Wind and hail insurance nc Idea

Home » Trending » Wind and hail insurance nc IdeaYour Wind and hail insurance nc images are ready. Wind and hail insurance nc are a topic that is being searched for and liked by netizens today. You can Get the Wind and hail insurance nc files here. Find and Download all royalty-free photos.

If you’re looking for wind and hail insurance nc pictures information connected with to the wind and hail insurance nc interest, you have come to the ideal blog. Our website frequently provides you with hints for seeing the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

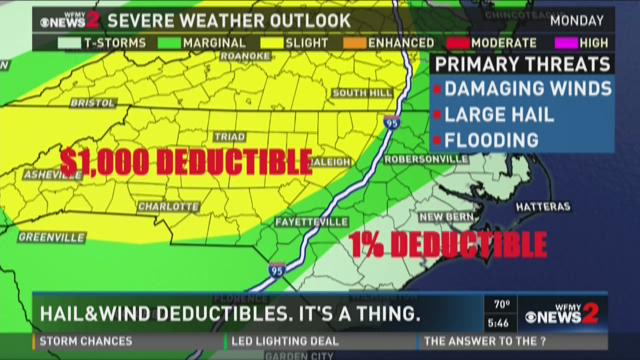

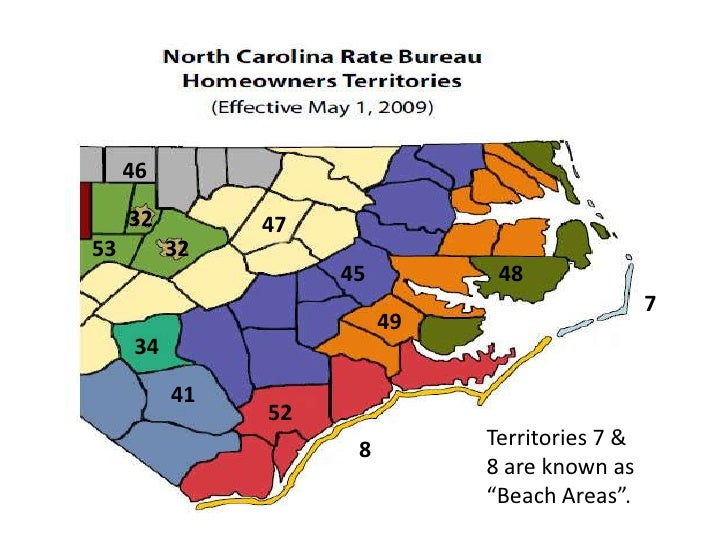

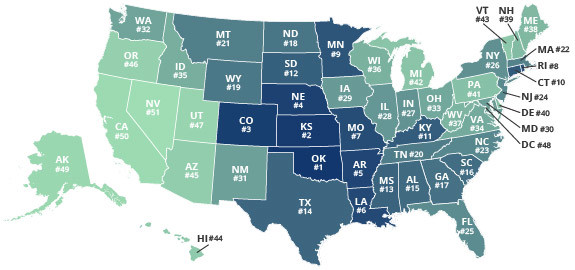

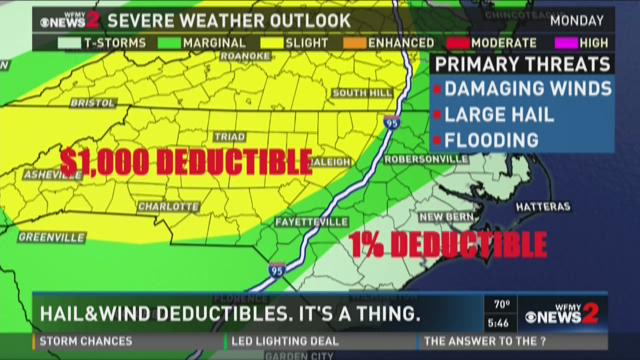

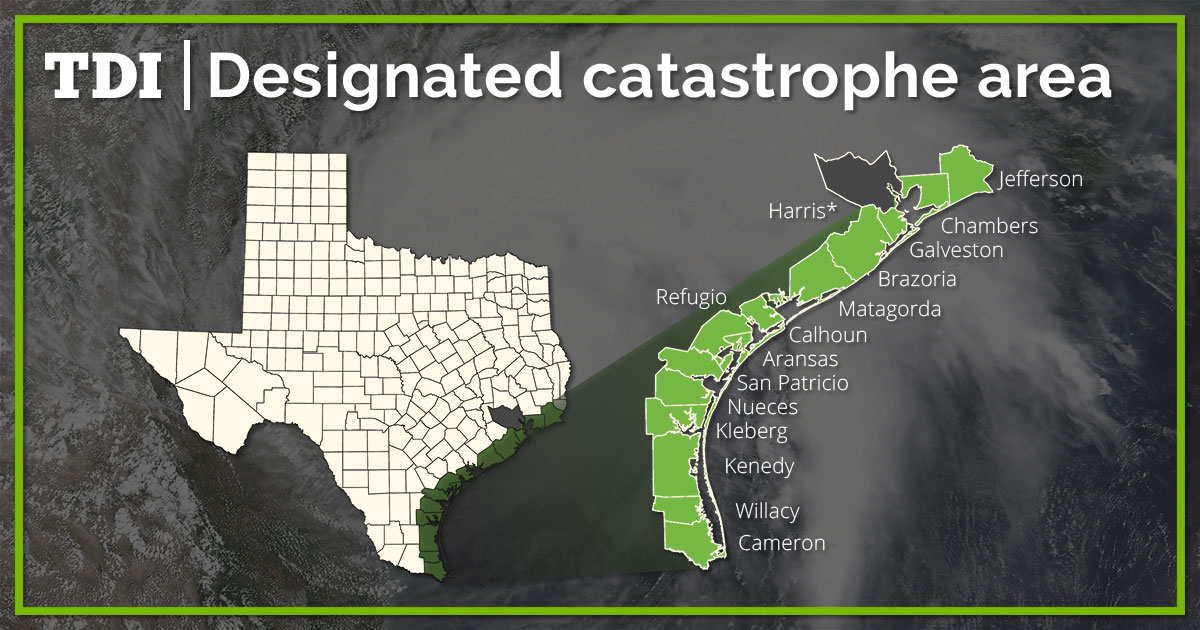

Wind And Hail Insurance Nc. The association was created by law to provide adequate essential property insurance to property owners having insurable property in the beach and coastal areas of north carolina. My current homeowners insurance is usaa, which only acts as a servicer for ncuia. Wind and hail insurance is a critical component of protecting your home and other precious assets, and if you live in certain areas and have a mortgage, it may be required. This means your insurance deductible is based on a percentage of the insured value of your home.

Wind And Hail Insurance Nc Nc Wind And Hail Insurance From mymissiontodoinlife.blogspot.com

Wind And Hail Insurance Nc Nc Wind And Hail Insurance From mymissiontodoinlife.blogspot.com

