Written premium in insurance Idea

Home » Trend » Written premium in insurance IdeaYour Written premium in insurance images are available in this site. Written premium in insurance are a topic that is being searched for and liked by netizens today. You can Get the Written premium in insurance files here. Find and Download all royalty-free photos.

If you’re looking for written premium in insurance images information linked to the written premium in insurance keyword, you have visit the right site. Our website always gives you hints for seeing the highest quality video and picture content, please kindly hunt and find more informative video articles and graphics that fit your interests.

Written Premium In Insurance. Written does not imply collected, but the gross policy premium to be collected as of the issue date of the policy, regardless of the payment plan. For example, if you pay $212 per month to keep your car insured, your yearly insurance premium would be $2,544. The concept is, thankfully, simple. Written premiums are the premiums registered on the books of an insurer or reinsurer at the time a policy is issued and paid for.

(PDF) Gross Written Premium of Insurance Companies in Cee From researchgate.net

(PDF) Gross Written Premium of Insurance Companies in Cee From researchgate.net

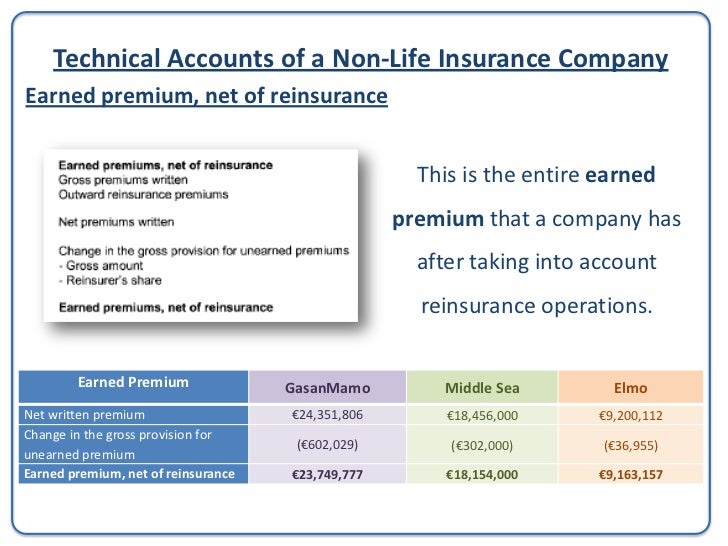

Don�t get confused between gross / net (which refers to reinsurance) and earned / written (which refers to the time period we group our data into). In essence this is, hopefully, an obvious idea. The term total written premium refers to the amount that customers pay for insurance coverage on the policies issued. Tax laws, however, may make allowances for gross premium reduced by expenses or unearned premiums. Net premium is the amount received or written on insurance policies when premiums are incurred or paid, and return premiums are deducted from gross premiums. Earned premium is the amount an insurance entity has recognized as revenue for the coverage provided under the insurance contract to date.

Written does not imply collected, but the gross policy premium to be collected as of the issue date of the policy, regardless of the payment plan.

Under current law, an insurer with as much as $350,000 in direct or net written premium, whichever is greater, is exempt from federal taxes. Written premiums may include direct and assumed premiums written. In 2007, the total amount of premiums written for the insurance industry in the. Net premium can be referred to as the present value of policy benefits less the present value of premiums payable in the future. In the insurance industry, gross premiums written is the sum of both direct premiums written (see next paragraph) and assumed premiums written, before deducting ceded reinsurance. The term total written premium refers to the amount that customers pay for insurance coverage on the policies issued.

Source: slideshare.net

Source: slideshare.net

Earned premium is the amount an insurance entity has recognized as revenue for the coverage provided under the insurance contract to date. The term total written premium refers to the amount that customers pay for insurance coverage on the policies issued. You could use either gross earned premiums or net earned premiums when calculating an ay loss ratio. Net premium is the amount received or written on insurance policies when premiums are incurred or paid, and return premiums are deducted from gross premiums. Definition gross written premium (gwp) — the total premium (direct and assumed) written by an insurer before deductions for reinsurance and ceding commissions.

