Why did my health insurance premium go up Idea

Home » Trend » Why did my health insurance premium go up IdeaYour Why did my health insurance premium go up images are available in this site. Why did my health insurance premium go up are a topic that is being searched for and liked by netizens now. You can Get the Why did my health insurance premium go up files here. Download all royalty-free vectors.

If you’re searching for why did my health insurance premium go up images information linked to the why did my health insurance premium go up interest, you have visit the ideal site. Our website frequently provides you with suggestions for downloading the highest quality video and image content, please kindly hunt and find more informative video content and images that fit your interests.

Why Did My Health Insurance Premium Go Up. You will not pay more than 8.5% of your annual income on health insurance premiums. This increase in third party premium rates can contribute to the increase in premium to be paid at the time of renewal. When an insurance company has a rate adjustment, it’s almost always upwards. In fact, in recent history the office of insurance regulation has been seeing a lot of requests for and approving many rate increases.

Importance of health insurance From slideshare.net

Importance of health insurance From slideshare.net

Sometimes, insurance companies revise their rates. Or, if you�ve added a new driver or vehicle to your policy, your rate could also increase at renewal time. The average increase of coverage a (replacement cost of the dwelling) is usually 2% to 4% annually. On a $200,000 home, coverage a limit might increase from $4000 to $8000. There are many reasons for the increase. Finally, if your carrier is paying more for everything from advertising to electricity, it also stands to reason that the costs of claims are increasing too.

It’s also important to keep in mind that a carrier won’t ever raise your insurance premium for the sole purpose of increasing an agent or broker’s commissions.

Even drivers with a clean record might see an increase in their insurance renewal price. In normal times the inflation factor can be small. You will find 7 reasons why your insurance premiums are rising faster than your salary. 4 hours ago why did my insurance rate go up suddenly? Jeff smith posted in life insurance last updated on february 19, 2021 you’ve been paying your life insurance premiums for 10, 20, maybe even 30 years and now out of nowhere, your premiums have gone up. Even drivers with a clean record might see an increase in their insurance renewal price.

Source: medium.com

Source: medium.com

Or, if you�ve added a new driver or vehicle to your policy, your rate could also increase at renewal time. That could have resulted in marketplace enrollees getting more in premium tax credits than they were eligible for. Even drivers with a clean record might see an increase in their insurance renewal price. Or, if you�ve added a new driver or vehicle to your policy, your rate could also increase at renewal time. There are multiple factors that determine when and why your insurance premium will go up and down.

Source: aoawest.com

Source: aoawest.com

Under normal circumstances, that mismatch would mean they generally need to pay. Under normal circumstances, that mismatch would mean they generally need to pay. This increase in third party premium rates can contribute to the increase in premium to be paid at the time of renewal. There are multiple factors that determine when and why your insurance premium will go up and down. You will find 7 reasons why your insurance premiums are rising faster than your salary.

Source: trillmag.com

Source: trillmag.com

Finally, if your carrier is paying more for everything from advertising to electricity, it also stands to reason that the costs of claims are increasing too. It’s also important to keep in mind that a carrier won’t ever raise your insurance premium for the sole purpose of increasing an agent or broker’s commissions. This rise in demand and hospital visits effectively causes a similar rise in medical care costs and premiums. Under normal circumstances, that mismatch would mean they generally need to pay. Your rates didn�t go up because of legislation directly increasing premiums, some who had lower rates before saw rates go up as a response to new protections.

Source: obamacarefacts.com

Source: obamacarefacts.com

When an insurance company has a rate adjustment, it’s almost always upwards. As mentioned above, auto rate increases are sometimes based on factors out of your control, such as claims in your zip code. In some states, those rates have to be approved by the state as “reasonable.” This is due to a number of factors. Your insurance premiums will go up companies will raise premiums due to those elevated claims they�ve seen in the past couple of years.

Source: doyle-ogden.com

Source: doyle-ogden.com

This increase in third party premium rates can contribute to the increase in premium to be paid at the time of renewal. This increase in third party premium rates can contribute to the increase in premium to be paid at the time of renewal. Your insurance premiums will go up companies will raise premiums due to those elevated claims they�ve seen in the past couple of years. Finally, if your carrier is paying more for everything from advertising to electricity, it also stands to reason that the costs of claims are increasing too. The average increase of coverage a (replacement cost of the dwelling) is usually 2% to 4% annually.

