Zone d flood insurance Idea

Home » Trend » Zone d flood insurance IdeaYour Zone d flood insurance images are available in this site. Zone d flood insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Zone d flood insurance files here. Get all free photos and vectors.

If you’re searching for zone d flood insurance images information related to the zone d flood insurance keyword, you have pay a visit to the right blog. Our website frequently provides you with hints for refferencing the maximum quality video and picture content, please kindly surf and find more enlightening video content and images that fit your interests.

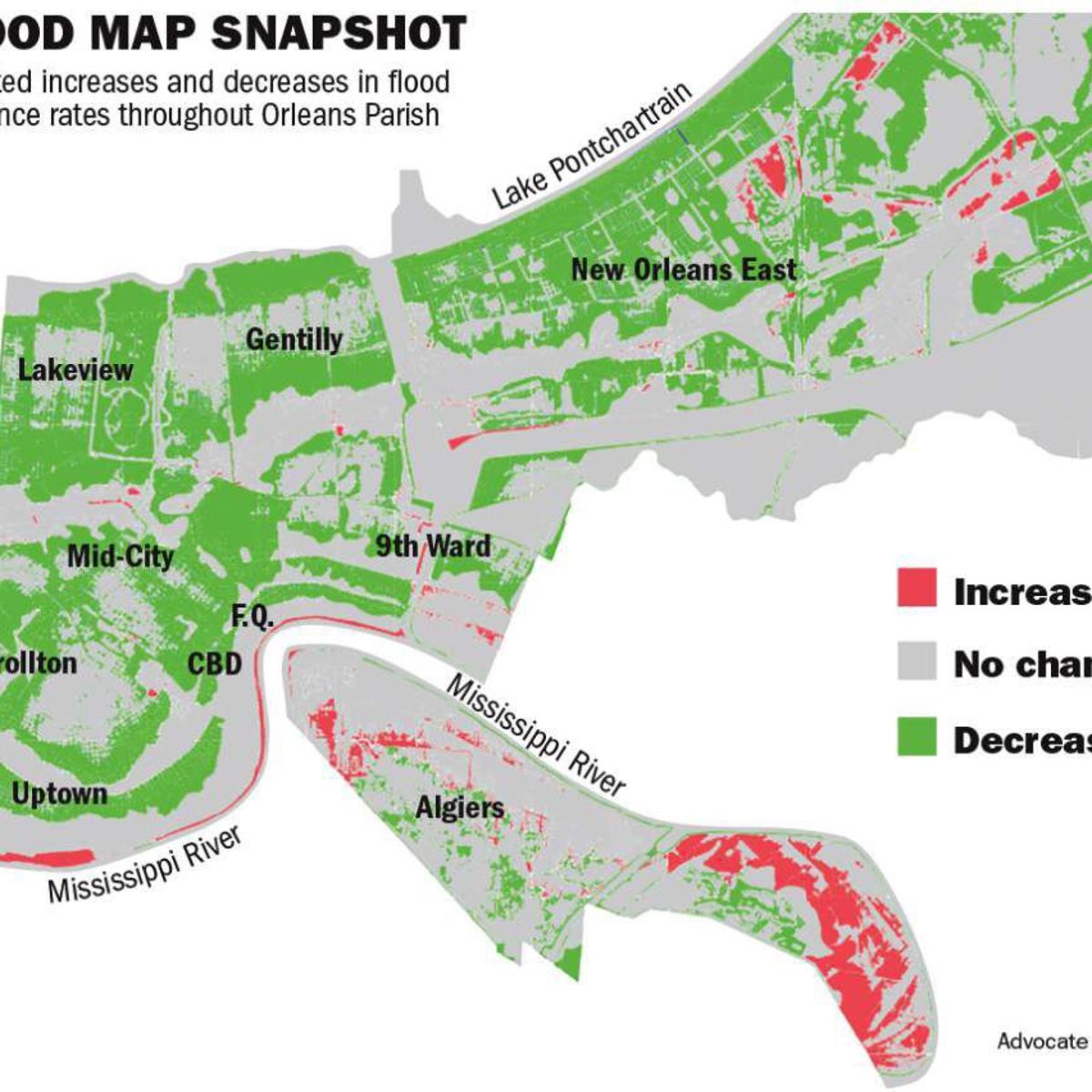

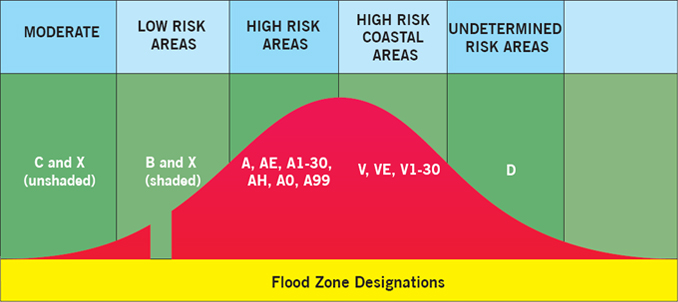

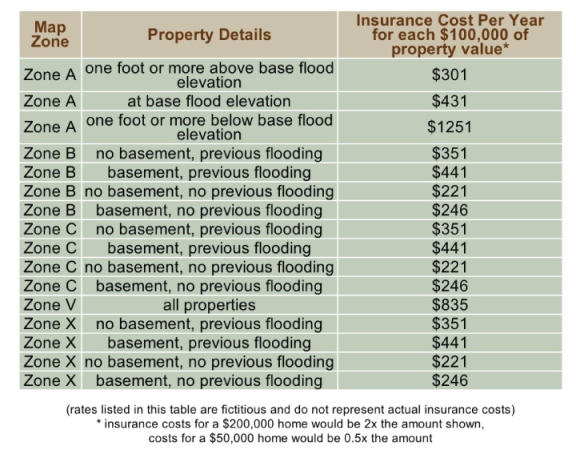

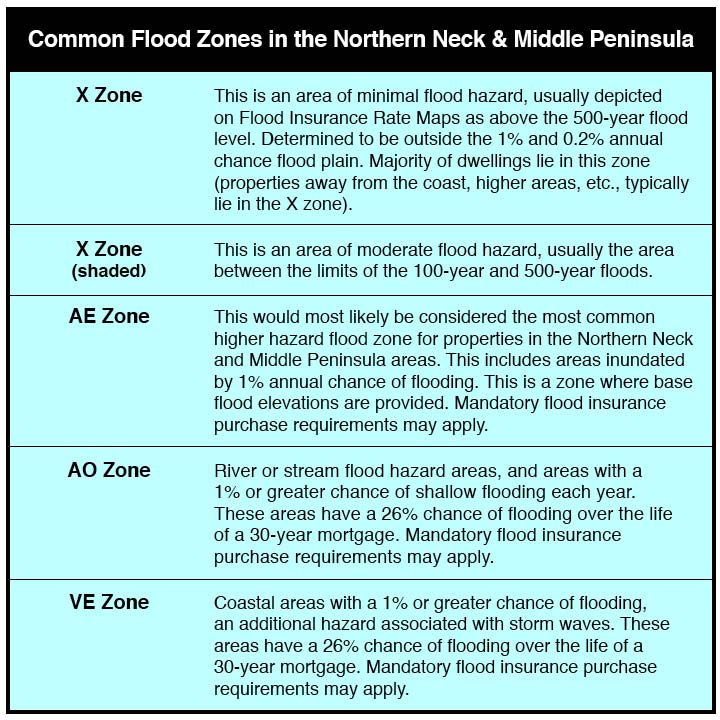

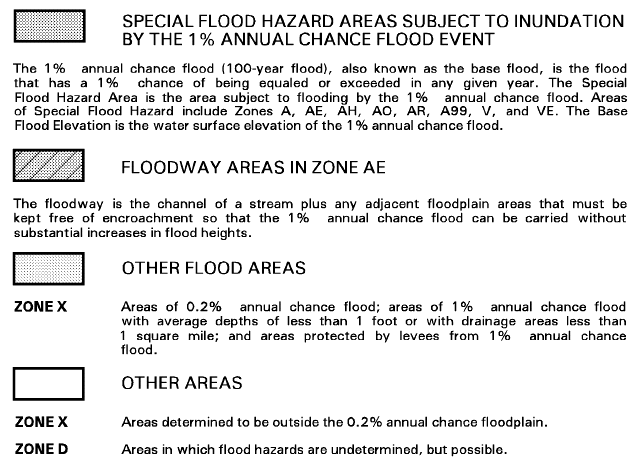

Zone D Flood Insurance. If your property covers two or more zones, the flood insurer will rate your premium based on the most hazardous zone. In areas designated as zone d, no analysi s of flood hazards has been conducted. Private flood insurance for flood zone c. The other option is to look for a policy from a private insurance company.

