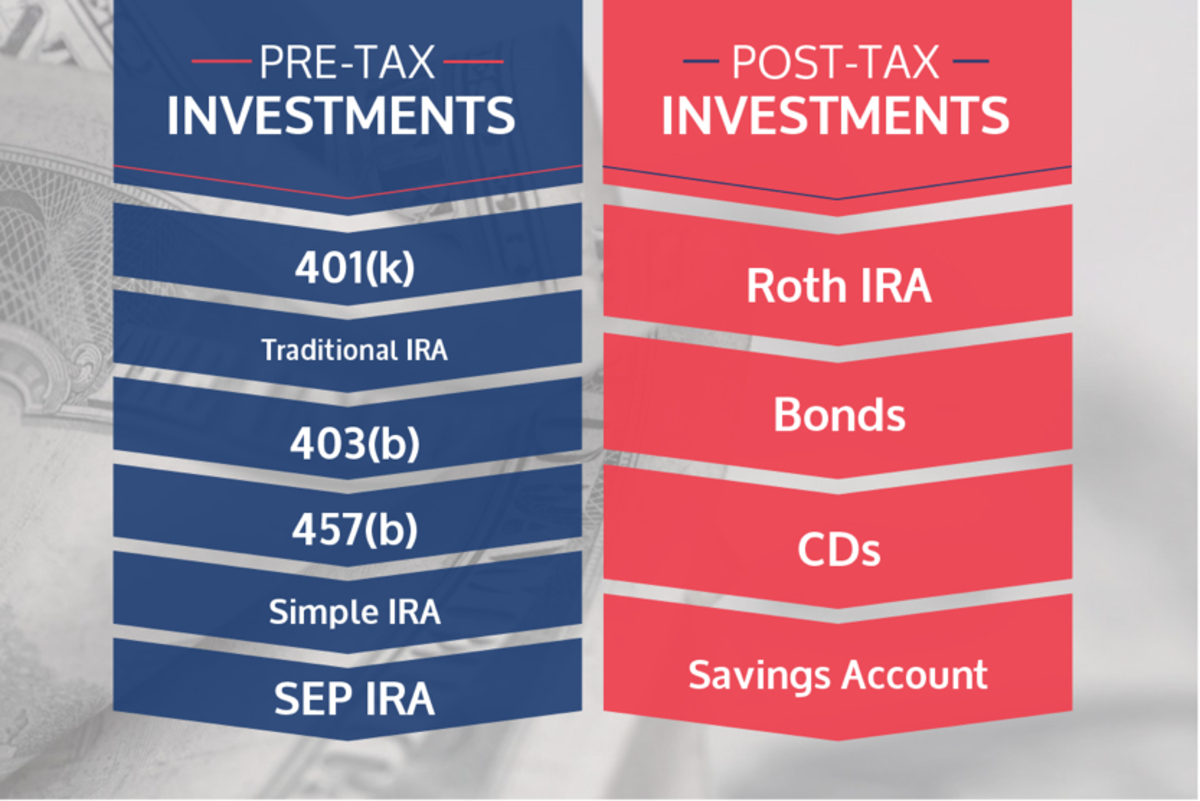

Source: visual.ly

Source: visual.ly

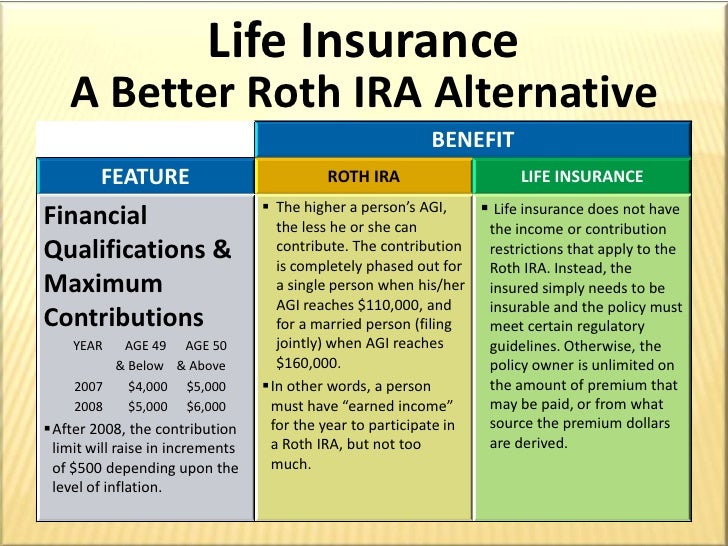

All life insurance is cheaper the younger and healthier you are, and whole life insurance is especially worth purchasing as soon as you can because it usually has a savings element that can grow over time. However, assets held within them grow free of federal income tax, and you can draw tax free income from either one of them. The best alternative to a roth ira is a properly structured whole life insurance policy. In contrast, a roth ira has no such considerations for its annual contributions. Whole life insurance, or any other type of permanent life insurance with cash value, can help fund retirement.

