Wind and hail insurance carolina beach Idea

Home » Trend » Wind and hail insurance carolina beach IdeaYour Wind and hail insurance carolina beach images are ready. Wind and hail insurance carolina beach are a topic that is being searched for and liked by netizens today. You can Get the Wind and hail insurance carolina beach files here. Download all free images.

If you’re searching for wind and hail insurance carolina beach pictures information linked to the wind and hail insurance carolina beach keyword, you have come to the right site. Our website frequently provides you with hints for seeing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and images that fit your interests.

Wind And Hail Insurance Carolina Beach. Our agents can get you connected to reliable companies, with insurance agents knowledgeable in all aspects of wind & hail coverage and flood zones throughout the area. See reviews, photos, directions, phone numbers and more for winds and hail insurance locations in. So this is a $300 addition to your monthly housing payment. North carolina wind and hail insurance is a critical component of protecting your home, automobiles, and other precious assets.

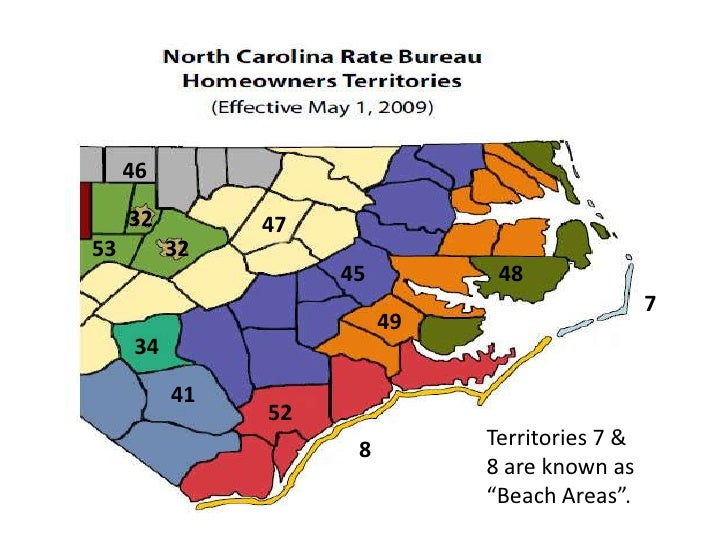

North Carolina Joint Underwriters and Wind Pool Map From homeinsuranceking.com

North Carolina Joint Underwriters and Wind Pool Map From homeinsuranceking.com

Certain mitigation credits (or discounts) may be available for qualifying homeowners insurance policies in north carolina’s beach and coastal territories. In areas that are at high risk of wind or hail damage, insurers will typically charge a flat dollar amount deductible, like $1,000, for most covered perils, and a percentage deductible (usually 1% to 5% of your home. Quality home owners insurance from trusted companies is very important when buying a home in the greater wilmington nc area and surrounding beaches. Resource insurance associates is an independent insurance agency with offices in columbia and sumter, south carolina. Just click here to find out more about the south carolina wind and hail underwriting association. The south carolina wind and hail underwriting association, created in 1971 and expanded in 2007, provides coverage for wind and hail damage for homes and businesses along the coast.

It provides coverage for the perils of wind and hail in the coastal area of the state designated by the legislature as beach. the.

If is very important when you are purchasing a new home that you choose a good insurance company. South carolina the south carolina wind and hail underwriting association, created in 1971 and expanded in 2007, provides coverage for wind and hail damage for homes and businesses along the coast. Recent history of homeowners insurance in late 2008, the outgoing commissioner of insurance for north carolina approved significant changes to both basic homeowners insurance rates and the rates which apply to the mandatory wind and hail coverage (called the beach plan) coastal homeowners must carry. So this is a $300 addition to your monthly housing payment. The eligibility for a windstorm and hail policy requires that the insured have an active primary coverage policy provided by an admitted carrier in north carolina that has excluded windstorm. In most of the coastal counties of north carolina, homeowners will need an additional policy to be protected against wind and hail damage.