Fema Flood Insurance Rate Map Florida From global-mapss.blogspot.com

Fema Flood Insurance Rate Map Florida From global-mapss.blogspot.com

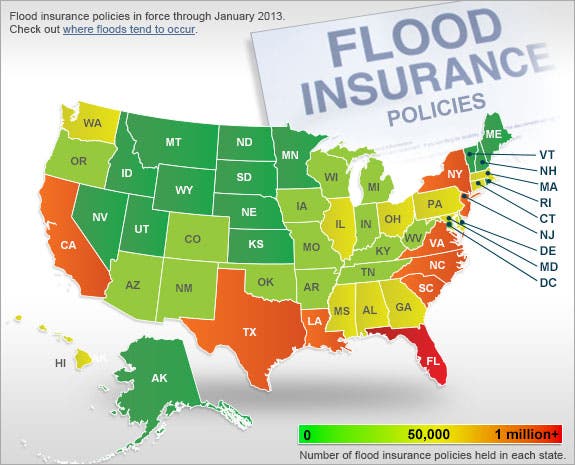

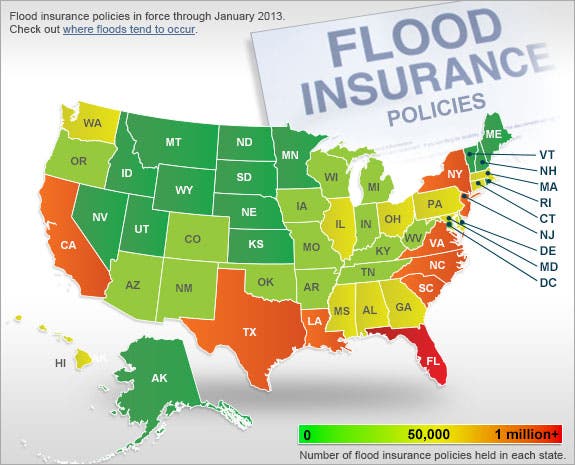

The average cost of flood insurance is $958 per year, or $80 a month, through the national flood. Flood zones are geographic areas that the fema has defined according to varying levels of flood risk. Private flood insurance for flood zone c. Flood d is designed to catch all other risk areas that are not defined by other flood zones. Zone d is the resulting designation on the flood map, to indicate that while flood risk remains, the probability of that flood risk has not been quantified. This refers to any area which simply hasn’t been mapped for flood hazards.

Flood insurance may be advisable for certain flood map zones and federally regulated lenders require flood insurance to purchase any home in areas designated as a special flood hazard area (sfha).

This refers to any area which simply hasn’t been mapped for flood hazards. Flood insurance may be advisable for certain flood map zones and federally regulated lenders require flood insurance to purchase any home in areas designated as a special flood hazard area (sfha). The designation of zone d is also used when a community incorporates portions of another community’s area where no map has been prepared. Purchasing flood insurance is recommended. In zone x and zone d, flood insurance is optional In areas designated as zone d, no analysi s of flood hazards has been conducted.

Source: florida-floodzone.com

Source: florida-floodzone.com

Homeowners generally have two options for getting flood insurance. Oahu homes are considered to be in a sfha when there is a least a one percent chance of a flood equal to or exceeding the base flood elevation (a 100. Flood insurance is optional and available, and the flood insurance rates for properties in zone d are commensurate with the uncertainty of the flood risk. Each zone reflects the severity or type of flooding in the area. What does this mean for property owners?