Source: statista.com

Source: statista.com

An insurance premium is the amount of money an individual or business must pay for an insurance policy. Written premium is an accounting term in the insurance industry used to describe the total amount that customers are required to pay for insurance coverage on policies issued by a company during a specific period of time. Written does not imply collected, but the gross policy premium to be collected as of the issue date of the policy, regardless of the payment plan. On this basis i thought that gross premium including policy fees and ipt would be a good base point as it represents the total premium that the policyholder actually pays for the insurance. In business services, for example, workers� comp accounts for only about 23% of total written premium, which is substantially less than its more than 40% share in construction and manufacturing.

Source: moneycontrol.com

Source: moneycontrol.com

Net premium is the amount received or written on insurance policies when premiums are incurred or paid, and return premiums are deducted from gross premiums. In business services, for example, workers� comp accounts for only about 23% of total written premium, which is substantially less than its more than 40% share in construction and manufacturing. Gwp is booked once an insurance company issues insurance policy (or in more technical words, when an underwriter underwrites the policy). Direct premiums written represents the premiums on all policies the company�s insurance subsidiaries have issued during the year. Typically, the premium is the amount paid by a person (or a business) for policies that provide auto, home, healthcare, or life insurance coverage.

State insurance departments typically impose taxes on income received by insurance companies. Written premiums are the premiums registered on the books of an insurer or reinsurer at the time a policy is issued and paid for. The term total written premium refers to the amount that customers pay for insurance coverage on the policies issued. Under current law, an insurer with as much as $350,000 in direct or net written premium, whichever is greater, is exempt from federal taxes. Gross direct insurance premiums, defined as gross insurance premiums for direct insurance for a reporting country, divided by the population, represent the average insurance spending per capita in.

Source: slideteam.net

Source: slideteam.net

Gross written premiums submitted by uk general insurance firms and uk life insurance firms. Gwp is booked once an insurance company issues insurance policy (or in more technical words, when an underwriter underwrites the policy). In business services, for example, workers� comp accounts for only about 23% of total written premium, which is substantially less than its more than 40% share in construction and manufacturing. Definition ofgross direct insurance premiums. Net premium is the amount received or written on insurance policies when premiums are incurred or paid, and return premiums are deducted from gross premiums.

Source: saveelon.com

Source: saveelon.com

Net premium is the amount received or written on insurance policies when premiums are incurred or paid, and return premiums are deducted from gross premiums. Written premiums are the premiums registered on the books of an insurer or reinsurer at the time a policy is issued and paid for. Written premium — this is the premium registered on the books of an insurer or a reinsurer at thetime a policy is issued and paid for. Gross direct insurance premiums, defined as gross insurance premiums for direct insurance for a reporting country, divided by the population, represent the average insurance spending per capita in. The concept is, thankfully, simple.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

Earned premium (ep) that portion of a policy�s premium that applies to the expired portion of the policy. Written premium — this is the premium registered on the books of an insurer or a reinsurer at thetime a policy is issued and paid for. Typically, the premium is the amount paid by a person (or a business) for policies that provide auto, home, healthcare, or life insurance coverage. It usually refers to the premiums written over a period of time, such as a year. The net written premium of an insurance company is simply the total value of the premiums that will be retained by an insurance business.

Source: ar2012.sampo.com

Source: ar2012.sampo.com

Direct premiums written are the premiums written by the insurer�s subsidiaries for all policies. Typically, the premium is the amount paid by a person (or a business) for policies that provide auto, home, healthcare, or life insurance coverage. Under current law, an insurer with as much as $350,000 in direct or net written premium, whichever is greater, is exempt from federal taxes. Don�t get confused between gross / net (which refers to reinsurance) and earned / written (which refers to the time period we group our data into). The important thing is to ensure correspondence between the premiums and claims.

Source: researchgate.net

Source: researchgate.net

The important thing is to ensure correspondence between the premiums and claims. Tax laws, however, may make allowances for gross premium reduced by expenses or unearned premiums. It usually refers to the premiums written over a period of time, such as a year. Written premium is the total amount that a policyholder is required to pay under the insurance contract absent a cancellation. The leading global insurance companies in 2019 in terms of revenue were berkshire hathaway, ping an insurance, and axa.