Source: realtor.com

Source: realtor.com

This is a continuation of a trend in the insurance industry. This is due to a number of factors. While my retirement income did not change, my monthly premium is now $349. It depends on where you live, what plan you have, whether you changed plans during open enrollment, and whether you get a premium subsidy. Insurance premiums are on the rise, and, really, it seems that there is an average increase in health insurance premiums by year.

Source: zillow.com

Source: zillow.com

Population growth sometimes rising healthcare costs is simply a matter of having more patients. Or, if you�ve added a new driver or vehicle to your policy, your rate could also increase at renewal time. There are many reasons for the increase. Population growth sometimes rising healthcare costs is simply a matter of having more patients. If your income goes down, you may qualify for lower monthly premiums.

Source: ibanding.my

Source: ibanding.my

If your income goes down, you may qualify for lower monthly premiums. As mentioned above, auto rate increases are sometimes based on factors out of your control, such as claims in your zip code. In some states, those rates have to be approved by the state as “reasonable.” Why did my life insurance premium go up? There are multiple factors that determine when and why your insurance premium will go up and down.

Source: blog.cfmimo.com

Source: blog.cfmimo.com

Population growth sometimes rising healthcare costs is simply a matter of having more patients. While my retirement income did not change, my monthly premium is now $349. Prescription drug spending is also on the rise, which adds yet another layer to why the costs of health insurance keep increasing. This increase in third party premium rates can contribute to the increase in premium to be paid at the time of renewal. You will not pay more than 8.5% of your annual income on health insurance premiums.

Source: youtube.com

Source: youtube.com

So did health insurance premiums increase for 2021? According to insure, the determining factors are as follows: This rise in demand and hospital visits effectively causes a similar rise in medical care costs and premiums. If your income goes down, you may qualify for lower monthly premiums. That could have resulted in marketplace enrollees getting more in premium tax credits than they were eligible for.

Source: jjinsurance.com

Source: jjinsurance.com

In some states, those rates have to be approved by the state as “reasonable.” Jeff smith posted in life insurance last updated on february 19, 2021 you’ve been paying your life insurance premiums for 10, 20, maybe even 30 years and now out of nowhere, your premiums have gone up. New, sophisticated, and costly technology helps in the diagnosis and treatment of health conditions, while specialized medications can prolong lives from diseases like cancer. The rates are increased once in a while after taking into consideration of few factors such as the claim ratio, premium collected etc. You will find 7 reasons why your insurance premiums are rising faster than your salary.

Source: izquotes.com

Source: izquotes.com

The cost of your specific health insurance policy could go up or it could go down, depending on whether you receive a premium subsidy (most exchange enrollees do, but everyone who enrolls outside the exchange pays full price), and how much your plan�s price is changing. According to insure, the determining factors are as follows: On a $200,000 home, coverage a limit might increase from $4000 to $8000. The rates are increased once in a while after taking into consideration of few factors such as the claim ratio, premium collected etc. So did health insurance premiums increase for 2021?

Source: womenshealthmag.com

Source: womenshealthmag.com

When an insurance company has a rate adjustment, it’s almost always upwards. When an insurance company has a rate adjustment, it’s almost always upwards. According to insure, the determining factors are as follows: In normal times the inflation factor can be small. And if you do get a subsidy, there are several variables that go into how much your rates might have changed.

Source: lgbtqnation.com

Source: lgbtqnation.com

Insurance premiums are on the rise, and, really, it seems that there is an average increase in health insurance premiums by year. When an insurance company has a rate adjustment, it’s almost always upwards. Even drivers with a clean record might see an increase in their insurance renewal price. On a $200,000 home, coverage a limit might increase from $4000 to $8000. Your insurance premiums will go up companies will raise premiums due to those elevated claims they�ve seen in the past couple of years.

Source: qualityquote.co.za

Source: qualityquote.co.za

On a $200,000 home, coverage a limit might increase from $4000 to $8000. On a $200,000 home, coverage a limit might increase from $4000 to $8000. In normal times the inflation factor can be small. Population growth sometimes rising healthcare costs is simply a matter of having more patients. Sometimes, insurance companies revise their rates.