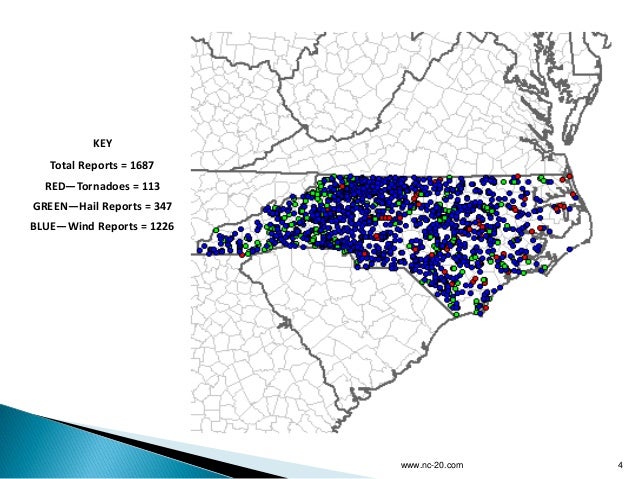

Wind and hail coverage is a loss resulting from windstorm or hail damage. Wind or hail insurance typically protects your home and personal belongings that get damaged due to forceful wind or wind events. Detached structures, including garages and sheds, are usually covered under this policy. The eligibity for a windstorm and hail policy with the nciua requires that the insured have an active primary coverage policy provided by an admitted carrier in north carolina that has excluded windstorm. This is the amount you’re responsible for paying before your insurance will kick in on a wind or hail damage claim. Home insurance covers damage to your home from wind, hail, fire, lightning etc.

Likewise, your auto insurance, comprehensive coverage would repair wind, fire, hail and lightning related damage to.

The fair plan is administered by the north carolina joint underwriting association. Wind and hail insurance is a critical component of protecting your home and other precious assets, and if you live in certain areas and have a mortgage, it may be required. In the state of north carolina, wind & hail insurance might not be a part of your homeowners policy. Wind or hail insurance typically protects your home and personal belongings that get damaged due to forceful wind or wind events. This is the amount you’re responsible for paying before your insurance will kick in on a wind or hail damage claim. North carolina wind and hail insurance is a critical component of protecting your home, automobiles, and other precious assets.

