Workers compensation insurance for independent contractors new jersey Idea

Home » Trending » Workers compensation insurance for independent contractors new jersey IdeaYour Workers compensation insurance for independent contractors new jersey images are ready. Workers compensation insurance for independent contractors new jersey are a topic that is being searched for and liked by netizens today. You can Find and Download the Workers compensation insurance for independent contractors new jersey files here. Find and Download all royalty-free photos and vectors.

If you’re searching for workers compensation insurance for independent contractors new jersey pictures information related to the workers compensation insurance for independent contractors new jersey keyword, you have pay a visit to the ideal site. Our website frequently gives you hints for seeing the highest quality video and image content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

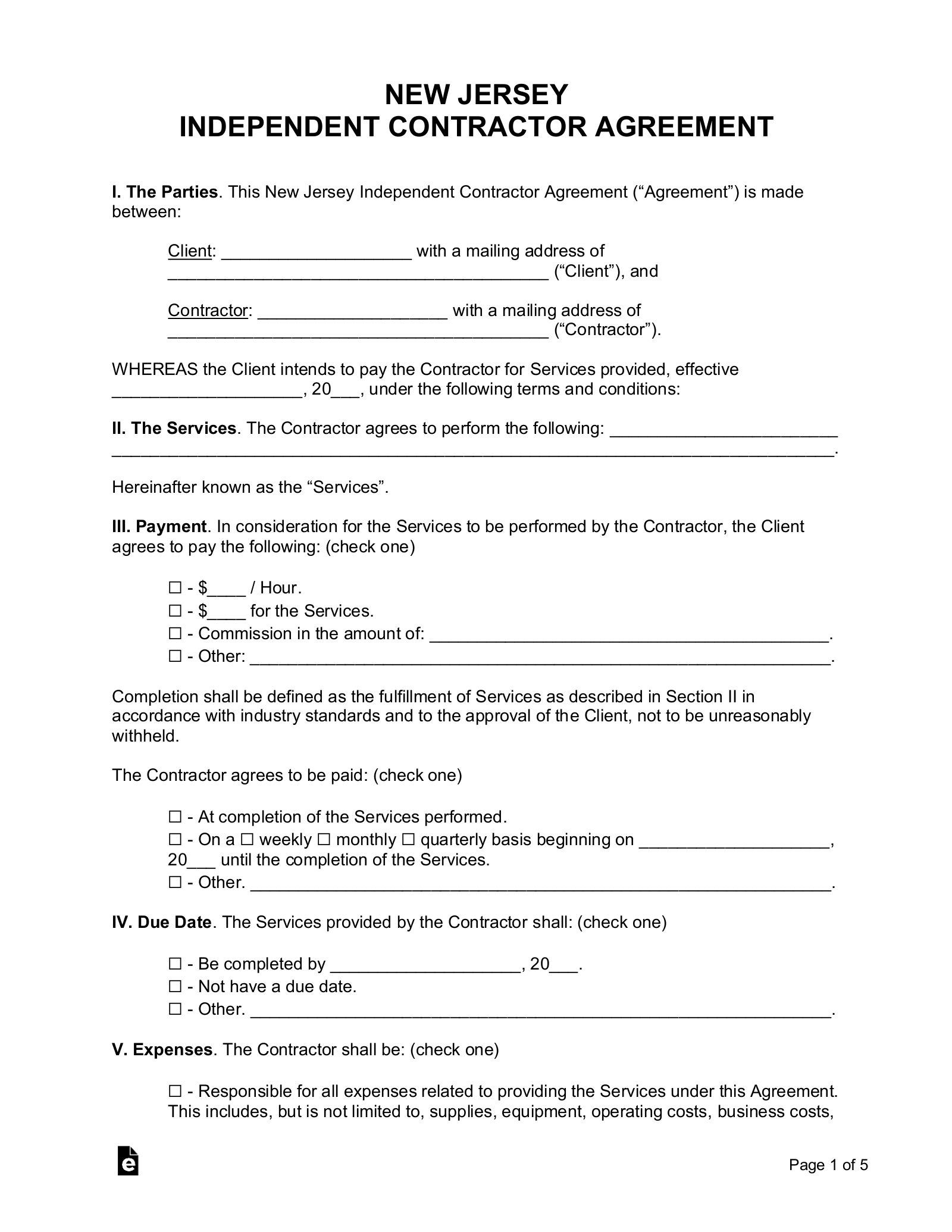

Workers Compensation Insurance For Independent Contractors New Jersey. There is legal significance if is a person is deemed to be an “employee,” as opposed to an independent contractor. Do you need workers’ comp if. You may need workers’ compensation insurance if a business you work with requires it. What you need to know.

