Why are insurance policies called aleatory contracts Idea

Home » Trend » Why are insurance policies called aleatory contracts IdeaYour Why are insurance policies called aleatory contracts images are available. Why are insurance policies called aleatory contracts are a topic that is being searched for and liked by netizens now. You can Find and Download the Why are insurance policies called aleatory contracts files here. Get all free photos.

If you’re looking for why are insurance policies called aleatory contracts pictures information connected with to the why are insurance policies called aleatory contracts keyword, you have visit the ideal blog. Our site always gives you suggestions for seeing the maximum quality video and image content, please kindly surf and find more informative video content and images that fit your interests.

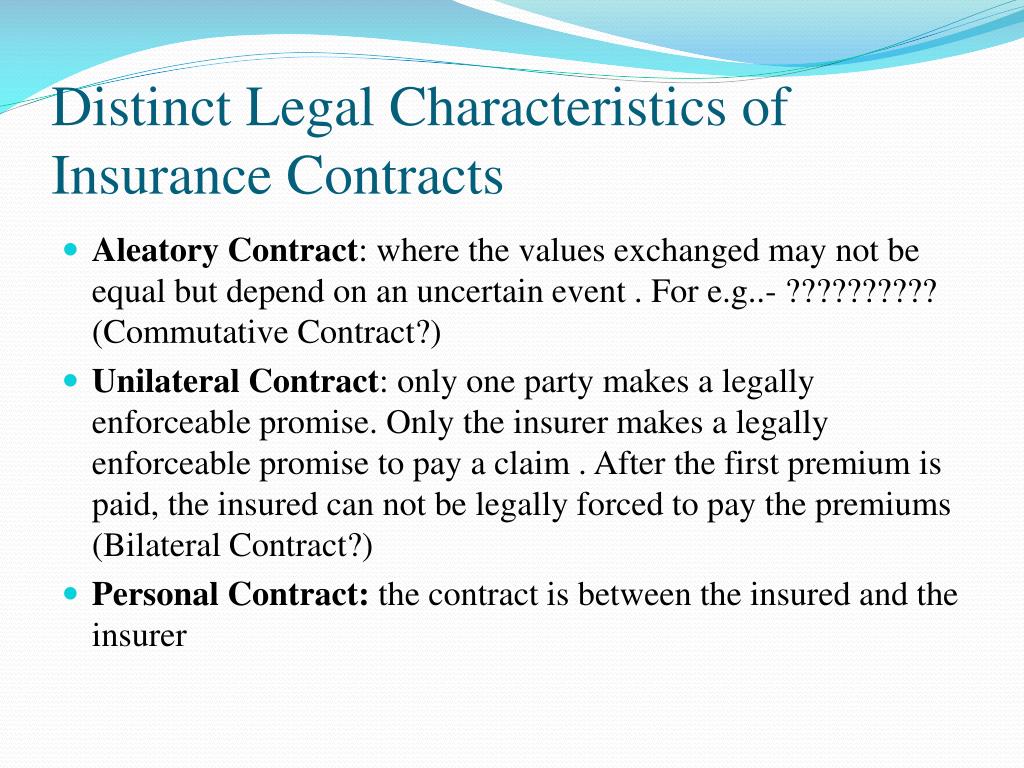

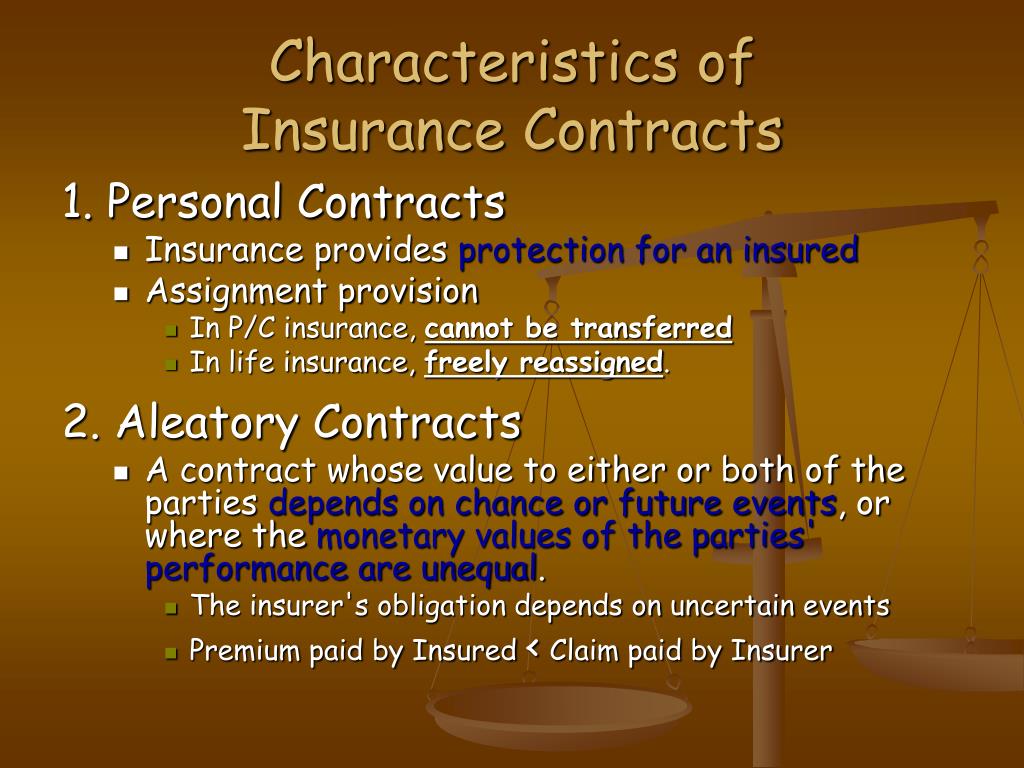

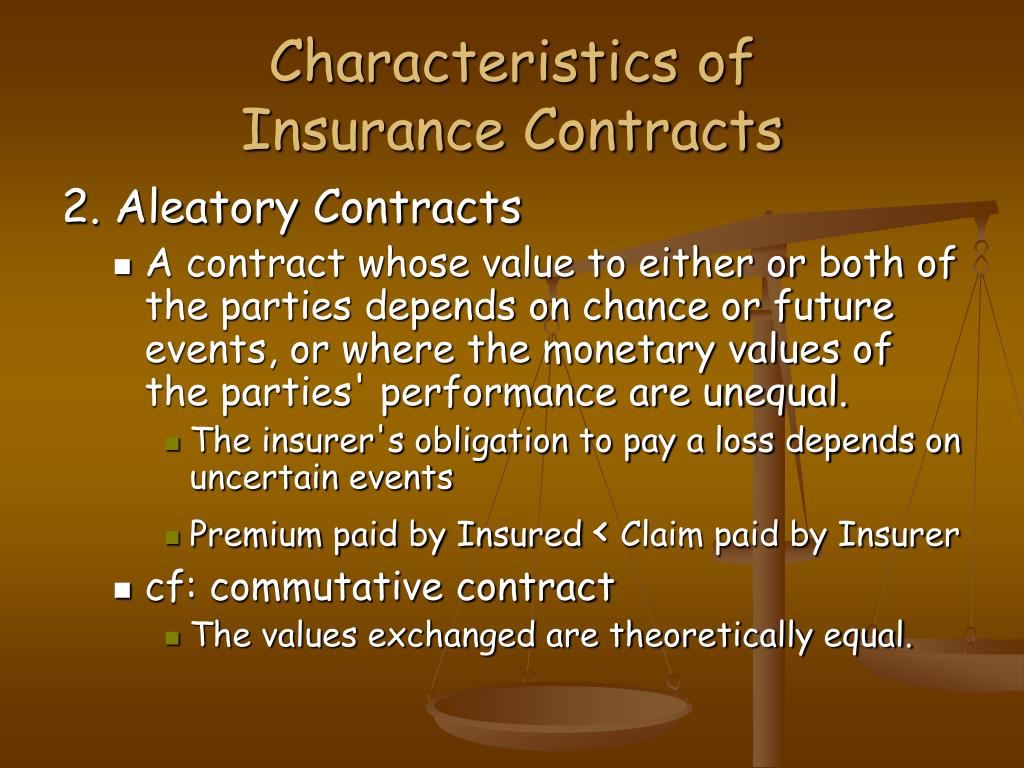

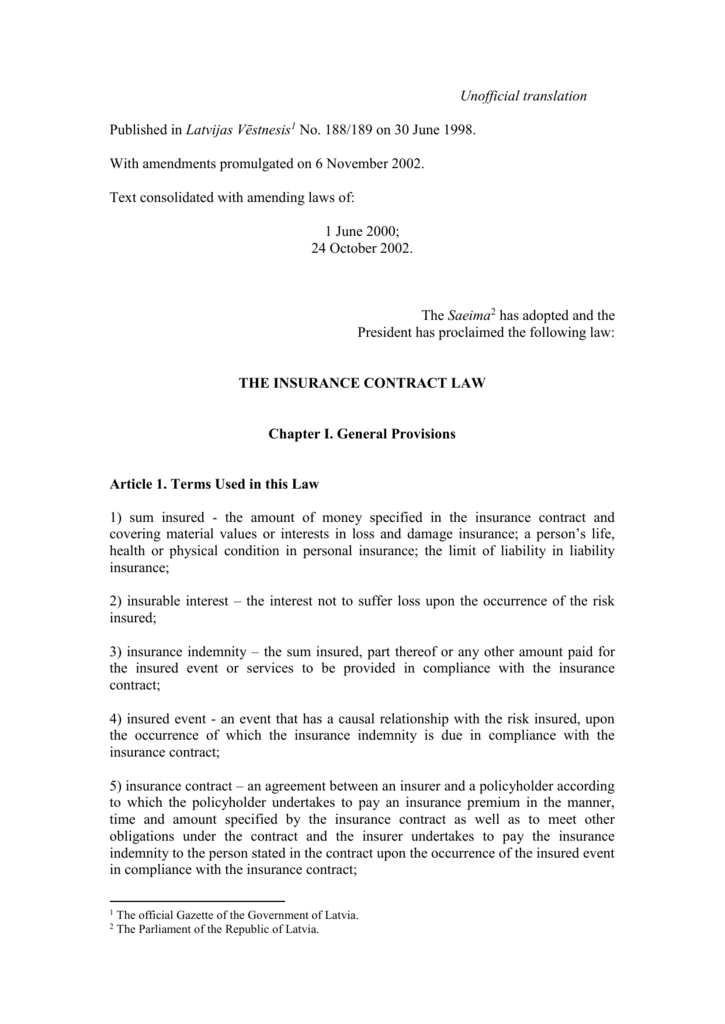

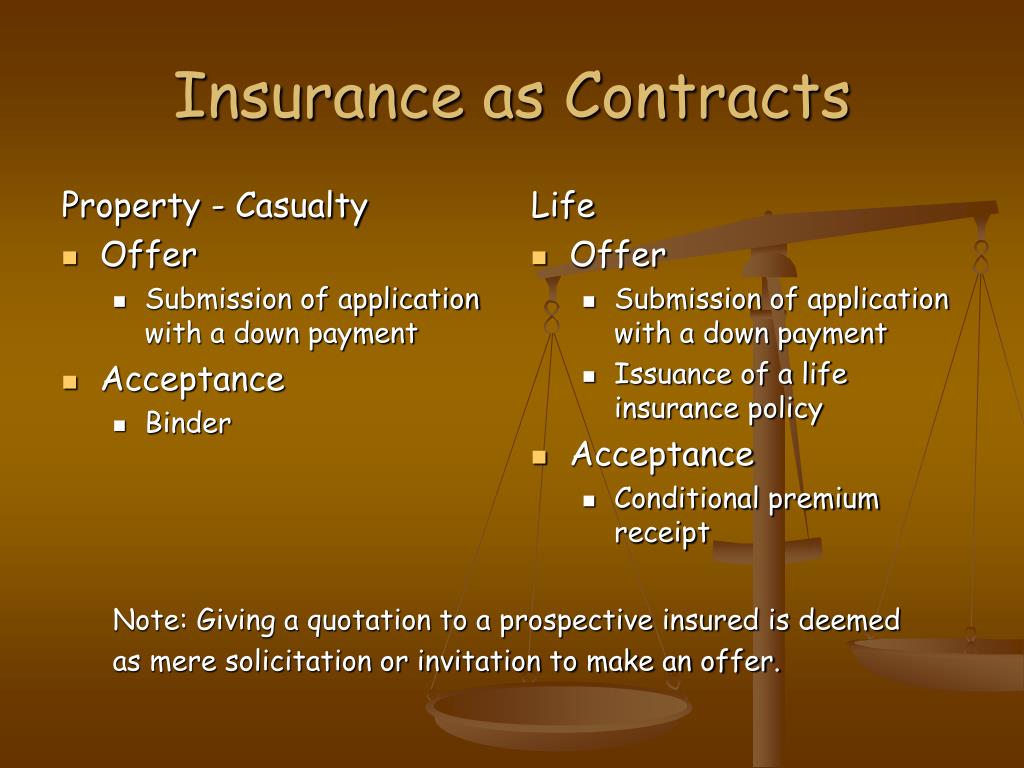

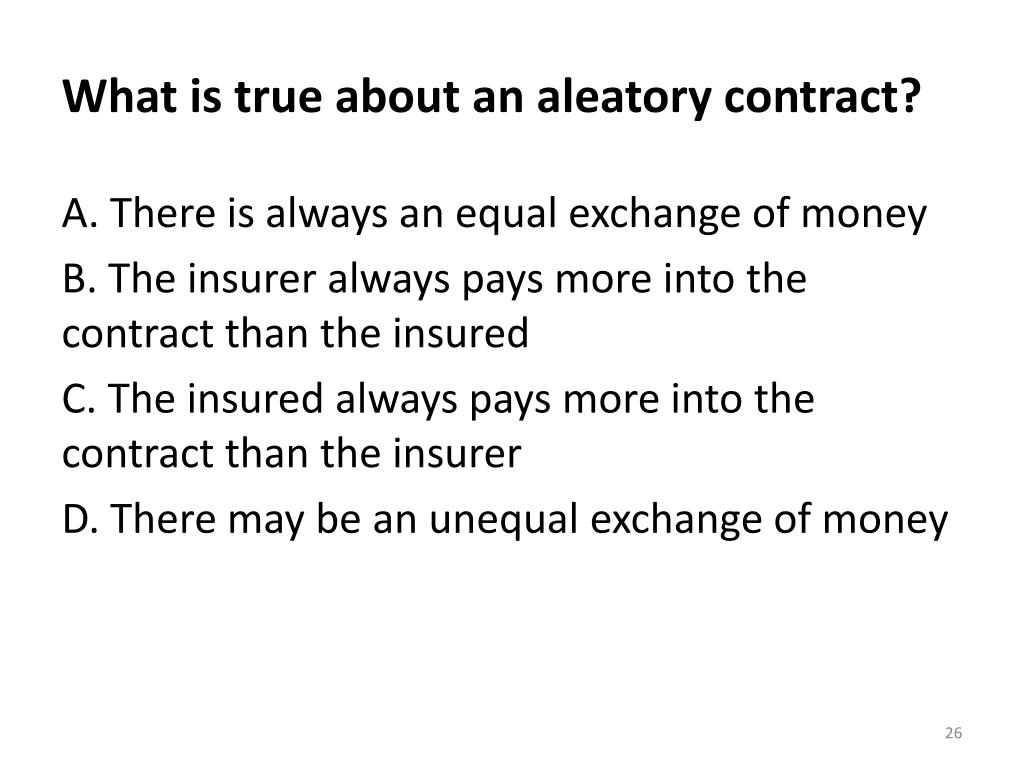

Why Are Insurance Policies Called Aleatory Contracts. Also know, why are insurance policies called aleatory contracts? Insurance contracts are aleatory in that the amount the insured will pay in premiums is unequal to the amount that the insurer will pay in the event of a loss. Aleatory contract — an agreement concerned with an uncertain event that provides for unequal transfer of value between the parties. What is aleatory contract in insurance policy?

PPT Principles Of Insurance PowerPoint Presentation From slideserve.com

PPT Principles Of Insurance PowerPoint Presentation From slideserve.com

This means there is an element of chance and potential for unequal exchange of value or consideration for both parties. With an insurance policy or contract, the risk is insured but nothing happens until a specific event occurs. Aleatory contracts, also known as aleatory insurance, turn out to be helpful because they support the insured person to deal with the financial risk. Aleatory (偶然性)¶ insurance contracts are aleatory. At times, you may need an addendum to the contract or to hire a contract. Insurance policies are aleatory contracts because an insured can pay premiums for many years without sustaining a covered loss.

Why are insurance policies called aleatory contracts?