Source: mapscatalogonline.blogspot.com

Source: mapscatalogonline.blogspot.com

Regardless of the name, wind insurance is additional coverage coastal homeowners must add to their insurance policy to cover damage from hurricanes, windstorms, and hail in some cases. Yet, in a majority of cases, especially on the east coast, it is wind and hail that can do. All homeowners who have a mortgage are required by lenders to have wind and hail insurance. In north carolina, a standard home owner’s policy covers wind damage. All homeowners who have a mortgage are required by lenders to have wind and hail insurance.

Source: slideshare.net

Source: slideshare.net

Currently, one of my biggest expenses is nc wind and hail insurance, which is separate from my homeowners insurance. The maximum residential limit of building coverage is $750,000, with a limit for personal property capped at 40% of the approved building coverage. Residents who have moved from florida or coastal texas can rejoice that they are no longer required to carry a separate wind insurance policy. The eligibility for a windstorm and hail policy requires that the insured have an active primary coverage policy provided by an admitted carrier in north carolina that has excluded windstorm. Home insurance covers damage to your home from wind, hail, fire, lightning etc.

Source: activerain.com

Source: activerain.com

The eligibity for a windstorm and hail policy with the nciua requires that the insured have an active primary coverage policy provided by an admitted carrier in north carolina that has excluded windstorm. If the claim is accepted, your insurer will cover the damage as long as you meet your wind/hail deductible. My current homeowners insurance is usaa, which only acts as a servicer for ncuia. Yet in a majority of cases, it is wind and hail that will do the most damage to your home! Due to skyrocketing claim costs, many insurance companies have excluded wind and hail damage from their standard homeowners policies in certain areas of north carolina.

Source: mapsforyoufree.blogspot.com

Source: mapsforyoufree.blogspot.com

This means your insurance deductible is based on a percentage of the insured value of your home. If you live in florida and would like to get a quote: Anyone ever heard of weston insurance?, house, 2 replies what would you rather have no wind, medium wind. Wind and hail insurance actually has three separate deductibles when in the south carolina wind and hail association pool. Little do many area residents know, private insurance carriers have since changed their tune.

Source: mapsforyoufree.blogspot.com

Source: mapsforyoufree.blogspot.com

Currently, one of my biggest expenses is nc wind and hail insurance, which is separate from my homeowners insurance. This is the amount you’re responsible for paying before your insurance will kick in on a wind or hail damage claim. If the sc wind and hail association policy has a 3% deductible, the insured will pay a 3% deductible on the dwelling, another 3% deductible on the contents, and a time or elimination period deductible on the loss of the coverage. Wind and hail insurance actually has three separate deductibles when in the south carolina wind and hail association pool. The fair plan is administered by the north carolina joint underwriting association.

Source: mapsforyoufree.blogspot.com

Source: mapsforyoufree.blogspot.com

This is the amount you’re responsible for paying before your insurance will kick in on a wind or hail damage claim. Yet, in a majority of cases, especially on the east coast, it is wind and hail that can do. If your claim is for $100,000 in property damage and you have a $5,000 policy deductible, your insurer will pay you $95,000 for repairs. If the claim is accepted, your insurer will cover the damage as long as you meet your wind/hail deductible. This is the amount you’re responsible for paying before your insurance will kick in on a wind or hail damage claim.

Source: mapscatalogonline.blogspot.com

Source: mapscatalogonline.blogspot.com

The eligibity for a windstorm and hail policy with the nciua requires that the insured have an active primary coverage policy provided by an admitted carrier in north carolina that has excluded windstorm. The maximum residential limit of building coverage is $750,000, with a limit for personal property capped at 40% of the approved building coverage. Many private insurance companies now write wind and hail insurance policies…for far less than the ncjua wind pool (nc joint underwriting. North carolina wind and hail insurance is a critical component of protecting your home, automobiles, and other precious assets. Regardless of the name, wind insurance is additional coverage coastal homeowners must add to their insurance policy to cover damage from hurricanes, windstorms, and hail in some cases.

Source: mymissiontodoinlife.blogspot.com

Source: mymissiontodoinlife.blogspot.com

Yet in a majority of cases, it is wind and hail that will do the most damage to your home! If the claim is accepted, your insurer will cover the damage as long as you meet your wind/hail deductible. North carolina wind and hail insurance is a critical component of protecting your home, automobiles, and other precious assets. North carolina wind and hail insurance is a critical component of protecting your home, automobiles, and other precious assets. Likewise, your auto insurance, comprehensive coverage would repair wind, fire, hail and lightning related damage to.