Workers� Compensation for Independent Contractors Strock From strockinsurance.com

Workers� Compensation for Independent Contractors Strock From strockinsurance.com

If you work as an independent contractor for another company, you won’t be covered under their workers’ compensation insurance policy. Do you need workers’ comp if. All workers� compensation rates in new jersey are set by njcrib and all insurance carriers are required to utilize these base manual rates for the purpose of pricing coverage. Therefore, if you’re injured on the job, you won’t receive workers’ compensation benefits like their employees do. This coverage is also known as workers’ comp or workman’s comp. There is legal significance if is a person is deemed to be an “employee,” as opposed to an independent contractor.

The new jersey division of workers’ compensation notes that an independent contractor acting as an employee may need to be covered, regardless of their tax classification or contract with the employer.

There is legal significance if is a person is deemed to be an “employee,” as opposed to an independent contractor. But, workers’ compensation can be expensive for an employer. Independent contractors are entitled to workers’ compensation coverage after signing an agreement, the employer’s insurance provider will do everything they can to deny your compensation claim. In new jersey, employment status is favored over independent contractor status. Provide equipment, vehicle, paid per fare, set own hours, 1099 form. New jersey uber drivers are independent contractors, not employees subject to workers compensation coverage.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

In new jersey, employment status is favored over independent contractor status. Provide equipment, vehicle, paid per fare, set own hours, 1099 form. In new jersey, employment status is favored over independent contractor status. State law mandates rate changes across insurance providers. Therefore, if you’re injured on the job, you won’t receive workers’ compensation benefits like their employees do.

Source: neworleanscitybusiness.com

Source: neworleanscitybusiness.com

Therefore, if you’re injured on the job, you won’t receive workers’ compensation benefits like their employees do. The state of new jersey passed its workers’ compensation law in 1911, making coverage mandatory for all employers. That determination is likely to be significant for a number of reasons, including: There is legal significance if is a person is deemed to be an “employee,” as opposed to an independent contractor. That can be a minor league pain given the.