Source: global-mapss.blogspot.com

Source: global-mapss.blogspot.com

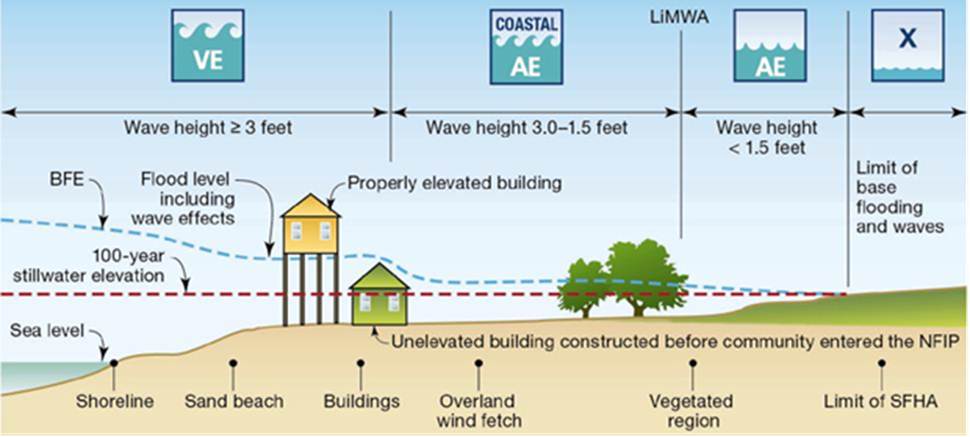

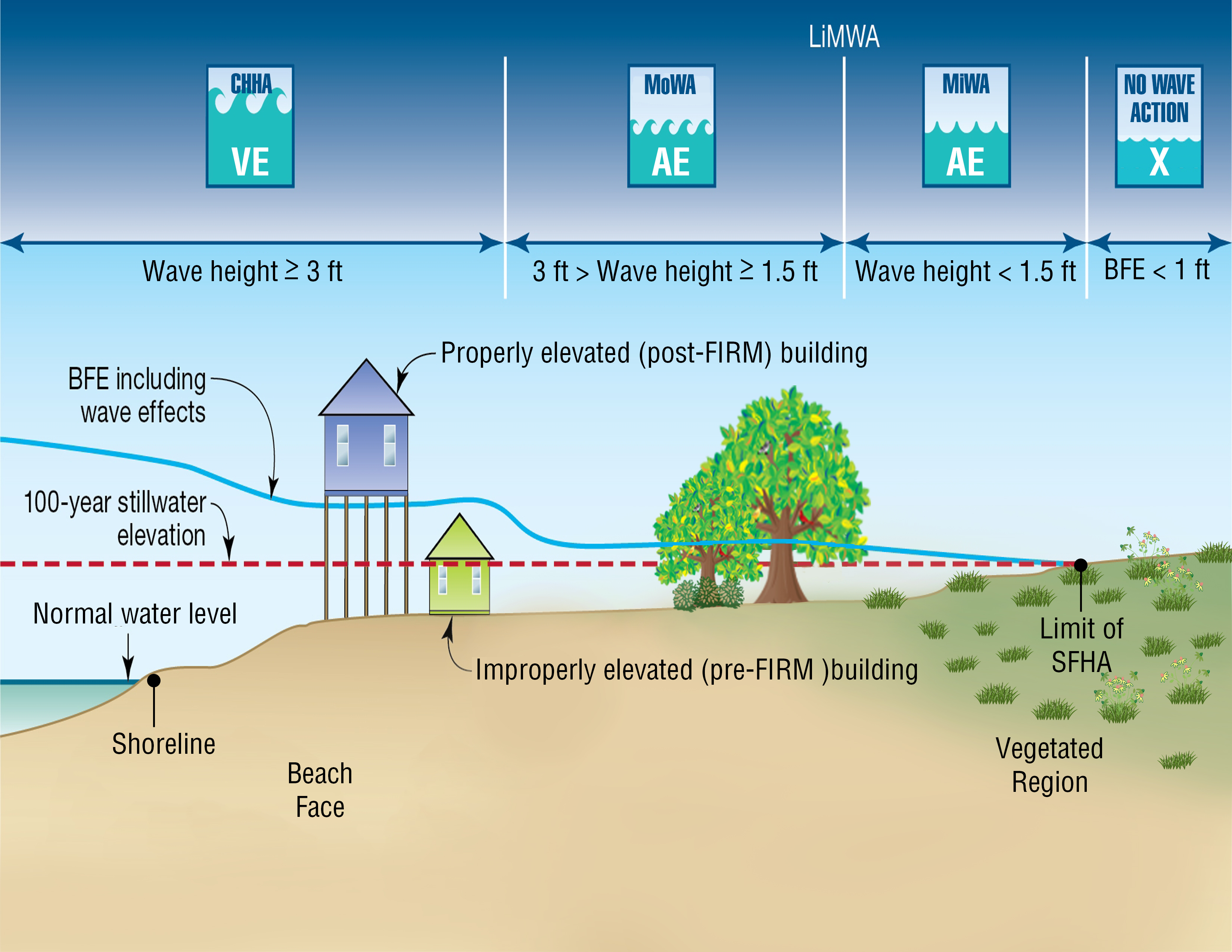

No flood analysis has been conducted in these areas, so you’ll need to decide for yourself if you believe that there is a risk. Some coastal areas are in flood zone ve. How flood zones affect home insurance costs. These zones usually have minimal flooding though there may be some ponding or local drainage problems. Backed by fema, the nfip accounts for nearly 95 percent of all flood insurance policies.

Source: floodelevationsurveyors.com

Source: floodelevationsurveyors.com

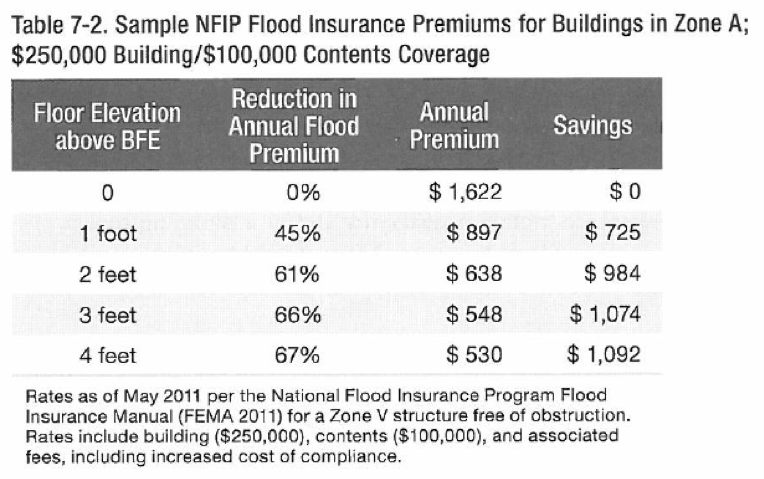

In areas designated as zone d, no analysi s of flood hazards has been conducted. Want to pay less for flood insurance in hawaii? Flood zones are geographic areas that the fema has defined according to varying levels of flood risk. In the most extreme cases, a home in a v zone can cost 100% or even 200% what it costs to insure a home in a b, c or x zone. The average price for flood insurance in flood zone ae is $1,025.

Source: summitengineeringinc.com

Source: summitengineeringinc.com

Private flood insurance for flood zone c. How flood zones affect home insurance costs. What flood zones require flood insurance? Zone d the zone d designation is used for areas where there are possible but undetermined flood hazards. Do flood zones affect insurance rates?

Source: andersoninsgroup.com

Source: andersoninsgroup.com

Some flood maps also include areas where there are possible but undetermined flood hazards or unstudied areas. If your property covers two or more zones, the flood insurer will rate your premium based on the most hazardous zone. There is no requirement from fema to purchase flood insurance in a d zone. What does this mean for property owners? No flood analysis has been conducted in these areas, so you’ll need to decide for yourself if you believe that there is a risk.

Source: floodpartners.com

Source: floodpartners.com

This isn’t a special flood hazard zone, so it is generally not subject to the higher flood insurance rates, but it doesn’t mean it will not have a flood risk. Your flood zone doesn�t affect your home insurance rates. Hawaii also has d zones, which are areas where fema has not studied the flood risk. Homeowners generally have two options for getting flood insurance. If a property covers two or more flood zones, the insurer will rate the premiums based on the most.