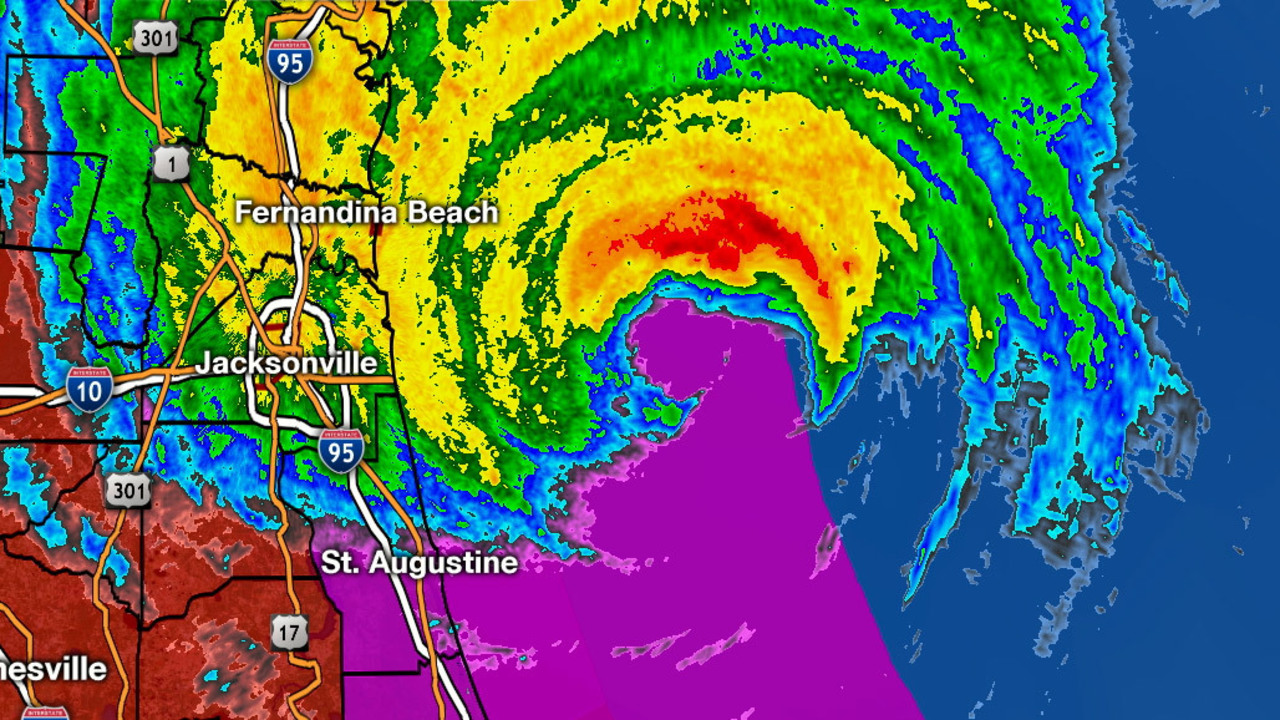

Source: wink24news.com

Source: wink24news.com

Coastal, coastal home insurance, coverage, flood, high risk areas, home insurance rates, north carolina, premiums, wind and hail Check your current insurance policy or check with your insurance agent to make sure your current policy fully protects you against wind and hail damage. The south carolina wind and hail underwriting association, created in 1971 and expanded in 2007, provides coverage for wind and hail damage for homes and businesses along the coast. Fema flood and sc wind and hail insurance the national oceanic and atmospheric administration or noaa has predicted a very active hurricane season this year, which starts on june 1. Resource insurance associates is an independent insurance agency with offices in columbia and sumter, south carolina.

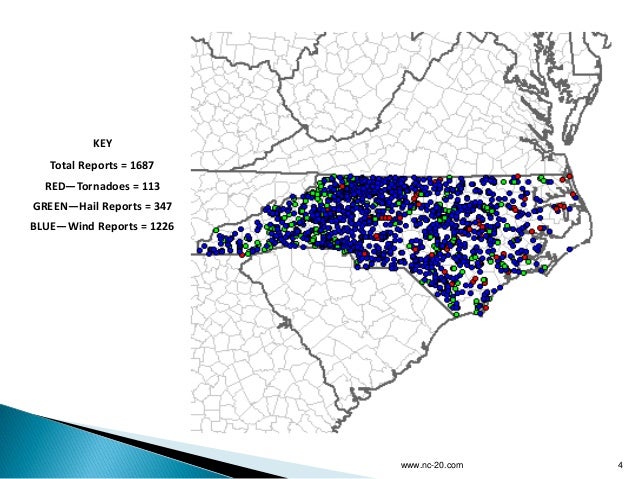

Source: howcanihelpthem.com

Source: howcanihelpthem.com

Just for wind and hail! Fema flood and sc wind and hail insurance the national oceanic and atmospheric administration or noaa has predicted a very active hurricane season this year, which starts on june 1. Here in wilmington nc there are a lot of choices for home owners, fire, flood, wind, and hail insurance companies. Resource insurance associates is an independent insurance agency with offices in columbia and sumter, south carolina. The beach plan’s rates for standalone wind and hail coverage must be 5 percent more than those of private insurers, and rates for full.

