Wv homeowners insurance information

Home » Trend » Wv homeowners insurance informationYour Wv homeowners insurance images are ready. Wv homeowners insurance are a topic that is being searched for and liked by netizens today. You can Download the Wv homeowners insurance files here. Download all free vectors.

If you’re searching for wv homeowners insurance images information connected with to the wv homeowners insurance interest, you have pay a visit to the right blog. Our site frequently gives you hints for seeking the maximum quality video and picture content, please kindly search and find more informative video articles and graphics that fit your interests.

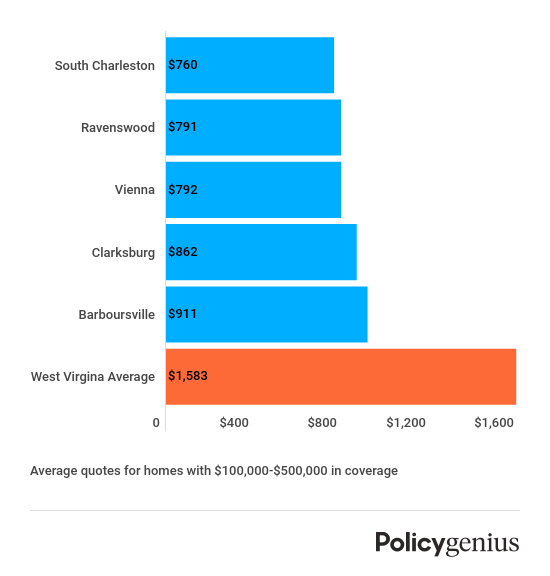

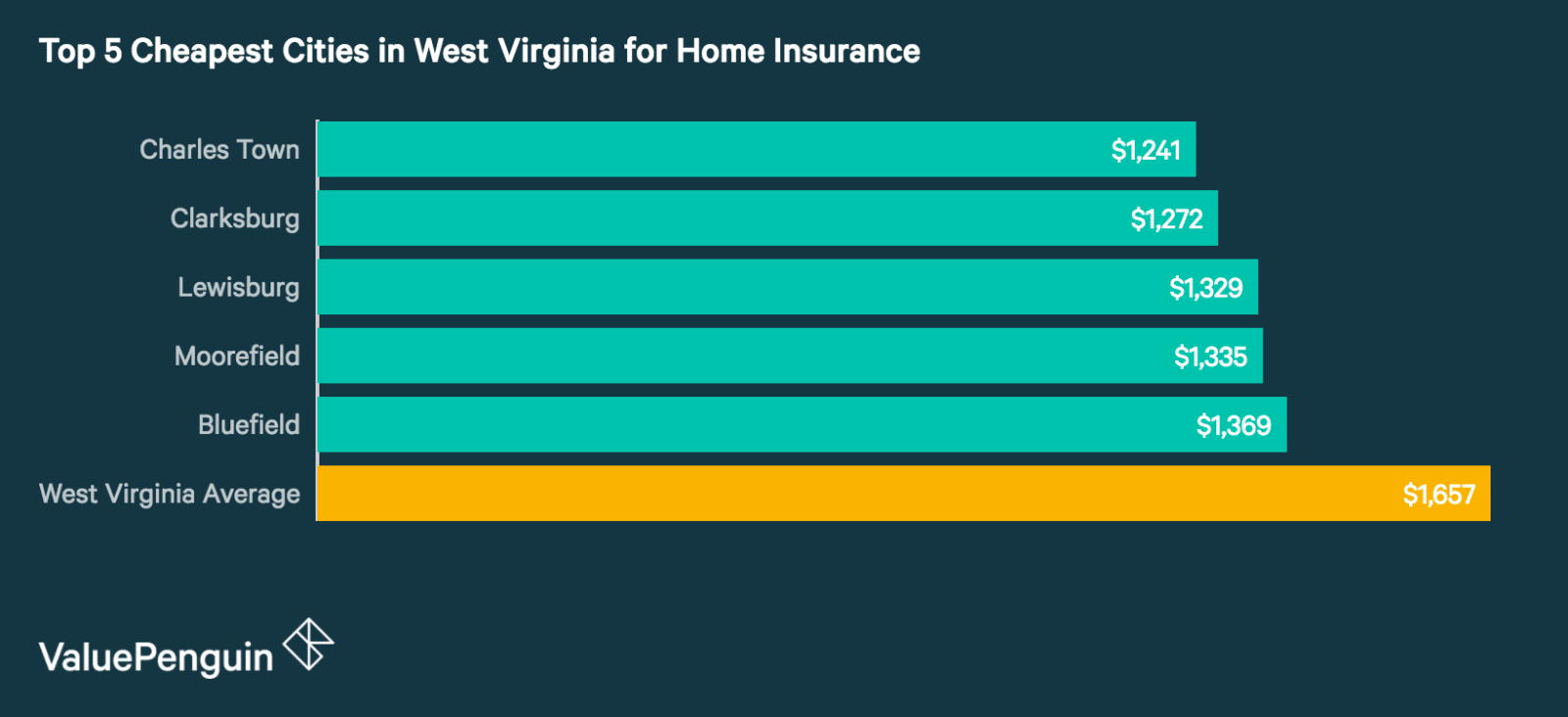

Wv Homeowners Insurance. Homeowners insurance in virginia costs an average of $1,123 a year, or about the same as 28 dozen of virginia’s famous oysters. We can provide cost estimates specific to your zip code and unique needs. The most expensive cities in west virginia for homeowners insurance are huntington and beckley. West virginia homeowners insurance discounts.