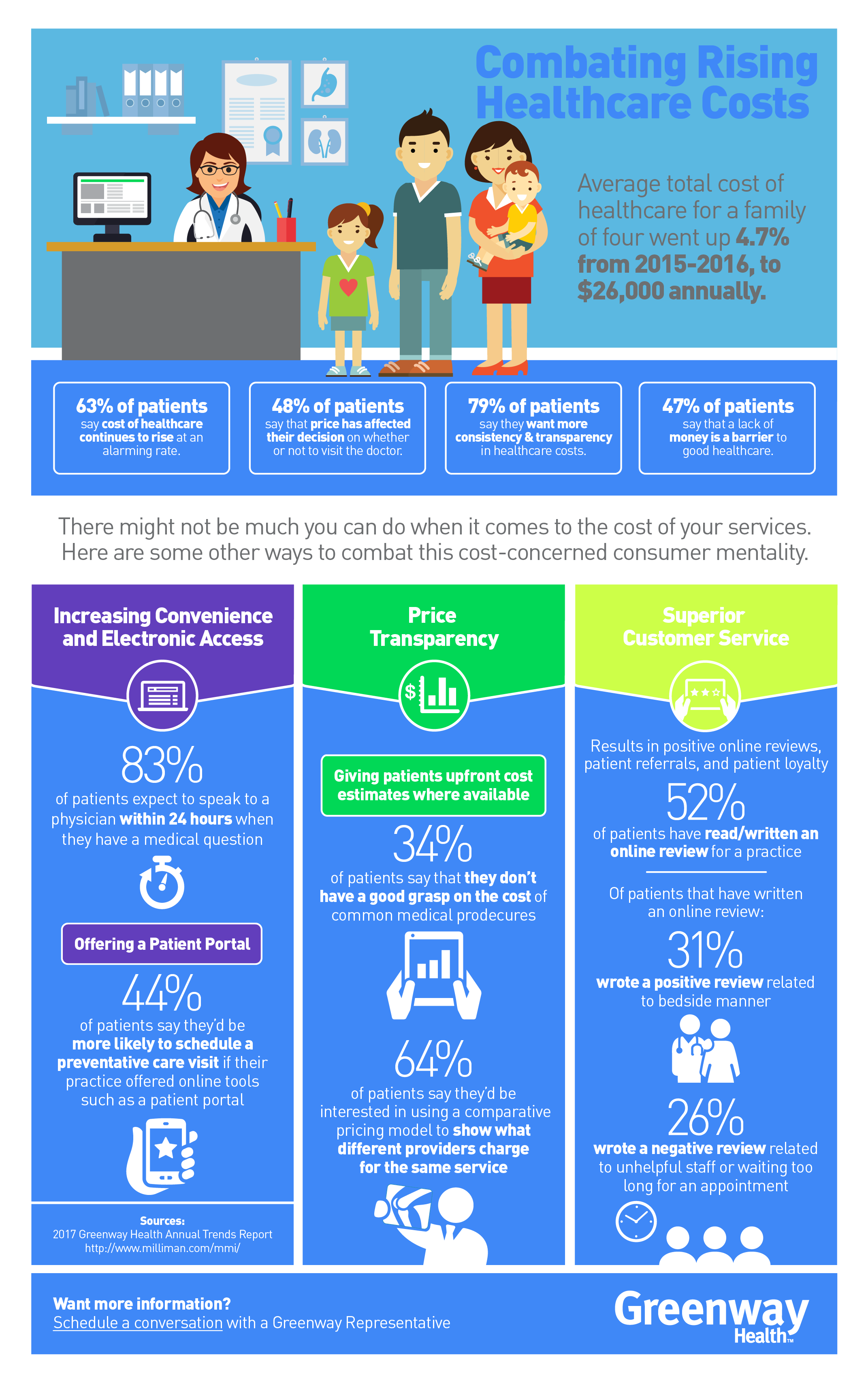

Source: greenwayhealth.com

Source: greenwayhealth.com

Sometimes, insurance companies revise their rates. And if you do get a subsidy, there are several variables that go into how much your rates might have changed. The standard medicare part b premium increased to $135.50 per month in 2019, up from $134 in 2018. While my retirement income did not change, my monthly premium is now $349. There are many reasons for the increase.

Source: slideshare.net

Source: slideshare.net

After careful examination, we have determined some reasons for rising costs of healthcare. As we addressed in a previous newsletter, the home insurance premiums in florida are seeing significant upward pressure. And if you do get a subsidy, there are several variables that go into how much your rates might have changed. Health insurance premiums go up with inflation, but they also regularly increase out of proportion to inflation. This is a continuation of a trend in the insurance industry.

Source: axisbank.com

Source: axisbank.com

This rise in demand and hospital visits effectively causes a similar rise in medical care costs and premiums. If your income goes down, you may qualify for lower monthly premiums. So did health insurance premiums increase for 2021? Sometimes, insurance companies revise their rates. While my retirement income did not change, my monthly premium is now $349.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title why did my health insurance premium go up by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information