Source: insurancemaneuvers.com

Source: insurancemaneuvers.com

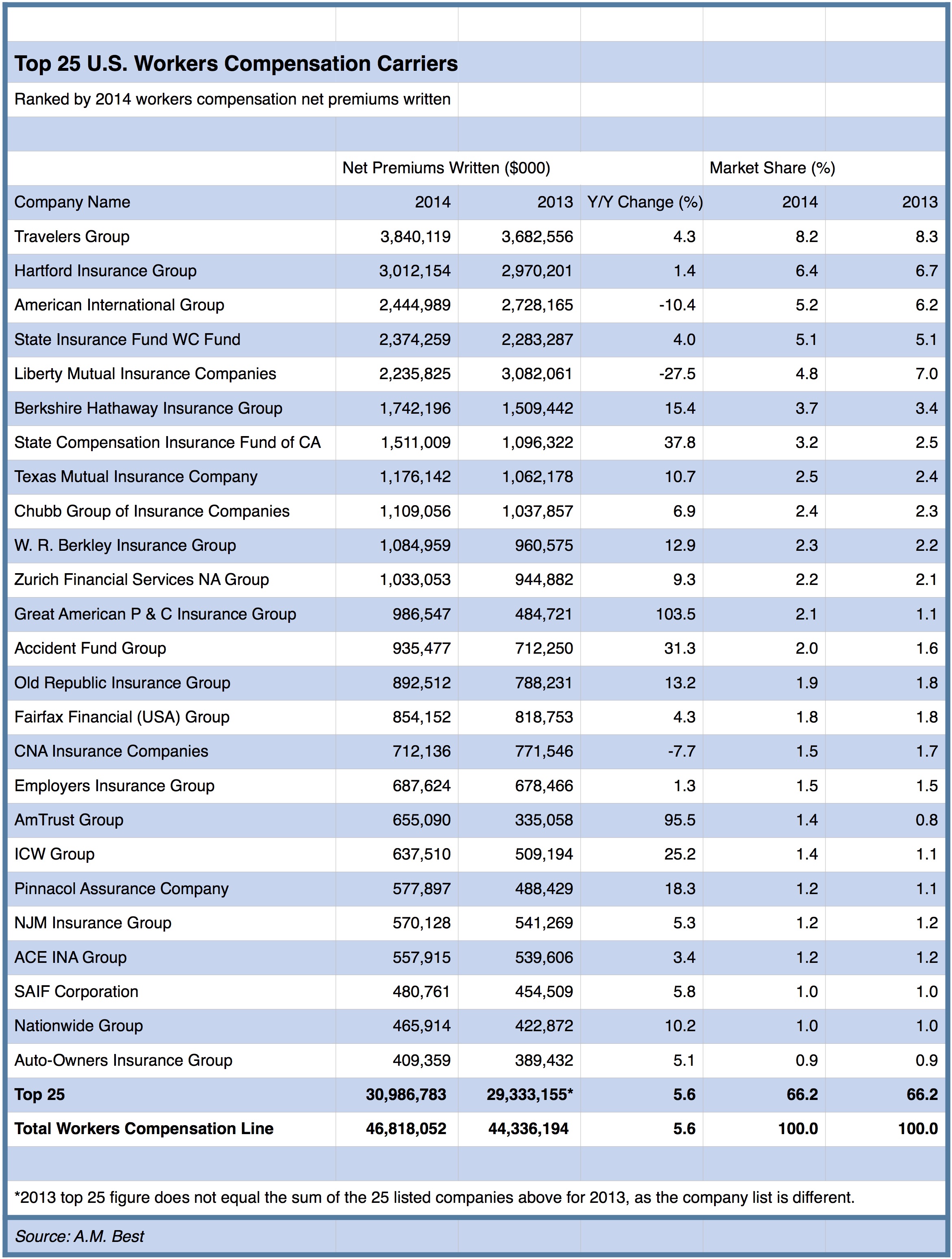

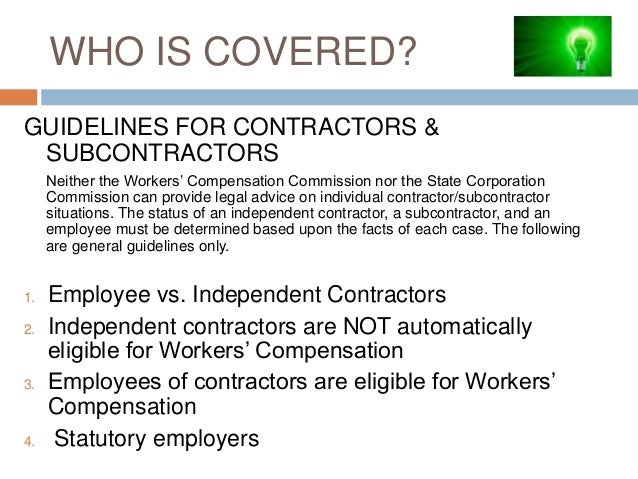

Workers comp and independent contractors: The simplest risk management approach to this problem is to require evidence of workers compensation insurance from all of your independent contractors. As stated in several state guidelines, independent contractors are required to provide workers compensation insurance for themselves. Independent contractors do not receive such protections. Employees are protected by many labor laws in new jersey, including the unemployment compensation law.

Source: employmentcontracts.com

Source: employmentcontracts.com

In some situations, federal law will govern, but the question is most often. That is why it�s so important to make sure workers are properly classified. What you need to know. Courts will look at the real relationship between the parties. It is mandatory by the state of new york and new jersey and is absolutely necessary for any business.

Source: formsbirds.com

Source: formsbirds.com

That is why it�s so important to make sure workers are properly classified. That determination is likely to be significant for a number of reasons, including: The new jersey division of workers’ compensation notes that an independent contractor acting as an employee may need to be covered, regardless of their tax classification or contract with the employer. If a court decides you misclassified workers as independent contractors when they are actually employees, you could be ordered to pay back taxes, overtime wages, health benefits, and workers� compensation fines for failing to carry adequate coverage. Whether a worker is an “employee” or an “independent contractor” is critical when it comes to such important issues as pension eligibility, workers� compensation coverage, wage and hour law, and many other matters.