Source: chegg.com

Source: chegg.com

Private flood insurance for flood zone c. Zone d is the resulting designation on the flood map, to indicate that while flood risk remains, the probability of that flood risk has not been quantified. Area with reduced risk due to levee, zone d = you are in an area that is provided some protection from flooding by a levee system. This isn’t a special flood hazard zone, so it is generally not subject to the higher flood insurance rates, but it doesn’t mean it will not have a flood risk. In the most extreme cases, a home in a v zone can cost 100% or even 200% what it costs to insure a home in a b, c or x zone.

Source: virginialuxurywaterfronthomes.com

Source: virginialuxurywaterfronthomes.com

Oddly for an island state, hawaii is mostly in flood zone ae. These zones could still have flood risk as historically more than 20% of. Some coastal areas are in flood zone ve. Although some federally backed lenders may still require it, in a zone d, there are no mandatory flood insurance requirements. The average price for flood insurance in flood zone ae is $1,025.

Source: global-mapss.blogspot.com

Source: global-mapss.blogspot.com

Zone d can be misleading. Backed by fema, the nfip accounts for nearly 95 percent of all flood insurance policies. There is no requirement from fema to purchase flood insurance in a d zone. While flood insurance may not be required, you may still be at risk of flooding. No flood analysis has been conducted in these areas, so you’ll need to decide for yourself if you believe that there is a risk.

Source: beachsamp.org

Source: beachsamp.org

The premier shield flood insurance agency can help shop and compare flooding insurance policy coverage options with multiple companies to help you get homeowners flood insurance coverage for homes up to $5,000,000 through companies like “neptune flood“, “the hartford“, “chubb“, “progressive“, and “foremost” in our flood insurance coverage area (tx, ct, ma, va, sc, oh, ri,. Although some federally backed lenders may still require it, in a zone d, there are no mandatory flood insurance requirements. Hawaii also has d zones, which are areas where fema has not studied the flood risk. What flood zones require flood insurance? Flood insurance may be advisable for certain flood map zones and federally regulated lenders require flood insurance to purchase any home in areas designated as a special flood hazard area (sfha).

Source: virginiaplaces.org

Source: virginiaplaces.org

These areas are shown on flood maps or areas beginning with the letter �d.� flood insurance rates reflect the uncertainty of the flood risk. Flood d is designed to catch all other risk areas that are not defined by other flood zones. The type of flood zone you live in has a huge effect on the price of your flood insurance. What does this mean for property owners? Do flood zones affect insurance rates?

Source: flindependentagents.com

Source: flindependentagents.com

While flood insurance may not be required, you may still be at risk of flooding. There are ways to save money on flood zone ae insurance in hawaii. Moderate to low risk areas in communities that participate in the nfip, flood insurance is available to all. The average cost of flood insurance is $958 per year, or $80 a month, through the national flood. The average cost of flood insurance through the nfip is $958 per year, but the amount you pay depends on your location.

Source: janettemcgrealrealtor.com

Source: janettemcgrealrealtor.com

No flood analysis has been conducted in these areas, so you’ll need to decide for yourself if you believe that there is a risk. In 2021, the national insurance flood program announced its premiums would increase from an estimated average of $880 per. In zone x and zone d, flood insurance is optional Nfip is administered by fema, which works closely with more than 80 private insurance companies to offer flood. The flood zone you live in significantly determines your flood insurance rate.

Source: floodzonedrs.com

Source: floodzonedrs.com

How flood zones affect home insurance costs. If your property covers two or more zones, the flood insurer will rate your premium based on the most hazardous zone. In the most extreme cases, a home in a v zone can cost 100% or even 200% what it costs to insure a home in a b, c or x zone. Flood insurance flood insurance is required by law for any primary building with federally backed funding (e.g., mortgage or business loan) in a flood map zone with an a designation — a, ae, ah, ao, ar, and a99. These zones are depicted on a community�s flood insurance rate map (firm) or flood hazard boundary map.