The Best West Virginia Homeowners Insurance Companies From reviews.com

The Best West Virginia Homeowners Insurance Companies From reviews.com

The average cost of home insurance in west virginia is $1,366 per year or $114 per month. View the table below to compare average homeowners insurance rates for a $400k home in west virginia. The amount you pay on homeowners insurance depends on your property. Average cost of homeowners insurance in west virginia. The easiest way to get a cheap homeowners insurance policy in west virginia is to. West virginia’s landscape is made up of beautiful mountain ranges, valleys, and rivers, but the state can suffer from natural hazards like severe thunderstorms, winter storms, and forest fires.

When seeking to find the right insurance.

Average cost of homeowners insurance in west virginia. The average cost of west virginia homeowners insurance is $877 in 2014 and $907 in 2015 according to iii. Conversely, the cheapest places to get homeowners insurance in the mountain state are martinsburg and morgantown. Average rates for $400k dwelling. Connect with an independent insurance agent to get tailored protection in minutes. Fortunately, a local expert can help for free.

Source: policygenius.com

Source: policygenius.com

If you’re not using an independent agent in fairmont like us, it can be hard, if not impossible to tell the difference between two homeowners insurance policies. West virginia’s landscape is made up of beautiful mountain ranges, valleys, and rivers, but the state can suffer from natural hazards like severe thunderstorms, winter storms, and forest fires. Your personal premium will vary depending on the cost of your house and the kind of coverage you choose to pay for. According to 2021 data from bankrate.com, the average annual cost of insurance in west virginia is $1,124 for $250,000 in dwelling coverage, which is a bit under the national average of $1,312. The amount you pay on homeowners insurance depends on your property.

Source: trustedchoice.com

Source: trustedchoice.com

We offer a variety of discounts for our home insurance customers based in west virginia. The average cost of west virginia homeowners insurance is $877 in 2014 and $907 in 2015 according to iii. Farmers ® builds value into every policy — but you may be eligible for even more savings. View the table below to compare average homeowners insurance rates for a $400k home in west virginia. The easiest way to get a cheap homeowners insurance policy in west virginia is to.

Source: trustedchoice.com

Source: trustedchoice.com

We can provide cost estimates specific to your zip code and unique needs. The average cost of homeowners insurance in west virginia is $1,124 per year, or about $94 per month, for $250,000 in dwelling coverage, according to bankrate’s 2022 study of annual quoted premiums. Average rates for $400k dwelling. This is a great deal compared to the national average of $1,132 (2014) and $1,173 (2015). According to 2021 data from bankrate.com, the average annual cost of insurance in west virginia is $1,124 for $250,000 in dwelling coverage, which is a bit under the national average of $1,312.

This is a great deal compared to the national average of $1,132 (2014) and $1,173 (2015). The amount you pay on homeowners insurance depends on your property. The average cost of west virginia homeowners insurance is $877 in 2014 and $907 in 2015 according to iii. Different insurance companies offer different levels of coverage, different endorsements and riders, and have different conditions and limitations. We offer a variety of discounts for our home insurance customers based in west virginia.

Source: reviews.com

Source: reviews.com

When seeking to find the right insurance. Homeowners in west virginia, virginia, and maryland can contact jones insurance agency for homeowners insurance and renters insurance. Since this is a bit lower than the nationwide average of $1,200, va is one of the more affordable states for home insurance coverage. Average cost % from statewide average. The average cost of home insurance in west virginia is $1,366 per year or $114 per month.

Source: pinterest.com

Source: pinterest.com

View the table below to compare average homeowners insurance rates for a $400k home in west virginia. Different insurance companies offer different levels of coverage, different endorsements and riders, and have different conditions and limitations. First, it�s essential to understand which insurance companies are best for your property and where to find a quote. The average cost of homeowners insurance in virginia is around $1,031 a year. Since this is a bit lower than the nationwide average of $1,200, va is one of the more affordable states for home insurance coverage.

Source: trustedchoice.com

Source: trustedchoice.com

What you need to know. A farm mutual insurance company providing actual cash value home owners and fire & lightning coverage across west virginia. The average cost of west virginia homeowners insurance is $877 in 2014 and $907 in 2015 according to iii. This is a great deal compared to the national average of $1,132 (2014) and $1,173 (2015). Since this is a bit lower than the nationwide average of $1,200, va is one of the more affordable states for home insurance coverage.