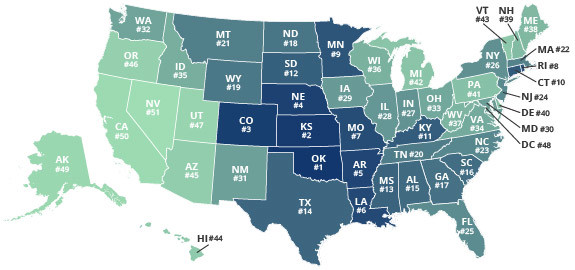

Source: homeinsuranceking.com

Source: homeinsuranceking.com

Here in wilmington nc there are a lot of choices for home owners, fire, flood, wind, and hail insurance companies. Member company information, including financial statements, needed by member. Coastal, coastal home insurance, coverage, flood, high risk areas, home insurance rates, north carolina, premiums, wind and hail Our agents can get you connected to reliable companies, with insurance agents knowledgeable in all aspects of wind & hail coverage and flood zones throughout the area. The maximum residential limit of building coverage is $750,000, with a limit for personal property capped at 40% of the approved building coverage.

Source: pbs.org

Source: pbs.org

The beach plan’s rates for standalone wind and hail coverage must be 5 percent more than those of private insurers, and rates for full. If you have a home or condo inside our hurricane wind pool, (from the beach out to hwy 31 on the north end) your regular sc homeowners insurance will not include. The good news for homeowners is that the wind pool, an association of insurance companies, offers expanded coverage for wind and hail damage. In nc, most homeowners have 1 percent deductible. Effective january 1, 2018 new commercial/nciua commercial wind rates the associations have adopted iso (insurance services office, inc) commercial property loss costs approved for usage in the state of north carolina, pursuant.

![]() Source: ncjua-nciua.org

Source: ncjua-nciua.org

There are some states in which no private windstorm insurance is available. So this is a $300 addition to your monthly housing payment. It provides coverage for the perils of wind and hail in the coastal area of the state designated by the legislature as beach. the. South carolina the south carolina wind and hail underwriting association, created in 1971 and expanded in 2007, provides coverage for wind and hail damage for homes and businesses along the coast. The beach plan’s rates for standalone wind and hail coverage must be 5 percent more than those of private insurers, and rates for full.

Source: news4jax.com

Source: news4jax.com

Copies of all bulletins, including underwriting and storm alerts, are available for viewing and download. The good news for homeowners is that the wind pool, an association of insurance. The south carolina wind and hail underwriting association (scwhua) is the residual property insurance market in south carolina. Location of private insurance companies with wind storm insurance. Resource insurance associates is an independent insurance agency with offices in columbia and sumter, south carolina.

Source: mapscatalogonline.blogspot.com

Source: mapscatalogonline.blogspot.com

In areas that are at high risk of wind or hail damage, insurers will typically charge a flat dollar amount deductible, like $1,000, for most covered perils, and a percentage deductible (usually 1% to 5% of your home. The mitigation credits can provide premium discounts for wind and hail coverage on homes with qualifying construction features that help mitigate damage and insurance losses. So this is a $300 addition to your monthly housing payment. North carolina wind and hail insurance is a critical component of protecting your home, automobiles, and other precious assets. The outer banks is $2800 for a $250,000 homeowners policy!

Source: mapsforyoufree.blogspot.com

Source: mapsforyoufree.blogspot.com

The beach plan’s rates for standalone wind and hail coverage must be 5 percent more than those of private insurers, and rates for full. Effective january 1, 2018 new commercial/nciua commercial wind rates the associations have adopted iso (insurance services office, inc) commercial property loss costs approved for usage in the state of north carolina, pursuant. Coastal, coastal home insurance, coverage, flood, high risk areas, home insurance rates, north carolina, premiums, wind and hail The maximum residential limit of building coverage is $750,000, with a limit for personal property capped at 40% of the approved building coverage. Member company information, including financial statements, needed by member.

Source: mapsforyoufree.blogspot.com

Source: mapsforyoufree.blogspot.com

Resource insurance associates is an independent insurance agency with offices in columbia and sumter, south carolina. In areas that are at high risk of wind or hail damage, insurers will typically charge a flat dollar amount deductible, like $1,000, for most covered perils, and a percentage deductible (usually 1% to 5% of your home. South carolina the south carolina wind and hail underwriting association, created in 1971 and expanded in 2007, provides coverage for wind and hail damage for homes and businesses along the coast. Our agents can get you connected to reliable companies, with insurance agents knowledgeable in all aspects of wind & hail coverage and flood zones throughout the area. The beach plan’s rates for standalone wind and hail coverage must be 5 percent more than those of private insurers, and rates for full.

