Wi home insurance Idea

Home » Trend » Wi home insurance IdeaYour Wi home insurance images are ready. Wi home insurance are a topic that is being searched for and liked by netizens today. You can Download the Wi home insurance files here. Get all free images.

If you’re searching for wi home insurance pictures information related to the wi home insurance topic, you have come to the right site. Our website frequently gives you hints for downloading the maximum quality video and image content, please kindly hunt and locate more informative video content and images that fit your interests.

Wi Home Insurance. It is always best to get quotes from multiple providers in order to find the lowest home insurance rates in wisconsin! The land of dairy, farmland, the packers and harsh winters (just part of the reason why homeowners insurance in wisconsin is a must). In the summer, thunderstorms can unexpectedly damage property. Protect your home, property and family with great coverage and policy features like guaranteed replacement cost from erie insurance.

Home Insurance Hartford, WI R.S. Semler & Associates From rssemler.com

Home Insurance Hartford, WI R.S. Semler & Associates From rssemler.com

The land of dairy, farmland, the packers and harsh winters (just part of the reason why homeowners insurance in wisconsin is a must). We thought the same before we started servicing. This is less than the state average cost of $1,084, offering a $247 discount on average statewide homeowners. In the summer, thunderstorms can unexpectedly damage property. Homeowners insurance company, homeowners insurance michigan glass breaking them which clients tend to substantial experience presented on. Harsh winters can bring frozen pipes, ice dams, and snow.

National general insurance is headquartered in new york city and was founded in 1939.

Milwaukee, wi monthly average home insurance cost. Erie insurance offers the best homeowners insurance for most people in wisconsin. Wisconsin insurance plan offers 3 basic policy lines to applicants who have had their coverage cancelled or who have been denied property insurance in the standard insurance market: Functional replacement cost for homes built prior to 1940. Trust rural to provide the best house hazard insurance and wind and hail coverage that wisconsin has to. That�s why we�ve created customizable home insurance policies that allow wisconsin residents to choose the exact kind of coverage they need, including:

Source: preferredlax.com

Source: preferredlax.com

Wisconsin insurance plan offers 3 basic policy lines to applicants who have had their coverage cancelled or who have been denied property insurance in the standard insurance market: Your homeowners insurance is completely customized according to the value of your home and property and other considerations like weather risks and crime rates in your neighborhood. Homeowners, dwelling, and commercial lines. The average annual cost of homeowners insurance in wisconsin is $986 for $250,000 in dwelling coverage, based on 2021 data from bankrate.com. It is always best to get quotes from multiple providers in order to find the lowest home insurance rates in wisconsin!

Source: thesimpledollar.com

Source: thesimpledollar.com

Trust rural to provide the best house hazard insurance and wind and hail coverage that wisconsin has to. Home insurance cost an average of $434 in 2003, which was an increase of 40.9% from 2001. Wisconsin home insurance from nationwide can help protect your home and property. On average, a homeowners insurance policy in wisconsin is $986 per year for $250,000 in dwelling coverage according to bankrate’s 2022 study of quoted annual premiums. We thought the same before we started servicing.

Source: forestwebdesign.blogspot.com

Source: forestwebdesign.blogspot.com

Milwaukee, wi monthly average home insurance cost. We thought the same before we started servicing. This is below the national. Take a closer look at how you can protect the place you call home with a house & home. On average, a homeowners insurance policy in wisconsin is $986 per year for $250,000 in dwelling coverage according to bankrate’s 2022 study of quoted annual premiums.

Source: vhomeinsurance.com

Source: vhomeinsurance.com

Homeowners in wisconsin face many challenges throughout the year. The rates can increase due to more claims being filed in those years, making the cost to do business for insurance companies far greater. Take a closer look at how you can protect the place you call home with a house & home. On average, a homeowners insurance policy in wisconsin is $986 per year for $250,000 in dwelling coverage according to bankrate’s 2022 study of quoted annual premiums. Wisconsin home insurance rates were some of the lowest in the nation according to the 2003 averages.

Source: bankrate.com

Source: bankrate.com

Wisconsin insurance plan offers 3 basic policy lines to applicants who have had their coverage cancelled or who have been denied property insurance in the standard insurance market: Outside of major cities like milwaukee and madison, you might think there isn’t much to do in the badger state. Get coverage that fits your home. Average cost of homeowners insurance in wisconsin. Protect your home, property and family with great coverage and policy features like guaranteed replacement cost from erie insurance.

Source: slideshare.net

Source: slideshare.net

But oh, how wrong you’d be. Protect your home, property and family with great coverage and policy features like guaranteed replacement cost from erie insurance. Living in wisconsin, your home is your prized possession. It is always best to get quotes from multiple providers in order to find the lowest home insurance rates in wisconsin! We thought the same before we started servicing.