Source: riskheads.org

Source: riskheads.org

In 2007, the total amount of premiums written for the insurance industry in the. Gross written premiums submitted by uk general insurance firms and uk life insurance firms. Under current law, an insurer with as much as $350,000 in direct or net written premium, whichever is greater, is exempt from federal taxes. Earned premium (ep) that portion of a policy�s premium that applies to the expired portion of the policy. Gross written premium (gwp) gwp is the amount which has been charged to the customer for issuance of a policy (but not necessarily recognized as a revenue).

Source: insurancejournal.com

Source: insurancejournal.com

It usually refers to the premiums written over a period of time, such as a year. The net written premium of an insurance company is simply the total value of the premiums that will be retained by an insurance business. Gross written premium (gwp) gwp is the amount which has been charged to the customer for issuance of a policy (but not necessarily recognized as a revenue). Rank group/company direct premiums written (1) market share (2) 1: Written premium is the total amount that a policyholder is required to pay under the insurance contract absent a cancellation.

Source: unstats.un.org

Source: unstats.un.org

Rank group/company direct premiums written (1) market share (2) 1: Tax laws, however, may make allowances for gross premium reduced by expenses or unearned premiums. You could use either gross earned premiums or net earned premiums when calculating an ay loss ratio. Rank group/company direct premiums written (1) market share (2) 1: Written premium is an accounting term in the insurance industry used to describe the total amount that customers are required to pay for insurance coverage on policies issued by a company during a specific period of time.

Source: pinterest.com

Source: pinterest.com

In essence this is, hopefully, an obvious idea. We publish details of a selection of requests made under the freedom of information act 2000, and the information we disclose in response. In essence this is, hopefully, an obvious idea. For example, the pennsylvania department of revenue imposes a tax on gross premiums written by pennsylvania insurance companies, but the tax does not apply to. In the insurance industry, gross premiums written is the sum of both direct premiums written (see next paragraph) and assumed premiums written, before deducting ceded reinsurance.

Source: spglobal.com

Source: spglobal.com

It usually refers to the premiums written over a period of time, such as a year. Definition ofgross direct insurance premiums. Net premiums written refers to the amount of money an insurance company receives from premiums that policyholders pay after the company has subtracted what it needs to pay for reinsurance or commissions. Tax laws, however, may make allowances for gross premium reduced by expenses or unearned premiums. In the insurance industry, gross premiums written is the sum of both direct premiums written (see next paragraph) and assumed premiums written, before deducting ceded reinsurance.

Source: statista.com

Source: statista.com

Don�t get confused between gross / net (which refers to reinsurance) and earned / written (which refers to the time period we group our data into). Under current law, an insurer with as much as $350,000 in direct or net written premium, whichever is greater, is exempt from federal taxes. Gross written premiums submitted by uk general insurance firms and uk life insurance firms. Net premium can be referred to as the present value of policy benefits less the present value of premiums payable in the future. Gross direct insurance premiums, defined as gross insurance premiums for direct insurance for a reporting country, divided by the population, represent the average insurance spending per capita in.

Source: getfilings.com

Source: getfilings.com

We publish details of a selection of requests made under the freedom of information act 2000, and the information we disclose in response. It usually refers to the premiums written over a period of time, such as a year. Includes additional and/or return premiums. In business services, for example, workers� comp accounts for only about 23% of total written premium, which is substantially less than its more than 40% share in construction and manufacturing. Definition gross written premium (gwp) — the total premium (direct and assumed) written by an insurer before deductions for reinsurance and ceding commissions.

Source: kaggle.com

Source: kaggle.com

Written does not imply collected, but the gross policy premium to be collected as of the issue date of the policy, regardless of the payment plan. Earned premium (ep) that portion of a policy�s premium that applies to the expired portion of the policy. Gross written premiums submitted by uk general insurance firms and uk life insurance firms. Written premiums are the premiums registered on the books of an insurer or reinsurer at the time a policy is issued and paid for. In 2007, the total amount of premiums written for the insurance industry in the.

Source: researchgate.net

Source: researchgate.net

A written premium is an accounting term in the insurance industry used to describe the total amount customers are required to pay for. Direct premiums written represents the premiums on all policies the company�s insurance subsidiaries have issued during the year. Written premium is the total amount that a policyholder is required to pay under the insurance contract absent a cancellation. You could use either gross earned premiums or net earned premiums when calculating an ay loss ratio. A written premium is an accounting term in the insurance industry used to describe the total amount customers are required to pay for.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title written premium in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information