Source: infuseinsurance.com

Source: infuseinsurance.com

First, it�s essential to understand which insurance companies are best for your property and where to find a quote. According to bankrate, virginia residents can get a pretty good deal when it comes to homeowners insurance rates. The average cost of homeowners insurance in virginia is around $1,031 a year. Average cost of homeowners insurance in west virginia. This is a great deal compared to the national average of $1,132 (2014) and $1,173 (2015).

Source: appalachianins.com

Source: appalachianins.com

The average cost of homeowners insurance in virginia is around $1,031 a year. View the table below to compare average homeowners insurance rates for a $400k home in west virginia. 1 many homeowners don’t realize that actual cash value policies subtract for wear and tear and depreciation. Majority of the top carriers in the market are large national and international insurance companies. Different insurance companies offer different levels of coverage, different endorsements and riders, and have different conditions and limitations.

Source: trustedchoice.com

Source: trustedchoice.com

What you need to know. View the table below to compare average homeowners insurance rates for a $400k home in west virginia. According to 2021 data from bankrate.com, the average annual cost of insurance in west virginia is $1,124 for $250,000 in dwelling coverage, which is a bit under the national average of $1,312. A farm mutual insurance company providing actual cash value home owners and fire & lightning coverage across west virginia. Connect with an independent insurance agent to get tailored protection in minutes.

Source: budgetmethod.com

Source: budgetmethod.com

Average cost of homeowners insurance in west virginia. Fortunately, a local expert can help for free. While the chart can give you good idea of cost trends in west virginia, be aware that different factors impact your homeowners insurance rate. Majority of the top carriers in the market are large national and international insurance companies. Contact us online to request a free quote or call us at:

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The average cost of homeowners insurance in west virginia is $1,124 per year, or about $94 per month, for $250,000 in dwelling coverage, according to bankrate’s 2022 study of annual quoted premiums. Connect with an independent insurance agent to get tailored protection in minutes. West virginia homeowners insurance discounts. Policy features that may meet the needs of west virginia homeowners. We can provide cost estimates specific to your zip code and unique needs.

Source: completehomewarranty.com

Source: completehomewarranty.com

What you need to know. Farmers ® builds value into every policy — but you may be eligible for even more savings. Policy features that may meet the needs of west virginia homeowners. A farm mutual insurance company providing actual cash value home owners and fire & lightning coverage across west virginia. The most expensive cities in west virginia for homeowners insurance are huntington and beckley.

Source: gowithproinsurance.com

Source: gowithproinsurance.com

If you’re not using an independent agent in fairmont like us, it can be hard, if not impossible to tell the difference between two homeowners insurance policies. The homeowners insurance market in west virginia is fairly concentrated, with the top two insurance carriers in the region controlling over 44% of the market, and the top five controlling close to 70%. We offer a variety of discounts for our home insurance customers based in west virginia. The best way to find out how much west virginia home insurance will cost you is to get a quote. Homeowners insurance in virginia costs an average of $1,123 a year, or about the same as 28 dozen of virginia’s famous oysters.

Policy features that may meet the needs of west virginia homeowners. According to bankrate, virginia residents can get a pretty good deal when it comes to homeowners insurance rates. Average cost of homeowners insurance in west virginia. Different insurance companies offer different levels of coverage, different endorsements and riders, and have different conditions and limitations. Homeowners insurance covers your house, personal property, and assets in the event that the unexpected happens.

Source: closeinsurance.biz

Source: closeinsurance.biz

A farm mutual insurance company providing actual cash value home owners and fire & lightning coverage across west virginia. Homeowners insurance covers your house, personal property, and assets in the event that the unexpected happens. Average cost of homeowners insurance in west virginia. West virginia’s landscape is made up of beautiful mountain ranges, valleys, and rivers, but the state can suffer from natural hazards like severe thunderstorms, winter storms, and forest fires. The average cost of homeowners insurance in virginia is around $1,031 a year.

Source: everquote.com

Source: everquote.com

Homeowners insurance covers your house, personal property, and assets in the event that the unexpected happens. The age of your home will affect the price of your insurance the most in west virginia. The amount you pay on homeowners insurance depends on your property. The homeowners insurance market in west virginia is fairly concentrated, with the top two insurance carriers in the region controlling over 44% of the market, and the top five controlling close to 70%. First, it�s essential to understand which insurance companies are best for your property and where to find a quote.

Source: vhomeinsurance.com

Source: vhomeinsurance.com

West virginia offices of the insurance commissioner homeowners insurance review standards checklist revised: While the chart can give you good idea of cost trends in west virginia, be aware that different factors impact your homeowners insurance rate. Majority of the top carriers in the market are large national and international insurance companies. Connect with an independent insurance agent to get tailored protection in minutes. West virginia offices of the insurance commissioner homeowners insurance review standards checklist revised:

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title wv homeowners insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information