At times, you may need an addendum to the contract or to hire a contract. An aleatory contract is a contract where an uncertain event determines the parties� rights and obligations. Aleatory contract — an agreement concerned with an uncertain event that provides for unequal transfer of value between the parties. An aleatory contract is conditioned upon the occurrence of an event. What is an example of an aleatory contract? An implied contract is an unstated or unintentional agreement that may be deemed to exist when the actions of any of the parties suggest the existence of an agreement.

Source: slideserve.com

Source: slideserve.com

What is an example of an aleatory contract? Aleatory contract — an agreement concerned with an uncertain event that provides for unequal transfer of value between the parties. Why are insurance policies called aleatory contracts? An aleatory contract is conditioned upon the occurrence of an event. Also know, why are insurance policies called aleatory contracts?

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

In insurance, an aleatory contract refers. Insurance policies are considered aleatory contracts because. Why are insurance policies called aleatory contracts? Insurance policy is considered an aleatory contract because: Aleatory contracts have existed for hundreds (and possibly thousands) of years, first showing up in roman law in relation to gambling and other uncontrollable chance events.

Why are insurance policies called aleatory contracts? Also know, why are insurance policies called aleatory contracts? Why are insurance policies called aleatory contracts? Aleatory contracts—also called aleatory insurance—are helpful because they typically help the purchaser reduce financial risk. Insurance contracts are aleatory in that the amount the insured will pay in premiums is unequal to the amount that the insurer will pay in the event of a loss.

Source: slideserve.com

Source: slideserve.com

Aleatory contract — an agreement concerned with an uncertain event that provides for unequal transfer of value between the parties. This means there is an element of chance and potential for unequal exchange of value or consideration for both parties. Insurance contracts are aleatory in that the amount the insured will pay in premiums is unequal to the amount that the insurer will pay in the event of a loss. Insurance contracts are aleatory in that the amount the insured will pay in premiums is unequal to the amount that the insurer will pay in the event of a loss. Additionally, another very common type of aleatory contract is an insurance policy.

Source: alqurumresort.com

Source: alqurumresort.com

Watch out a lot more about it. Performance is conditioned upon a future occurrence. Through this contract the insured get promised of compensation against loss of property due to specific probable accidents mentioned in the contract in lieu o. This means there is an element of chance and potential for unequal exchange of value or consideration for both parties. Watch out a lot more about it.

Source: slideserve.com

Source: slideserve.com

Insurance contracts are aleatory in that the amount the insured will pay in premiums is unequal to the amount that the insurer will pay in the event of a loss. Also know, why are insurance policies called aleatory contracts? Insurance contracts are aleatory in that the amount the insured will pay in premiums is unequal to the amount that the insurer will pay in the event of a loss. The insurer performs the promised action only if a specified chance event occurs the valuable consideration necessary to make a. This means there is an element of chance and potential for unequal exchange of value or consideration for both.

Source: slideserve.com

Source: slideserve.com

This means there is an element of chance and potential for unequal exchange of value or consideration for both parties. Insurance contracts are aleatory in that the amount the insured will pay in premiums is unequal to the amount that the insurer will pay in the event of a loss. Why are insurance policies called aleatory contracts? An aleatory contract is conditioned upon the occurrence of an event. Watch out a lot more about it.

Source: specialforu2.blogspot.com

Source: specialforu2.blogspot.com

Insurance is termed an aleatory contract because it is a contract where the performance of the contract is contingent upon the occurrence of a particular (9). Why are insurance policies called aleatory contracts? Watch out a lot more about it. Through this contract the insured get promised of compensation against loss of property due to specific probable accidents mentioned in the contract in lieu o. This means there is an element of chance and potential for unequal exchange of value or consideration for both parties.