Source: blog.advisors-resource.com

Source: blog.advisors-resource.com

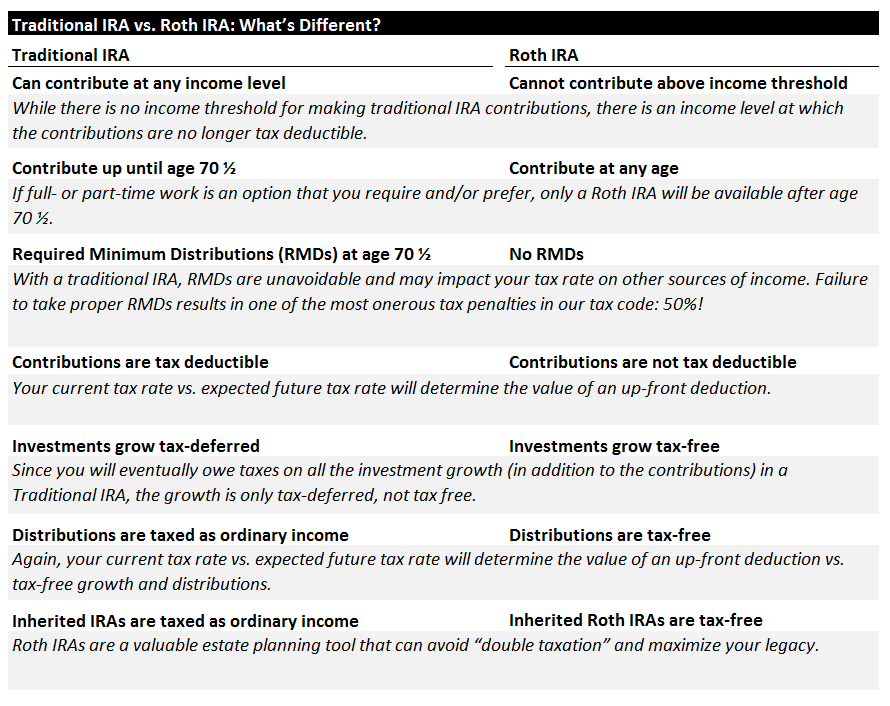

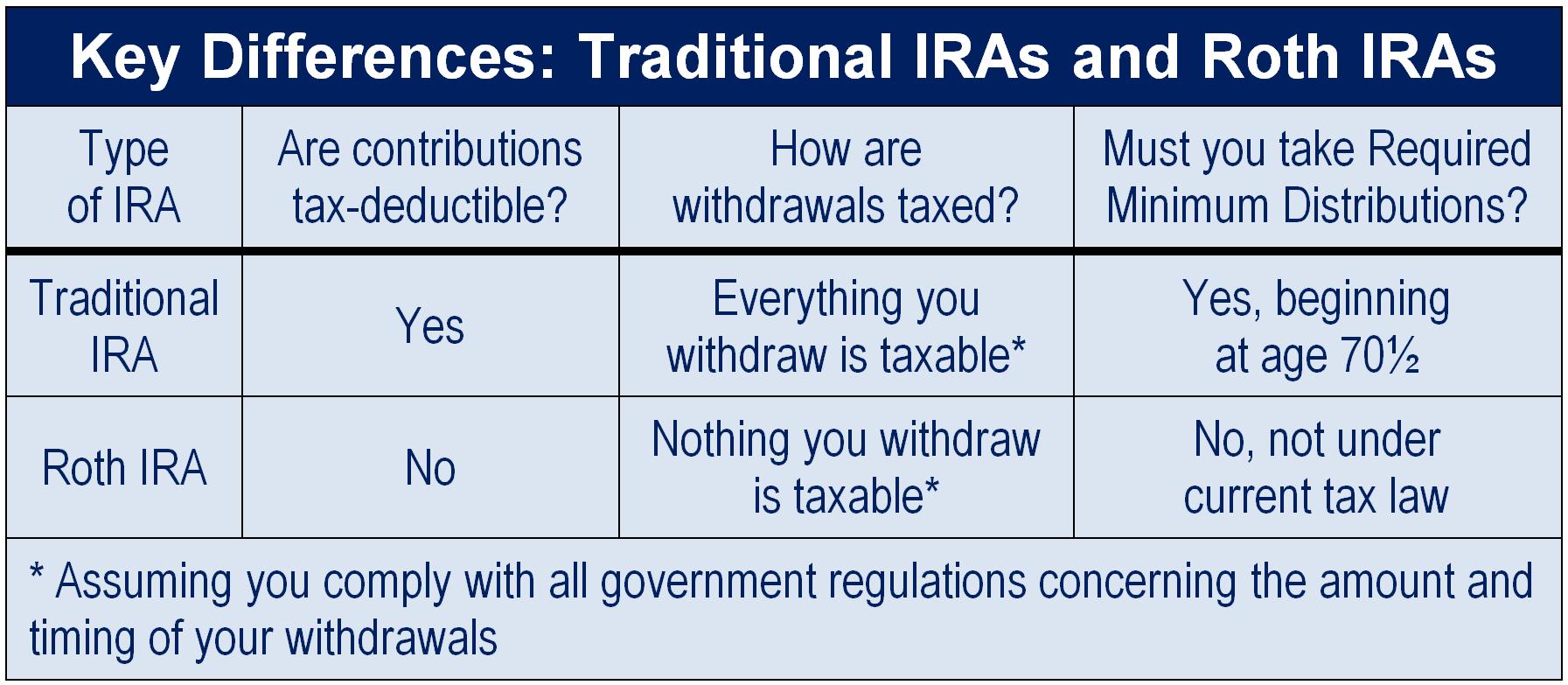

However, assets held within them grow free of federal income tax, and you can draw tax free income from either one of them. Whole life insurance, or any other type of permanent life insurance with cash value, can help fund retirement. Roth ira annual contribution limits are $6,000 ($7,000 if you�re age 50 or older). In contrast, a roth ira has no such considerations for its annual contributions. Whole life insurance, which is also called permanent life insurance, and roth iras, which is a variation on the traditional individual retirement account, are two types of financial vehicles that frequently are used in retirement planning.

Source: toughnickel.com

Source: toughnickel.com

You may earn a higher rate of interest by using variable life or some forms of universal life for an lirp. Life insurance vs roth ira 👪 jan 2022. The difference is that the roth ira is primarily an investment vehicle, while cash value life insurance is an insurance product. With life insurance, it’s also important to be aware of modified endowed contracts. Whole life insurance and roth individual retirement accounts both offer tax advantages, but which one is right for you depends on your personal situation.

