Why did insurance premiums increase information

Home » Trending » Why did insurance premiums increase informationYour Why did insurance premiums increase images are available. Why did insurance premiums increase are a topic that is being searched for and liked by netizens now. You can Get the Why did insurance premiums increase files here. Download all free images.

If you’re searching for why did insurance premiums increase images information connected with to the why did insurance premiums increase topic, you have come to the right site. Our site always gives you hints for downloading the highest quality video and picture content, please kindly surf and locate more enlightening video content and graphics that fit your interests.

Why Did Insurance Premiums Increase. Reasons for a rate increase if you�re wondering, why is my car insurance so high? Why did my geico insurance go up 2022? Some factors that lead to rate rises include: Why did my car insurance go up without an accident or ticket?

EXPLAINED Why Do Auto Insurance Premiums Increase? From tgsinsurance.com

EXPLAINED Why Do Auto Insurance Premiums Increase? From tgsinsurance.com

You can expect your car insurance premium to increase if you�ve committed any traffic violations, added drivers to your policy, moved, changed or upgraded insurance coverage, or added a vehicle. Why do health insurance premiums rise each year? This model forecasts auto insurance premiums to increase by 24% by 2030. Importantly, this forecast includes no expectations for increased natural disaster damages. If you�re unable to get a straight answer from your representative, you may wish to check with your state�s insurance regulator. If your insurance company insures a large number of homes in your area, they might raise premiums after a major incident—winter storm, wildfire, or windstorm.

New, sophisticated, and costly technology helps in the diagnosis and treatment of health conditions, while specialized medications can prolong lives from diseases like cancer.

You will find 7 reasons why your insurance premiums are rising faster than your salary. This is due to a number of factors. A 4% jump in premiums to $1,398 a year is the result of an overall rise in material costs, disruption in supply chains, and climate change. Why did my homeowners insurance go up 2022? If you�re unable to get a straight answer from your representative, you may wish to check with your state�s insurance regulator. The growing number of complex and expensive procedures available in private hospitals;

Source: angrybearblog.com

Source: angrybearblog.com

When insurance companies find themselves in an. Emergency cleanup services, skilled trades, personal belongings, and homes in general have become more expensive, which leads to higher claims payouts. Reasons why your health insurance premium increases on renewal #1 healthcare inflation according to the economic times, inflation in healthcare is growing at a rate of 12 to 18%! This is due to a number of factors. The growing number of complex and expensive procedures available in private hospitals;

Source: wideinfo.org

Source: wideinfo.org

It�s unusual for an insurance company to raise its premiums without cause. This model forecasts auto insurance premiums to increase by 24% by 2030. Your insurer raised rates to cover its cost of doing business you filed a claim or live an area where many others have you added a pool, trampoline, woodstove you’ve added a certain breed of dog to the family you built an addition or did a major renovation inflation Or, it could be because of your driving record, claims made or even your credit score. Here are common reasons why home insurance rates increase:

Source: qualityquote.co.za

Source: qualityquote.co.za

In fact, historic jumps in the occurrence and magnitude of natural catastrophes has forced carriers to pay larger settlements with higher frequency. If your insurance company insures a large number of homes in your area, they might raise premiums after a major incident—winter storm, wildfire, or windstorm. Emergency cleanup services, skilled trades, personal belongings, and homes in general have become more expensive, which leads to higher claims payouts. And the rate of private health insurance claims. You will find 7 reasons why your insurance premiums are rising faster than your salary.

Source: cdllife.com

Source: cdllife.com

The cost of your home insurance may go up if your insurance company predicts that homes in your area have become more prone to burglaries or damage from extreme weather events, for example. Reasons for a rate increase if you�re wondering, why is my car insurance so high? It is found that many of these claims did not arise accidentally but through lack of maintenance, which led to the damage. On the bright side, most people shopping on the exchange for health insurance won’t feel these increases all that much. Auto accidents and traffic violations are common explanations for an insurance rate increasing, but there are other reasons why car insurance premiums go up including an address change, new vehicle, and claims in your zip code.

Source: blog.militarydisabilitymadeeasy.com

Source: blog.militarydisabilitymadeeasy.com

Here are common reasons why home insurance rates increase: If none of these events have occurred and you haven�t filed an insurance claim, you could be wondering what. Or, it could be because of your driving record, claims made or even your credit score. This is due to a number of factors. Due to the ‘cost of doing business’ being included in these calculations, consumers should have higher premiums in 2022, especially if there is a market expansion.

Source: longviewfa.com

Source: longviewfa.com

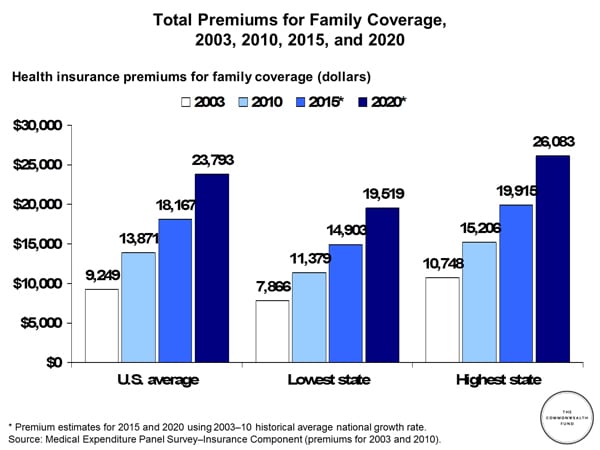

Or, it could be because of your driving record, claims made or even your credit score. The national average is a 22% increase, despite the concentrated efforts of some states to provide cheaper premiums, as is the case with the kansas health insurance exchange. Business costs are on the rise for most companies in the u.s. On the bright side, most people shopping on the exchange for health insurance won’t feel these increases all that much. Your insurance premiums will go up companies will raise premiums due to those elevated claims they�ve seen in the past couple of years.