Source: mapsforyoufree.blogspot.com

Source: mapsforyoufree.blogspot.com

The outer banks is $2800 for a $250,000 homeowners policy! Here in wilmington nc there are a lot of choices for home owners, fire, flood, wind, and hail insurance companies. Effective january 1, 2018 new commercial/nciua commercial wind rates the associations have adopted iso (insurance services office, inc) commercial property loss costs approved for usage in the state of north carolina, pursuant. Remember to talk with your agent and/or insurance company, to ensure you are properly covered for wind and hail losses. Quality home owners insurance from trusted companies is very important when buying a home in the greater wilmington nc area and surrounding beaches.

Source: mapscatalogonline.blogspot.com

Source: mapscatalogonline.blogspot.com

The south carolina wind and hail underwriting association (scwhua) is the residual property insurance market in south carolina. The eligibity for a windstorm and hail policy with the nciua requires that the insured have an active primary coverage policy provided by an admitted carrier in north carolina that has excluded windstorm. The good news for homeowners is that the wind pool, an association of insurance companies, offers expanded coverage for wind and hail damage. Copies of all bulletins, including underwriting and storm alerts, are available for viewing and download. A similar entity in north carolina is known as the beach plan.

Source: mapsdatabasez.blogspot.com

The eligibility for a windstorm and hail policy requires that the insured have an active primary coverage policy provided by an admitted carrier in north carolina that has excluded windstorm. If is very important when you are purchasing a new home that you choose a good insurance company. Quality home owners insurance from trusted companies is very important when buying a home in the greater wilmington nc area and surrounding beaches. The south carolina wind and hail underwriting association (scwhua) is the residual property insurance market in south carolina. The good news for homeowners is that the wind pool, an association of insurance.

Source: mapsforyoufree.blogspot.com

Source: mapsforyoufree.blogspot.com

Just for wind and hail! Remember to talk with your agent and/or insurance company, to ensure you are properly covered for wind and hail losses. So this is a $300 addition to your monthly housing payment. The good news for homeowners is that the wind pool, an association of insurance companies, offers expanded coverage for wind and hail damage. See reviews, photos, directions, phone numbers and more for winds and hail insurance locations in.

Source: slideshare.net

Source: slideshare.net

Certain mitigation credits (or discounts) may be available for qualifying homeowners insurance policies in north carolina’s beach and coastal territories. It provides coverage for the perils of wind and hail in the coastal area of the state designated by the legislature as beach. the. The eligibility for a windstorm and hail policy requires that the insured have an active primary coverage policy provided by an admitted carrier in north carolina that has excluded windstorm. Our agents can get you connected to reliable companies, with insurance agents knowledgeable in all aspects of wind & hail coverage and flood zones throughout the area. Links to other south carolina insurance sites are available.

Source: wallpaperpins.blogspot.com

Source: wallpaperpins.blogspot.com

If is very important when you are purchasing a new home that you choose a good insurance company. The south carolina wind and hail underwriting association (scwhua) is the residual property insurance market in south carolina. The eligibity for a windstorm and hail policy with the nciua requires that the insured have an active primary coverage policy provided by an admitted carrier in north carolina that has excluded windstorm. See reviews, photos, directions, phone numbers and more for winds and hail insurance locations in. Check your current insurance policy or check with your insurance agent to make sure your current policy fully protects you against wind and hail damage.

Source: mapsforyoufree.blogspot.com

Source: mapsforyoufree.blogspot.com

North carolina wind and hail insurance is a critical component of protecting your home, automobiles, and other precious assets. It provides coverage for the perils of wind and hail in the coastal area of the state designated by the legislature as beach. the. Quality home owners insurance from trusted companies is very important when buying a home in the greater wilmington nc area and surrounding beaches. South carolina the south carolina wind and hail underwriting association, created in 1971 and expanded in 2007, provides coverage for wind and hail damage for homes and businesses along the coast. There are some states in which no private windstorm insurance is available.

Source: ncjua-nciua.org

Source: ncjua-nciua.org

Check your current insurance policy or check with your insurance agent to make sure your current policy fully protects you against wind and hail damage. Recent history of homeowners insurance in late 2008, the outgoing commissioner of insurance for north carolina approved significant changes to both basic homeowners insurance rates and the rates which apply to the mandatory wind and hail coverage (called the beach plan) coastal homeowners must carry. South carolina wind and hail underwriting association created; Check your current insurance policy or check with your insurance agent to make sure your current policy fully protects you against wind and hail damage. There are some states in which no private windstorm insurance is available.

Source: everquote.com

Source: everquote.com

North carolina wind and hail insurance is a critical component of protecting your home, automobiles, and other precious assets. There are some states in which no private windstorm insurance is available. The eligibity for a windstorm and hail policy with the nciua requires that the insured have an active primary coverage policy provided by an admitted carrier in north carolina that has excluded windstorm. If is very important when you are purchasing a new home that you choose a good insurance company. Give us a call, stop by, or request a quote online to find out how much we can save you on your insurance.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title wind and hail insurance carolina beach by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information