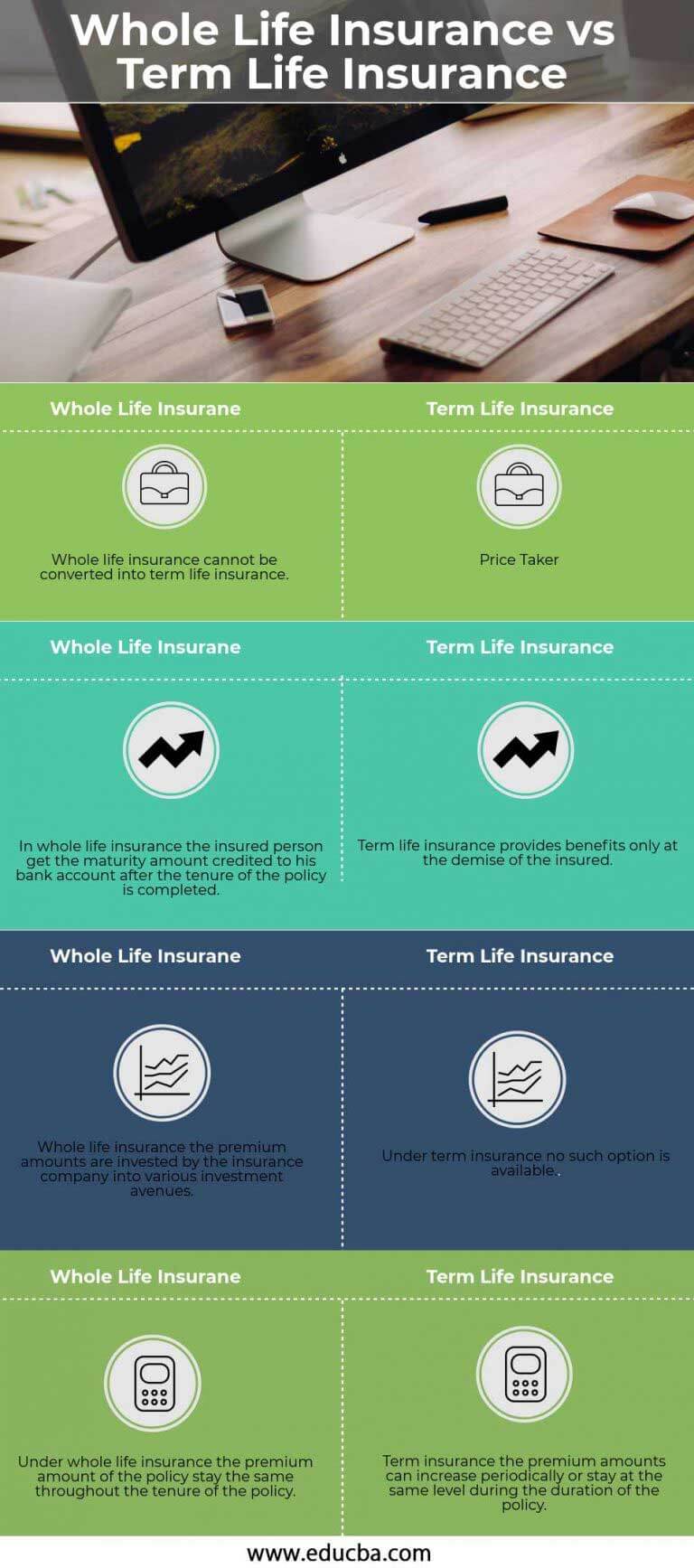

Source: educba.com

Source: educba.com

Life auto home health business renter disability commercial auto long term care annuity. Life auto home health business renter disability commercial auto long term care annuity. 8 reasons whole life insurance is not like a roth ira aug 9, 2013 — not as expensive as a separate ltc policy because it merely extends the death benefit already there. This can be used for major purchases such as. You can access your principal and growth, with no taxes due under current tax law;

Source: slideshare.net

Source: slideshare.net

Compare this to someone who buys a much cheaper term life insurance policy, which has no savings feature, and invests the difference in an ira. What is the downside of a roth ira? Roth ira annual contribution limits are $6,000 ($7,000 if you�re age 50 or older). Whole life insurance, or any other type of permanent life insurance with cash value, can help fund retirement. Whole life pros and cons;

Source: hillsbank.com

Source: hillsbank.com

The tax benefits of a life insurance policy can be affected by how much money you fund the policy with. 8 reasons whole life insurance is not like a roth ira aug 9, 2013 — not as expensive as a separate ltc policy because it merely extends the death benefit already there. Generally, life insurance is a more expensive way to save for retirement. You may earn a higher rate of interest by using variable life or some forms of universal life for an lirp. Roth ira vs whole life insurance;