Source: slideserve.com

Source: slideserve.com

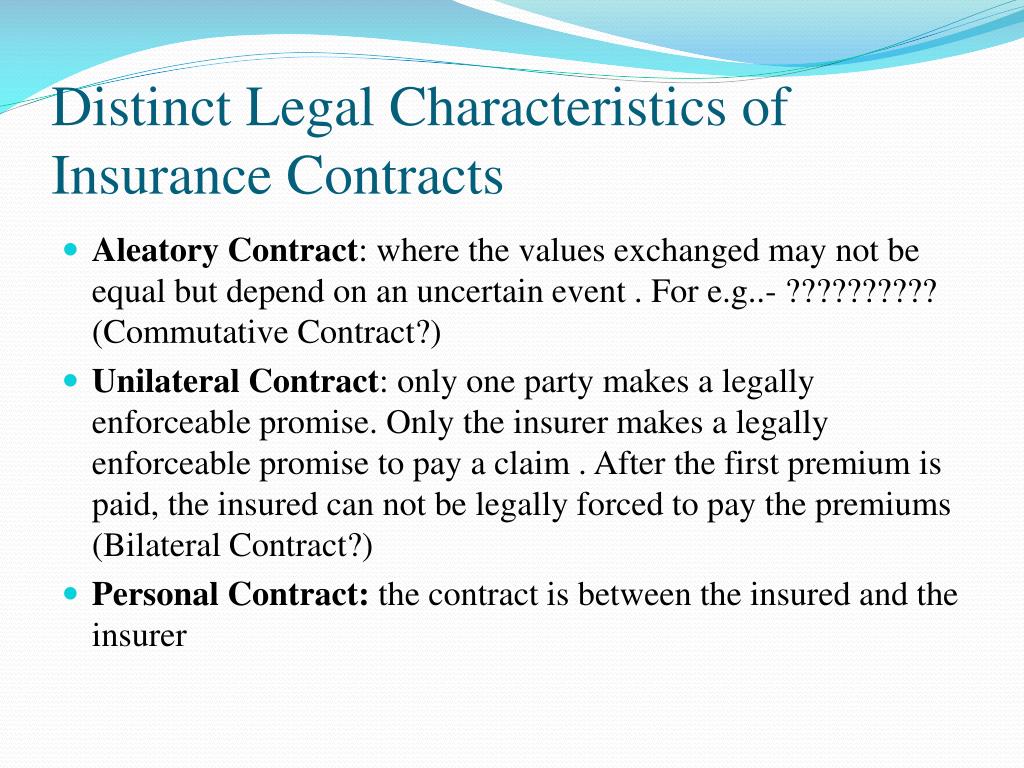

What is aleatory contract in insurance policy? Aleatory contracts, also known as aleatory insurance, turn out to be helpful because they support the insured person to deal with the financial risk. For example, gambling, wagering, or betting typically use aleatory contracts. This means there is an element of chance and potential for unequal exchange of value or consideration for both. Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims.

Source: taylorsphotopeace.blogspot.com

Insurance policies are aleatory contracts because an insured can pay premiums for many years without sustaining a covered loss. What does aleatory mean in insurance? An implied contract is an unstated or unintentional agreement that may be deemed to exist when the actions of any of the parties suggest the existence of an agreement. Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims. Why are insurance policies called aleatory contracts?

Source: alqurumresort.com

Source: alqurumresort.com

Why are insurance policies called aleatory contracts? Aleatory contracts, also known as aleatory insurance, turn out to be helpful because they support the insured person to deal with the financial risk. What is aleatory contract in insurance policy? Performance is conditioned upon a future occurrence. An aleatory contract allow an incentive whereby the parties involved do these have to appoint a particular food until this specific triggering uncertain.