Source: verywellhealth.com

Source: verywellhealth.com

When insurance providers pay a lot of. This is a continuation of a trend in the insurance industry. This model forecasts auto insurance premiums to increase by 24% by 2030. Your insurer raised rates to cover its cost of doing business you filed a claim or live an area where many others have you added a pool, trampoline, woodstove you’ve added a certain breed of dog to the family you built an addition or did a major renovation inflation A decrease in your credit score.

Source: qualityquote.co.za

Source: qualityquote.co.za

The cost of your home insurance may go up if your insurance company predicts that homes in your area have become more prone to burglaries or damage from extreme weather events, for example. Asides from the increase caused by inflation, the following may be the reason for your premium increase: The bottom line is that insurance premiums just tend to go up. Reasons why your health insurance premium increases on renewal #1 healthcare inflation according to the economic times, inflation in healthcare is growing at a rate of 12 to 18%! Why did my car insurance go up without an accident or ticket?

Source: qualityquote.co.za

Source: qualityquote.co.za

If you�re unable to get a straight answer from your representative, you may wish to check with your state�s insurance regulator. Insurance premiums are on the rise, and, really, it seems that there is an average increase in health insurance premiums by year. And the rate of private health insurance claims. Due to the ‘cost of doing business’ being included in these calculations, consumers should have higher premiums in 2022, especially if there is a market expansion. Rates for policies classified as preferred risk policies (prps) increased by 15% on average at the beginning of 2021.

Source: chambersmedical.com

Source: chambersmedical.com

The national average is a 22% increase, despite the concentrated efforts of some states to provide cheaper premiums, as is the case with the kansas health insurance exchange. When insurance companies find themselves in an. A 4% jump in premiums to $1,398 a year is the result of an overall rise in material costs, disruption in supply chains, and climate change. An increase in cost of medical equipment and changing technology; This includes overall costs such as cost of medicines, hospital admission charges, cost of various treatments, medical advancements and so on.

Source: biba.org.uk

Source: biba.org.uk

This includes overall costs such as cost of medicines, hospital admission charges, cost of various treatments, medical advancements and so on. Business costs are on the rise for most companies in the u.s. Reasons why your health insurance premium increases on renewal #1 healthcare inflation according to the economic times, inflation in healthcare is growing at a rate of 12 to 18%! This is due to a number of factors. The cost of your home insurance may go up if your insurance company predicts that homes in your area have become more prone to burglaries or damage from extreme weather events, for example.

Source: tgsinsurance.com

Source: tgsinsurance.com

But, that doesn�t mean you are stuck. However, of all the listed factors. Increased hospital costs (including doctors� charges); Or, it could be because of your driving record, claims made or even your credit score. Your insurer raised rates to cover its cost of doing business you filed a claim or live an area where many others have you added a pool, trampoline, woodstove you’ve added a certain breed of dog to the family you built an addition or did a major renovation inflation

Source: qualityquote.co.za

Source: qualityquote.co.za

You can expect your car insurance premium to increase if you�ve committed any traffic violations, added drivers to your policy, moved, changed or upgraded insurance coverage, or added a vehicle. Here are common reasons why home insurance rates increase: The last few months have left ken hoagland surprised at how much the mortgage payment has gone up. Due to the ‘cost of doing business’ being included in these calculations, consumers should have higher premiums in 2022, especially if there is a market expansion. In fact, most insurance companies reduce the premiums that they charge their loyal customers over time to increase customer retention rates.

Source: einsurance.com

Source: einsurance.com

The national average is a 22% increase, despite the concentrated efforts of some states to provide cheaper premiums, as is the case with the kansas health insurance exchange. This is a continuation of a trend in the insurance industry. Asides from the increase caused by inflation, the following may be the reason for your premium increase: It is found that many of these claims did not arise accidentally but through lack of maintenance, which led to the damage. The bottom line is that insurance premiums just tend to go up.

Source: doyle-ogden.com

Source: doyle-ogden.com

The factors we have listed above might potentially be the reason for your home premium increase. Or, it could be because of your driving record, claims made or even your credit score. Business costs are on the rise for most companies in the u.s. When insurance companies find themselves in an. Here are common reasons why home insurance rates increase:

When insurance providers pay a lot of. If none of these events have occurred and you haven�t filed an insurance claim, you could be wondering what. Across the country, many individuals should expect their auto insurance rates to increase much more than 24%, especially if they are living in areas particularly prone to natural disasters, such. But, that doesn�t mean you are stuck. When insurance providers pay a lot of.

Source: trustedunion.com

Source: trustedunion.com

If none of these events have occurred and you haven�t filed an insurance claim, you could be wondering what. Emergency cleanup services, skilled trades, personal belongings, and homes in general have become more expensive, which leads to higher claims payouts. Sometimes, your insurance premiums will increase because the insurer along with the state insurance board decide to change a rate plan. This is due to a number of factors. Rates for policies classified as preferred risk policies (prps) increased by 15% on average at the beginning of 2021.

Source: insurancespecialists.com

Source: insurancespecialists.com

In an effort to buoy the federally funded program that�s sinking in debt, the national flood insurance program (nfip) raised premiums on new and renewed policies by 11.3% on average after april 1, 2020. Health insurance premiums go up with inflation, but they also regularly increase out of proportion to inflation. Reasons for a rate increase if you�re wondering, why is my car insurance so high? An increase in cost of medical equipment and changing technology; The last few months have left ken hoagland surprised at how much the mortgage payment has gone up.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title why did insurance premiums increase by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information