Source: wallethacks.com

Source: wallethacks.com

8 reasons whole life insurance is not like a roth ira aug 9, 2013 — not as expensive as a separate ltc policy because it merely extends the death benefit already there. The tax benefits of a life insurance policy can be affected by how much money you fund the policy with. Compare this to someone who buys a much cheaper term life insurance policy, which has no savings feature, and invests the difference in an ira. Immediate cash value, with growth that gets better every year This past weekend we had our first cold front of the season pass through here in south florida.

Source: juwitalove.blogspot.com

Each can be adopted to provide a source of regular income in retirement,. With life insurance, it’s also important to be aware of modified endowed contracts. Roth iras give you many investment options and generally pay a higher rate of interest than an lirp based on a whole life insurance policy. 8 reasons whole life insurance is not like a roth ira aug 9, 2013 — not as expensive as a separate ltc policy because it merely extends the death benefit already there. 1 life insurance policies can be structured to accept much more than $7,000 in annual premiums, which can help if you’re trying to catch up and build savings before you retire.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

8 reasons whole life insurance is not like a roth ira aug 9, 2013 — not as expensive as a separate ltc policy because it merely extends the death benefit already there. With life insurance, it’s also important to be aware of modified endowed contracts. Whole life pros and cons; Generally, life insurance is a more expensive way to save for retirement. This ability to overfund life insurance for later use makes whole life insurance an excellent means of building up substantial savings in a shorter amount of time versus a roth ira.

Source: bankonyourself.com

Source: bankonyourself.com

Generally, life insurance is a more expensive way to save for retirement. Roth ira vs whole life insurance; Whole life insurance and roth individual retirement accounts both offer tax advantages, but which one is right for you depends on your personal situation. Life auto home health business renter disability commercial auto long term care annuity. This can be used for major purchases such as.

Source: lifeinsurance411.org

Source: lifeinsurance411.org

Roth ira vs whole life insurance; Roth ira annual contribution limits are $6,000 ($7,000 if you�re age 50 or older). Each can be adopted to provide a source of regular income in retirement,. The difference is that the roth ira is primarily an investment vehicle, while cash value life insurance is an insurance product. However, assets held within them grow free of federal income tax, and you can draw tax free income from either one of them.

Source: melsretirementblog.com

Source: melsretirementblog.com

The best alternative to a roth ira is a properly structured whole life insurance policy. 8 reasons whole life insurance is not like a roth ira aug 9, 2013 — not as expensive as a separate ltc policy because it merely extends the death benefit already there. Whole life insurance, or any other type of permanent life insurance with cash value, can help fund retirement. The best alternative to a roth ira is a properly structured whole life insurance policy. Ul premiums pay for the insurance as well as funding the investments, so overall performance won�t match investing the same amount in a roth ira, but the added protection is.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

They can dip into their savings at any time after. 1 life insurance policies can be structured to accept much more than $7,000 in annual premiums, which can help if you’re trying to catch up and build savings before you retire. This can be used for major purchases such as. 8 reasons whole life insurance is not like a roth ira aug 9, 2013 — not as expensive as a separate ltc policy because it merely extends the death benefit already there. You may earn a higher rate of interest by using variable life or some forms of universal life for an lirp.

Source: youtube.com

Source: youtube.com

The big advantage of using whole life insurance in the form of a rich person roth over a roth ira is the lack of any statutory limit on the amount you can contribute to such a policy. All life insurance is cheaper the younger and healthier you are, and whole life insurance is especially worth purchasing as soon as you can because it usually has a savings element that can grow over time. Whole life insurance, which is also called permanent life insurance, and roth iras, which is a variation on the traditional individual retirement account, are two types of financial vehicles that frequently are used in retirement planning. This can be used for major purchases such as. 1 life insurance policies can be structured to accept much more than $7,000 in annual premiums, which can help if you’re trying to catch up and build savings before you retire.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title whole life insurance vs roth ira by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information