Source: thaipoliceplus.com

Source: thaipoliceplus.com

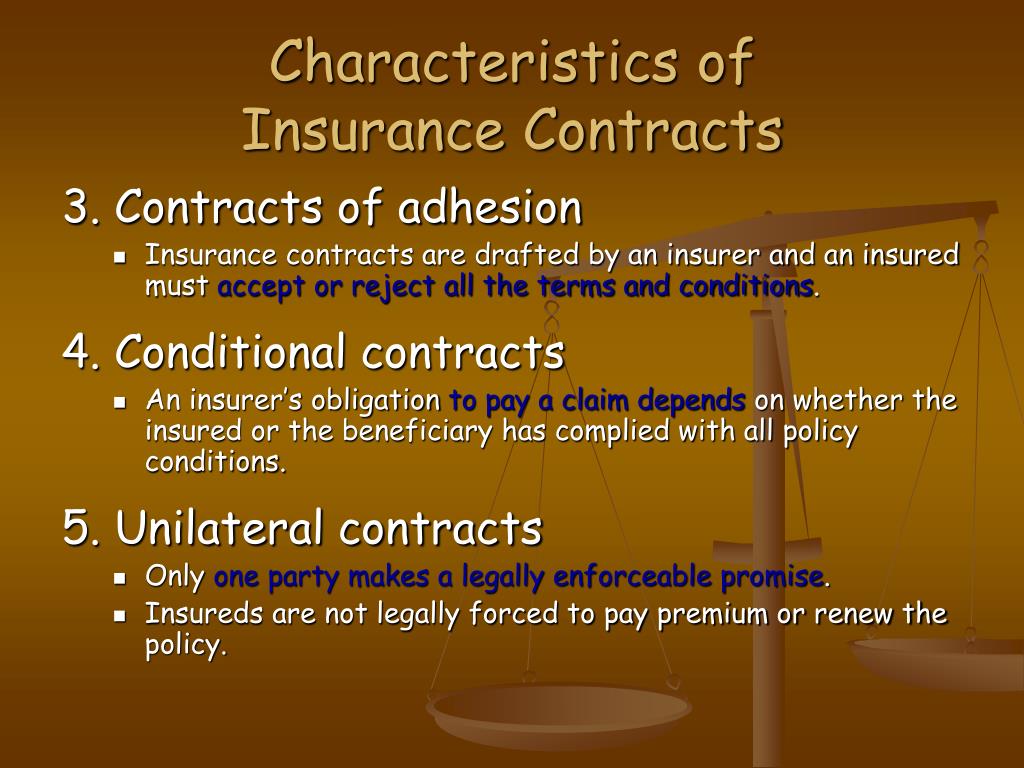

Aleatory contract — an agreement concerned with an uncertain event that provides for unequal transfer of value between the parties. Robert strotz, flight insurance and the theory of choice. This means there is an element of chance and potential for unequal exchange of value or consideration for both parties. Insurance policy is a legal contract & its formation is subject to the fulfillment of the requisites of a contract defined under indian contract act. Aleatory contracts—also called aleatory insurance—are helpful because they typically help the purchaser reduce financial risk.

Source: slideserve.com

Source: slideserve.com

At times, you may need an addendum to the contract or to hire a contract. Why are insurance policies called aleatory contracts? Aleatory contract — an agreement concerned with an uncertain event that provides for unequal transfer of value between the parties. Aleatory contract — an agreement concerned with an uncertain event that provides for unequal transfer of value between the parties. Also know, why are insurance policies called aleatory contracts?

Source: noclutter.cloud

Source: noclutter.cloud

What does aleatory mean in insurance? For example, gambling, wagering, or betting typically use aleatory contracts. Aleatory (偶然性)¶ insurance contracts are aleatory. At times, you may need an addendum to the contract or to hire a contract. Why are insurance policies called aleatory contracts?

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

When the purpose of insurance is to protect against loss of property due to an accident it is known as general insurance. An aleatory contract is a contract where an uncertain event determines the parties� rights and obligations. Author the insured’s obligation to make a premium payment is typically much less in value than the amount the insured “promises” to pay should a triggering event happen. An aleatory contract is a contract where an uncertain event determines the parties� rights and obligations. Insurance policies are aleatory contracts because an insured can pay premiums for many years without sustaining a covered loss.

Source: slideserve.com

Source: slideserve.com

Consequently, the benefits provided by an insurance policy may or may not exceed the premiums paid. This means there is an element of chance and potential for unequal exchange of value or consideration for both parties. Aleatory contracts have existed for hundreds (and possibly thousands) of years, first showing up in roman law in relation to gambling and other uncontrollable chance events. Insurance contracts are aleatory in that the amount the insured will pay in premiums is unequal to the amount that the insurer will pay in the event of a loss. Also know, why are insurance policies called aleatory contracts?

Source: slideshare.net

Source: slideshare.net

An aleatory contract allow an incentive whereby the parties involved do these have to appoint a particular food until this specific triggering uncertain. Robert strotz, flight insurance and the theory of choice. Aleatory contract — an agreement concerned with an uncertain event that provides for unequal transfer of value between the parties. Why are insurance policies called aleatory contracts? This means there is an element of chance and potential for unequal exchange of value or consideration for both.

Source: slideserve.com

Source: slideserve.com

An aleatory contract is a contract where an uncertain event determines the parties� rights and obligations. This means there is an element of chance and potential for unequal exchange of value or consideration for both. Additionally, another very common type of aleatory contract is an insurance policy. When the purpose of insurance is to protect against loss of property due to an accident it is known as general insurance. Aleatory contracts—also called aleatory insurance—are helpful because they typically help the purchaser reduce financial risk.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title why are insurance policies called aleatory contracts by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information