Source: rebatesonrealestate.com

Source: rebatesonrealestate.com

The type of flood zone you live in has a huge effect on the price of your flood insurance. If you are buying through the national flood insurance program, the maximum limits available on your building and personal belongings are $250,000 and $100,000, respectively. These zones are depicted on a community�s flood insurance rate map (firm) or flood hazard boundary map. Some coastal areas are in flood zone ve. Flood insurance may be advisable for certain flood map zones and federally regulated lenders require flood insurance to purchase any home in areas designated as a special flood hazard area (sfha).

Source: homeinsuranceking.com

Source: homeinsuranceking.com

Here are some benchmark estimates: Homes in zone d have not been assigned a unique flooding risk. The premier shield flood insurance agency can help shop and compare flooding insurance policy coverage options with multiple companies to help you get homeowners flood insurance coverage for homes up to $5,000,000 through companies like “neptune flood“, “the hartford“, “chubb“, “progressive“, and “foremost” in our flood insurance coverage area (tx, ct, ma, va, sc, oh, ri,. These zones usually have minimal flooding though there may be some ponding or local drainage problems. Flood insurance flood insurance is required by law for any primary building with federally backed funding (e.g., mortgage or business loan) in a flood map zone with an a designation — a, ae, ah, ao, ar, and a99.

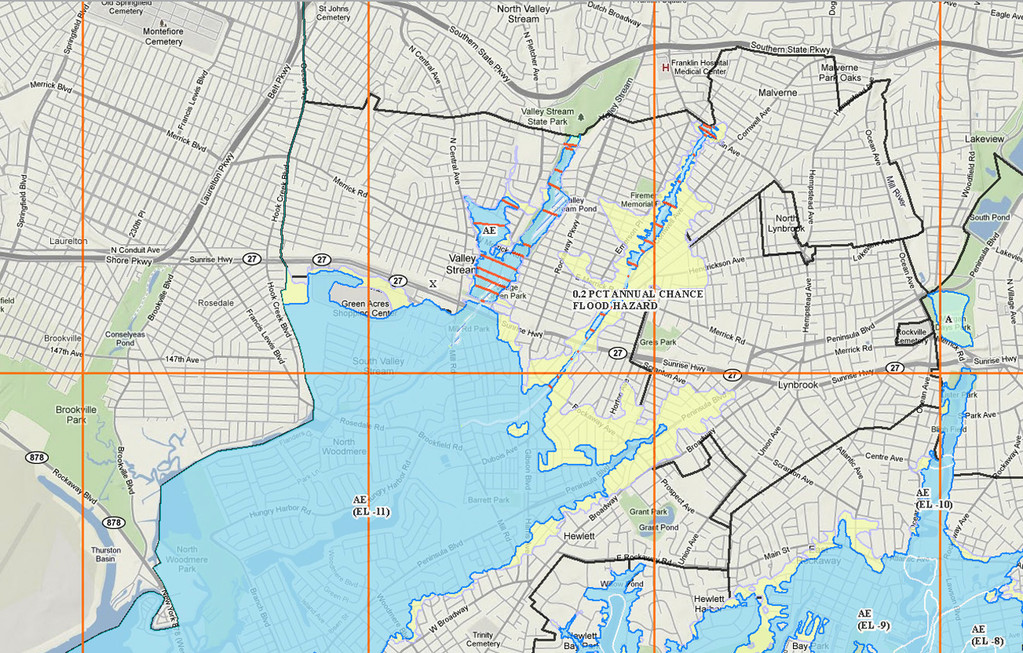

Source: liherald.com

Source: liherald.com

The flood zone you live in significantly determines your flood insurance rate. In 2021, the national insurance flood program announced its premiums would increase from an estimated average of $880 per. Each zone reflects the severity or type of flooding in the area. Flood insurance flood insurance is required by law for any primary building with federally backed funding (e.g., mortgage or business loan) in a flood map zone with an a designation — a, ae, ah, ao, ar, and a99. Private flood insurance for flood zone c.

Source: florida-floodzone.com

Source: florida-floodzone.com

If you are buying through the national flood insurance program, the maximum limits available on your building and personal belongings are $250,000 and $100,000, respectively. In 2016, there were 59,332 paid flood claims with an average amount of $62,247. The first is the national flood insurance program (nfip). What does this mean for property owners? Zone d the zone d designation is used for areas where there are possible but undetermined flood hazards.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title zone d flood insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information