Source: ncjua-nciua.com

Source: ncjua-nciua.com

The problem i keep having is that usaa values the rebuild cost at $900k while it’s appraised value is maybe only $500k. Wind and hail policies usually have two deductible options, a wind deductible and a named storm deductible. Many private insurance companies now write wind and hail insurance policies…for far less than the ncjua wind pool (nc joint underwriting. In north carolina, a standard home owner’s policy covers wind damage. North carolina wind and hail insurance is a critical component of protecting your home, automobiles, and other precious assets.

Source: mapsforyoufree.blogspot.com

Source: mapsforyoufree.blogspot.com

Yet in a majority of cases, it is wind and hail that will do the most damage to your home! In north carolina, a standard home owner’s policy covers wind damage. Yet in a majority of cases, it is wind and hail that will do the most damage to your home! You choose the deductible amount based on what you think you can afford and the amount will be indicated on your policys declarations page. Wind and hail insurance is a critical component of protecting your home and other precious assets, and if you live in certain areas and have a mortgage, it may be required.

Source: mapsdatabasez.blogspot.com

Source: mapsdatabasez.blogspot.com

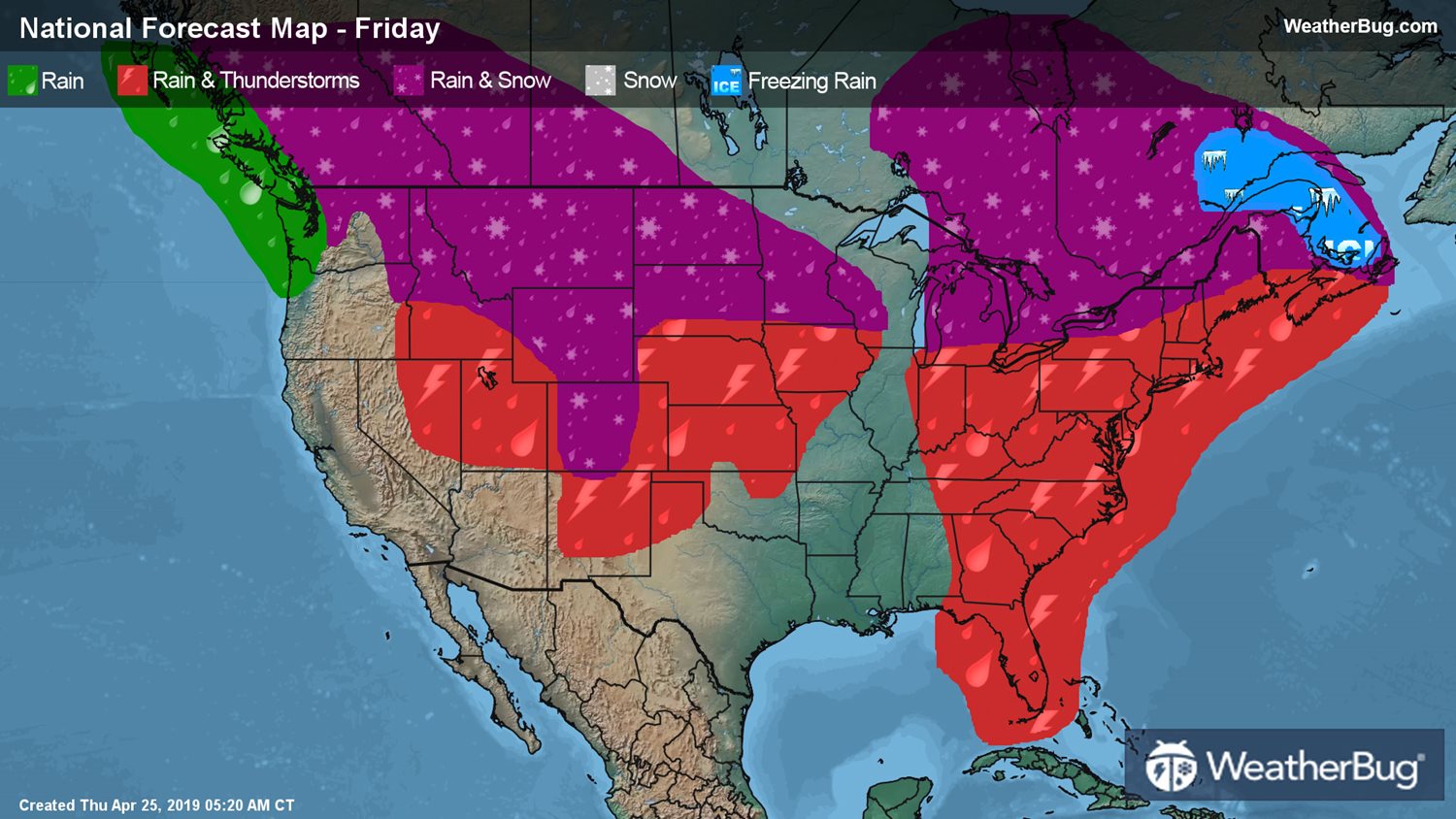

Some covered events include hail storms, tornadoes, tropical storms, hurricanes, and cyclones. In north carolina, a standard home owner’s policy covers wind damage. All homeowners who have a mortgage are required by lenders to have wind and hail insurance. Wind and hail coverage is a loss resulting from windstorm or hail damage. Due to skyrocketing claim costs, many insurance companies have excluded wind and hail damage from their standard homeowners policies in certain areas of north carolina.

Source: mapsforyoufree.blogspot.com

Source: mapsforyoufree.blogspot.com

Yet in a majority of cases, it is wind and hail that will do the most damage to your home! This means your insurance deductible is based on a percentage of the insured value of your home. Yet in a majority of cases, it is wind and hail that will do the most damage to your home! If you live in florida and would like to get a quote. If the sc wind and hail association policy has a 3% deductible, the insured will pay a 3% deductible on the dwelling, another 3% deductible on the contents, and a time or elimination period deductible on the loss of the coverage.

Source: lit438dld.blogspot.com

Source: lit438dld.blogspot.com

Home insurance covers damage to your home from wind, hail, fire, lightning etc. All homeowners who have a mortgage are required by lenders to have wind and hail insurance. All homeowners who have a mortgage are required by lenders to have wind and hail insurance. In north carolina, a standard home owner’s policy covers wind damage. Living in north carolina, it is extremely important to include wind and hail insurance for your home and contents.

Source: mymissiontodoinlife.blogspot.com

Source: mymissiontodoinlife.blogspot.com