Source: mynewmarkets.com

Source: mynewmarkets.com

As stated in several state guidelines, independent contractors are required to provide workers compensation insurance for themselves. So, being that only employees are entitled to receive workers’ compensation benefits, an employer might classify you as an independent contractor rather than an employee in […] That is why it�s so important to make sure workers are properly classified. Provide equipment, vehicle, paid per fare, set own hours, 1099 form. There is legal significance if is a person is deemed to be an “employee,” as opposed to an independent contractor.

Source: futureofsourcing.com

The new jersey division of workers’ compensation notes that an independent contractor acting as an employee may need to be covered, regardless of their tax classification or contract with the employer. Tort liability under respondeat superior; That is why it�s so important to make sure workers are properly classified. If a court decides you misclassified workers as independent contractors when they are actually employees, you could be ordered to pay back taxes, overtime wages, health benefits, and workers� compensation fines for failing to carry adequate coverage. In addition, under new jersey law, employers are required to carry workers’ compensation and unemployment insurance to cover employees.

Source: insuranceagentsofnj.com

Source: insuranceagentsofnj.com

Therefore, if you’re injured on the job, you won’t receive workers’ compensation benefits like their employees do. In addition, under new jersey law, employers are required to carry workers’ compensation and unemployment insurance to cover employees. Employee rights and benefits overview in new jersey, employers are required to carry workers’ compensation insurance to cover their employees when they become ill or are injured on the job due to their work duties. If you work as an independent contractor for another company, you won’t be covered under their workers’ compensation insurance policy. That is why it�s so important to make sure workers are properly classified.

Source: businessinsure.com

Source: businessinsure.com

New jersey uber drivers are independent contractors, not employees subject to workers compensation coverage. If you work as an independent contractor for another company, you won’t be covered under their workers’ compensation insurance policy. But, workers’ compensation can be expensive for an employer. Employees are protected by many labor laws in new jersey, including the unemployment compensation law. But independent contractors (ics) have more freedom and may retain rights to their intellectual property.

Source: malamutlaw.com

Source: malamutlaw.com

Workers comp and independent contractors: State law mandates rate changes across insurance providers. The state of new jersey passed its workers’ compensation law in 1911, making coverage mandatory for all employers. New jersey uber drivers are independent contractors, not employees subject to workers compensation coverage. That can be a minor league pain given the.

Source: lawsquared.co

That is why it�s so important to make sure workers are properly classified. The simplest risk management approach to this problem is to require evidence of workers compensation insurance from all of your independent contractors. Workers comp and independent contractors: If a court decides you misclassified workers as independent contractors when they are actually employees, you could be ordered to pay back taxes, overtime wages, health benefits, and workers� compensation fines for failing to carry adequate coverage. Tort liability under respondeat superior;

Source: workmanscompnewjersey.com

Source: workmanscompnewjersey.com

New jersey uber drivers are independent contractors, not employees subject to workers compensation coverage. The simplest risk management approach to this problem is to require evidence of workers compensation insurance from all of your independent contractors. Whether a worker is an “employee” or an “independent contractor” is critical when it comes to such important issues as pension eligibility, workers� compensation coverage, wage and hour law, and many other matters. Employees are protected by many labor laws in new jersey, including the unemployment compensation law. In some states employers can.

Source: strockinsurance.com

Source: strockinsurance.com

The new jersey division of workers’ compensation notes that an independent contractor acting as an employee may need to be covered, regardless of their tax classification or contract with the employer. That can be a minor league pain given the. But, workers’ compensation can be expensive for an employer. The new jersey division of workers’ compensation notes that an independent contractor acting as an employee may need to be covered, regardless of their tax classification or contract with the employer. There is legal significance if is a person is deemed to be an “employee,” as opposed to an independent contractor.