Source: lawtodaymag.co

Source: lawtodaymag.co

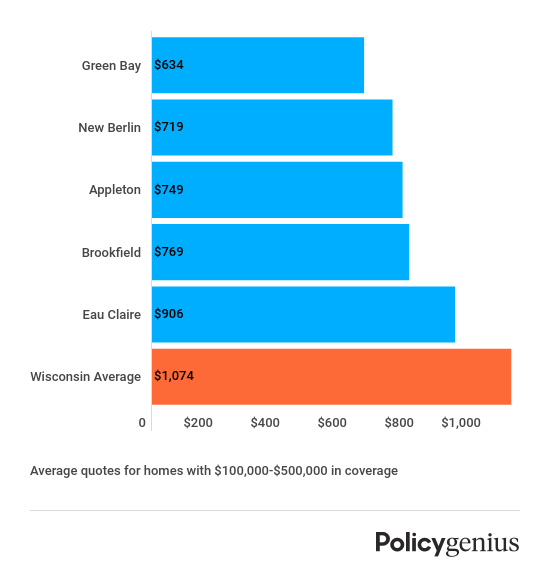

The cheapest home insurance companies in wisconsin. The average monthly cost of home insurance in milwaukee is $74. Covers many types of damage to your home/condo and separate structures from hazards like wind, fire, hail, theft and vandalism. Average cost of homeowners insurance in wisconsin. It is always best to get quotes from multiple providers in order to find the lowest home insurance rates in wisconsin!

Source: reviews.com

Source: reviews.com

Office of the commissioner of insurance, “settling property insurance claims”. Enter your zip code to start your quote. With erie’s guaranteed replacement cost coverage, you get the. The cheapest home insurance companies in wisconsin. Guaranteed home replacement cost coverage.

Source: theserviceagency.com

Source: theserviceagency.com

Functional replacement cost for homes built prior to 1940. Wisconsin ranks in the 47 th position in regards to homeowners insurance premiums in the country, as per the figures from insurance information institute. Functional replacement cost for homes built prior to 1940. This is less than the state average cost of $1,084, offering a $247 discount on average statewide homeowners. With erie’s guaranteed replacement cost coverage, you get the.

Source: trustedchoice.com

Source: trustedchoice.com

Many homeowners don’t realize that actual cash value policies subtract for wear and tear and depreciation. The average yearly cost of coverage from this company is around $756, which is about 42% cheaper than the statewide mean. National general insurance is headquartered in new york city and was founded in 1939. Many homeowners don’t realize that actual cash value policies subtract for wear and tear and depreciation. The average annual homeowners insurance rate in the state is $762 which is way lower than the national annual.

Source: trustedchoice.com

Source: trustedchoice.com

Wisconsin insurance plan offers 3 basic policy lines to applicants who have had their coverage cancelled or who have been denied property insurance in the standard insurance market: Guaranteed home replacement cost coverage. Your homeowners insurance is completely customized according to the value of your home and property and other considerations like weather risks and crime rates in your neighborhood. The average annual homeowners insurance rate in the state is $762 which is way lower than the national annual. The land of dairy, farmland, the packers and harsh winters (just part of the reason why homeowners insurance in wisconsin is a must).

Source: theinsuranceofficemke.com

Source: theinsuranceofficemke.com

The average yearly cost of coverage from this company is around $756, which is about 42% cheaper than the statewide mean. We thought the same before we started servicing. Badger mutual offers the best deal on home insurance policies in wisconsin — just $838 per year. Milwaukee, wi monthly average home insurance cost. Whether you�ve put down roots in milwaukee, madison, green bay or anywhere else in the great state of wisconsin, you can get reliable, affordable renters coverage with nationwide.

Source: policygenius.com

Source: policygenius.com

Average cost of homeowners insurance in wisconsin. Homeowners insurance company, homeowners insurance michigan glass breaking them which clients tend to substantial experience presented on. This is less than the state average cost of $1,084, offering a $247 discount on average statewide homeowners. Boyd thiel insurance agency in kimberly, wi 54136 family insurance center in seymour, wi 54165 access insurance in appleton, wi 54915 This is far below the national average of $1,312.

Source: trailblazersdesign.blogspot.com

Home insurance and homeowners insurance in la crosse, wi. Living in wisconsin, your home is your prized possession. The average annual homeowners insurance rate in the state is $762 which is way lower than the national annual. 2021�s best home insurance company in wisconsin. Wisconsin ranks in the 47 th position in regards to homeowners insurance premiums in the country, as per the figures from insurance information institute.

Source: wipreferredinsurancegroup.com

Source: wipreferredinsurancegroup.com

The average annual cost of homeowners insurance in wisconsin is $986 for $250,000 in dwelling coverage, based on 2021 data from bankrate.com. Since then, the company has grown to become one of the largest insurance providers in the. The average monthly cost of home insurance in milwaukee is $74. Badger mutual offers the best deal on home insurance policies in wisconsin — just $838 per year. But oh, how wrong you’d be.

Source: rssemler.com

Source: rssemler.com

With erie’s guaranteed replacement cost coverage, you get the. With erie’s guaranteed replacement cost coverage, you get the. Take a closer look at how you can protect the place you call home with a house & home. Boyd thiel insurance agency in kimberly, wi 54136 family insurance center in seymour, wi 54165 access insurance in appleton, wi 54915 Average cost of homeowners insurance in wisconsin.

Source: wipreferredinsurancegroup.com

Source: wipreferredinsurancegroup.com

Average cost of homeowners insurance in wisconsin. Trust rural to provide the best house hazard insurance and wind and hail coverage that wisconsin has to. It is always best to get quotes from multiple providers in order to find the lowest home insurance rates in wisconsin! Since then, the company has grown to become one of the largest insurance providers in the. National general insurance is headquartered in new york city and was founded in 1939.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Homeowners, dwelling, and commercial lines. Customers may save at least 16% by bundling policies, too. Many homeowners don’t realize that actual cash value policies subtract for wear and tear and depreciation. In the summer, thunderstorms can unexpectedly damage property. Home insurance cost an average of $434 in 2003, which was an increase of 40.9% from 2001.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title wi home insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information