Currently, one of my biggest expenses is nc wind and hail insurance, which is separate from my homeowners insurance. The eligibity for a windstorm and hail policy with the nciua requires that the insured have an active primary coverage policy provided by an admitted carrier in north carolina that has excluded windstorm. In the state of north carolina, wind & hail insurance might not be a part of your homeowners policy. If you live in florida and would like to get a quote: Regardless of the name, wind insurance is additional coverage coastal homeowners must add to their insurance policy to cover damage from hurricanes, windstorms, and hail in some cases.

Source: mapsforyoufree.blogspot.com

Source: mapsforyoufree.blogspot.com

Similarly, is wind and hail insurance mandatory in nc? Wind and hail insurance actually has three separate deductibles when in the south carolina wind and hail association pool. The problem i keep having is that usaa values the rebuild cost at $900k while it’s appraised value is maybe only $500k. If your claim is for $100,000 in property damage and you have a $5,000 policy deductible, your insurer will pay you $95,000 for repairs. It should be noted that these exclusions only apply in certain coastal areas so if you live far from the coast your standard homeowners policy should cover wind and hail damage but it is always a.

Source: sentarmeenunanube.blogspot.com

Source: sentarmeenunanube.blogspot.com

North carolina wind and hail insurance is a critical component of protecting your home, automobiles, and other precious assets. If you live in florida and would like to get a quote: If the sc wind and hail association policy has a 3% deductible, the insured will pay a 3% deductible on the dwelling, another 3% deductible on the contents, and a time or elimination period deductible on the loss of the coverage. Currently, one of my biggest expenses is nc wind and hail insurance, which is separate from my homeowners insurance. Once you�ve initiated a wind or hail damage claim, we�ll process your claim as quickly as possible and work with you to create a timeline for repairs.

Source: kvue.com

Source: kvue.com

Due to skyrocketing claim costs, many insurance companies have excluded wind and hail damage from their standard homeowners policies in certain areas of north carolina. Wind and hail insurance is a critical component of protecting your home and other precious assets, and if you live in certain areas and have a mortgage, it may be required. North carolina wind hail insurance may not be a part of your regular home insurance policy. My current homeowners insurance is usaa, which only acts as a servicer for ncuia. You choose the deductible amount based on what you think you can afford and the amount will be indicated on your policys declarations page.

Source: mapsdatabasez.blogspot.com

Some covered events include hail storms, tornadoes, tropical storms, hurricanes, and cyclones. Detached structures, including garages and sheds, are usually covered under this policy. In the state of north carolina, wind & hail insurance might not be a part of your homeowners policy. If the claim is accepted, your insurer will cover the damage as long as you meet your wind/hail deductible. Monday to friday, 6:30 a.m.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title wind and hail insurance nc by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information