Source: csisinsuranceservices.com

Source: csisinsuranceservices.com

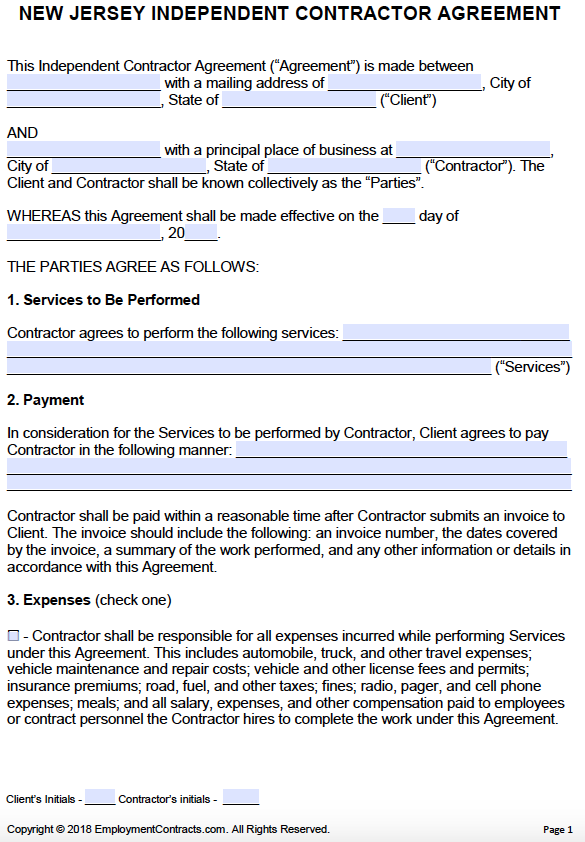

Whether a worker is an “employee” or an “independent contractor” is critical when it comes to such important issues as pension eligibility, workers� compensation coverage, wage and hour law, and many other matters. Nj workers� compensation insurance rates new jersey is a base rate state; Employee rights and benefits overview in new jersey, employers are required to carry workers’ compensation insurance to cover their employees when they become ill or are injured on the job due to their work duties. This coverage is also known as workers’ comp or workman’s comp. In some situations, federal law will govern, but the question is most often.

Source: eforms.com

Source: eforms.com

It is mandatory by the state of new york and new jersey and is absolutely necessary for any business. In some states employers can. In fact, it’s the law in every state. E.if the director of the division of workers� compensation determines, after investigation, that an employer knowingly failed to provide the protection prescribed in this article, knowingly misrepresented one or more employees as independent contractors, or knowingly provided false, incomplete or misleading information concerning the number of employees , the director shall. If you work as an independent contractor for another company, you won’t be covered under their workers’ compensation insurance policy.

Source: brossfrankel.com

Source: brossfrankel.com

E.if the director of the division of workers� compensation determines, after investigation, that an employer knowingly failed to provide the protection prescribed in this article, knowingly misrepresented one or more employees as independent contractors, or knowingly provided false, incomplete or misleading information concerning the number of employees , the director shall. If a court decides you misclassified workers as independent contractors when they are actually employees, you could be ordered to pay back taxes, overtime wages, health benefits, and workers� compensation fines for failing to carry adequate coverage. So, being that only employees are entitled to receive workers’ compensation benefits, an employer might classify you as an independent contractor rather than an employee in […] Independent contractors do not receive such protections. There is legal significance if is a person is deemed to be an “employee,” as opposed to an independent contractor.

Source: workerscompensationinsurancewatamichi.blogspot.com

Source: workerscompensationinsurancewatamichi.blogspot.com

In new jersey, employment status is favored over independent contractor status. The simplest risk management approach to this problem is to require evidence of workers compensation insurance from all of your independent contractors. This coverage is also known as workers’ comp or workman’s comp. While it may be clear that you have to carry a policy that covers all employees it can get confusing if you also use independent contractors, also known as 1099 contractors, in your business. Provide equipment, vehicle, paid per fare, set own hours, 1099 form.

Source: compensationinsurancezuein.blogspot.com

Source: compensationinsurancezuein.blogspot.com

The courts liberally construe the law in order to cover as many workers as possible under the workers’ compensation act. There is legal significance if is a person is deemed to be an “employee,” as opposed to an independent contractor. Workers comp and independent contractors: New jersey regulations does allow insurance companies to utilize experience modifiers and offer premium credits and debits on workers comp coverage. But independent contractors (ics) have more freedom and may retain rights to their intellectual property.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title workers compensation insurance for independent contractors new jersey by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information